Bend Oregon Complaint — Foreclosure of Mortgage is a legal process initiated by a lender or a financial institution to reclaim property or assets from a borrower who has failed to make mortgage payments as per the agreed terms. It occurs when the borrower defaults on the mortgage, resulting in the lender seeking legal remedies to recover the outstanding debt by selling the property. In Bend, Oregon, complaints related to foreclosure of mortgage can vary depending on the circumstances and the specific legal requirements of the case. Here are some scenarios and types of complaints commonly associated with foreclosure of mortgage in Bend, Oregon: 1. Judicial Foreclosure Complaint: This complaint is filed by the lender through the court system, where the borrower is taken to court, and a judgment is sought to allow the foreclosure process to proceed legally. 2. Non-Judicial Foreclosure Complaint: Unlike judicial foreclosure, this type of complaint does not involve the court system. Instead, the lender follows a specific process outlined by Oregon law, including providing a notice of default to the borrower and publishing a notice of sale in local newspapers. 3. Wrongful Foreclosure Complaint: This complaint is made by the borrower when they believe that the foreclosure was conducted in violation of their legal rights or in breach of the terms agreed upon in the mortgage contract. Examples may include errors in the foreclosure process, improper documentation, or violations of foreclosure laws. 4. Deficiency Judgment Complaint: In cases where the sale of the foreclosed property does not cover the entire outstanding debt, the lender may pursue a deficiency judgment against the borrower. The complaint filed by the lender seeks to obtain a court order to collect the remaining debt. 5. Fair Debt Collection Practices Act (FD CPA) Complaint: If a borrower believes that the lender violated their rights under the FD CPA during the foreclosure process, they may file a complaint to address any alleged harassment, deceptive practices, or unfair treatment from the lender or their representatives. It is important to note that the foreclosure process in Bend, Oregon, is subject to specific laws and regulations. Anyone involved in a foreclosure should consult with legal professionals to fully understand their rights and any potential complaints they may need to file in response to the foreclosure of their mortgage.

