Title: An In-depth Look at Eugene Oregon Petition to Review Accounting and Surcharge Trustee Keywords: Eugene Oregon, petition, review accounting, surcharge trustee, legal, financial, trust, beneficiaries, assets, responsibilities, reasons, process, outcome Introduction: The Eugene Oregon Petition to Review Accounting and Surcharge Trustee is a legal process initiated by concerned parties to evaluate the accounting practices and performance of a trustee responsible for managing assets held in a trust. This detailed description explores the various aspects of this petition, shedding light on its purpose, types, significance, and potential outcomes. Types of Eugene Oregon Petition to Review Accounting and Surcharge Trustee: 1. General Review Petition: This type of petition is filed to request a comprehensive examination of the accounts and financial management practices of a trustee. It aims to determine if the trustee has fulfilled their fiduciary duties accurately, diligently, and in the best interest of the trust beneficiaries. 2. Specific Concerns Petition: This category of petition focuses on addressing specific concerns or irregularities found in the trustee's accounting practices or management of the trust's assets. It seeks to investigate any potential breaches of fiduciary duty, negligence, misappropriation, or conflicts of interest. Key Components and Purpose: a) Legal Compliance: The Eugene Oregon Petition to Review Accounting and Surcharge Trustee enables beneficiaries of a trust and other interested parties to ensure the trustee's adherence to legal obligations, such as maintaining accurate records, providing transparent accounting reports, and acting in accordance with trust terms. b) Financial Accountability: The petition examines the trustee's financial management practices, including asset valuations, investments, income distribution, expenses, and potential misappropriation or unauthorized use of trust funds. It helps determine if the trustee has acted prudently and responsibly with regard to the trust's assets. c) Trustee's Responsibilities: The petition assesses whether the trustee has performed their duties diligently and with due care, including prudent administration, timely communication with beneficiaries, investing with reasonable judgment, and avoiding conflicts of interest. It examines their compliance with the terms of the trust and applicable laws. d) Beneficiaries' Interests: The intention of this petition is to safeguard the best interests of the trust beneficiaries, protecting them from potential financial harm resulting from mismanagement, improper accounting, or breaches of fiduciary duty by the trustee. It aims to ensure that beneficiaries receive their rightful entitlements. Process and Outcome: Filing the Petition: The process begins by submitting a formal petition to the appropriate court, typically outlining the specific concerns or general review requested. The court then sets a hearing date to evaluate the validity of the concerns raised and the necessity for a review. Review and Investigation: During the review process, detailed examination of the trustee's accounting and financial records is conducted. This may involve analyzing bank statements, investment portfolios, income and expense reports, receipts, and any other relevant documents. An independent accounting expert may be appointed if necessary. Court Decision: Once the review is complete, the court evaluates the evidence presented and determines whether the trustee has fulfilled their fiduciary duties adequately. Based on the findings, the court may decide to surcharge the trustee for any losses incurred due to their negligence or mismanagement. Alternatively, if the review clears the trustee of any wrongdoing, they will be absolved of the accusations. Conclusion: The Eugene Oregon Petition to Review Accounting and Surcharge Trustee serves as a crucial legal mechanism for ensuring the responsible management of trust assets and protecting the interests of beneficiaries. By reviewing the trustee's accounting practices, the court can ascertain whether the trustee has acted in accordance with their fiduciary duties and take appropriate action if deemed necessary.

