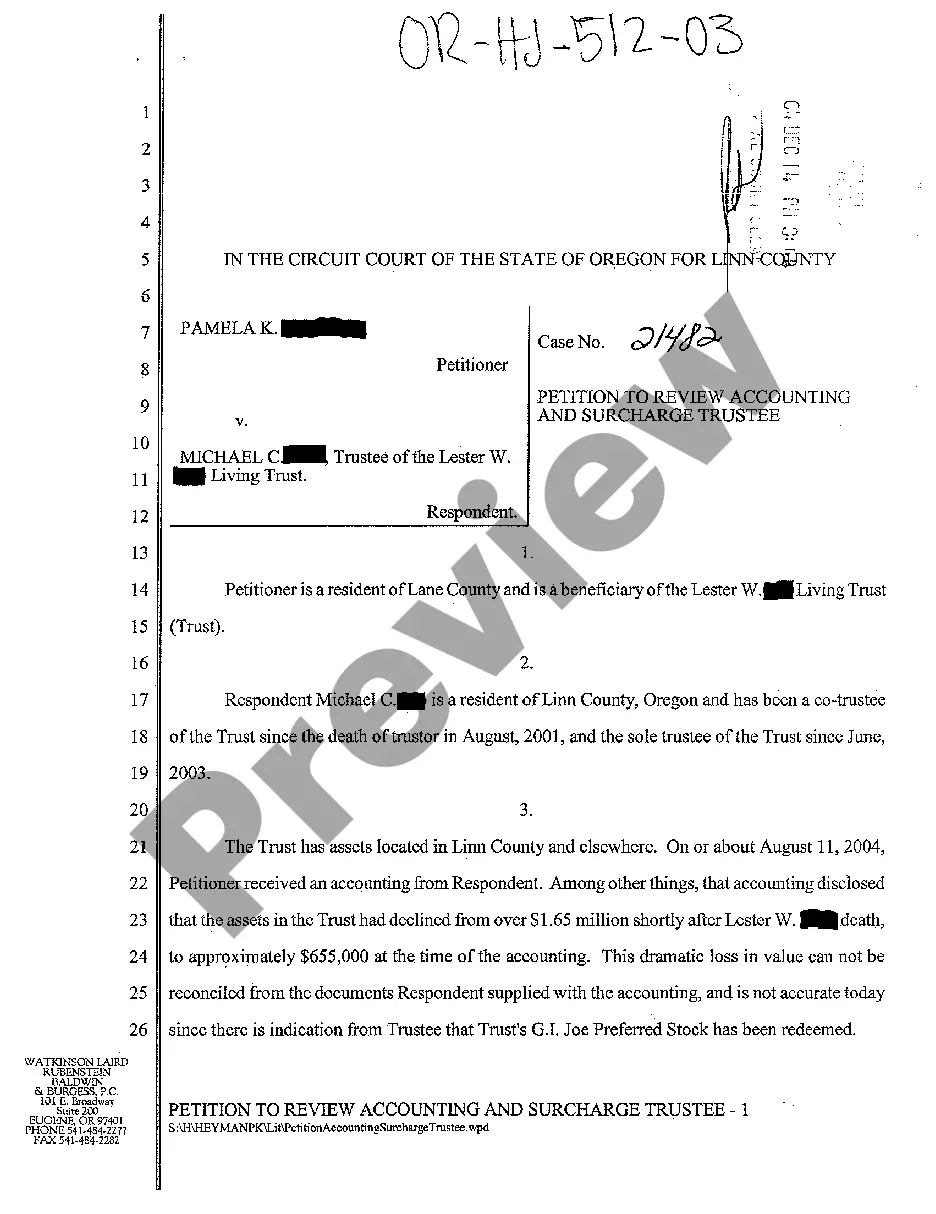

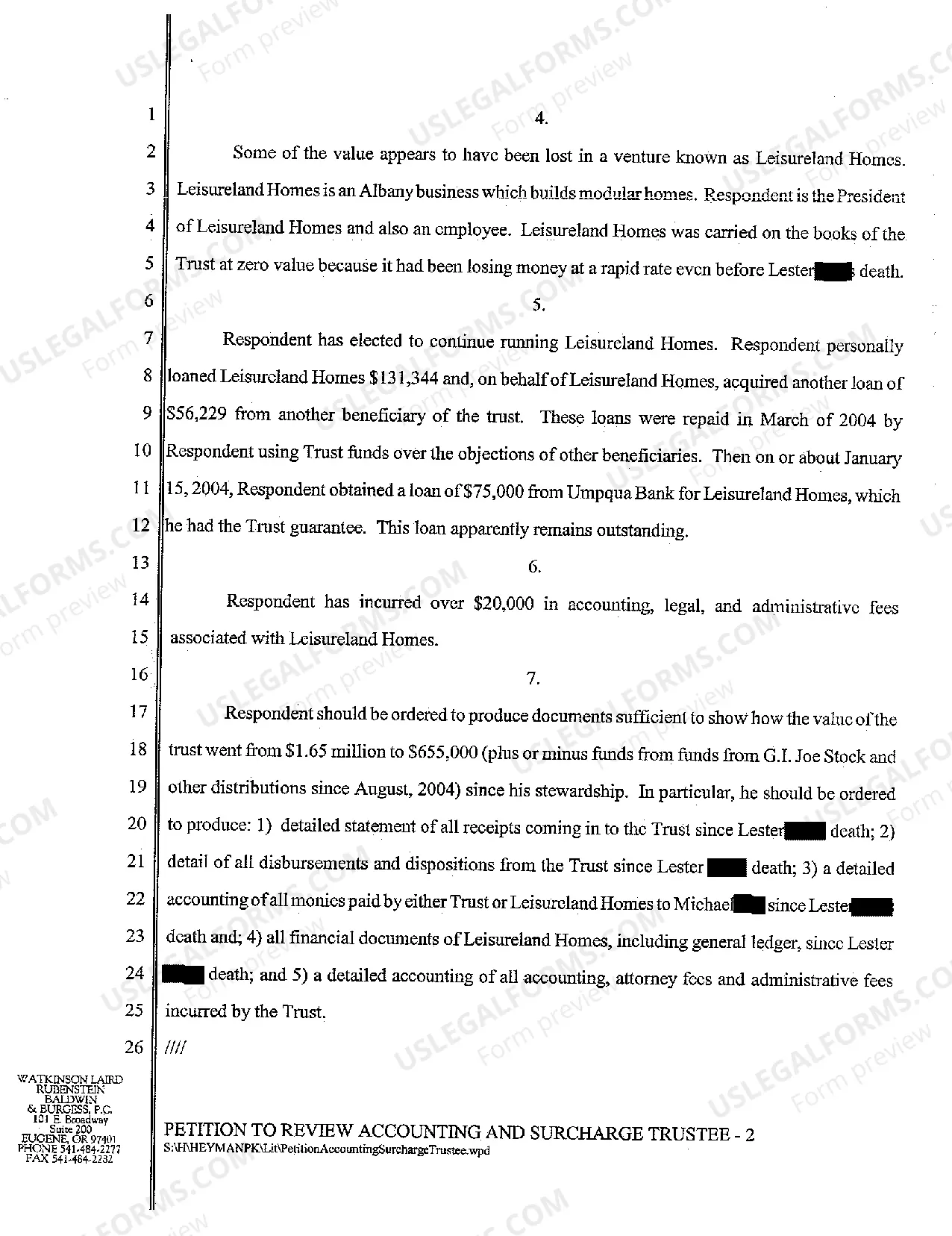

Bend Oregon Petition to Review Accounting and Surcharge Trustee is a legal process initiated by individuals or organizations based in Bend, Oregon, seeking a review and examination of accounting records and potentially the removal of a surcharge trustee. This petition focuses on financial matters, aiming to ensure transparency and proper management of trust funds or assets. The following are some key aspects related to the Bend Oregon Petition to Review Accounting and Surcharge Trustee: 1. Purpose: The primary goal of this petition is to scrutinize the financial accounts and transactions managed by a surcharge trustee. It aims to evaluate whether the trustee has fulfilled their duties ethically, responsibly, and in accordance with the applicable laws and regulations. 2. Background: The Bend Oregon Petition to Review Accounting and Surcharge Trustee can arise due to various concerns. This includes suspicions of mismanagement, embezzlement, breach of fiduciary duty, or any other irregularities that may impact the trust's beneficiaries or interested parties. 3. Filing the Petition: To initiate the process, the petitioner must draft a comprehensive petition detailing the reasons for the review and potential surcharge of the trustee. This document will outline the specific allegations and provide supporting evidence or documentation. 4. Review of Accounting: The core of the petition is the examination of the trustee's accounting records. A qualified professional, such as an accountant or forensic expert, is typically appointed to investigate the trustee's financial activities and report any discrepancies or malfeasance. 