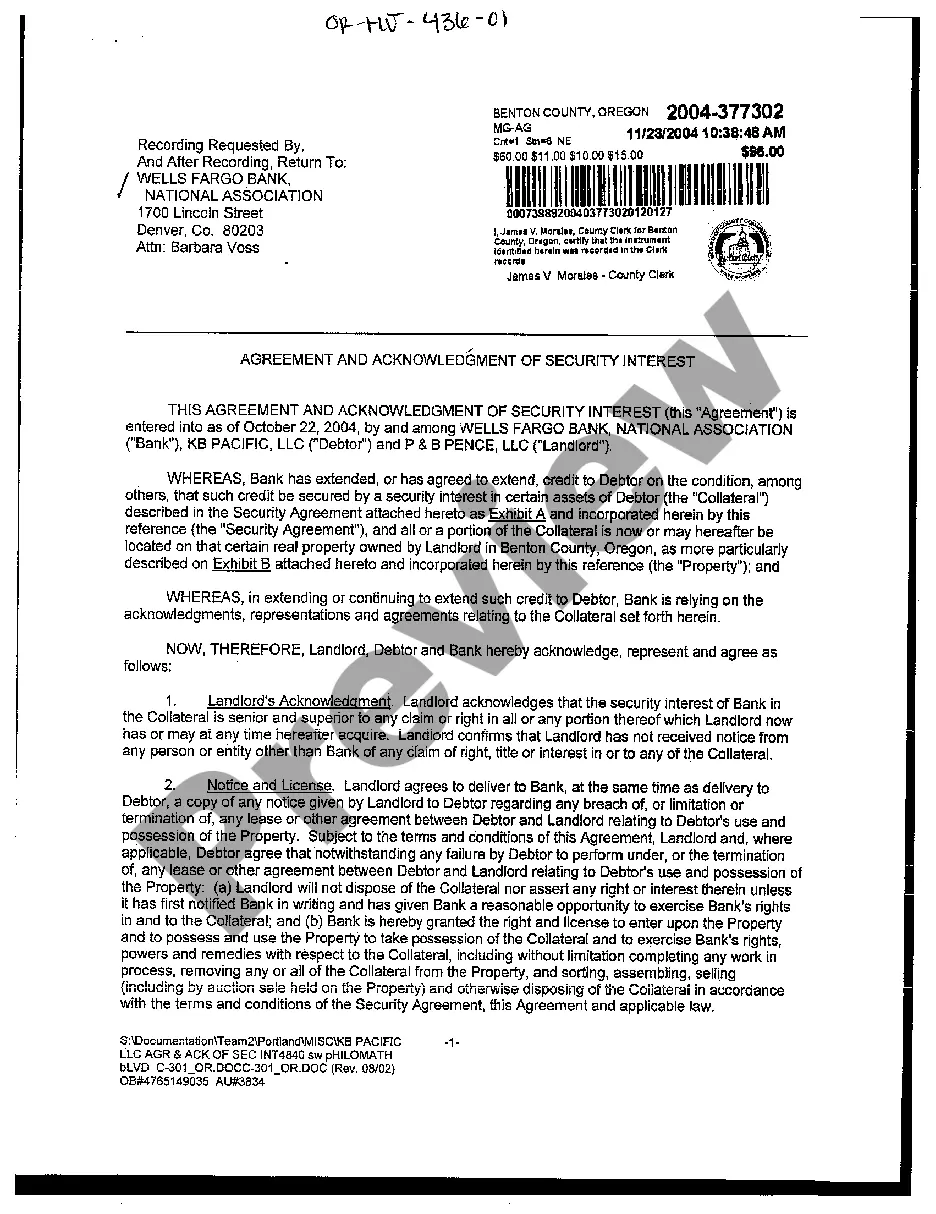

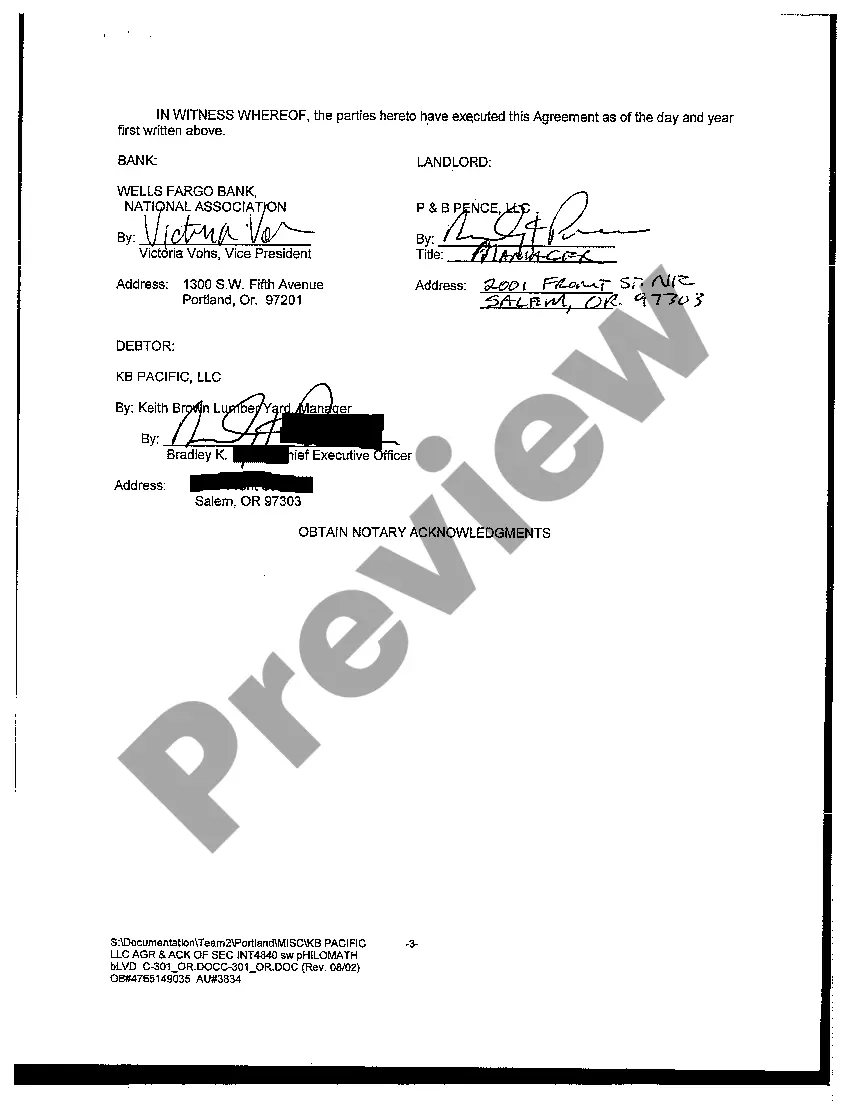

Title: Understanding the Portland Oregon Agreement and Acknowledgment of Security Interest Keywords: Portland Oregon Agreement, Acknowledgment of Security Interest, legal document, creditor, debtor, collateral, types Introduction: The Portland Oregon Agreement and Acknowledgment of Security Interest is a legally binding document that plays a crucial role in formalizing and protecting the rights of creditors and debtors in the state of Oregon. This agreement outlines the terms and conditions for the creation, attachment, and enforcement of security interests on specific collateral held by a debtor to secure repayment of a debt. By examining the various types of Portland Oregon Agreement and Acknowledgment of Security Interest, we can gain a comprehensive understanding of its significance in both commercial and personal contexts. Types of Portland Oregon Agreement and Acknowledgment of Security Interest: 1. Commercial Security Agreement: A Commercial Security Agreement is a common type of Portland Oregon Agreement and Acknowledgment of Security Interest used in the business realm. It establishes a contractual relationship between a business creditor and debtor, detailing how the debtor's collateral provides security for the repayment of a debt. This agreement often covers valuable assets such as machinery, equipment, accounts receivable, or inventory. 2. Personal Property Security Agreement: The Personal Property Security Agreement is another variant of the Portland Oregon Agreement and Acknowledgment of Security Interest that focuses on personal property instead of commercial assets. This type of agreement applies to individuals or consumers who pledge their personal property, such as vehicles, jewelry, appliances, or electronics, as collateral to obtain a loan or credit. 3. Real Estate Mortgage Agreement: The Real Estate Mortgage Agreement is a type of Portland Oregon Agreement and Acknowledgment of Security Interest used when securing a loan against real estate property. In this agreement, the debtor pledges their property, such as a house, land, or commercial building, as collateral. If the debtor fails to meet their obligations, the creditor may exercise the right to foreclose on the property and recover their investment. 