Title: Understanding Bend Oregon Order to Show Cause of Why an Accounting Should Not be Ordered Keywords: Bend Oregon, order to show cause, accounting, legal process, reasons, litigation, types Introduction: A Bend Oregon order to show cause is a legal process that requires a party to provide justifiable reasons as to why an accounting should not be ordered. This detailed description aims to explore this legal procedure, its significance, and provide insights into possible types of cases where an order to show cause is initiated. 1. The Basics of Bend Oregon Order to Show Cause: — Understanding Bend Oregon Order to Show Cause: This section explains the concept of an order to show cause, emphasizing its necessity in certain legal disputes where accounting evidence is crucial. — Legal Process: Here, we outline the steps involved in filing and responding to a Bend Oregon Order to Show Cause. It includes both the documentation required and the timelines to adhere to. 2. Reasons Why an Accounting Should Not be Ordered: — Insufficient Prima Facie Case: Parties may present evidence challenging the need for an accounting by demonstrating that the requesting party lacks the necessary evidence to establish a legitimate claim. — Inability to Establish Misappropriation: If a party is unable to establish misappropriation, it can be argued that an accounting is unnecessary. — Appropriate Alternative Remedies: Showing that alternative resolutions, such as damages or specific performance, adequately address the dispute without the need for an accounting. 3. Common Types of Cases Involving an Order to Show Cause: — Business Partnership Dissolution: In cases where business partners decide to end their relationship, an order to show cause might be filed to determine the proper allocation of profits, assets, and debts. — Probate or Trust Disputes: Order to show cause may be initiated in probate or trust situations, ensuring beneficiaries are accounted for and assets are distributed correctly according to the trust or's wishes. — Divorce Proceedings: In divorce cases, an order to show cause can be used to determine the fair division of marital assets and liabilities between spouses. — Breach of Fiduciary Duty: When a party alleges mismanagement or improper handling of funds by a fiduciary, an order to show cause may be sought to examine the financial records. Conclusion: A Bend Oregon Order to Show Cause of Why an Accounting Should not be Ordered is an essential legal tool that allows parties to present their arguments against the necessity of an accounting. Understanding the reasons and types of cases where an order to show cause is relevant can provide insight into how this process serves justice in Bend, Oregon's legal system.

