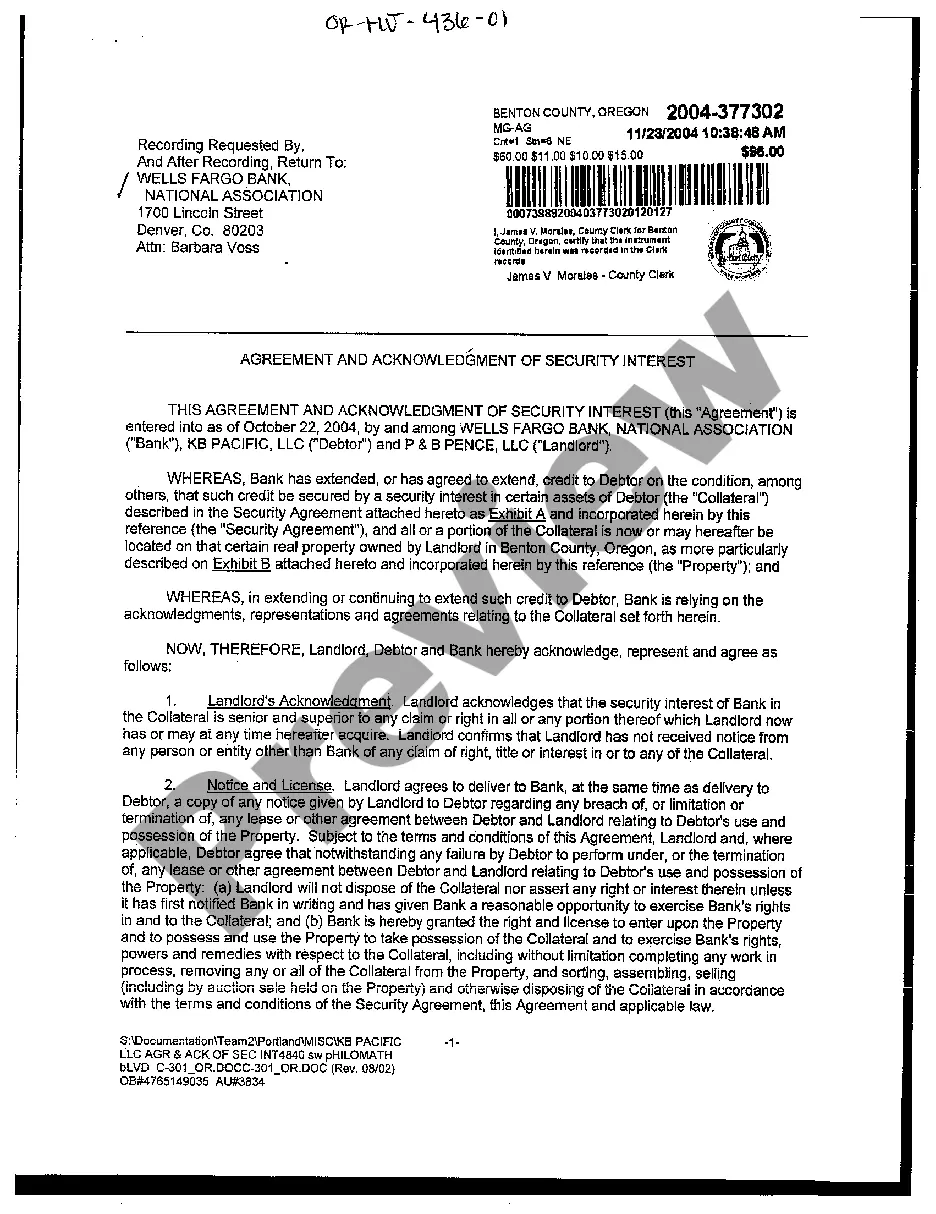

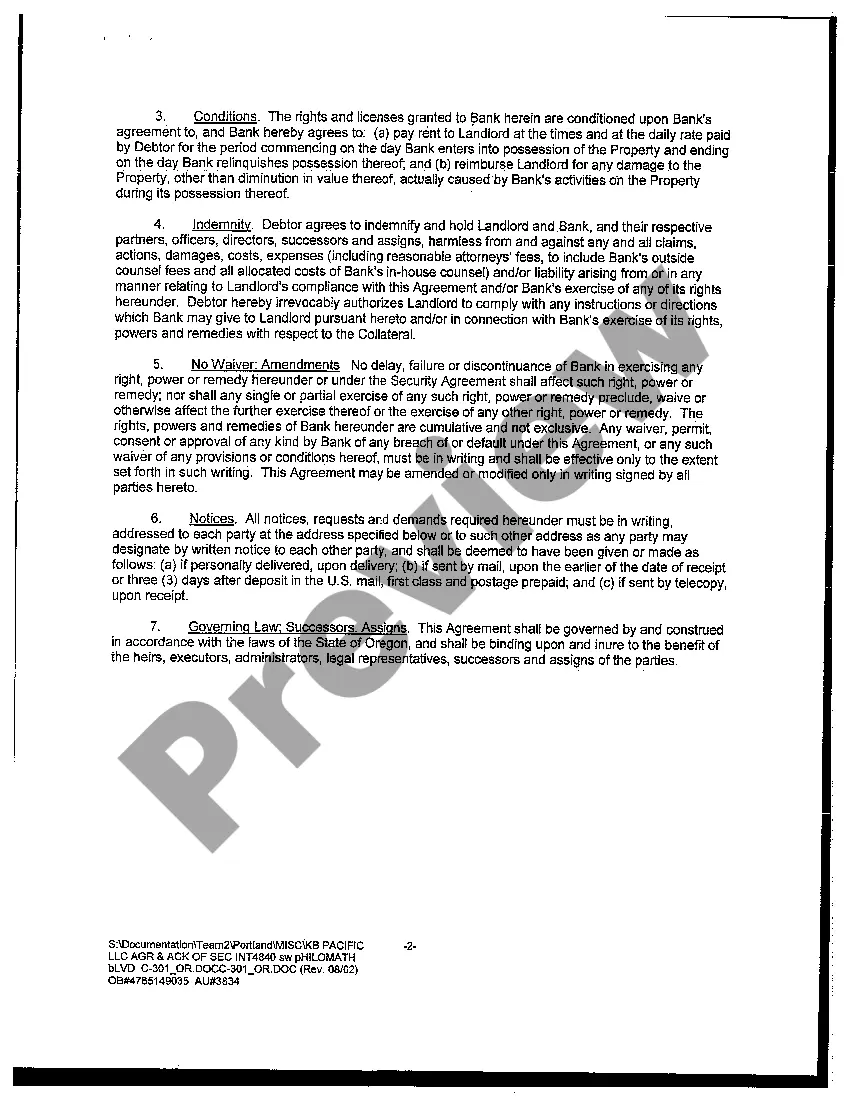

Title: Understanding the Bend Oregon Agreement and Acknowledgment of Security Interest: Types and Comprehensive Description Introduction: In Bend, Oregon, the Agreement and Acknowledgment of Security Interest plays a crucial role in protecting the interests of lenders and creditors. This legal document acts as an assurance that the borrower acknowledges and agrees to grant a security interest in specific collateral to secure the loan. This article aims to provide a detailed description of the Bend Oregon Agreement and Acknowledgment of Security Interest, along with highlighting different types that may exist. 1. Definition and Purpose: The Bend Oregon Agreement and Acknowledgment of Security Interest is a legally binding contract typically executed between a debtor and lender. Its primary purpose is to recognize and document the borrower's agreement to provide collateral as security for the loan. The agreement ensures that the lender has a legal claim on the assets specified in case of default or non-payment, offering protection for the lender's investment. 2. Key Components: a) Identification of Parties: The agreement begins by identifying the borrower and lender, stating their legal names, addresses, and contact details. b) Description of Collateral: This section outlines the collateral being offered as security, precisely describing the assets involved, such as real estate, machinery, vehicles, inventory, accounts receivable, etc. c) Grant of Security Interest: The debtor affirms their intention to grant a security interest in the specified collateral to the lender. This section solidifies the lender's control over the assets