4. Agricultural Lien Agreement: An Agricultural Lien Agreement is specific to the agricultural industry and is applicable when a debtor pledges agricultural products, livestock, or equipment as collateral. This type of Portland Oregon Agreement and Acknowledgment of Security Interest ensures that the creditor has a security interest in the agricultural goods provided by the debtor to secure the outstanding debt. Conclusion: The Portland Oregon Agreement and Acknowledgment of Security Interest is a critical legal document that safeguards the rights of both creditors and debtors. It serves as a means to establish security interests in collateral, ensuring a higher chance of debt repayment. By understanding the different types of agreements available, businesses, individuals, and agricultural entities can make informed decisions about securing loans while protecting their interests.

Portland Oregon Agreement and Acknowledgment of Security Interest

Description

How to fill out Portland Oregon Agreement And Acknowledgment Of Security Interest?

Do you need a trustworthy and inexpensive legal forms provider to get the Portland Oregon Agreement and Acknowledgment of Security Interest? US Legal Forms is your go-to choice.

Whether you need a simple arrangement to set rules for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed in accordance with the requirements of specific state and county.

To download the form, you need to log in account, find the required template, and click the Download button next to it. Please take into account that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Portland Oregon Agreement and Acknowledgment of Security Interest conforms to the laws of your state and local area.

- Read the form’s details (if provided) to learn who and what the form is intended for.

- Start the search over in case the template isn’t suitable for your legal situation.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Portland Oregon Agreement and Acknowledgment of Security Interest in any provided file format. You can return to the website when you need and redownload the form free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time learning about legal papers online for good.