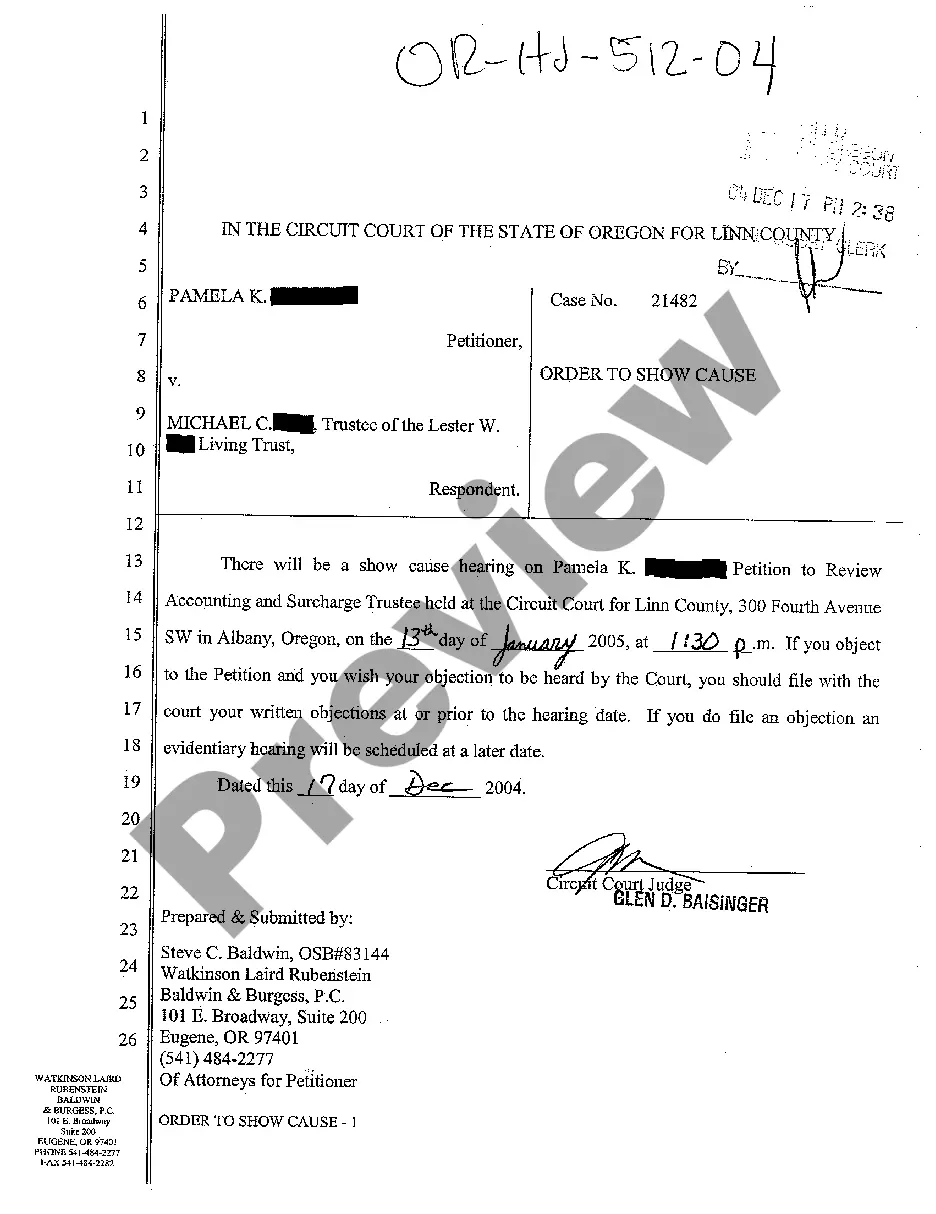

Bend Oregon Order to Show Cause of Why an Accounting Should not be Ordered

State:

Oregon

City:

Bend

Control #:

OR-HJ-512-04

Format:

PDF

Instant download

This form is available by subscription

Description

A04 Order to Show Cause of Why an Accounting Should not be Ordered

Title: Understanding Bend Oregon Order to Show Cause of Why an Accounting Should Not be Ordered Keywords: Bend Oregon, order to show cause, accounting, legal process, reasons, litigation, types Introduction: A Bend Oregon order to show cause is a legal process that requires a party to provide justifiable reasons as to why an accounting should not be ordered. This detailed description aims to explore this legal procedure, its significance, and provide insights into possible types of cases where an order to show cause is initiated. 1. The Basics of Bend Oregon Order to Show Cause: — Understanding Bend Oregon Order to Show Cause: This section explains the concept of an order to show cause, emphasizing its necessity in certain legal disputes where accounting evidence is crucial. — Legal Process: Here, we outline the steps involved in filing and responding to a Bend Oregon Order to Show Cause. It includes both the documentation required and the timelines to adhere to. 2. Reasons Why an Accounting Should Not be Ordered: — Insufficient Prima Facie Case: Parties may present evidence challenging the need for an accounting by demonstrating that the requesting party lacks the necessary evidence to establish a legitimate claim. — Inability to Establish Misappropriation: If a party is unable to establish misappropriation, it can be argued that an accounting is unnecessary. — Appropriate Alternative Remedies: Showing that alternative resolutions, such as damages or specific performance, adequately address the dispute without the need for an accounting. 3. Common Types of Cases Involving an Order to Show Cause: — Business Partnership Dissolution: In cases where business partners decide to end their relationship, an order to show cause might be filed to determine the proper allocation of profits, assets, and debts. — Probate or Trust Disputes: Order to show cause may be initiated in probate or trust situations, ensuring beneficiaries are accounted for and assets are distributed correctly according to the trust or's wishes. — Divorce Proceedings: In divorce cases, an order to show cause can be used to determine the fair division of marital assets and liabilities between spouses. — Breach of Fiduciary Duty: When a party alleges mismanagement or improper handling of funds by a fiduciary, an order to show cause may be sought to examine the financial records. Conclusion: A Bend Oregon Order to Show Cause of Why an Accounting Should not be Ordered is an essential legal tool that allows parties to present their arguments against the necessity of an accounting. Understanding the reasons and types of cases where an order to show cause is relevant can provide insight into how this process serves justice in Bend, Oregon's legal system.

Free preview

How to fill out Bend Oregon Order To Show Cause Of Why An Accounting Should Not Be Ordered?

If you’ve already used our service before, log in to your account and download the Bend Oregon Order to Show Cause of Why an Accounting Should not be Ordered on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Ensure you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Bend Oregon Order to Show Cause of Why an Accounting Should not be Ordered. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!