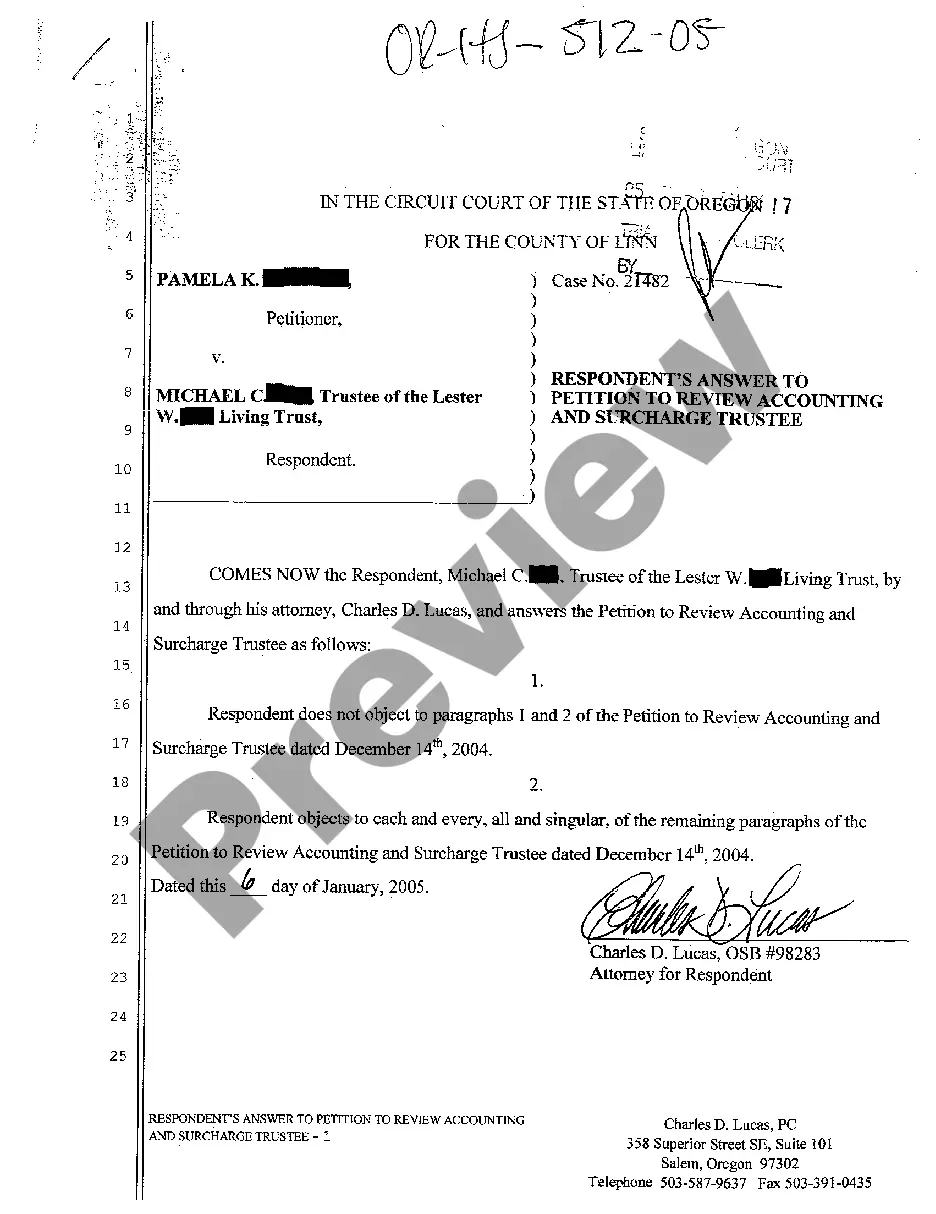

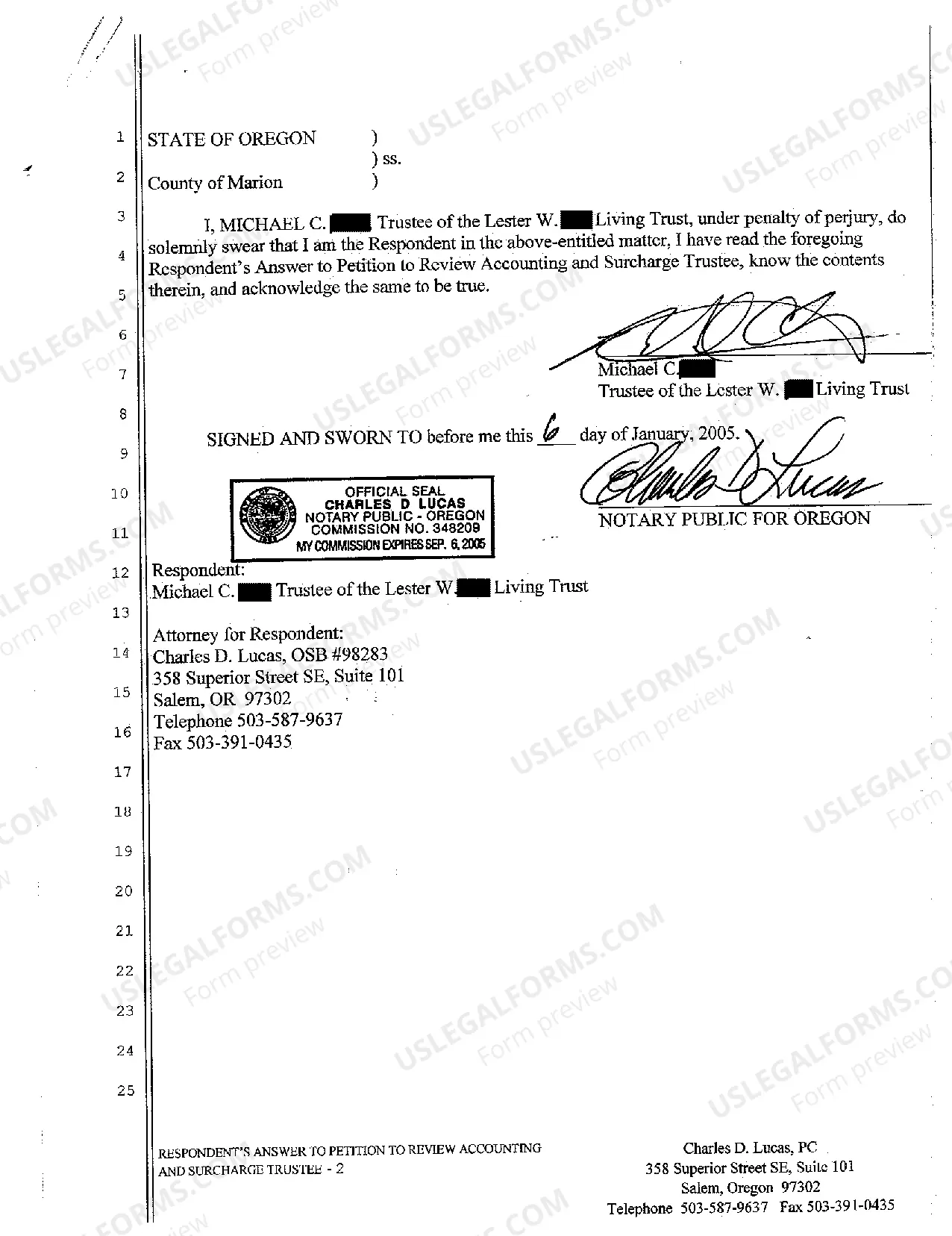

Portland Oregon Respondent's Answer to Petition to Review Accounting and Surcharge Trustee is a legal document that provides a detailed response to a petition filed by a party seeking a review of accounting and potential surcharge of a trustee in the Portland, Oregon jurisdiction. This document aims to address the allegations put forward by the petitioner and present compelling arguments, supporting evidence, and legal reasoning to counter those claims. In this context, relevant keywords for the Portland Oregon Respondent's Answer to Petition to Review Accounting and Surcharge Trustee include: 1. Portland, Oregon: Referring to the specific jurisdiction where the dispute is being addressed, highlighting the legal framework and applicable state laws in this region. 2. Respondent: The party who is submitting the response to the petition. This may include the trustee or any other party directly involved in the trust dispute. 3. Petition to Review Accounting: Denoting the petitioner's request for a comprehensive review of the trustee's accounting practices and financial transactions related to the trust. 4. Surcharge Trustee: The petitioner accuses the trustee of alleged misconduct, seeking to impose additional charges or penalties for their purported wrongdoing. Different types or sections within the Portland Oregon Respondent's Answer to Petition to Review Accounting and Surcharge Trustee can vary based on specific legal circumstances and the issues addressed, such as: 1. Introduction and Background: This section may provide an overview of the trust, its purpose, relevant beneficiaries, and parties involved to provide context for the dispute. 