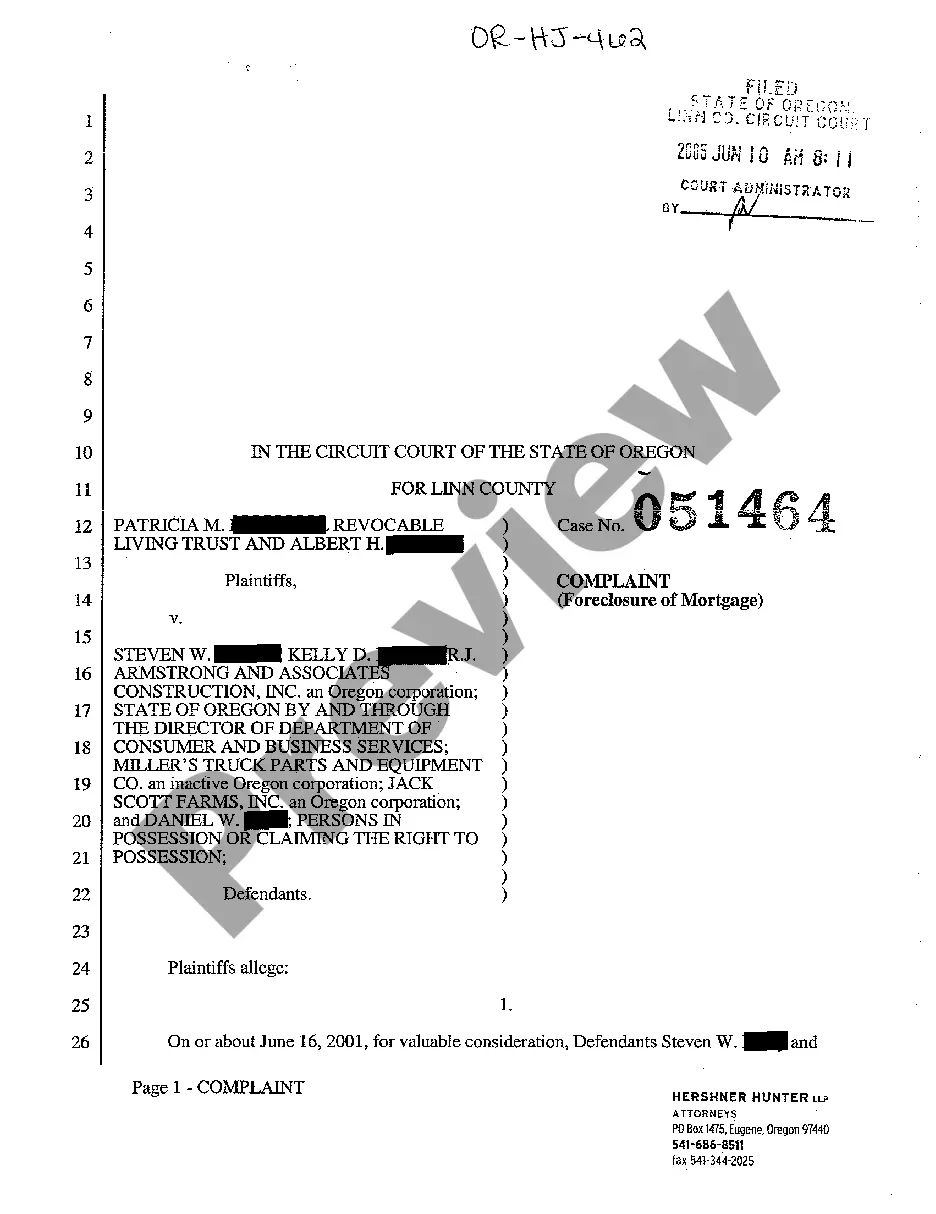

Bend Oregon Complaint - Foreclosure of Mortgage

State:

Oregon

City:

Bend

Control #:

OR-HJ-462

Format:

