Title: Understanding the Eugene Oregon Complaint for Strict Foreclosure: Types, Process, and Legal Guidelines Description: In Eugene, Oregon, a Complaint for Strict Foreclosure is a legal document filed by a lender or mortgagee seeking to enforce their rights to foreclose on a property due to loan default. This detailed description sheds light on the different types of Eugene Oregon Complaints for Strict Foreclosure, their processes, and essential legal guidelines. Keywords: Eugene Oregon, Complaint for Strict Foreclosure, types, process, legal guidelines, loan default, lender, mortgagee. 1. Types of Eugene Oregon Complaints for Strict Foreclosure: — Residential Property Complaint for Strict Foreclosure — Commercial Property Complaint for Strict Foreclosure 2. Process: The Eugene Oregon Complaint for Strict Foreclosure follows a specific process, which generally includes the following steps: — Initial Delinquency: When a borrower falls behind on their mortgage payments, typically after several missed payments or breaches of loan terms. — Notice of Default: The lender issues a formal notice to the borrower, informing them of their default status and potential foreclosure actions. — Complaint Filing: If the borrower fails to cure the default or reach an alternative solution, the lender files a Complaint for Strict Foreclosure with the local court. — Notice of Complaint: The borrower is served with the Complaint, providing them an opportunity to respond and present their case. — Court Proceedings: If the borrower does not offer a valid legal defense, the court proceeds with the foreclosure proceedings. — Foreclosure Sale: After obtaining a judgment in their favor, the lender conducts a foreclosure sale to recover the outstanding loan amount. 3. Legal Guidelines: — Redemption Period: In Eugene, Oregon, there is no statutory redemption period after a Strict Foreclosure. Once the court grants the foreclosure judgment, the borrower's right to redeem the property diminishes. — Lender's Sale Rights: Depending on the specific circumstances and the type of foreclosure, the lender may have the option to sell the property through a public auction or private sale. — Surplus Funds: If the foreclosure sale exceeds the amount owed, surplus funds are usually returned to the borrower after satisfying outstanding liens. — Deficiency Judgment: In certain cases where the foreclosure sale does not cover the outstanding debt, the lender may seek a deficiency judgment against the borrower for the remaining amount. Overall, navigating the Eugene Oregon Complaint for Strict Foreclosure can be intricate and legally complex. It is vital for borrowers facing foreclosure to seek legal advice and understand their rights and options throughout the process. Note: The information provided here is for general informational purposes only and should not be considered legal advice. Consult an attorney or legal professional for specific guidance regarding the Eugene Oregon Complaint for Strict Foreclosure.

