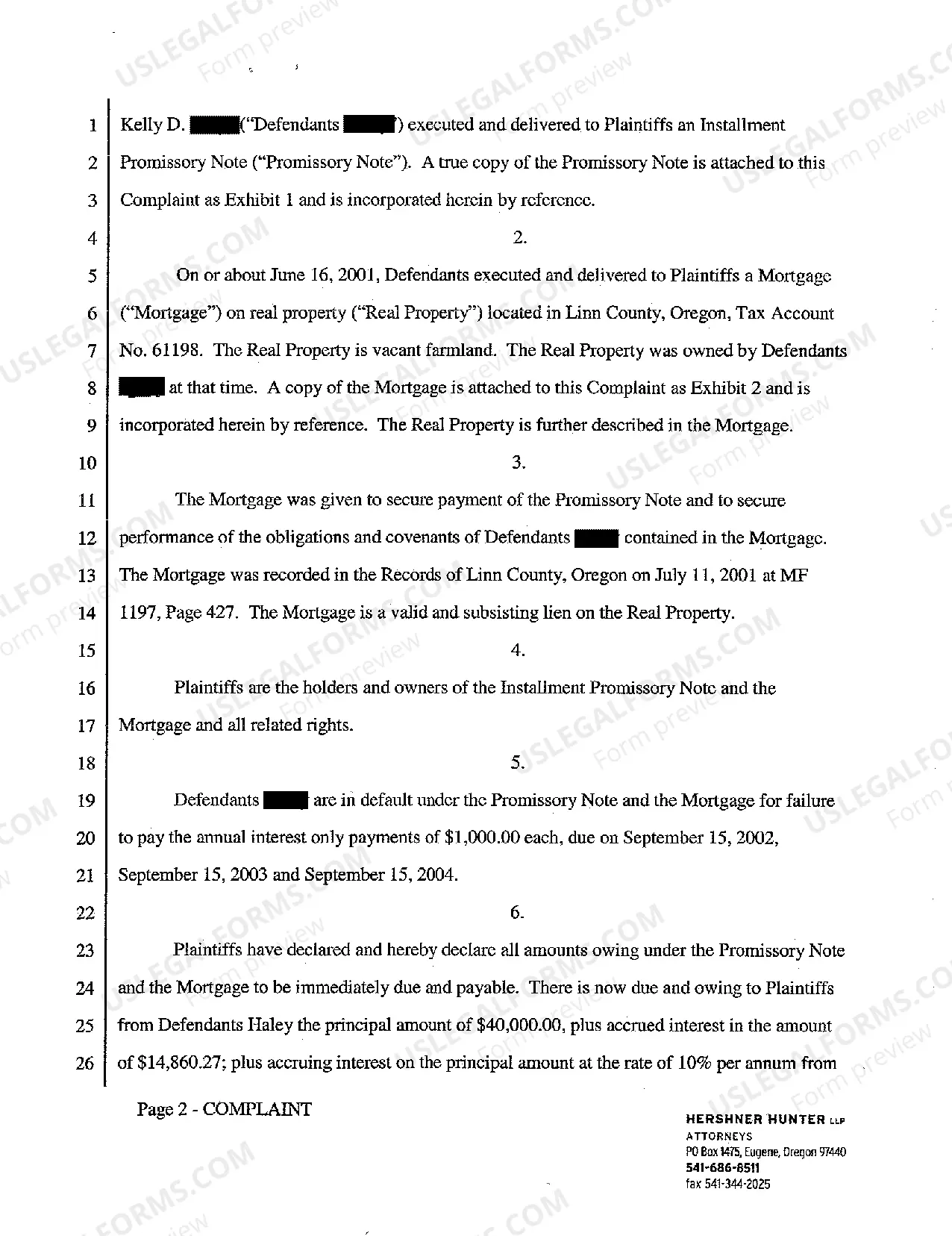

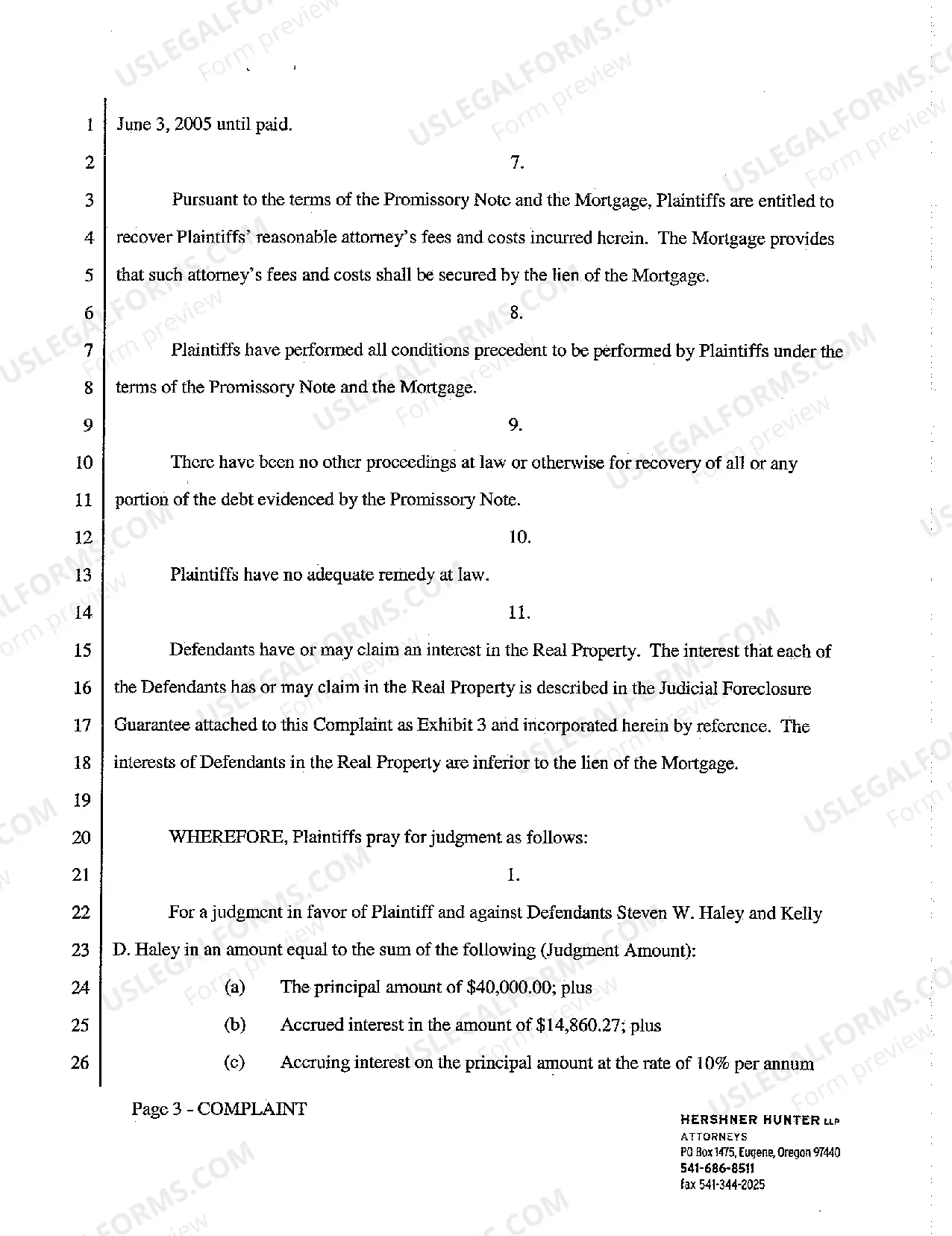

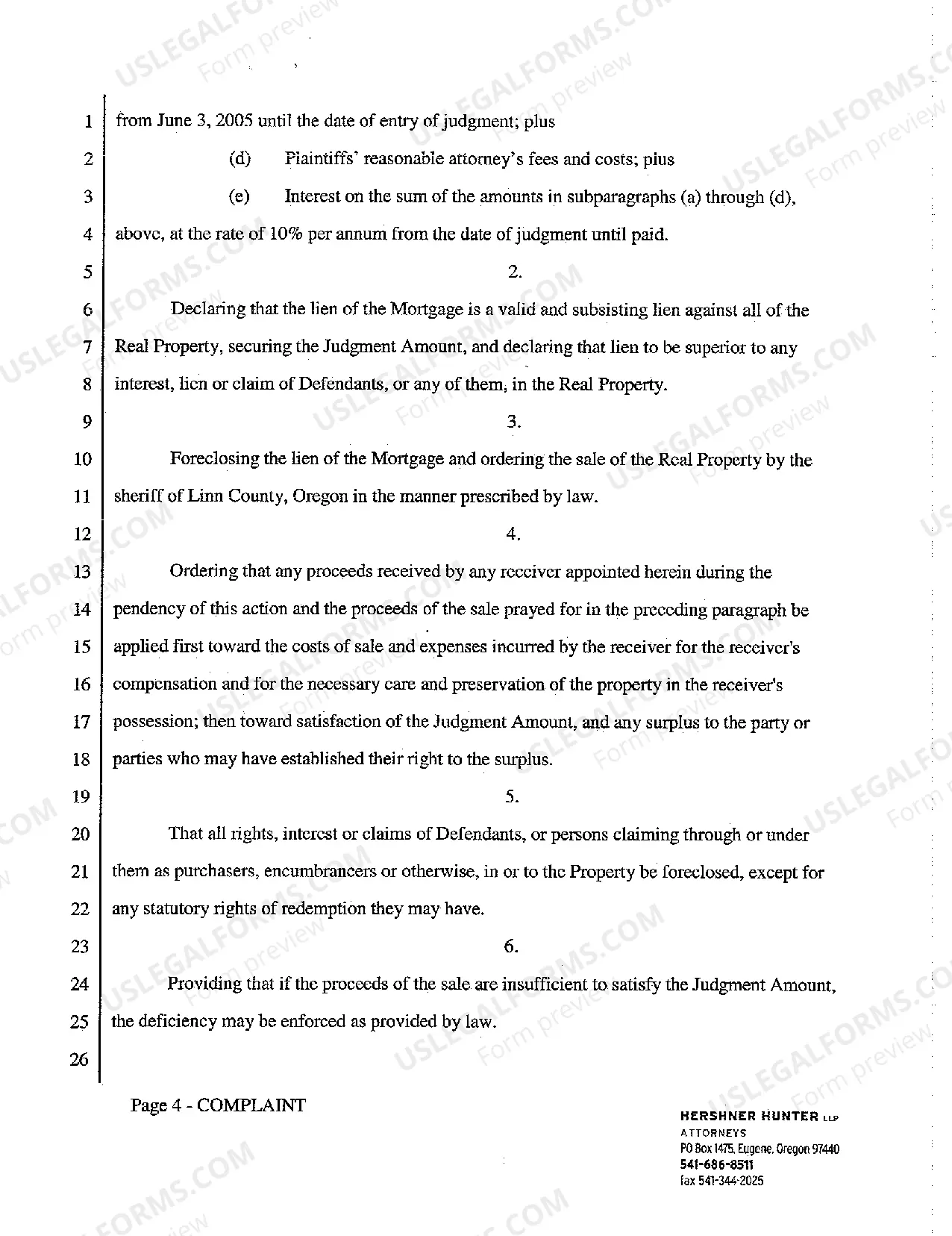

Gresham Oregon Complaint — Foreclosure of Mortgage is a legal process initiated by a lender when a borrower defaults on their mortgage payments. This procedure allows the lender to repossess the property in order to recover the unpaid debt. Here are different types of Gresham Oregon Complaint — Foreclosure of Mortgage: 1. Judicial Foreclosure: This type of foreclosure requires the lender to file a lawsuit against the borrower to obtain a court order to foreclose on the property. The court conducts a public auction to sell the property to the highest bidder in order to satisfy the outstanding mortgage debt. 2. Non-Judicial Foreclosure: Also known as a power of sale foreclosure, this type of foreclosure does not involve the court system. Instead, the lender follows a specific timeline and procedure