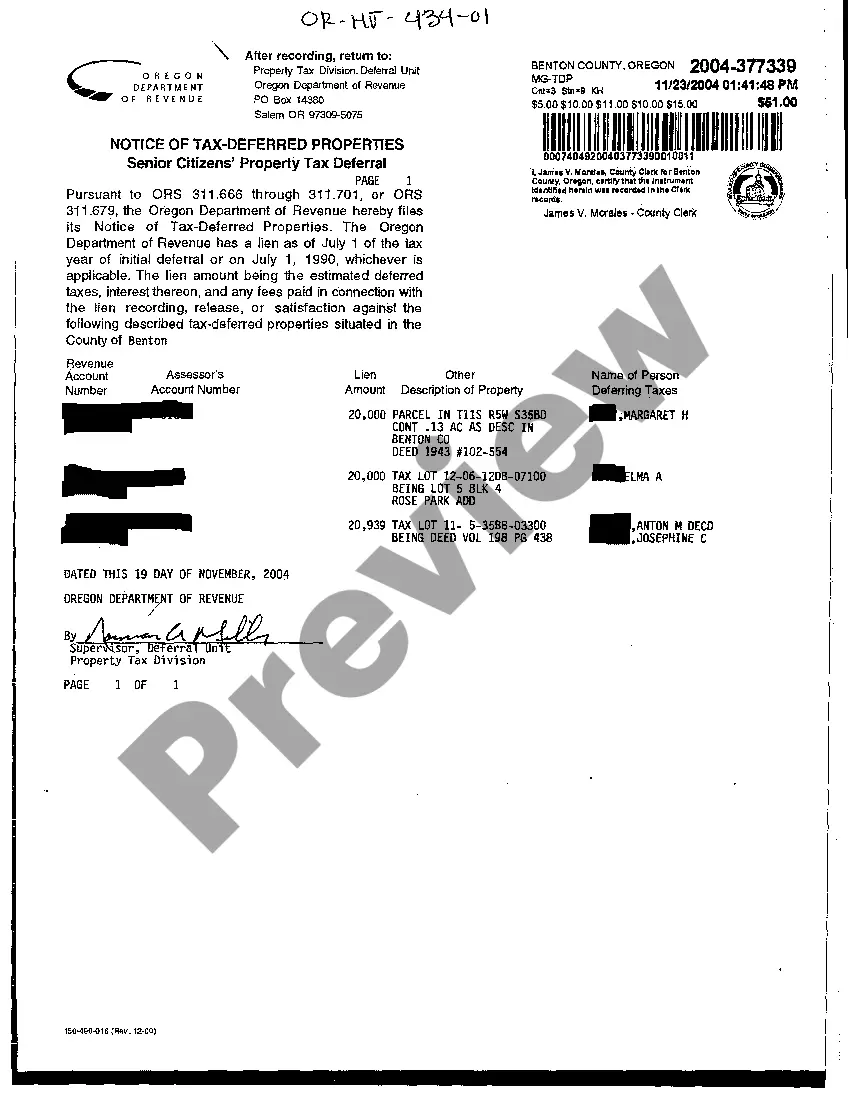

Portland Oregon Notice of Tax-Deferred Properties is a public notification issued by the local government regarding properties that qualify for tax deferral programs in Portland, Oregon. These programs aim to provide financial relief and incentives to eligible property owners. Tax deferral allows property owners to postpone paying property taxes, primarily catering to low-income individuals, seniors, or disabled citizens who may struggle with meeting their tax obligations. By deferring taxes, qualified property owners can use their limited resources for other essential needs, ensuring stability and reducing the risk of losing their homes. There are various types of Portland Oregon Notice of Tax-Deferred Properties, each designed to address specific needs and criteria: 1. Senior Deferral Program: This type caters to residents aged 62 or older who own and occupy their primary residence. It enables seniors to defer their property taxes, including special assessments, at a low interest rate until certain triggering events occur, such as the sale or transfer of the property or the death of the taxpayer. 2. Disabled Citizens Deferral Program: Similar to the Senior Deferral Program, this option offers property tax deferral at a low interest rate specifically for disabled individuals who own and occupy their primary residence. Eligibility criteria and triggering events are comparable to the Senior Deferral Program. 3. Special Assessment Deferral Program: This program allows property owners to defer payment of special assessments, such as those incurred for local improvement projects (e.g., road construction or sewer system improvements). It provides a temporary relief by postponing the assessment payment until a triggering event, such as the sale or transfer of the property, occurs. The Portland Oregon Notice of Tax-Deferred Properties provides detailed information about the qualifying criteria, application process, and terms of the tax deferral programs. It outlines the benefits of participating in these programs and provides contact details for further inquiries. Property owners interested in taking advantage of these tax deferral opportunities should carefully review the notice and follow the instructions provided to ensure they meet all the necessary requirements.

Portland Oregon Notice of Tax-Deferred Properties

Description

How to fill out Portland Oregon Notice Of Tax-Deferred Properties?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Portland Oregon Notice of Tax-Deferred Properties becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Portland Oregon Notice of Tax-Deferred Properties takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Portland Oregon Notice of Tax-Deferred Properties. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!