Title: Understanding Bend Oregon Respondent's Answer to Petition to Review Accounting and Surcharge Trustee Introduction: In the legal process of trust administration, disputes may arise between beneficiaries and trustees. If a beneficiary in Bend, Oregon wishes to challenge a trustee's accounting or request to surcharge the trustee, they can file a Petition to Review Accounting and Surcharge Trustee. In response, the trustee or Bend Oregon respondent is required to provide an answer outlining their position and defense. This article aims to provide a detailed description of Bend Oregon Respondent's Answer to Petition to Review Accounting and Surcharge Trustee, highlighting its importance, legal framework, and potential types of respondent's answers. 1. Importance of Respondent's Answer: The Bend Oregon respondent's answer plays a crucial role in addressing the beneficiary's allegations and establishing the trustee's defense. It allows the trustee to present their version of events, provide supporting evidence, and rebut the claims made in the petition. This answer serves as an opportunity for the trustee to protect their interests, justifying their actions and ensuring fairness in trust administration. 2. Legal Framework: The Bend Oregon respondent's answer is prepared in accordance with applicable state laws and court rules. Typically, the trustee's response should adhere to Oregon Revised Statutes governing trust administration, particularly those related to surcharge and accounting review. Additionally, knowledge of relevant case precedents and court procedures is essential to craft an effective response. 3. Elements to Include in the Respondent's Answer: a. Introduction and Identification: Begin by identifying the parties involved in the dispute, including the respondent (trustee), petitioner (beneficiary), and the trust itself. Mention the case name, number, and the court where the petition was filed. b. General Denials and Admissions: Respond to each allegation stated in the petitioner's claim, admitting or denying them specifically. This section is crucial for establishing the trustee's position and highlighting any genuine mistakes or misunderstandings. c. Affirmative Defenses: Present valid legal arguments and defenses to counter the petitioner's claims. These defenses may include arguments like fulfillment of fiduciary duties, adherence to trust terms, consent by the beneficiaries, or statute of limitations, among others. d. Counterclaims or Requests for Relief: If appropriate, the respondent may assert counterclaims against the petitioner, seeking remedies or asserting their own grievances. It is important to ensure the counterclaims are relevant to the accounting or surcharge issues raised in the original petition. e. Supporting Documentation: Accompany the respondent's answer with relevant supporting documents, such as trust agreements, financial records, receipts, communications with beneficiaries, or any other evidence that reinforces the trustee's position. 4. Types of Respondent's Answers: a. Direct Denial Answer: A straightforward answer where the trustee denies all allegations made by the petitioner, providing counterarguments and evidence to support their stance. b. Partial Admission Answer: In cases where the trustee acknowledges some of the petitioner's allegations, this answer concedes certain points while refuting others. c. Affirmative Defense Answer: This response aims to highlight legal defenses, focusing on establishing the trustee's compliance with their fiduciary duties, proving consent, asserting statutory protections, or providing evidence of mitigating circumstances. Conclusion: Responding to a Petition to Review Accounting and Surcharge Trustee is a critical step for trustees in Bend, Oregon. By carefully crafting their answer, trustees can effectively defend their actions, present counterarguments, and provide supporting evidence to ensure a fair resolution to trust-related disputes. Understanding the legal framework and utilizing various types of responses can greatly contribute to a successful defense strategy.