outlined in the mortgage documents to sell the property without court supervision and recover the debt owed. 3. Notice of Default: Before initiating the foreclosure process, the lender usually sends a notice of default to the borrower, informing them that they are in breach of their mortgage agreement due to non-payment. This notice provides an opportunity for the borrower to rectify the default by paying the outstanding amount within a specified period. 4. Pre-Foreclosure: This stage occurs after the borrower receives a notice of default, but before the property is sold at auction. During this period, the borrower may try to negotiate with the lender for alternatives such as loan modification or short sale to avoid foreclosure. 5. Auction/Sheriff's Sale: In the event that the borrower fails to resolve the default, the property is put up for auction. Typically, the auction is conducted by a sheriff or under the supervision of a court-appointed trustee. Interested buyers place bids, and the highest bidder becomes the new owner of the property. 6. RED Properties: If the property does not sell at auction, it becomes Real Estate Owned (RED) or bank-owned property. In this case, the lender becomes the owner and is responsible for managing and selling the property through traditional real estate channels. 7. Foreclosure Mediation: In some cases, borrowers may have the opportunity to engage in foreclosure mediation, a process where an impartial third party assists in negotiations between the borrower and lender to find a mutually agreeable solution and potentially avoid foreclosure. It is crucial for borrowers in Gresham, Oregon, facing the foreclosure process to seek legal advice to understand their rights, explore available options, and navigate the complex legal procedures associated with Gresham Oregon Complaint — Foreclosure of Mortgage.

