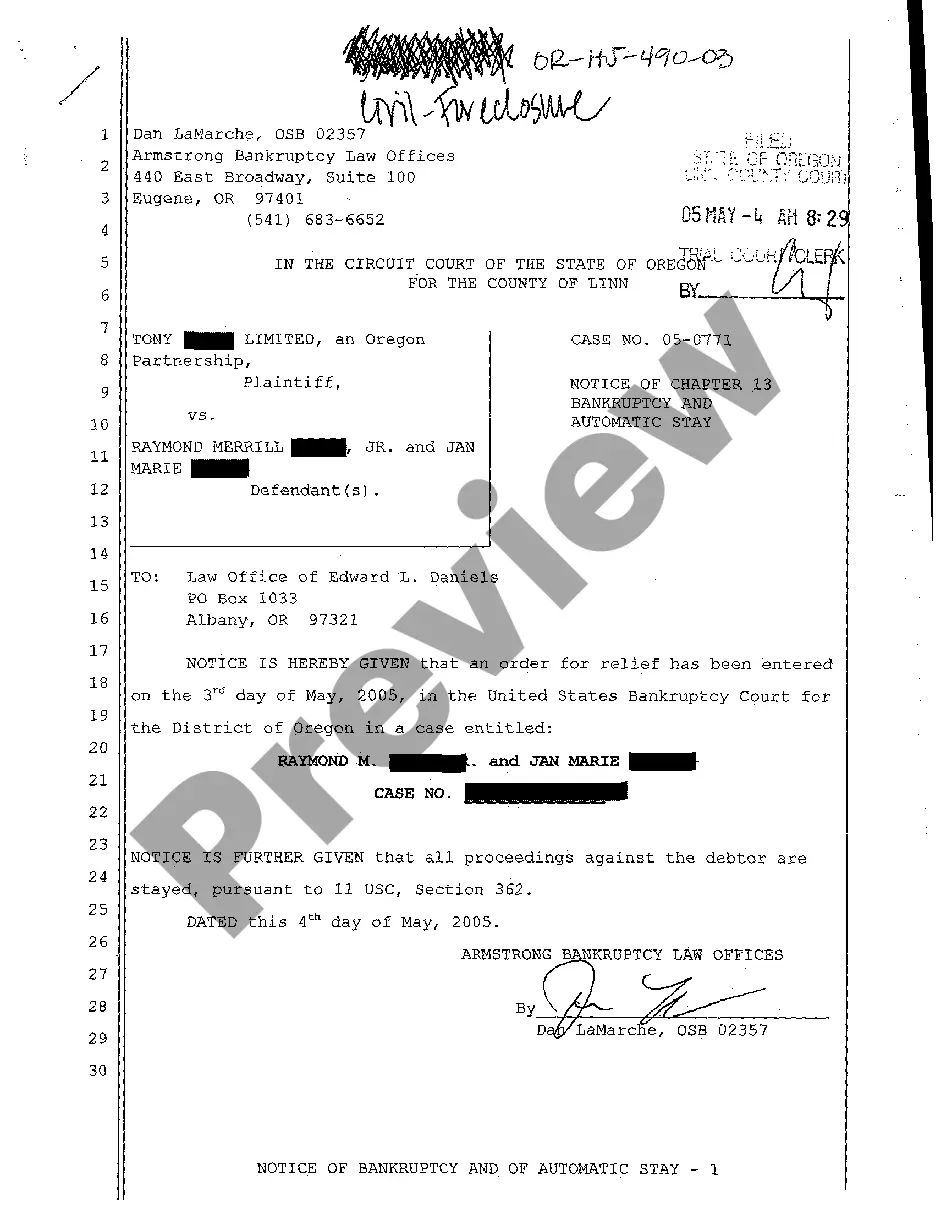

Bend Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay

Description

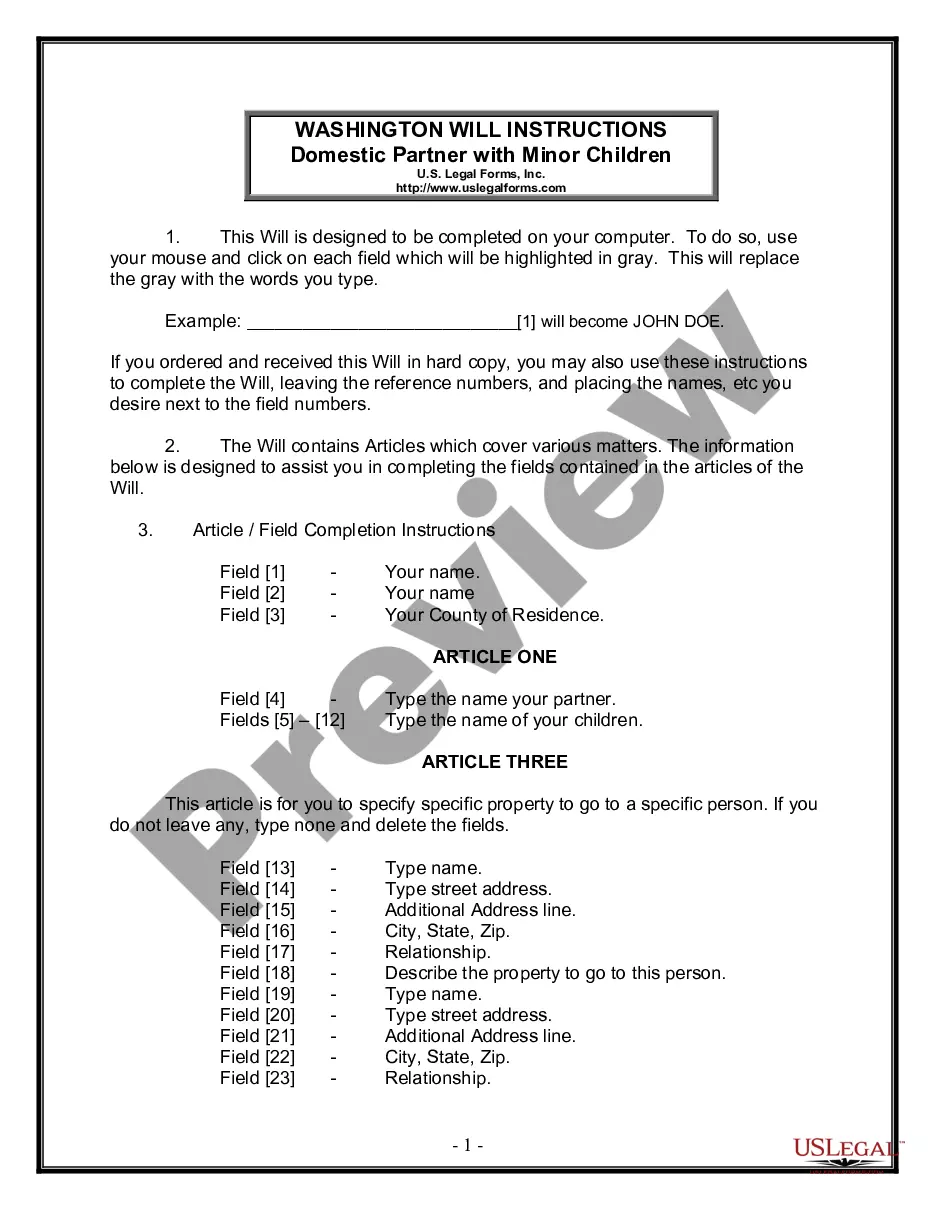

How to fill out Oregon Notice Of Chapter 13 Bankruptcy And Automatic Stay?

Take advantage of the US Legal Forms and gain immediate access to any form template you desire.

Our valuable website featuring countless templates streamlines the process of locating and acquiring almost any document sample you require.

You can quickly export, complete, and authenticate the Bend Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay within minutes rather than spending hours online searching for the correct template.

Leveraging our collection is an excellent tactic to enhance the security of your form submissions. Our experienced attorneys routinely assess all documents to ensure that the templates are applicable for a specific state and adhere to current laws and regulations.

Initiate the download process. Click Buy Now and select your preferred pricing option. Then, register for an account and complete your order using a credit card or PayPal.

Download the file. Specify the format for obtaining the Bend Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay and modify and complete, or sign it according to your needs.

- How can you access the Bend Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay.

- If you possess an account, simply Log In to your profile. The Download button will be available on all the documents you browse.

- Moreover, you can retrieve all previously saved files from the My documents section.

- If you have not yet created an account, follow these steps.

- Locate the form you need. Verify that it is the document you are seeking: confirm its title and description, and utilize the Preview option if accessible. If not, use the Search bar to find the right one.

Form popularity

FAQ

The average Chapter 13 monthly payment varies based on your total income and debt repayment plan. Generally, individuals may expect payments between $200 to $400 per month, but this can differ based on individual circumstances. When filing a Bend Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay, it's crucial to create a budget that accurately reflects your financial capabilities. Consulting with a professional or using U.S. Legal Forms can help you determine your expected payment based on your unique situation.

