In Hillsboro, Oregon, the complaint — foreclosure of mortgage is a legal process initiated by a lender to reclaim a property from a borrower who has defaulted on their mortgage payments. This thorough and detailed description will provide information about the foreclosure process in Hillsboro, the parties involved, possible reasons for foreclosure, and different types of foreclosure complaints that may be encountered. Foreclosure of mortgage occurs when a borrower fails to make regular mortgage payments or breaches the terms and conditions set forth in their mortgage agreement. The lender, usually a bank or financial institution, files a complaint with the local court to seek legal action against the borrower and regain possession of the property securing the loan. This complaint begins the foreclosure process, aiming to recover the outstanding loan amount through the sale of the property. The foreclosure complaint typically includes relevant information such as the borrower's name, address, and details of the mortgage agreement. It identifies the lender as the plaintiff and the borrower as the defendant. Additionally, the complaint will mention the outstanding loan balance, accrued interest, fees, and costs associated with the foreclosure process. It may also outline a specific amount of time for the borrower to respond or rectify the default. There are several types of foreclosure complaints that may be filed in Hillsboro, Oregon, depending on the circumstances and the state laws. Some common types include: 1. Judicial foreclosure: This is the most common type in Oregon, where the lender files a complaint in court to initiate the foreclosure process. The court oversees the proceedings until the foreclosure sale occurs. 2. Non-judicial foreclosure: Also known as trustee sales, this type does not involve the court system. Instead, the foreclosure process is managed by a trustee as outlined in the mortgage agreement or deed of trust. Non-judicial foreclosures are typically faster and less expensive for lenders. 3. Strict foreclosure: In this type, the court determines that the borrower's default cannot be remedied or that the borrower is not entitled to any further time to cure the default. Once the court enters the order of strict foreclosure, the lender becomes the new owner of the property without a public sale. 4. Deed-in-lieu of foreclosure: This foreclosure alternative allows the borrower to voluntarily transfer ownership of the property to the lender, avoiding the lengthy foreclosure process. The lender may agree to accept the property deed and forgive any remaining debt owed by the borrower. It's essential to note that each foreclosure complaint type has distinct procedures and timelines, which can vary in different states and jurisdictions. Borrowers facing foreclosure should consult with legal professionals, such as foreclosure defense attorneys or housing counselors, to understand their rights and explore possible alternatives to foreclosure. In Hillsboro, Oregon, a complaint — foreclosure of mortgage serves as the initial legal step towards reclaiming a property secured by a mortgage loan. Understanding the various types of foreclosure complaints and seeking professional guidance can help borrowers navigate this challenging situation effectively.

Hillsboro Oregon Complaint - Foreclosure of Mortgage

Description

How to fill out Hillsboro Oregon Complaint - Foreclosure Of Mortgage?

Getting verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Hillsboro Oregon Complaint - Foreclosure of Mortgage gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Hillsboro Oregon Complaint - Foreclosure of Mortgage takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

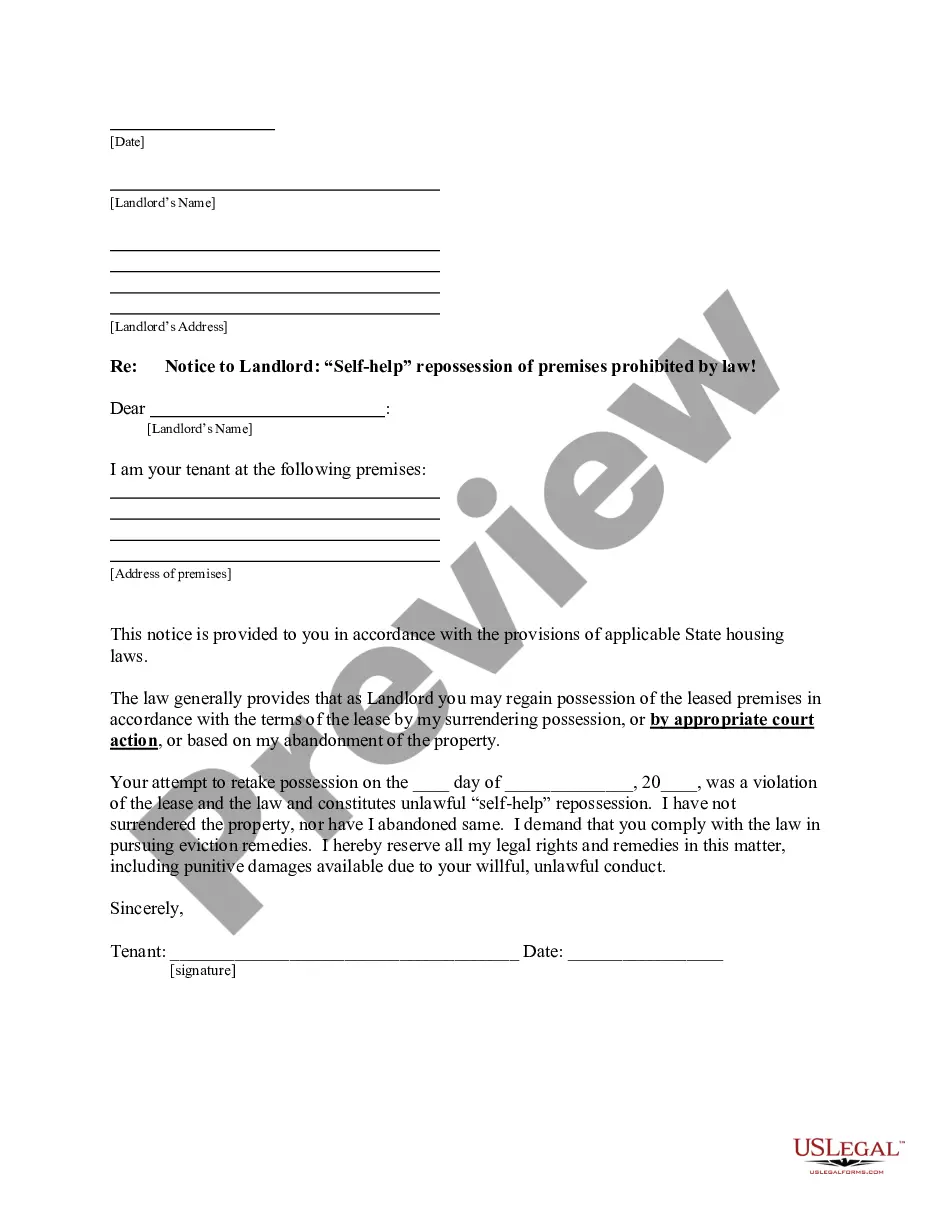

- Look at the Preview mode and form description. Make sure you’ve picked the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Hillsboro Oregon Complaint - Foreclosure of Mortgage. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!