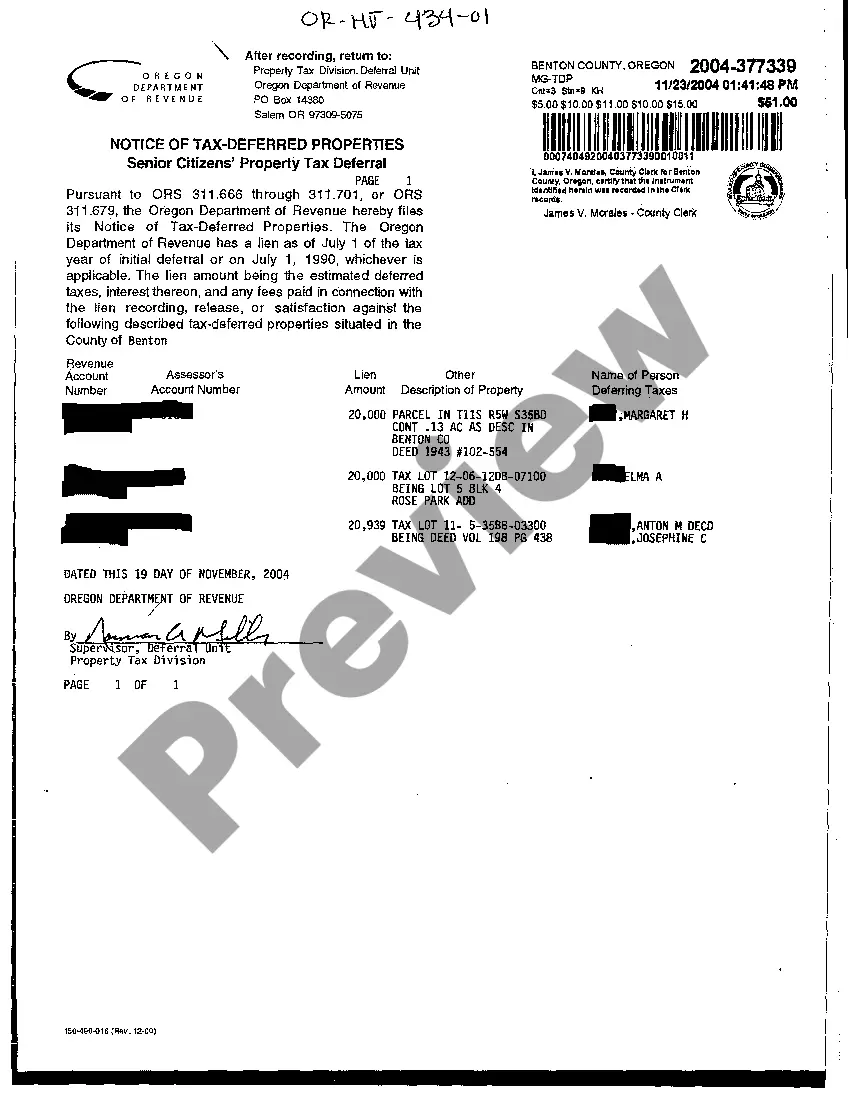

The Gresham Oregon Notice of Tax-Deferred Properties is a legal document issued by the city of Gresham, Oregon, related to properties that are eligible for tax deferral. This notice notifies property owners that they have the option to defer their property taxes under certain circumstances. Tax deferral is a program designed to provide financial relief to property owners who are facing economic hardships or specific qualifying conditions. By deferring property taxes, owners can postpone paying a portion or all of their property taxes until a later date, usually when the property is sold or transferred to a new owner. There are different types of Gresham Oregon Notice of Tax-Deferred Properties, each catering to specific situations: 1. Senior Citizen Tax Deferral: This program is available to senior citizens aged 62 or older who meet specific income criteria. It allows eligible seniors to defer property taxes, keeping their homes more affordable as they age. 2. Disabled Person Tax Deferral: Similar to the senior citizen program, this tax deferral option is designed for individuals with disabilities who meet certain income requirements. It provides financial assistance to disabled property owners, enabling them to stay in their homes while managing their tax obligations. 3. Hardship Tax Deferral: The hardship tax deferral is available to property owners who are experiencing temporary financial difficulties due to unemployment, medical emergencies, or other unforeseen circumstances. It provides temporary relief by deferring property taxes until the owner's financial situation improves. To apply for a Gresham Oregon Notice of Tax-Deferred Property, property owners must complete an application form and submit it to the Gresham city tax office. The application process requires providing necessary documentation and meeting eligibility requirements based on the specific tax deferral program applied for. It is important for property owners to understand that tax deferral is not tax exemption. It merely postpones the payment of property taxes, and interest accrues at a specified rate during the deferral period. Property owners must fulfill their tax obligations once their situation improves or upon the transfer of the property. The Gresham Oregon Notice of Tax-Deferred Properties is an essential tool for property owners in Gresham to obtain temporary financial relief while still maintaining ownership and possession of their properties. By deferring property taxes, eligible individuals can effectively manage their finances during challenging times. It is advisable to consult with a tax professional or the Gresham city tax office to get accurate information and guidance regarding the tax deferral programs available and their implications.