5. Surcharge of Trustee: If the review reveals evidence of financial mismanagement or misconduct, the court may impose surcharges or penalties on the trustee. This could include reimbursing the trust for any losses incurred due to the trustee's actions, removing the trustee from their position, or appointing a new trustee to rectify the situation. 6. Types of Petitions: While the Bend Oregon Petition to Review Accounting and Surcharge Trustee generally pertains to trust-related matters, it can encompass various subcategories. For instance, there may be specific petitions for revocable living trusts, irrevocable trusts, charitable trusts, special needs trusts, or testamentary trusts, depending on the particular circumstances. 7. Legal Procedures: The petitioners will need to navigate the legal system during this process. This typically involves filing the petition, gathering and presenting evidence, attending hearings or court proceedings, and potentially engaging legal counsel to ensure proper representation and adherence to the legal requirements. In conclusion, the Bend Oregon Petition to Review Accounting and Surcharge Trustee is a significant legal mechanism designed to safeguard the interests of trust beneficiaries and interested parties. By seeking a thorough examination of accounting records and potentially penalizing trustees for any financial misconduct, this process aims to uphold transparency and accountability in trust management.

Bend Oregon Petition to Review Accounting and Surcharge Trustee

Description

How to fill out Bend Oregon Petition To Review Accounting And Surcharge Trustee?