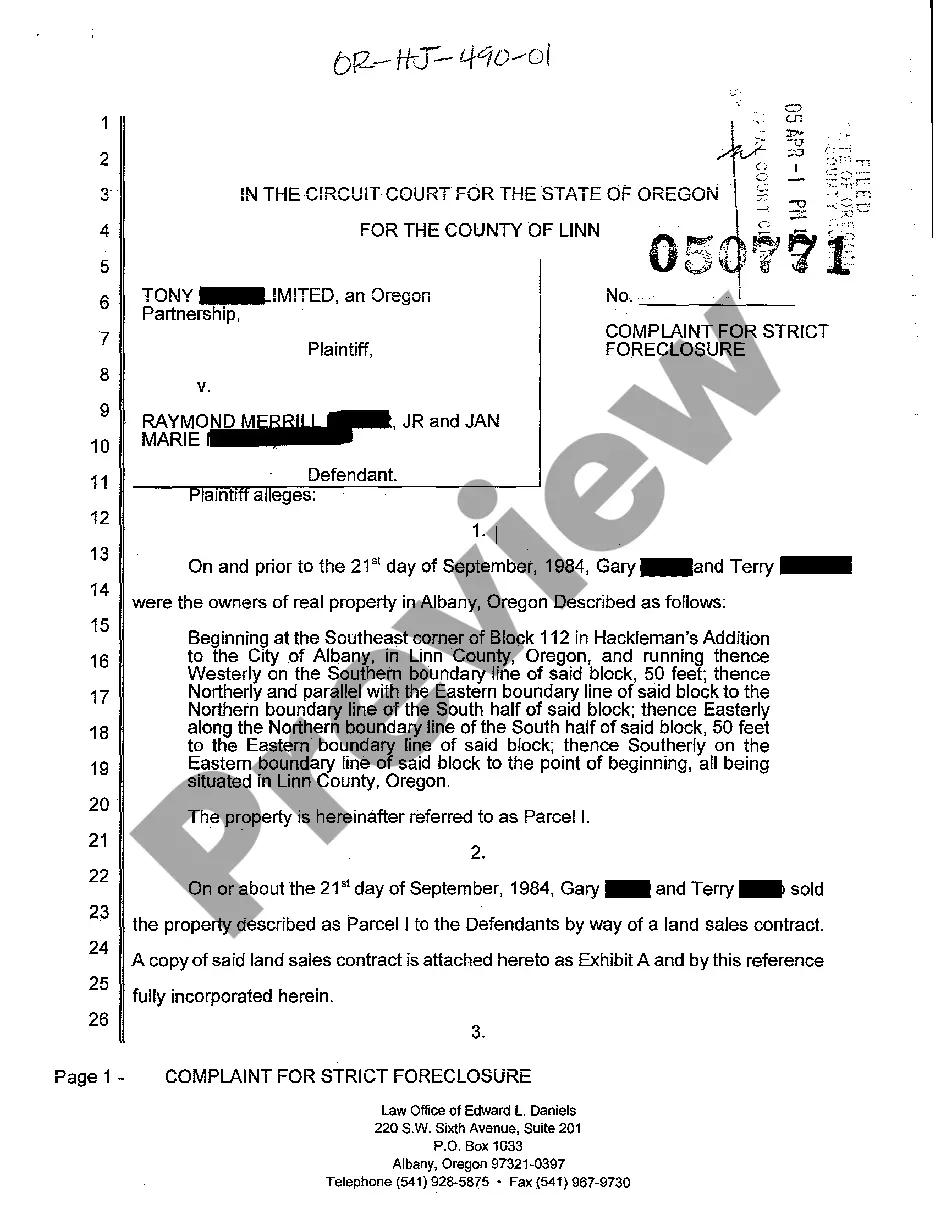

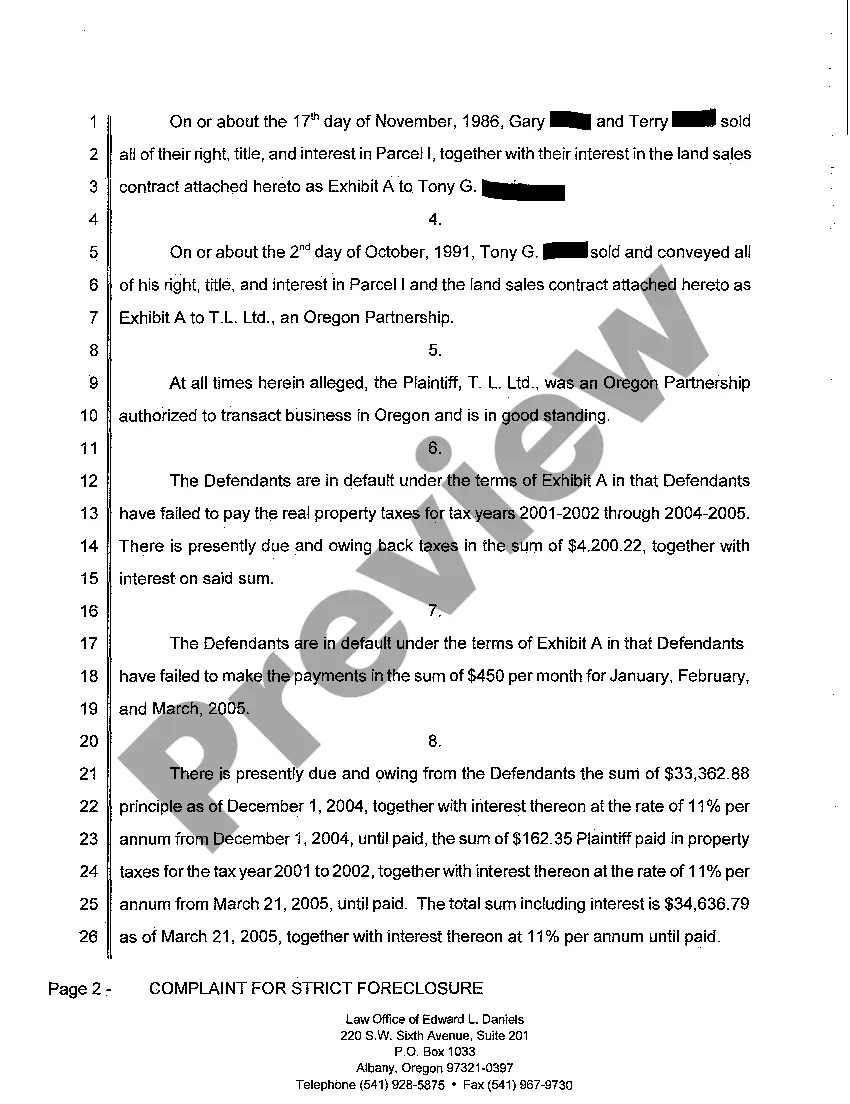

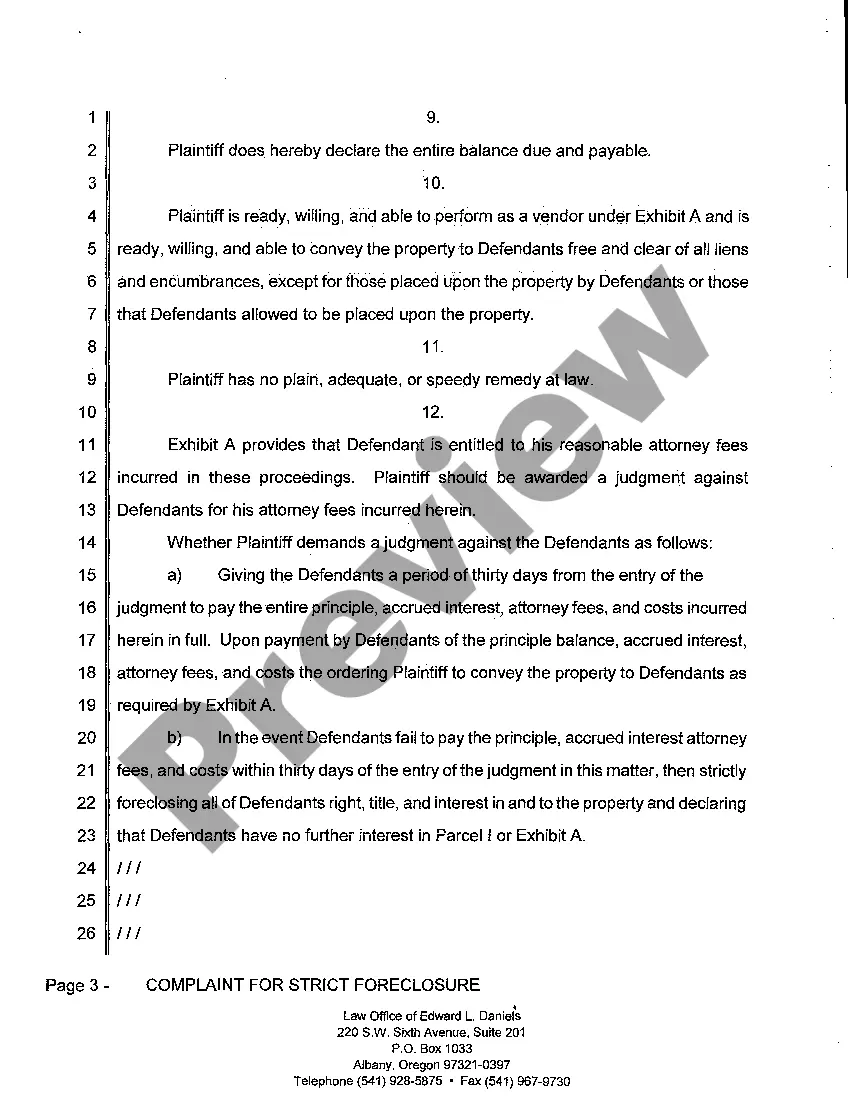

Eugene Oregon Complaint for Strict Foreclosure

Description

How to fill out Eugene Oregon Complaint For Strict Foreclosure?

If you are in search of a legitimate document, it’s exceedingly challenging to select a superior service than the US Legal Forms website – likely the most extensive collections on the web.

Here you can obtain thousands of templates for business and personal uses categorized by types and regions, or specific keywords.

With our exceptional search capability, finding the latest Eugene Oregon Complaint for Strict Foreclosure is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Acquire the template. Choose the file format and save it to your device. Edit. Fill out, alter, print, and sign the obtained Eugene Oregon Complaint for Strict Foreclosure.

- Moreover, the significance of each document is validated by a group of experienced attorneys who consistently examine the templates on our site and update them in accordance with the latest state and county regulations.

- If you are already acquainted with our platform and possess an account, all you need to do to acquire the Eugene Oregon Complaint for Strict Foreclosure is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, just follow the instructions below.