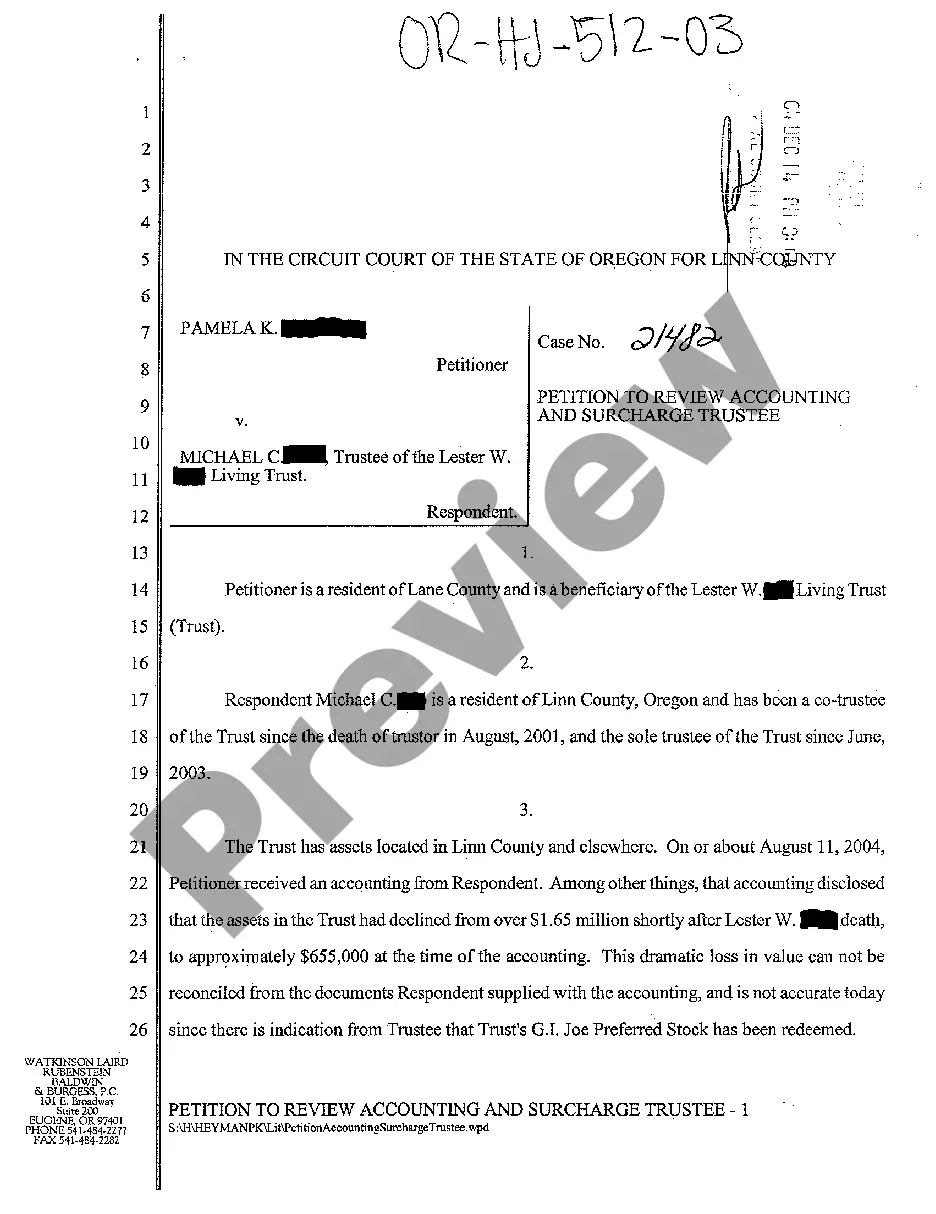

Eugene Oregon Petition to Review Accounting and Surcharge Trustee

State:

Oregon

City:

Eugene

Control #:

OR-HJ-512-03

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Petition to Review Accounting and Surcharge Trustee