Take advantage of the US Legal Forms and get immediate access to any form template you want. Our useful website with thousands of document templates makes it easy to find and obtain virtually any document sample you require. You can save, complete, and sign the Bend Oregon Petition to Review Accounting and Surcharge Trustee in just a matter of minutes instead of surfing the Net for many hours attempting to find an appropriate template.

Utilizing our catalog is a superb way to improve the safety of your record filing. Our professional lawyers regularly check all the records to ensure that the forms are appropriate for a particular state and compliant with new acts and regulations.

How can you obtain the Bend Oregon Petition to Review Accounting and Surcharge Trustee? If you have a profile, just log in to the account. The Download option will be enabled on all the documents you view. In addition, you can find all the previously saved documents in the My Forms menu.

If you don’t have an account yet, stick to the tips below:

- Open the page with the template you require. Make certain that it is the form you were looking for: verify its name and description, and take take advantage of the Preview feature when it is available. Otherwise, use the Search field to look for the needed one.

- Start the downloading process. Click Buy Now and select the pricing plan you like. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Download the document. Pick the format to get the Bend Oregon Petition to Review Accounting and Surcharge Trustee and revise and complete, or sign it for your needs.

US Legal Forms is probably the most considerable and trustworthy document libraries on the internet. Our company is always happy to assist you in virtually any legal process, even if it is just downloading the Bend Oregon Petition to Review Accounting and Surcharge Trustee.

Feel free to take full advantage of our service and make your document experience as efficient as possible!