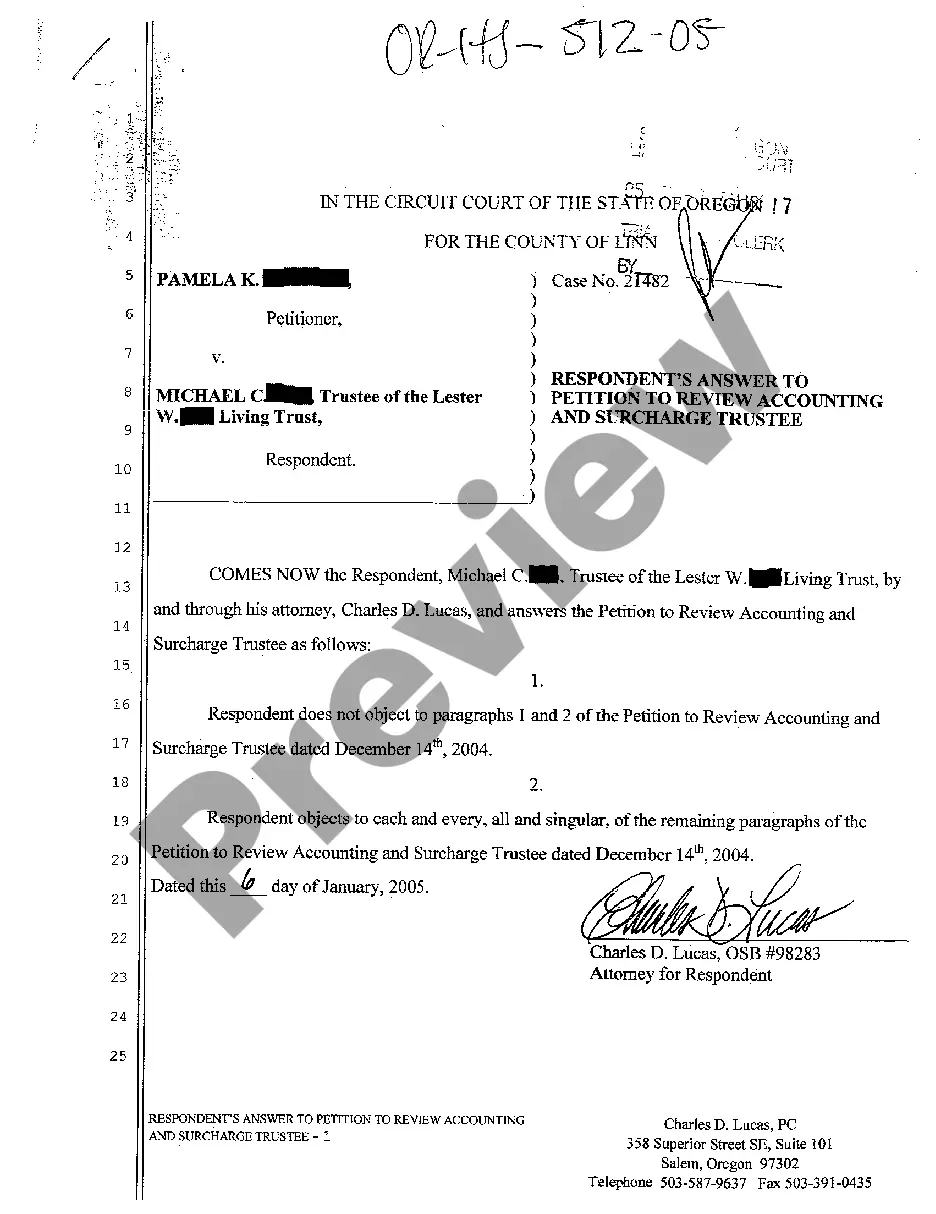

Bend Oregon Respondent's Answer to Petition to Review Accounting and Surcharge Trustee

Description

How to fill out Bend Oregon Respondent's Answer To Petition To Review Accounting And Surcharge Trustee?

Benefit from the US Legal Forms and get immediate access to any form sample you need. Our helpful platform with thousands of document templates allows you to find and obtain virtually any document sample you will need. You are able to download, fill, and certify the Bend Oregon Respondent's Answer to Petition to Review Accounting and Surcharge Trustee in just a couple of minutes instead of surfing the Net for many hours attempting to find an appropriate template.

Using our library is an excellent way to raise the safety of your form filing. Our professional legal professionals on a regular basis review all the documents to make sure that the templates are relevant for a particular state and compliant with new acts and polices.

How can you obtain the Bend Oregon Respondent's Answer to Petition to Review Accounting and Surcharge Trustee? If you have a profile, just log in to the account. The Download button will be enabled on all the samples you view. Furthermore, you can find all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, follow the instructions below:

- Open the page with the form you need. Make certain that it is the template you were hoping to find: check its name and description, and make use of the Preview function if it is available. Otherwise, use the Search field to look for the appropriate one.

- Launch the saving process. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Save the document. Pick the format to get the Bend Oregon Respondent's Answer to Petition to Review Accounting and Surcharge Trustee and revise and fill, or sign it according to your requirements.

US Legal Forms is probably the most considerable and reliable template libraries on the internet. Our company is always happy to help you in virtually any legal case, even if it is just downloading the Bend Oregon Respondent's Answer to Petition to Review Accounting and Surcharge Trustee.

Feel free to take advantage of our service and make your document experience as convenient as possible!