Gresham Oregon Notice of Tax-Deferred Properties

Description

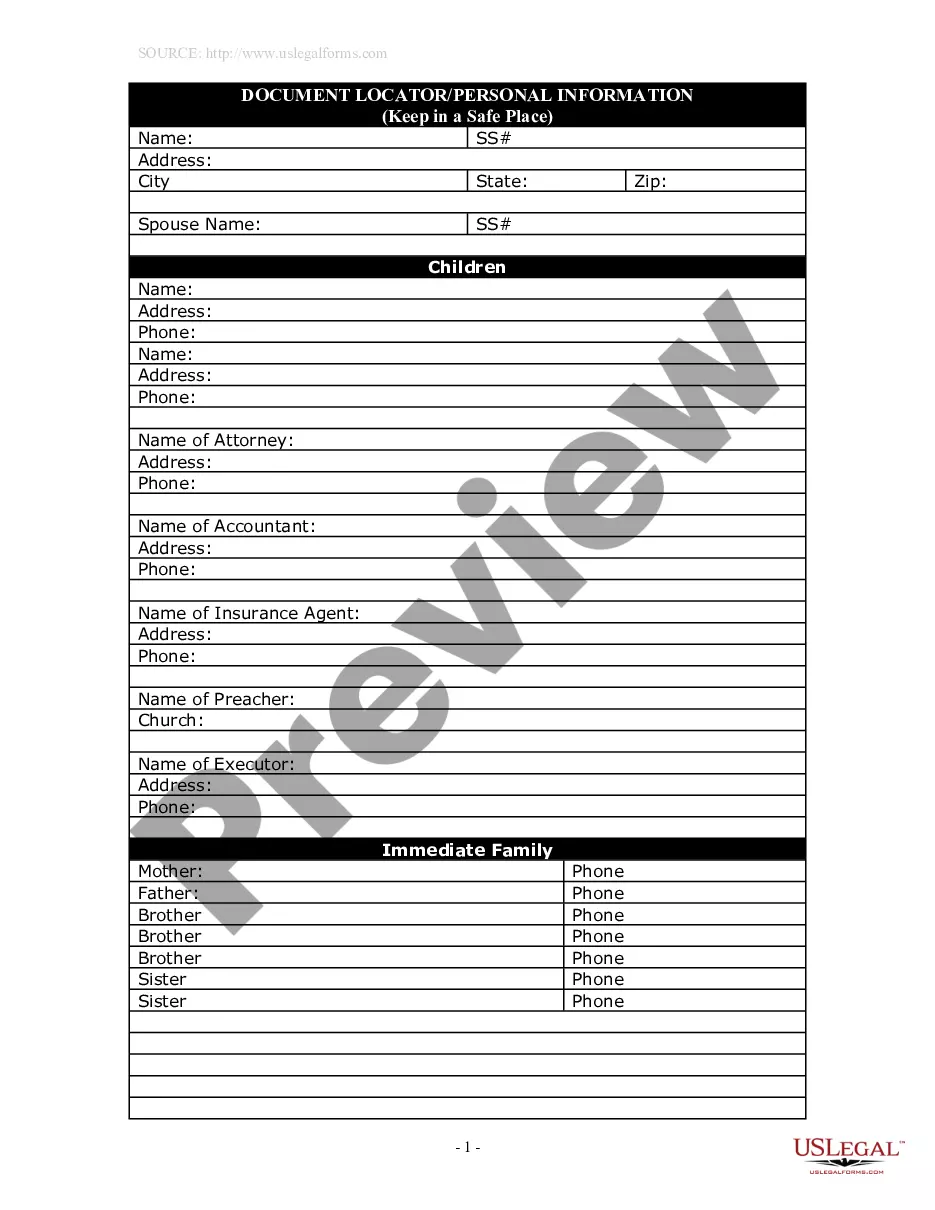

How to fill out Gresham Oregon Notice Of Tax-Deferred Properties?