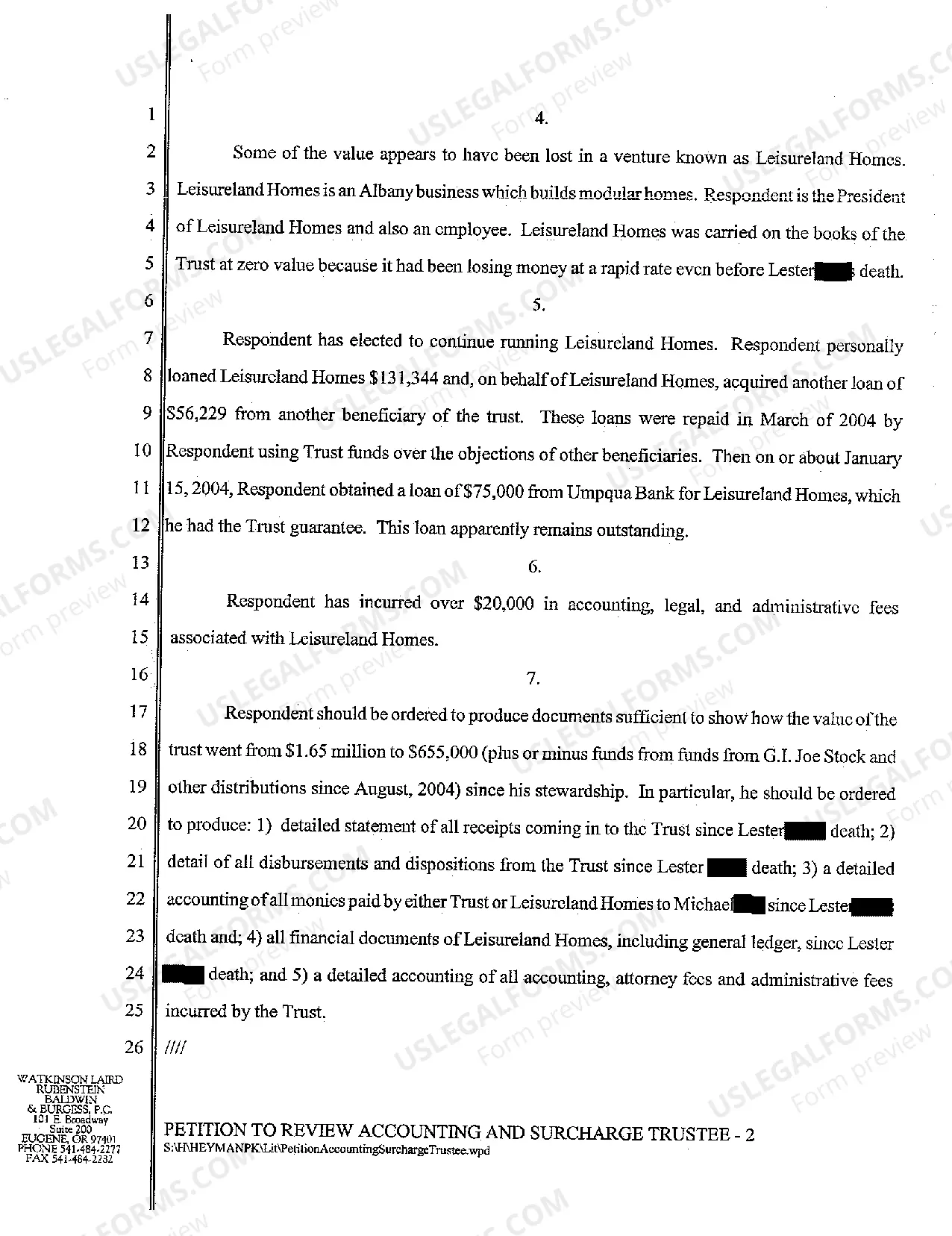

Title: An In-depth Look at Eugene Oregon Petition to Review Accounting and Surcharge Trustee Keywords: Eugene Oregon, petition, review accounting, surcharge trustee, legal, financial, trust, beneficiaries, assets, responsibilities, reasons, process, outcome Introduction: The Eugene Oregon Petition to Review Accounting and Surcharge Trustee is a legal process initiated by concerned parties to evaluate the accounting practices and performance of a trustee responsible for managing assets held in a trust. This detailed description explores the various aspects of this petition, shedding light on its purpose, types, significance, and potential outcomes. Types of Eugene Oregon Petition to Review Accounting and Surcharge Trustee: 1. General Review Petition: This type of petition is filed to request a comprehensive examination of the accounts and financial management practices of a trustee. It aims to determine if the trustee has fulfilled their fiduciary duties accurately, diligently, and in the best interest of the trust beneficiaries. 2. Specific Concerns Petition: This category of petition focuses on addressing specific concerns or irregularities found in the trustee's accounting practices or management of the trust's assets. It seeks to investigate any potential breaches of fiduciary duty, negligence, misappropriation, or conflicts of interest. Key Components and Purpose: a) Legal Compliance: The Eugene Oregon Petition to Review Accounting and Surcharge Trustee enables beneficiaries of a trust and other interested parties to ensure the trustee's adherence to legal obligations, such as maintaining accurate records, providing transparent accounting reports, and acting in accordance with trust terms. b) Financial Accountability: The petition examines the trustee's financial management practices, including asset valuations, investments, income distribution, expenses, and potential misappropriation or unauthorized use of trust funds. It helps determine if the trustee has acted prudently and responsibly with regard to the trust's assets. c) Trustee's Responsibilities: The petition assesses whether the trustee has performed their duties diligently and with due care, including prudent administration, timely communication with beneficiaries, investing with reasonable judgment, and avoiding conflicts of interest. It examines their compliance with the terms of the trust and applicable laws. d) Beneficiaries' Interests: The intention of this petition is to safeguard the best interests of the trust beneficiaries, protecting them from potential financial harm resulting from mismanagement, improper accounting, or breaches of fiduciary duty by the trustee. It aims to ensure that beneficiaries receive their rightful entitlements. Process and Outcome: Filing the Petition: The process begins by submitting a formal petition to the appropriate court, typically outlining the specific concerns or general review requested. The court then sets a hearing date to evaluate the validity of the concerns raised and the necessity for a review. Review and Investigation: During the review process, detailed examination of the trustee's accounting and financial records is conducted. This may involve analyzing bank statements, investment portfolios, income and expense reports, receipts, and any other relevant documents. An independent accounting expert may be appointed if necessary. Court Decision: Once the review is complete, the court evaluates the evidence presented and determines whether the trustee has fulfilled their fiduciary duties adequately. Based on the findings, the court may decide to surcharge the trustee for any losses incurred due to their negligence or mismanagement. Alternatively, if the review clears the trustee of any wrongdoing, they will be absolved of the accusations. Conclusion: The Eugene Oregon Petition to Review Accounting and Surcharge Trustee serves as a crucial legal mechanism for ensuring the responsible management of trust assets and protecting the interests of beneficiaries. By reviewing the trustee's accounting practices, the court can ascertain whether the trustee has acted in accordance with their fiduciary duties and take appropriate action if deemed necessary.

Free preview

How to fill out Eugene Oregon Petition To Review Accounting And Surcharge Trustee?

If you’ve already utilized our service before, log in to your account and save the Eugene Oregon Petition to Review Accounting and Surcharge Trustee on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Ensure you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Eugene Oregon Petition to Review Accounting and Surcharge Trustee. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!