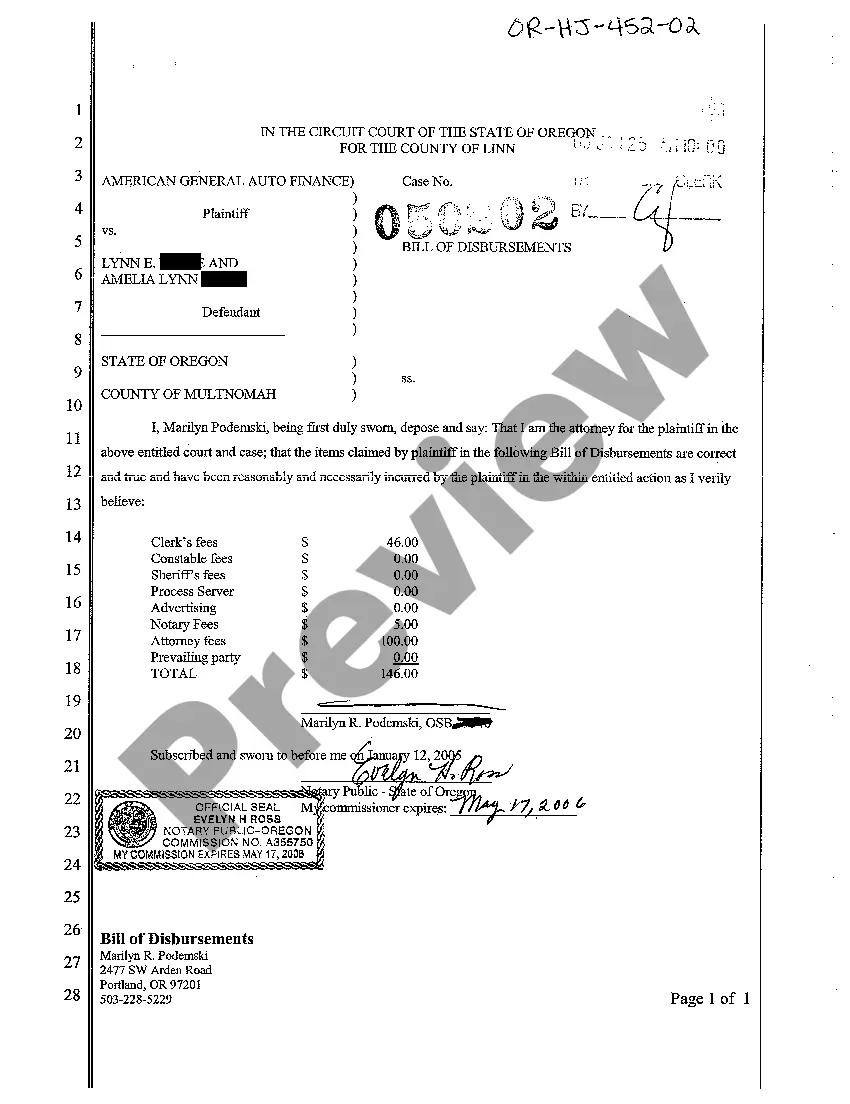

The Eugene Oregon Bill of Disbursements refers to a comprehensive document that provides a detailed breakdown of financial transactions and expenditures made by the city of Eugene, Oregon. It serves as a transparent account of how public funds are allocated and spent within the municipal jurisdiction. By examining this bill, citizens, policymakers, and stakeholders can gain insight into the city's financial activities and ensure accountability. The Eugene Oregon Bill of Disbursements encompasses various categories of expenditures that cover a wide range of services and programs. These can include but are not limited to payroll disbursements, operating expenses, vendor payments, contractual obligations, utility bills, city infrastructure maintenance, public works projects, grants, and subsidies. One key aspect of the Eugene Oregon Bill of Disbursements is its itemized format, which lists each transaction individually. This allows for transparency and easy identification of specific expenditures. The document typically includes relevant information such as the recipient of payment, transaction date, purpose of the disbursement, and the amount disbursed. Different types of Eugene Oregon Bill of Disbursements may include: 1. General Fund Disbursements: These are expenses related to the day-to-day operations of the city, such as the salaries of city employees, office supplies, maintenance costs, and other general administrative expenses. 2. Public Works Disbursements: This category covers expenses related to the construction, repair, and maintenance of public infrastructure, including roads, bridges, parks, public buildings, and other civic amenities. 3. Community Services Disbursements: These disbursements pertain to funds allocated for the betterment of the local community, including social welfare programs, public health initiatives, recreational facilities, and support for nonprofit organizations. 4. Capital Projects Disbursements: This category involves expenses associated with long-term investments in the city's infrastructure, such as the construction of new facilities, major renovations, or upgrades to existing structures. 5. Grant Disbursements: Grants received by the city from federal, state, or private entities are disbursed through this segment of the bill. These funds are typically directed towards specific projects or programs that align with the granters' objectives. Overall, the Eugene Oregon Bill of Disbursements plays a crucial role in promoting transparency, accountability, and effective fiscal management within the city of Eugene. It enables citizens and stakeholders to have a comprehensive understanding of the allocation and utilization of public funds for the betterment of the community.

Eugene Oregon Bill of Disbursements

State:

Oregon

City:

Eugene

Control #:

OR-HJ-452-02

Format:

PDF

Instant download

This form is available by subscription

Description

A02 Bill of Disbursements

The Eugene Oregon Bill of Disbursements refers to a comprehensive document that provides a detailed breakdown of financial transactions and expenditures made by the city of Eugene, Oregon. It serves as a transparent account of how public funds are allocated and spent within the municipal jurisdiction. By examining this bill, citizens, policymakers, and stakeholders can gain insight into the city's financial activities and ensure accountability. The Eugene Oregon Bill of Disbursements encompasses various categories of expenditures that cover a wide range of services and programs. These can include but are not limited to payroll disbursements, operating expenses, vendor payments, contractual obligations, utility bills, city infrastructure maintenance, public works projects, grants, and subsidies. One key aspect of the Eugene Oregon Bill of Disbursements is its itemized format, which lists each transaction individually. This allows for transparency and easy identification of specific expenditures. The document typically includes relevant information such as the recipient of payment, transaction date, purpose of the disbursement, and the amount disbursed. Different types of Eugene Oregon Bill of Disbursements may include: 1. General Fund Disbursements: These are expenses related to the day-to-day operations of the city, such as the salaries of city employees, office supplies, maintenance costs, and other general administrative expenses. 2. Public Works Disbursements: This category covers expenses related to the construction, repair, and maintenance of public infrastructure, including roads, bridges, parks, public buildings, and other civic amenities. 3. Community Services Disbursements: These disbursements pertain to funds allocated for the betterment of the local community, including social welfare programs, public health initiatives, recreational facilities, and support for nonprofit organizations. 4. Capital Projects Disbursements: This category involves expenses associated with long-term investments in the city's infrastructure, such as the construction of new facilities, major renovations, or upgrades to existing structures. 5. Grant Disbursements: Grants received by the city from federal, state, or private entities are disbursed through this segment of the bill. These funds are typically directed towards specific projects or programs that align with the granters' objectives. Overall, the Eugene Oregon Bill of Disbursements plays a crucial role in promoting transparency, accountability, and effective fiscal management within the city of Eugene. It enables citizens and stakeholders to have a comprehensive understanding of the allocation and utilization of public funds for the betterment of the community.

How to fill out Eugene Oregon Bill Of Disbursements?

If you’ve already utilized our service before, log in to your account and save the Eugene Oregon Bill of Disbursements on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Make certain you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Eugene Oregon Bill of Disbursements. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!