Title: Exploring the Eugene, Oregon Petition for Accounting of Living Trust: Types and Key Information Introduction: The Eugene, Oregon Petition for Accounting of Living Trust holds significance in ensuring the transparency and proper management of living trusts. In this comprehensive overview, we will delve into the different types of petitions available and explore key information surrounding this legal process in Eugene, Oregon. 1. Types of Eugene, Oregon Petition for Accounting of Living Trust: a. Initial Petition for Accounting: — This type of petition is typically filed by a beneficiary of a living trust seeking an initial accounting of the trust's assets, income, expenses, and distributions. b. Subsequent Petition for Accounting: — Subsequent petitions are filed when a beneficiary requires additional information or a revised accounting of the living trust after the initial petition has been settled. c. Petition for Termination of Living Trust Accounting: — This type of petition is filed when a beneficiary wishes to terminate the accounting of a living trust, usually because the trust has reached its final distribution or other legal requirements are met. 2. Key Information Regarding Eugene, Oregon Petition for Accounting of Living Trust: a. Purpose and Objective: — The primary purpose of filing a petition for accounting of a living trust is to request a court-supervised review of the trustee's management of the trust assets, ensuring transparency and accountability. b. Legal Requirements: — The petitioner must have legal standing, typically being a current beneficiary of the living trust. It is crucial to provide evidence showing a reasonable belief that the trustee is mismanaging the trust or withholding essential information. c. Filing Process: — The petitioner must submit a completed petition form to the appropriate court, along with supporting documentation and any required filing fees. The documents should be served to the trustee and other interested parties. d. Court Evaluation and Decision: — Once the petition is filed, the court evaluates the presented case, including the trustee's response and any objections from beneficiaries or interested parties. The court then decides whether an accounting is necessary and may appoint an impartial accountant if required. e. Resolution and Trustee's Duties: — Depending on the court's ruling, the trustee may be required to provide a detailed accounting of trust assets, income, expenses, and distributions. The trustee must cooperate throughout the process and adhere to any orders issued by the court. Conclusion: The Eugene, Oregon Petition for Accounting of Living Trust is an essential legal mechanism for beneficiaries seeking transparency and oversight of trust management. By understanding the various types of petitions available and the key information surrounding this process, individuals can navigate the legal requirements with confidence and ensure the proper management of living trusts in Eugene, Oregon.

Eugene Oregon Petition for Accounting of Living Trust

State:

Oregon

City:

Eugene

Control #:

OR-HJ-512-01

Format:

PDF

Instant download

This form is available by subscription

Description

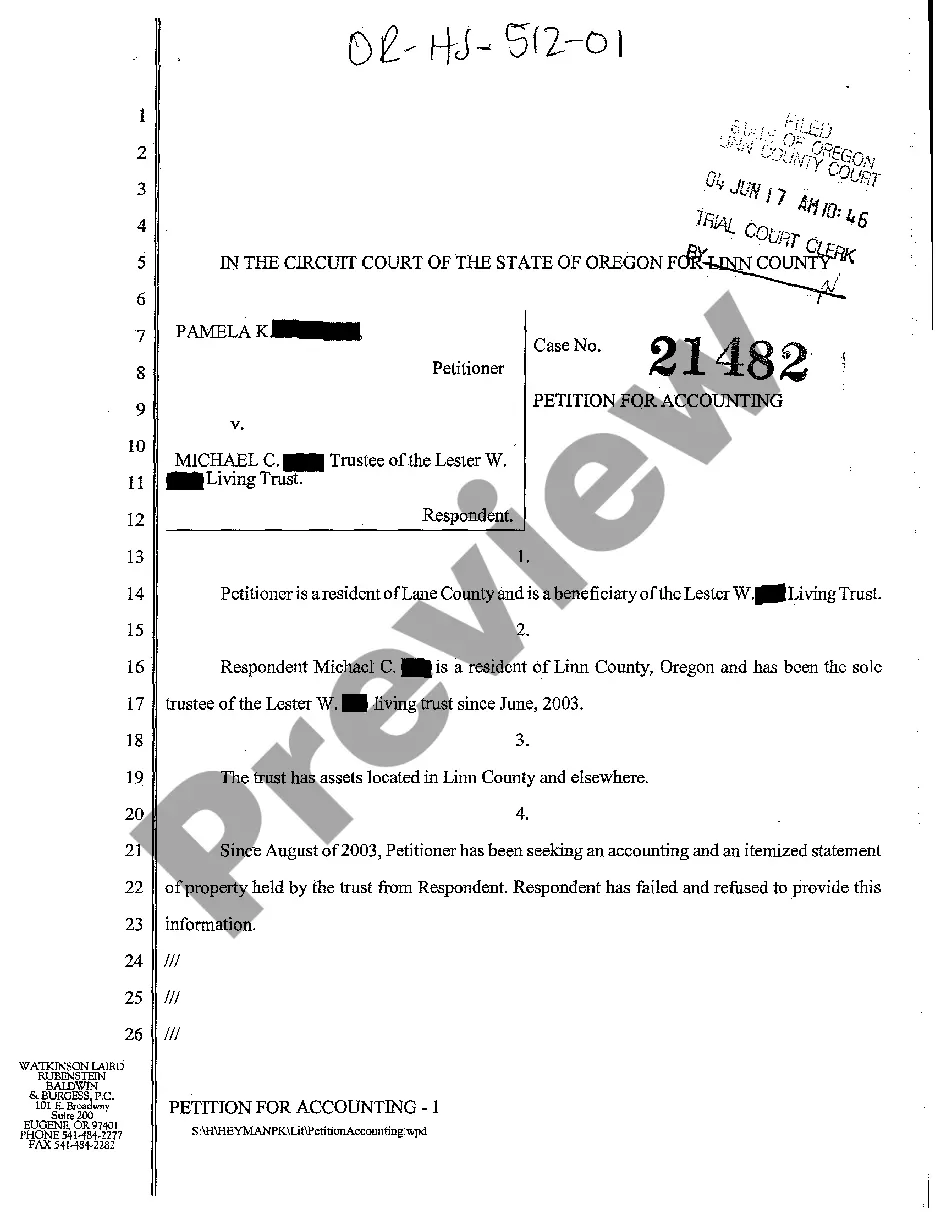

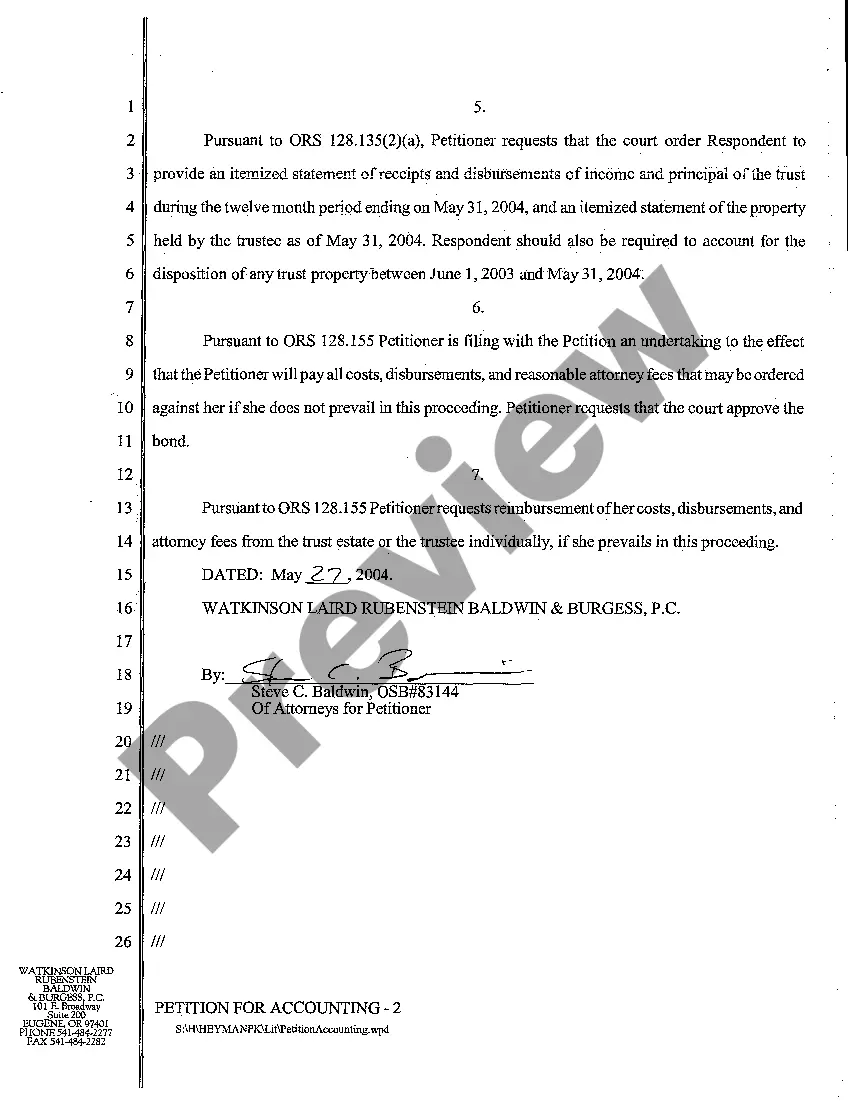

A01 Petition for Accounting of Living Trust

Title: Exploring the Eugene, Oregon Petition for Accounting of Living Trust: Types and Key Information Introduction: The Eugene, Oregon Petition for Accounting of Living Trust holds significance in ensuring the transparency and proper management of living trusts. In this comprehensive overview, we will delve into the different types of petitions available and explore key information surrounding this legal process in Eugene, Oregon. 1. Types of Eugene, Oregon Petition for Accounting of Living Trust: a. Initial Petition for Accounting: — This type of petition is typically filed by a beneficiary of a living trust seeking an initial accounting of the trust's assets, income, expenses, and distributions. b. Subsequent Petition for Accounting: — Subsequent petitions are filed when a beneficiary requires additional information or a revised accounting of the living trust after the initial petition has been settled. c. Petition for Termination of Living Trust Accounting: — This type of petition is filed when a beneficiary wishes to terminate the accounting of a living trust, usually because the trust has reached its final distribution or other legal requirements are met. 2. Key Information Regarding Eugene, Oregon Petition for Accounting of Living Trust: a. Purpose and Objective: — The primary purpose of filing a petition for accounting of a living trust is to request a court-supervised review of the trustee's management of the trust assets, ensuring transparency and accountability. b. Legal Requirements: — The petitioner must have legal standing, typically being a current beneficiary of the living trust. It is crucial to