Filling out Chapter 13 bankruptcy forms requires careful attention to your financial situation. You will need to collect detailed information about your debts, income, and expenses. Using resources like U.S. Legal Forms can simplify this process, as they provide accurate templates specifically designed for the Bend Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay. By following their step-by-step guidance, you can ensure you fill out the forms correctly.

Bankruptcy Chapter 13 relief from automatic stay refers to the circumstances where a creditor may seek permission from the court to proceed with collection efforts despite the automatic stay. This happens when a creditor believes they have a valid reason to take action, such as if you fail to make required payments. Understanding this process is crucial for anyone facing financial challenges. The Bend Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay offers you essential information on how to navigate these complicated situations effectively.

In Bend, Oregon, the automatic stay in Chapter 13 Bankruptcy typically lasts for the duration of your repayment plan, which can be three to five years. This stay protects you from most creditors and allows you to reorganize your debts without the pressure of collection actions. However, it is essential to comply with the plan’s terms to maintain this protection. Remember, the Bend Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay is your key tool in managing your financial obligations.

Yes, an automatic stay is a key feature of a Bend Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay. When you file for Chapter 13 bankruptcy, the automatic stay takes effect immediately. It serves to protect you from creditors by prohibiting them from pursuing collections or legal actions during the bankruptcy process. This legal shield helps you regain control over your financial situation as you work on your repayment plan.

When you file for a Bend Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay, the automatic stay provides immediate relief from creditor actions. It halts collection efforts, stops eviction proceedings, and freezes repossessions. This instant protection allows you to reorganize your finances without the constant pressure from creditors. You can focus on creating a plan for debt repayment and securing your financial future.

Yes, you can file Chapter 13 on your own, but it is often advised to seek professional guidance. The process requires understanding complex legal forms and prevailing laws, especially regarding the Bend Oregon Notice of Chapter 13 Bankruptcy and Automatic Stay. Many individuals find that the assistance of a legal expert can simplify this process. If you choose to do it alone, be sure to use reliable resources to ensure your filing is accurate and complete.