We always want to minimize or avoid legal damage when dealing with nuanced law-related or financial matters. To do so, we apply for attorney services that, as a rule, are extremely costly. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of legal counsel. We provide access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Gresham Oregon Notice of Tax-Deferred Properties or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Gresham Oregon Notice of Tax-Deferred Properties complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Gresham Oregon Notice of Tax-Deferred Properties would work for you, you can pick the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

Property taxes may not automatically decrease after age 65, but seniors can benefit from various tax relief programs. The Gresham Oregon Notice of Tax-Deferred Properties allows individuals to defer their taxes, which can lead to improved financial stability. While property values or tax rates may change, programs aimed at seniors can provide valuable support. To understand your options better, look for helpful resources on the uslegalforms platform.

Yes, seniors in Oregon can receive property tax breaks through several programs. The Gresham Oregon Notice of Tax-Deferred Properties is one option that enables qualifying seniors to defer property taxes on their homes. This benefit assists seniors in managing their finances, making homeownership more sustainable. For further information and assistance, you may explore resources on the uslegalforms platform.

In Oregon, you may begin to defer property taxes once you reach the age of 65. This program caters to qualified individuals who meet specific criteria, which can provide notable financial relief. The Gresham Oregon Notice of Tax-Deferred Properties allows eligible seniors to postpone their property tax payments, helping to ease their financial burdens. It is advisable to check with local authorities or the uslegalforms platform for detailed eligibility requirements and application processes.

Yes, you can bury a family member on your property in Oregon, but specific regulations apply. You must notify local authorities and meet zoning requirements to ensure the burial site is legal. Exploring options related to the Gresham Oregon Notice of Tax-Deferred Properties is a good idea, as this knowledge helps navigate potential legal considerations. Legal platforms like uslegalforms can guide you through the necessary steps and paperwork.

Burying a loved one on your property can foster a sense of connection and peace for family members. It allows for personal memorialization, creating a space where family can gather and remember their loved one. Additionally, understanding local laws is crucial; in the context of Gresham Oregon Notice of Tax-Deferred Properties, it is advisable to consult legal resources to ensure compliance with all regulations before proceeding.

In Oregon, property taxes can go unpaid for up to three years before the property is subject to foreclosure. It is important to stay informed about your tax obligations, especially with the Gresham Oregon Notice of Tax-Deferred Properties. Delaying payment may lead to complications, and you could ultimately lose your property. Staying proactive helps ensure that you can manage your taxes effectively.

In Oregon, property owners 62 years or older may qualify for tax deferral or reduction programs. The Gresham Oregon Notice of Tax-Deferred Properties includes options specifically designed for seniors to assist them in managing property taxes. This ensures that older homeowners can remain in their homes without undue financial stress. To take advantage of these benefits, it is essential to apply and confirm eligibility with local authorities.

In California, property tax breaks often become available for homeowners at age 55, with several exemptions and reductions available. While the Gresham Oregon Notice of Tax-Deferred Properties relates primarily to Oregon, it's valuable to understand age-related benefits in various states. Each region has its own regulations and tax relief options, so it's wise to check the local legislation where you reside. Seeking advice can clarify your options.

Deferral in the context of local property tax refers to the ability of eligible homeowners to delay their tax payments. Utilizing the Gresham Oregon Notice of Tax-Deferred Properties can help residents manage their financial obligations effectively. This means that taxes are not eliminated but rather postponed until certain conditions are met, such as property sale or death of the owner. Understanding this process is vital for long-term financial planning.

deferred property is one where the owner has postponed their tax payments through a recognized program or legal provision. In Gresham, Oregon, the Notice of TaxDeferred Properties represents an important resource for eligible homeowners. This framework can assist individuals in preserving their home against financial pressures while managing tax responsibilities. It's crucial to apply for tax deferral correctly to avoid penalties.