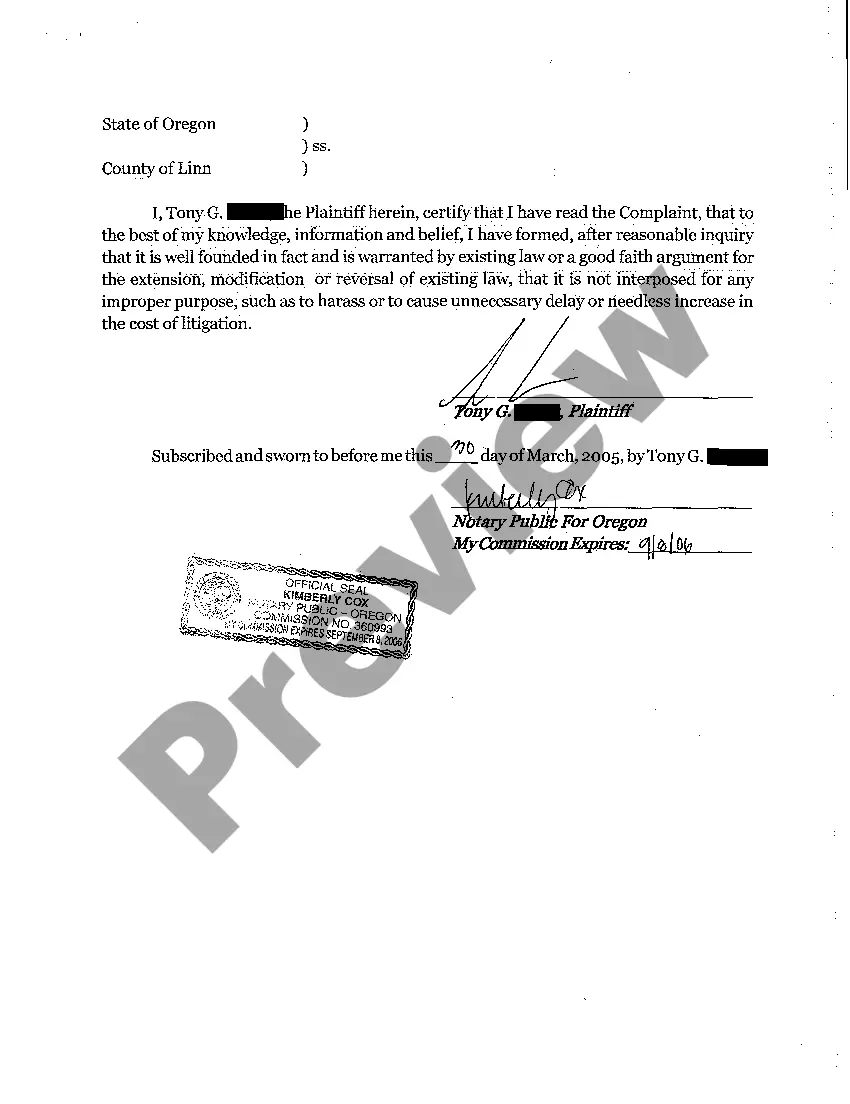

- Ensure you have selected the document you desire. Review its description and use the Preview option to view its content. If it does not meet your demands, utilize the Search box at the top of the display to find the appropriate record.

- Validate your choice. Press the Buy now button. Following that, select the desired pricing plan and enter your details to create an account.

Form popularity

FAQ

The best way to complain about a bank is to clearly articulate your issues and gather any supporting evidence. You can start by contacting the bank’s customer service, and if that does not resolve your complaint, escalate it to regulatory bodies like the FDIC or the Oregon Department of Consumer and Business Services. If your complaint involves a Eugene Oregon complaint for strict foreclosure, consider seeking legal assistance to enhance your case and advocate for your rights.

In Oregon, banks are regulated by the Oregon Department of Consumer and Business Services. This agency oversees financial institutions to ensure compliance with state laws and protects consumers from unfair practices. If you're facing issues, particularly related to foreclosure, understanding these regulations can empower you in your Eugene Oregon complaint for strict foreclosure. Staying informed allows you to safeguard your rights.

Filing a complaint against a bank in Oregon involves gathering necessary documentation and submitting your case to the appropriate regulatory body. You can present your issue to the Oregon Department of Consumer and Business Services or take legal action by submitting a complaint related to your Eugene Oregon complaint for strict foreclosure. Consider seeking the help of an attorney for effective navigation through this process.

To stop a foreclosure in Oregon, you can file a complaint for strict foreclosure. This legal action allows you to challenge the foreclosure process and assert your rights. It's important to act quickly, as there are specific timelines involved in foreclosures. Consulting with a legal professional familiar with the Eugene Oregon complaint for strict foreclosure process can provide you guidance tailored to your situation.

The 120-day rule for foreclosure refers to a regulation that requires lenders to wait at least 120 days after the first missed payment before filing for foreclosure. This rule aims to give borrowers a chance to catch up on payments or find alternatives. Knowing this rule can empower you or those you care about when navigating the legal landscape of the Eugene Oregon Complaint for Strict Foreclosure.

Typically, the homeowner suffers the most during a foreclosure. Losing a home can lead to emotional distress, financial instability, and long-term credit damage. Additionally, the community may also feel the impacts, as foreclosures can lead to decreased property values. If you're facing this situation, understanding the Eugene Oregon Complaint for Strict Foreclosure can provide vital insights and options.

A complaint in foreclosure is a legal document filed by a lender to initiate foreclosure proceedings against a borrower. This document outlines the reasons for the foreclosure and the borrower's default. With the Eugene Oregon Complaint for Strict Foreclosure, you can better comprehend your rights and the lender's obligations during this serious process.

The foreclosure process in Mississippi generally takes around 90 to 120 days, depending on various factors. However, if complications arise, it could extend the timeline significantly. Understanding the Eugene Oregon Complaint for Strict Foreclosure can help you navigate this process more efficiently, allowing you to anticipate and prepare for potential delays.

To file a complaint against the state of Oregon, you should identify the agency responsible for the issue you're experiencing. Many departments have specific procedures for addressing complaints. If you're dealing with a situation that involves a Eugene Oregon Complaint for Strict Foreclosure, you might find assistance through legal resources or forms available at US Legal Forms.

In Oregon, you can file complaints on a variety of issues, including consumer disputes, housing grievances, and public nuisances. Different agencies handle specific types of complaints, so it's essential to direct your issue to the correct organization. If you're unsure, platforms like US Legal Forms can guide you on how to properly format a Eugene Oregon Complaint for Strict Foreclosure or other specific complaints.