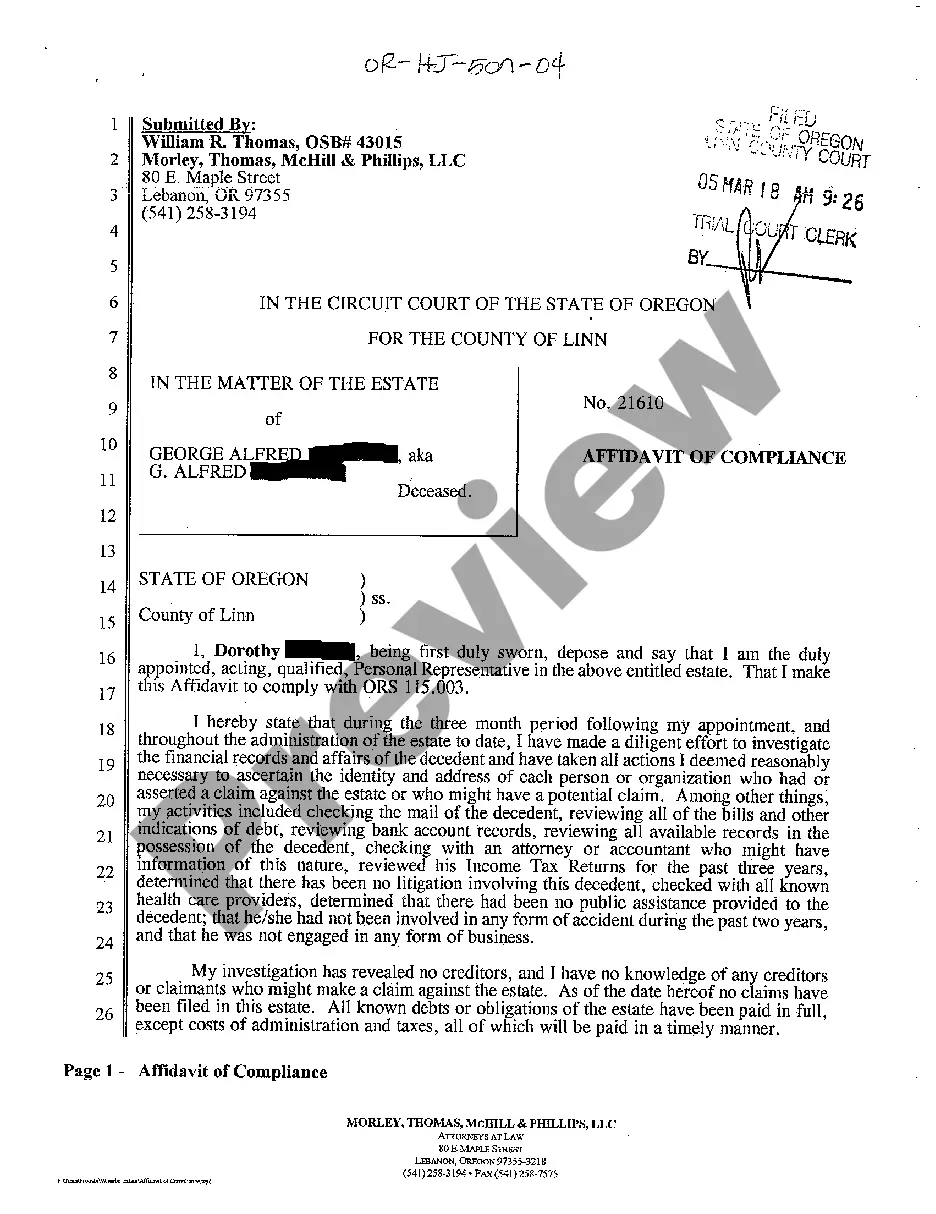

The Hillsboro Oregon Affidavit of Compliance of Appointed Personal Representative is a legal document that ensures a personal representative appointed by the probate court is in compliance with the requirements of O.R.S. 113.165. This affidavit is an essential part of the probate process in Hillsboro, Oregon, and its surrounding areas. The Affidavit of Compliance of Appointed Personal Representative serves as proof that the personal representative has fulfilled the necessary duties and responsibilities as mandated by state law. It is crucial for the personal representative to complete and submit this document accurately and on time to demonstrate their compliance and ensure a smooth probate process. Some key components covered in the Hillsboro Oregon Affidavit of Compliance of Appointed Personal Representative are: 1. Personal Representative Information: The affidavit requires the personal representative's full legal name, contact information, and their relationship to the deceased individual (known as the decedent). 2. Decedent Information: This section of the affidavit captures relevant details about the decedent, including their full legal name, date of death, and last known address. It is essential to provide accurate information to facilitate the probate process. 3. Notice: The personal representative must confirm that they have provided proper notice to all interested parties, including beneficiaries, heirs, creditors, and other relevant individuals, as required by law. This ensures transparency and allows interested parties to exercise their legal rights. 4. Inventory and Appraisal: The Hillsboro Oregon Affidavit of Compliance of Appointed Personal Representative may require the personal representative to declare that they have completed an inventory and appraisal of the decedent's assets, including real estate, personal property, and financial accounts. This step helps determine the estate's overall value and assists in the fair distribution of assets. 5. Taxes and Debts: The personal representative will likely have to provide information about the decedent's outstanding debts, taxes owed, and any claims against the estate. This ensures that debts are properly paid and that the distribution of assets is carried out following legal obligations. 6. Distribution of Assets: The affidavit may include a section where the personal representative outlines their actions regarding the distribution of the estate's assets. They may need to describe the steps taken to transfer the assets to beneficiaries and the terms of distribution as specified in the decedent's will or determined by the court. It is important to note that specific requirements or variations may exist based on individual cases or the type of probate involved, including small estate affidavits or formal probate administrations. Consulting with an experienced probate attorney or legal professional in Hillsboro, Oregon would ensure accurate completion of the Affidavit of Compliance of Appointed Personal Representative and adherence to all relevant laws.

