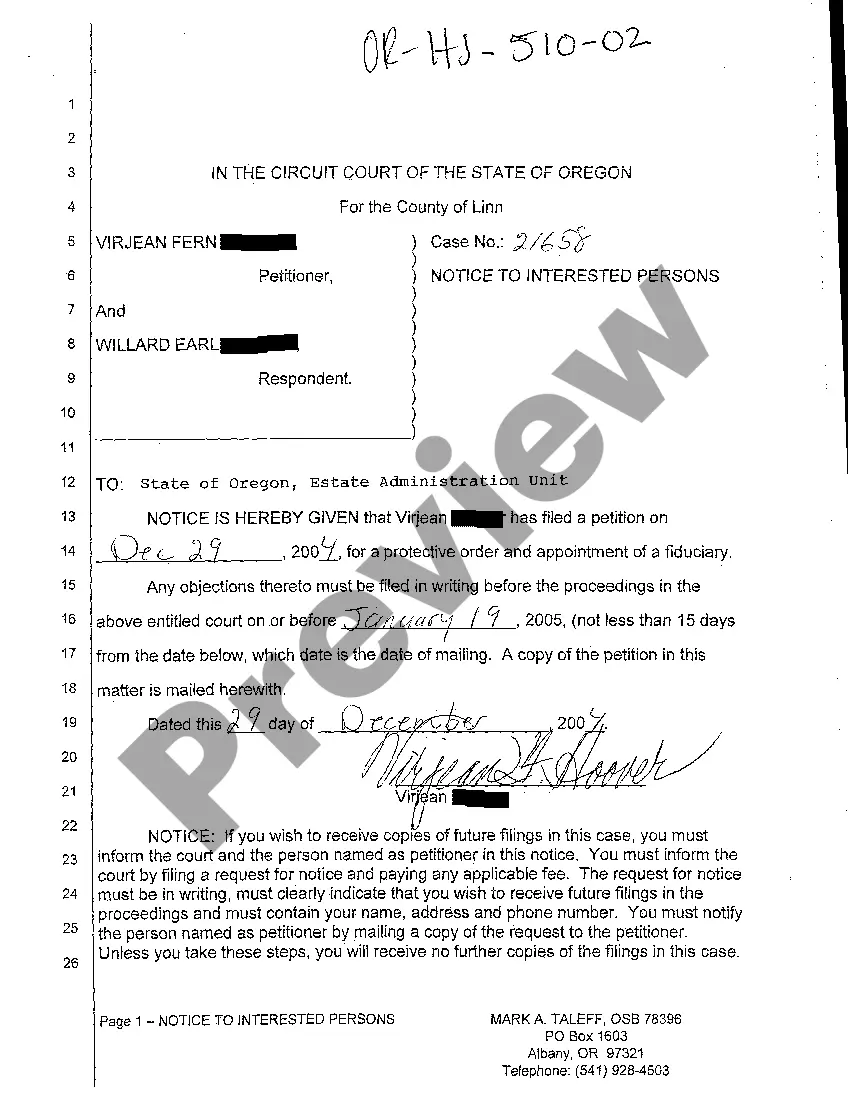

A Hillsboro Oregon Notice to Interested Persons of the Filing for the Appointment of Fiduciary is a legally required document that informs individuals with a potential interest in an estate about the filing for the appointment of a fiduciary. This notice aims to ensure that all interested parties have the opportunity to participate in the estate proceedings, provide their claims or objections, and protect their rights. In Hillsboro, Oregon, there are primarily two types of notices to interested persons commonly associated with the filing for the appointment of a fiduciary: 1. Hillsboro Oregon Notice to Interested Persons of the Filing for the Appointment of Fiduciary — Probate Estate: This type of notice is specifically related to the probate process. When an individual passes away, their estate often goes through probate, during which a personal representative or executor is appointed to handle the estate's affairs. This notice informs potentially interested persons, such as heirs, creditors, and beneficiaries, about the initiation of the probate process and the impending appointment of a fiduciary. 2. Hillsboro Oregon Notice to Interested Persons of the Filing for the Appointment of Fiduciary — Guardianship/Conservatorship: In some cases, an individual may become incapacitated or unable to manage their own affairs. When this happens, a guardian or conservator is appointed by the court to make decisions on behalf of the incapacitated person. This notice informs interested individuals about the filing for the appointment of a fiduciary in guardianship or conservatorship matters. Regardless of the specific type, a Hillsboro Oregon Notice to Interested Persons of the Filing for the Appointment of Fiduciary contains essential information, such as the name of the decedent or incapacitated individual, the personal representative or fiduciary being considered for appointment, the court handling the matter, the case number, and pertinent dates. The notice also briefly explains the purpose of the notice and provides instructions on how interested persons can participate in the proceedings or voice any objections. It is crucial for those who receive this notice to carefully review its contents and take appropriate action, especially if they believe they have a claim to the estate, are owed a debt by the decedent or incapacitated person, or have concerns regarding the proposed fiduciary. By following the outlined procedures within the given time frame, individuals can ensure their participation in the estate proceedings and safeguard their rights.

Hillsboro Oregon Notice to Interested Persons of the Filing for the Appointment of Fiduciary

Description

How to fill out Hillsboro Oregon Notice To Interested Persons Of The Filing For The Appointment Of Fiduciary?

If you’ve already used our service before, log in to your account and download the Hillsboro Oregon Notice to Interested Persons of the Filing for the Appointment of Fiduciary on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Make sure you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Hillsboro Oregon Notice to Interested Persons of the Filing for the Appointment of Fiduciary. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!

Form popularity

FAQ

Executors' year However, many beneficiaries don't realise that executors and administrators have twelve months before they are obliged to distribute the estate to the beneficiaries. Time runs from the date of death.

There is not any legal timeframe for applying for probate, however much of the estate administration will not be possible until this is received, so it is generally one of the first things that is done. In the case of some small estates, probate may not be necessary. This will depend on the amount of assets held.

6-9 months is how long probate typically takes in Oregon Once the four-month discovery and notice period is complete, the probate court and PR begin overseeing the settling of the estate. For example, valid creditors receive payment and settlement from out of the estate's assets.

The person named as beneficiary would automatically receive everything in the trust when the owner passes away. In some cases, you may not be able to avoid probate entirely, but you can keep some assets out of it. Some assets allow a beneficiary to be named, which will allow them to inherit without going to probate.

How do I get letters? Letters Testamentary or Letters of Administration are issued by the court, once the court has appointed you the Personal Representative of the estate.

The executor will need to wait until the 2 month time limit is up, before distributing the estate. Six month limit to bring a claim ? in other cases, it can be sensible for the executors not to pay any beneficiaries until at least 6 months after receiving the grant of probate.

Other deadlines exist that must be followed. For instance, a list of assets must be provided within 90 days after the executor was appointed.

Not less than 30 days after the death of the decedent, one or more the of the claiming successors may file an affidavit with the clerk of the probate court in the county where the decedent died or was domiciled or resided at the time of death or in the county where the property of the decedent was located at the time

The administration of a probate estate takes a minimum of 4 Months in Oregon. The typical amount of time is closer to 7 to 10 months depending on the nature of the assets and the backlog at the court house.

Small Estate Probate In order to qualify, the assets must be: Less than $200,000 worth in real estate. Less than $75,000 worth in personal property (including bank accounts and vehicles) Less than $275,000 worth in total value.