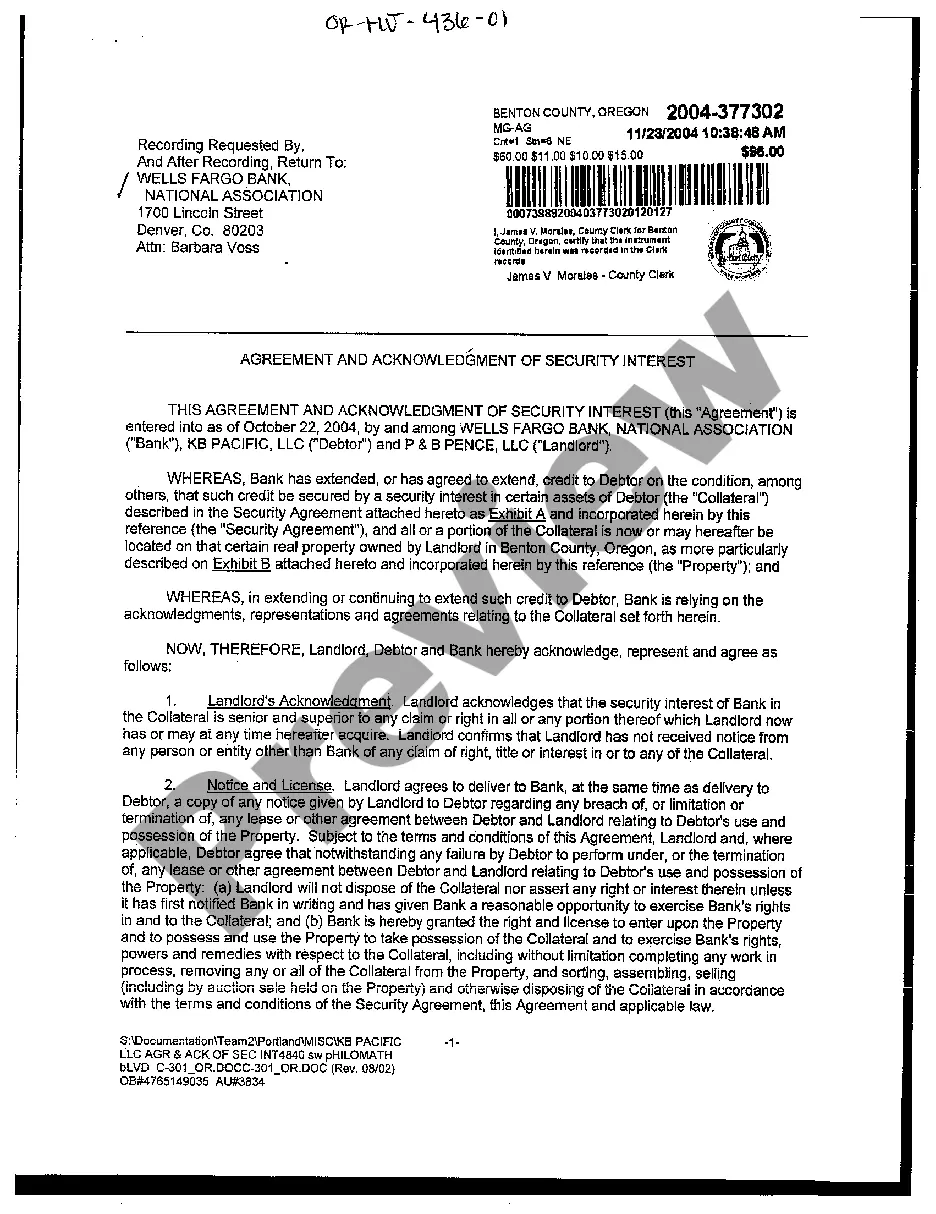

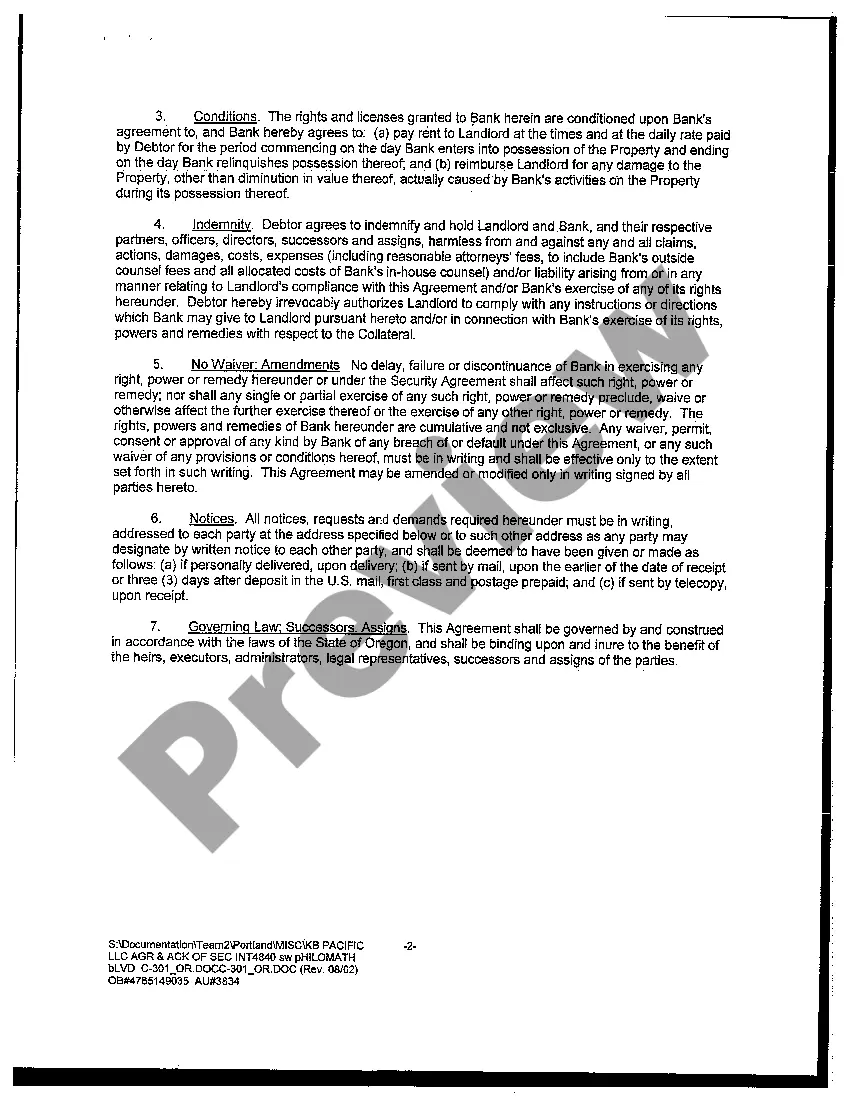

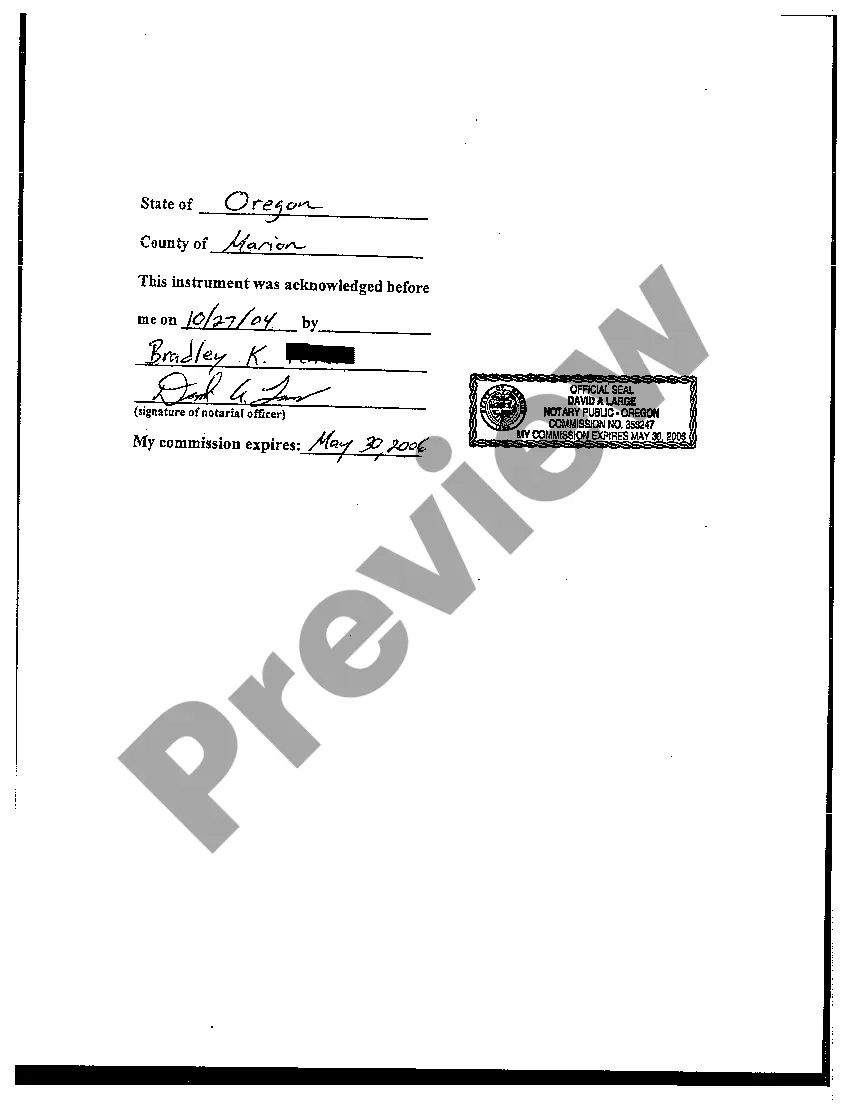

The Hillsboro Oregon Agreement and Acknowledgment of Security Interest is a legal document that outlines the terms and conditions of a security interest agreement in the context of Hillsboro, Oregon. It is typically used in situations where an individual or business entity wants to secure a loan or extension of credit by offering collateral. This agreement serves as a written record of the agreement between the debtor (borrower) and the secured party (lender) and ensures that both parties understand their rights and obligations regarding the security interest. It is crucial for both parties to comprehend the terms and conditions laid out in the agreement to avoid any potential disputes in the future. The Hillsboro Oregon Agreement and Acknowledgment of Security Interest may include several important components, such as: 1. Identification of the parties involved: This section clarifies and identifies the debtor and the secured party, ensuring accurate documentation of both parties' legal names and contact information. 2. Description of collateral: This section provides a detailed description of the collateral being used to secure the loan or credit extension. It includes a specific and comprehensive list of assets, such as real estate, vehicles, inventory, equipment, accounts receivable, or other properties. 