upon default. d) Representations and Warranties: The debtor assures that they own the collateral, the collateral has no prior claims or liens, and it will be maintained in good condition until the loan is fully repaid. e) Default Provisions: The agreement establishes the conditions that will be considered as default, such as non-payment, bankruptcy, or violation of other loan terms, along with the remedies available to the lender. f) Other Clauses: The Bend Oregon Agreement and Acknowledgment of Security Interest may include clauses about insurance, subordination, indemnification, and the borrower's responsibility to pay for attorney fees or other costs related to enforcing the agreement. 3. Types of Bend Oregon Agreement and Acknowledgment of Security Interest: a) Real Estate Mortgage: Specifically used when securing a loan with real property as collateral. b) Vehicle Loan Agreement: Pertains to specific loans secured by automobiles, motorcycles, or other vehicles. c) Business Security Agreement: Applicable for loans secured by commercial assets, such as inventory, accounts receivable, equipment, or intellectual property. d) Chattel Mortgage: Used to secure loans with movable personal property, including furniture, appliances, or valuable collections. Conclusion: The Bend Oregon Agreement and Acknowledgment of Security Interest is a vital legal document designed to protect lenders and creditors. It provides a clear framework for securing loans and ensuring that the borrower acknowledges the lender's security interest in specified collateral. By understanding the various components and types of this agreement, borrowers and lenders can establish a mutually beneficial agreement while mitigating potential risks.