Hillsboro Oregon Affidavit of Compliance of Appointed Personal Representative

Description

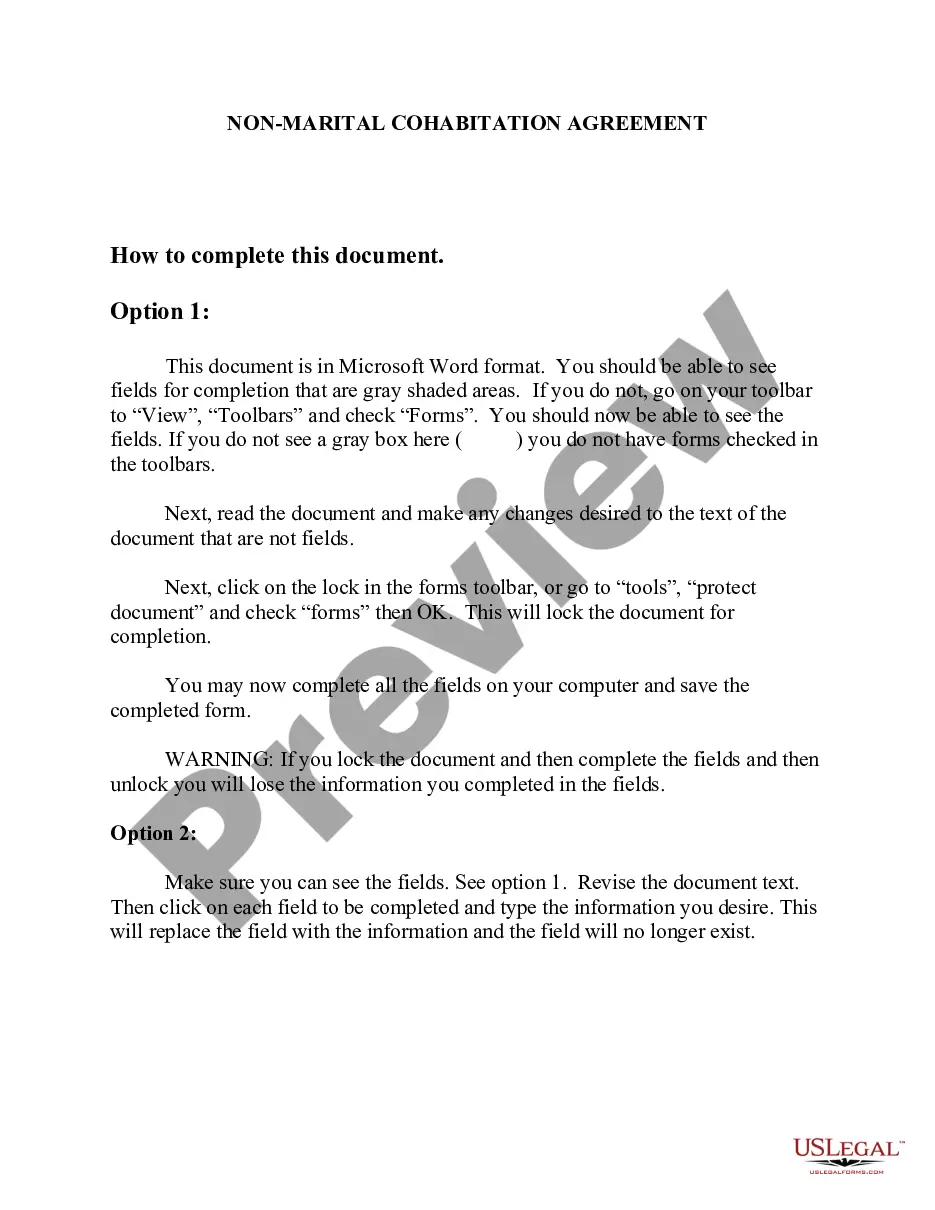

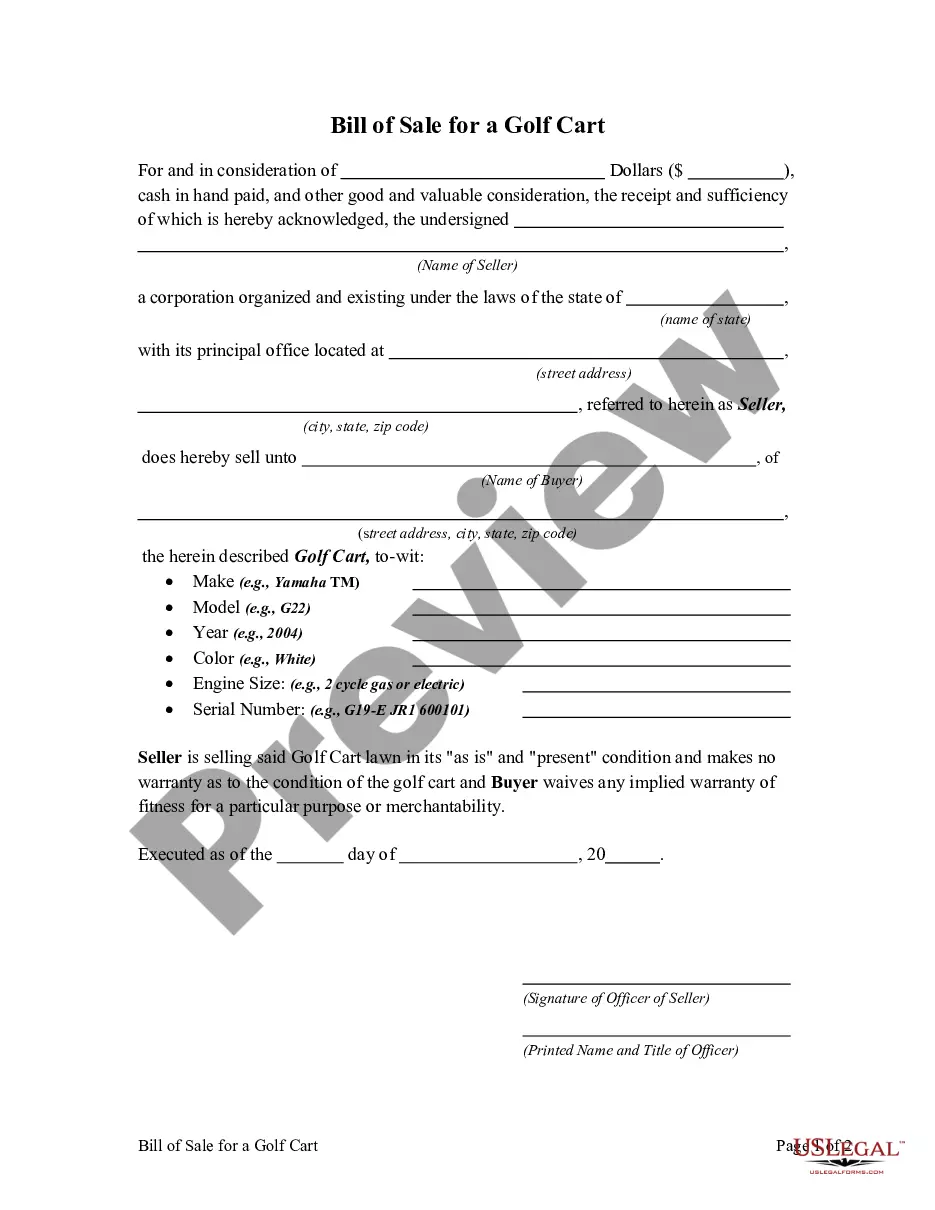

How to fill out Hillsboro Oregon Affidavit Of Compliance Of Appointed Personal Representative?

Regardless of social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for a person with no law background to draft this sort of paperwork cfrom the ground up, mainly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our service provides a massive library with more than 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you want the Hillsboro Oregon Affidavit of Compliance of Appointed Personal Representative or any other document that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Hillsboro Oregon Affidavit of Compliance of Appointed Personal Representative quickly employing our trusted service. In case you are presently an existing customer, you can go ahead and log in to your account to get the needed form.

Nevertheless, in case you are new to our platform, ensure that you follow these steps before obtaining the Hillsboro Oregon Affidavit of Compliance of Appointed Personal Representative:

- Be sure the template you have chosen is suitable for your location considering that the rules of one state or area do not work for another state or area.

- Preview the form and read a short outline (if provided) of scenarios the document can be used for.

- If the form you selected doesn’t meet your needs, you can start over and search for the needed document.

- Click Buy now and pick the subscription option that suits you the best.

- with your login information or create one from scratch.

- Choose the payment gateway and proceed to download the Hillsboro Oregon Affidavit of Compliance of Appointed Personal Representative as soon as the payment is through.

You’re good to go! Now you can go ahead and print the form or fill it out online. In case you have any issues locating your purchased forms, you can quickly find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.