3. Security interest specifics: This section outlines the extent of the security interest granted by the debtor to the secured party. It may specify whether the interest is limited or unlimited, and whether it covers both present and future collateral. 4. Terms and conditions: This section delineates the terms and conditions of the agreement, including the repayment schedule, interest rate, late payment provisions, default provisions, and any additional fees or charges. 5. Rights and obligations of the parties: This part defines the rights and obligations of both the debtor and the secured party. It often includes clauses related to insurance requirements, maintenance of collateral, and the lender's right to inspect or access the collateral if necessary. 6. Signatures and notarization: The agreement is typically signed by both the debtor and secured party to indicate their consent and understanding of the terms. Notarization may be required for additional legal validity. It is important to note that there may be different types of Hillsboro Oregon Agreement and Acknowledgment of Security Interest, depending on the specific industry or purpose of the agreement. Some examples include real estate security agreements, equipment financing security agreements, or inventory financing security agreements. Each type may have distinct provisions and considerations tailored to the particular asset being pledged as collateral. This document is crucial for protecting the rights of both parties and ensuring a transparent understanding of the security interest arrangement in Hillsboro, Oregon. Given the legal implications surrounding such agreements, it is advisable to consult with an attorney or legal professional to draft or review the document in order to ensure compliance with relevant laws and regulations.

Hillsboro Oregon Agreement and Acknowledgment of Security Interest

Description

How to fill out Hillsboro Oregon Agreement And Acknowledgment Of Security Interest?

We always strive to reduce or prevent legal issues when dealing with nuanced legal or financial affairs. To accomplish this, we apply for attorney solutions that, as a rule, are very expensive. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of a lawyer. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Hillsboro Oregon Agreement and Acknowledgment of Security Interest or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is equally straightforward if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Hillsboro Oregon Agreement and Acknowledgment of Security Interest adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Hillsboro Oregon Agreement and Acknowledgment of Security Interest is suitable for you, you can select the subscription option and proceed to payment.

- Then you can download the form in any suitable file format.

For over 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!