Bend Oregon Agreement and Acknowledgment of Security Interest

Description

How to fill out Bend Oregon Agreement And Acknowledgment Of Security Interest?

If you are looking for a relevant form template, it’s difficult to choose a more convenient service than the US Legal Forms website – probably the most extensive online libraries. With this library, you can get thousands of templates for business and individual purposes by categories and states, or keywords. With the advanced search function, finding the most up-to-date Bend Oregon Agreement and Acknowledgment of Security Interest is as easy as 1-2-3. Furthermore, the relevance of each record is proved by a team of expert attorneys that regularly review the templates on our website and revise them in accordance with the newest state and county requirements.

If you already know about our system and have a registered account, all you should do to receive the Bend Oregon Agreement and Acknowledgment of Security Interest is to log in to your user profile and click the Download option.

If you make use of US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have found the form you want. Read its description and make use of the Preview option (if available) to check its content. If it doesn’t meet your needs, use the Search option near the top of the screen to get the needed document.

- Affirm your decision. Choose the Buy now option. Next, select the preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Make use of your bank card or PayPal account to finish the registration procedure.

- Get the template. Indicate the file format and save it to your system.

- Make changes. Fill out, edit, print, and sign the obtained Bend Oregon Agreement and Acknowledgment of Security Interest.

Every single template you save in your user profile does not have an expiry date and is yours forever. You can easily gain access to them via the My Forms menu, so if you need to receive an additional version for modifying or printing, you can return and save it once more at any time.

Make use of the US Legal Forms extensive library to get access to the Bend Oregon Agreement and Acknowledgment of Security Interest you were looking for and thousands of other professional and state-specific templates in one place!

Form popularity

FAQ

One of the most common examples of a security interest is a mortgage: a person borrows money from the bank to buy a house, and they grant a mortgage over the house so that if they default in repaying the loan, the bank can sell the house and apply the proceeds to the outstanding loan.

A ?SECURITY AGREEMENT? is an agreement that. creates or provides for an interest in personal property. that secures payment or performance of an obligation. Uniform Commercial Code (§9-102(a)(73); §1-201(b)(35)).

Below are the most common types of automatically perfected security interest: Purchase Money Security Interests in Consumer Goods, Purchase Money Security Interests in Non-Consumer Goods, Perfection in Proceeds from the Sale of Goods, and. Assignments of Accounts Receivable and Contract Rights.

First Priority Security Interest means the right to be paid before any other person from any money or other valuable consideration recovered by:? Judgment or settlement of a legal action;? Settlement not due to legal action; or? Undisputed payment.

Security interest dramatically reduces the level of risk a lender takes on, thereby allowing for lower interest rates and other incentives to borrow. If a security interest is granted, the exchange is known as a 'secured transaction. ' A common example of a security interest is a real estate mortgage or deed of trust.

A security interest arises when, in exchange for a loan, a borrower agrees in a security agreement that the lender (the secured party) may take specified collateral owned by the borrower if he or she should default on the loan.

First Security Interest means a Security Interest (as hereinafter defined) that has priority of record over all other recorded liens except those liens made superior by statute (such as general ad valorem tax liens and special assessments).

What is priority of a security interest? The priority of a secured party regards the party's right to payment in the event of default by a debtor. If a debtor defaults, a secured party with a security interest in collateral will have a claim of ownership in the collateral.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the