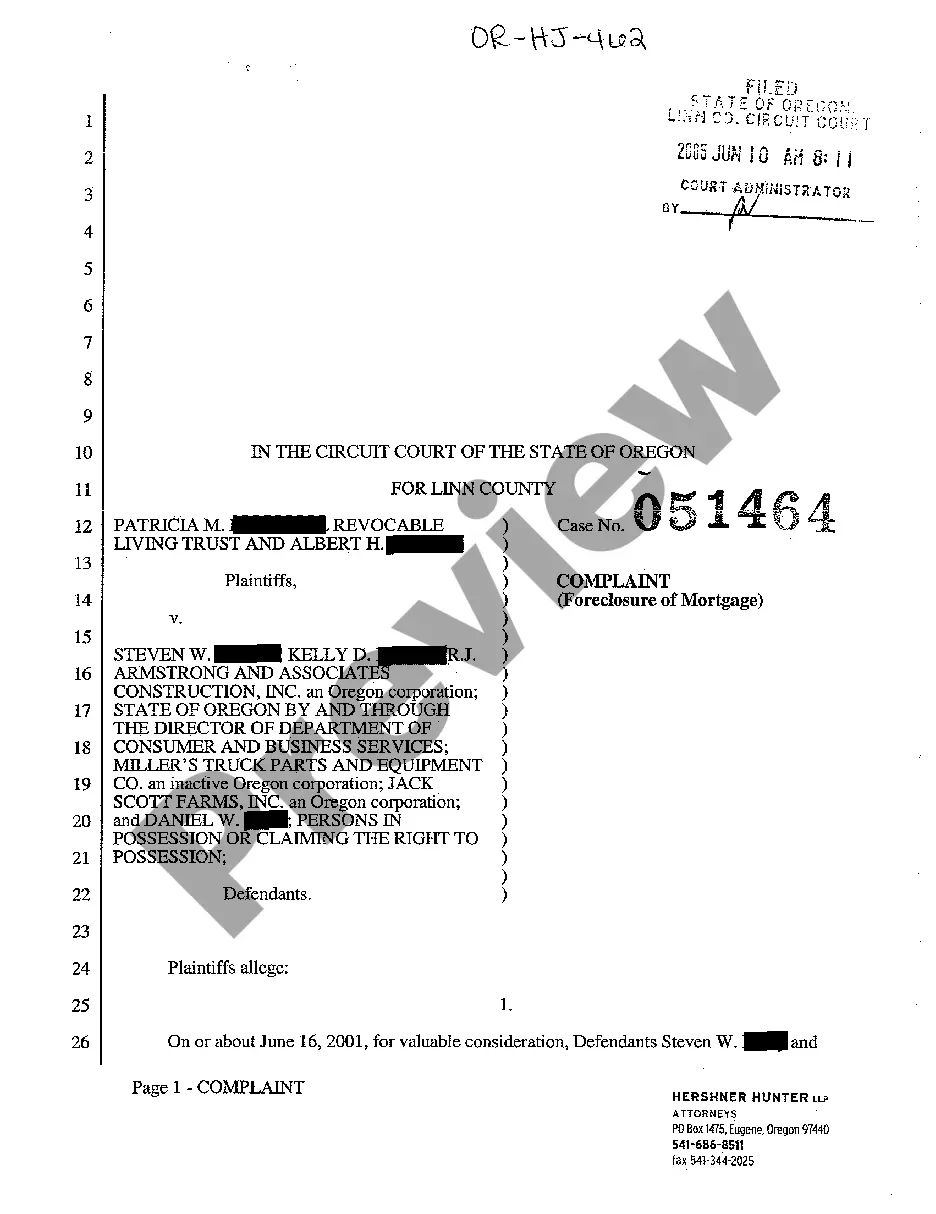

Gresham Oregon Complaint - Foreclosure of Mortgage

State:

Oregon

City:

Gresham

Control #:

OR-HJ-462

Format:

PDF

Instant download

This form is available by subscription

Description

Complaint - Foreclosure of Mortgage

Gresham Oregon Complaint — Foreclosure of Mortgage is a legal process initiated by a lender when a borrower defaults on their mortgage payments. This procedure allows the lender to repossess the property in order to recover the unpaid debt. Here are different types of Gresham Oregon Complaint — Foreclosure of Mortgage: 1. Judicial Foreclosure: This type of foreclosure requires the lender to file a lawsuit against the borrower to obtain a court order to foreclose on the property. The court conducts a public auction to sell the property to the highest bidder in order to satisfy the outstanding mortgage debt. 2. Non-Judicial Foreclosure: Also known as a power of sale foreclosure, this type of foreclosure does not involve the court system. Instead, the lender follows a specific timeline and procedure outlined in the mortgage documents to sell the property without court supervision and recover the debt owed. 3. Notice of Default: Before initiating the foreclosure process, the lender usually sends a notice of default to the borrower, informing them that they are in breach of their mortgage agreement due to non-payment. This notice provides an opportunity for the borrower to rectify the default by paying the outstanding amount within a specified period. 