PDF

Instant download

This form is available by subscription

Description

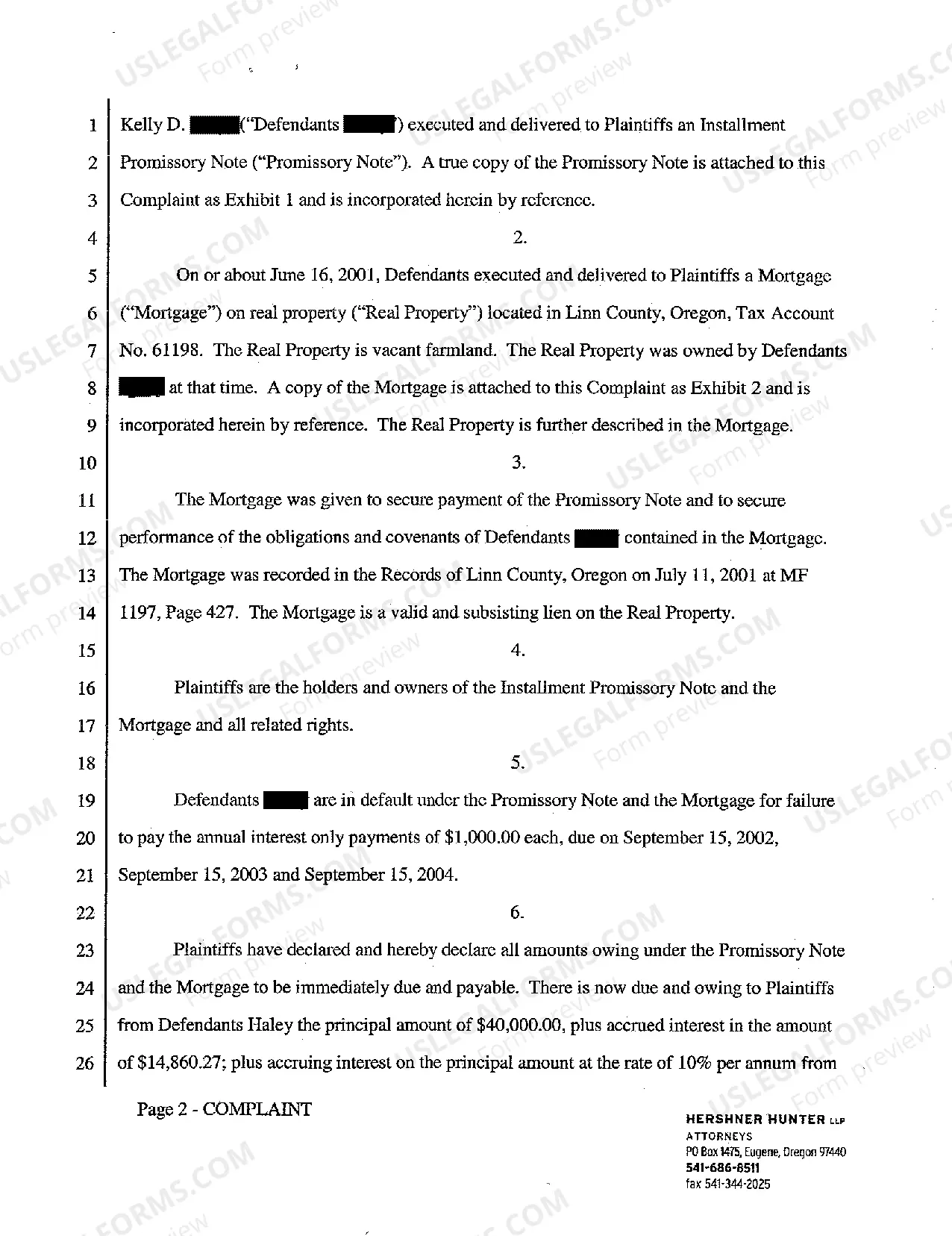

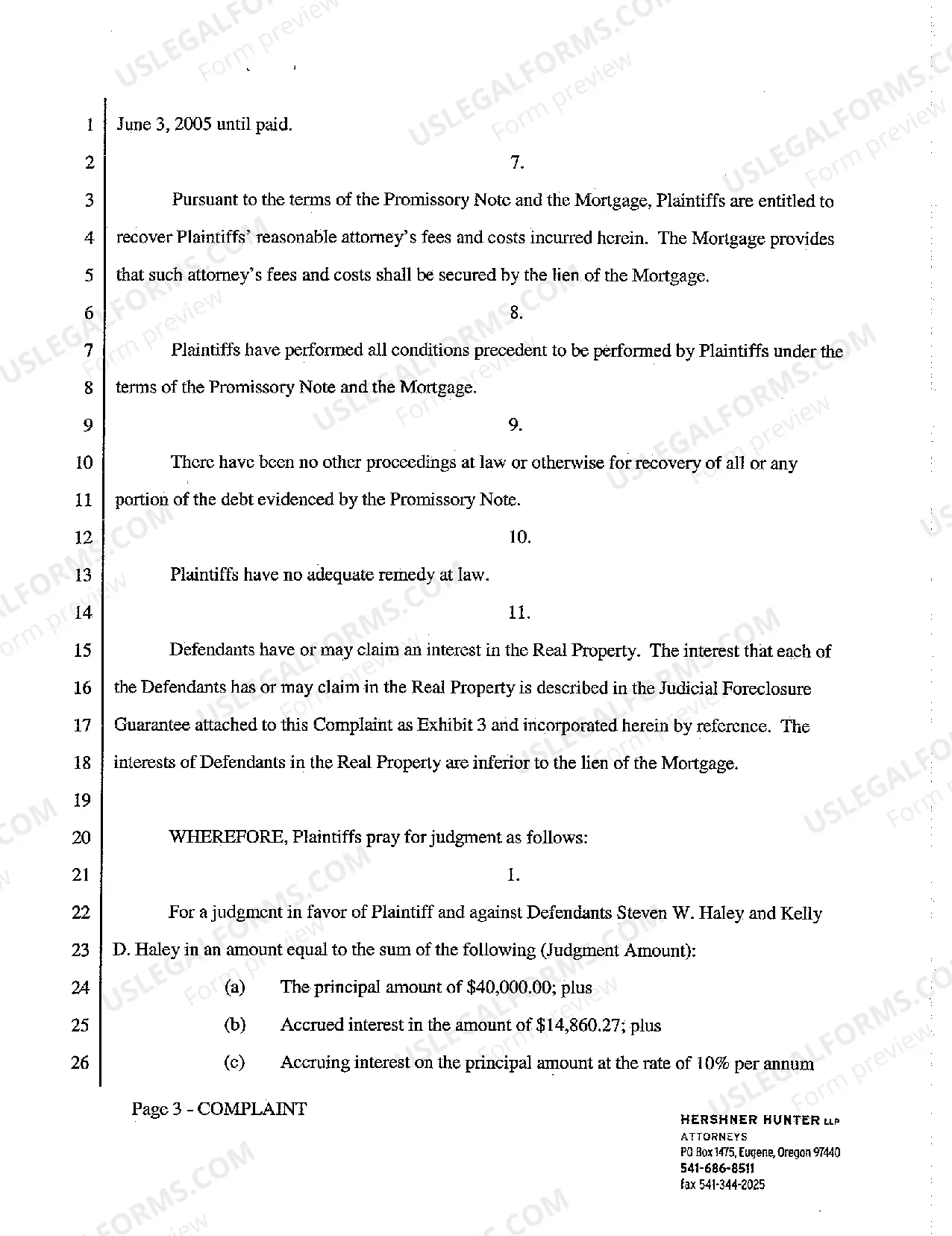

Complaint - Foreclosure of Mortgage

Bend Oregon Complaint — Foreclosure of Mortgage is a legal process initiated by a lender or a financial institution to reclaim property or assets from a borrower who has failed to make mortgage payments as per the agreed terms. It occurs when the borrower defaults on the mortgage, resulting in the lender seeking legal remedies to recover the outstanding debt by selling the property. In Bend, Oregon, complaints related to foreclosure of mortgage can vary depending on the circumstances and the specific legal requirements of the case. Here are some scenarios and types of complaints commonly associated with foreclosure of mortgage in Bend, Oregon: 1. Judicial Foreclosure Complaint: This complaint is filed by the lender through the court system, where the borrower is taken to court, and a judgment is sought to allow the foreclosure process to proceed legally. 2. Non-Judicial Foreclosure Complaint: Unlike judicial foreclosure, this type of complaint does not involve the court system. Instead, the lender follows a specific process outlined by Oregon law, including providing a notice of default to the borrower and publishing a notice of sale in local newspapers. 