provide evidence showing a reasonable belief that the trustee is mismanaging the trust or withholding essential information. c. Filing Process: — The petitioner must submit a completed petition form to the appropriate court, along with supporting documentation and any required filing fees. The documents should be served to the trustee and other interested parties. d. Court Evaluation and Decision: — Once the petition is filed, the court evaluates the presented case, including the trustee's response and any objections from beneficiaries or interested parties. The court then decides whether an accounting is necessary and may appoint an impartial accountant if required. e. Resolution and Trustee's Duties: — Depending on the court's ruling, the trustee may be required to provide a detailed accounting of trust assets, income, expenses, and distributions. The trustee must cooperate throughout the process and adhere to any orders issued by the court. Conclusion: The Eugene, Oregon Petition for Accounting of Living Trust is an essential legal mechanism for beneficiaries seeking transparency and oversight of trust management. By understanding the various types of petitions available and the key information surrounding this process, individuals can navigate the legal requirements with confidence and ensure the proper management of living trusts in Eugene, Oregon.

Free preview

How to fill out Eugene Oregon Petition For Accounting Of Living Trust?

If you’ve already utilized our service before, log in to your account and save the Eugene Oregon Petition for Accounting of Living Trust on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Make certain you’ve located the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Eugene Oregon Petition for Accounting of Living Trust. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!