4. Pre-Foreclosure: This stage occurs after the borrower receives a notice of default, but before the property is sold at auction. During this period, the borrower may try to negotiate with the lender for alternatives such as loan modification or short sale to avoid foreclosure. 5. Auction/Sheriff's Sale: In the event that the borrower fails to resolve the default, the property is put up for auction. Typically, the auction is conducted by a sheriff or under the supervision of a court-appointed trustee. Interested buyers place bids, and the highest bidder becomes the new owner of the property. 6. RED Properties: If the property does not sell at auction, it becomes Real Estate Owned (RED) or bank-owned property. In this case, the lender becomes the owner and is responsible for managing and selling the property through traditional real estate channels. 7. Foreclosure Mediation: In some cases, borrowers may have the opportunity to engage in foreclosure mediation, a process where an impartial third party assists in negotiations between the borrower and lender to find a mutually agreeable solution and potentially avoid foreclosure. It is crucial for borrowers in Gresham, Oregon, facing the foreclosure process to seek legal advice to understand their rights, explore available options, and navigate the complex legal procedures associated with Gresham Oregon Complaint — Foreclosure of Mortgage.

Free preview

How to fill out Gresham Oregon Complaint - Foreclosure Of Mortgage?

If you’ve already used our service before, log in to your account and save the Gresham Oregon Complaint - Foreclosure of Mortgage on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Gresham Oregon Complaint - Foreclosure of Mortgage. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!