3. Wrongful Foreclosure Complaint: This complaint is made by the borrower when they believe that the foreclosure was conducted in violation of their legal rights or in breach of the terms agreed upon in the mortgage contract. Examples may include errors in the foreclosure process, improper documentation, or violations of foreclosure laws. 4. Deficiency Judgment Complaint: In cases where the sale of the foreclosed property does not cover the entire outstanding debt, the lender may pursue a deficiency judgment against the borrower. The complaint filed by the lender seeks to obtain a court order to collect the remaining debt. 5. Fair Debt Collection Practices Act (FD CPA) Complaint: If a borrower believes that the lender violated their rights under the FD CPA during the foreclosure process, they may file a complaint to address any alleged harassment, deceptive practices, or unfair treatment from the lender or their representatives. It is important to note that the foreclosure process in Bend, Oregon, is subject to specific laws and regulations. Anyone involved in a foreclosure should consult with legal professionals to fully understand their rights and any potential complaints they may need to file in response to the foreclosure of their mortgage.

Free preview

How to fill out Bend Oregon Complaint - Foreclosure Of Mortgage?

If you’ve already utilized our service before, log in to your account and save the Bend Oregon Complaint - Foreclosure of Mortgage on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Ensure you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Bend Oregon Complaint - Foreclosure of Mortgage. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!