2. Allegations and Denials: The respondent will address each allegation made by the petitioner, either accepting or denying the claims and substantiating their position through factual evidence or legal arguments. 3. Accounting Review: If the respondent agrees to an accounting review, they may provide additional documents, financial statements, or records to deliver a comprehensive view of the trust's financial activities. 4. Fiduciary Duty: The respondent may assert their adherence to the trustee's fiduciary duty to act in the beneficiaries' best interests and present evidence to refute any claims of breach of duty. 5. Surcharge Defense: In cases where the petitioner seeks to surcharge the trustee, the respondent will present a robust defense, highlighting reasons why surcharge is unwarranted, necessary or unjust. 6. Expert Testimony: If applicable, the respondent may involve expert witnesses who can provide professional insight into complex accounting or trustee responsibilities to support their claims. 7. Conclusion and Prayer for Relief: The respondent's answer will conclude with a request for the court to dismiss or deny the petitioner's claims, and potentially seek any other appropriate legal remedies available. It is crucial to note that specific details and sections of the Respondent's Answer may differ depending on the unique circumstances of each case, the preferences of the legal counsel involved, and any specific local procedural requirements. Legal advice should be sought to ensure compliance with Portland, Oregon jurisdictional guidelines.

Portland Oregon Respondent's Answer to Petition to Review Accounting and Surcharge Trustee

State:

Oregon

City:

Portland

Control #:

OR-HJ-512-05

Format:

PDF

Instant download

This form is available by subscription

Description

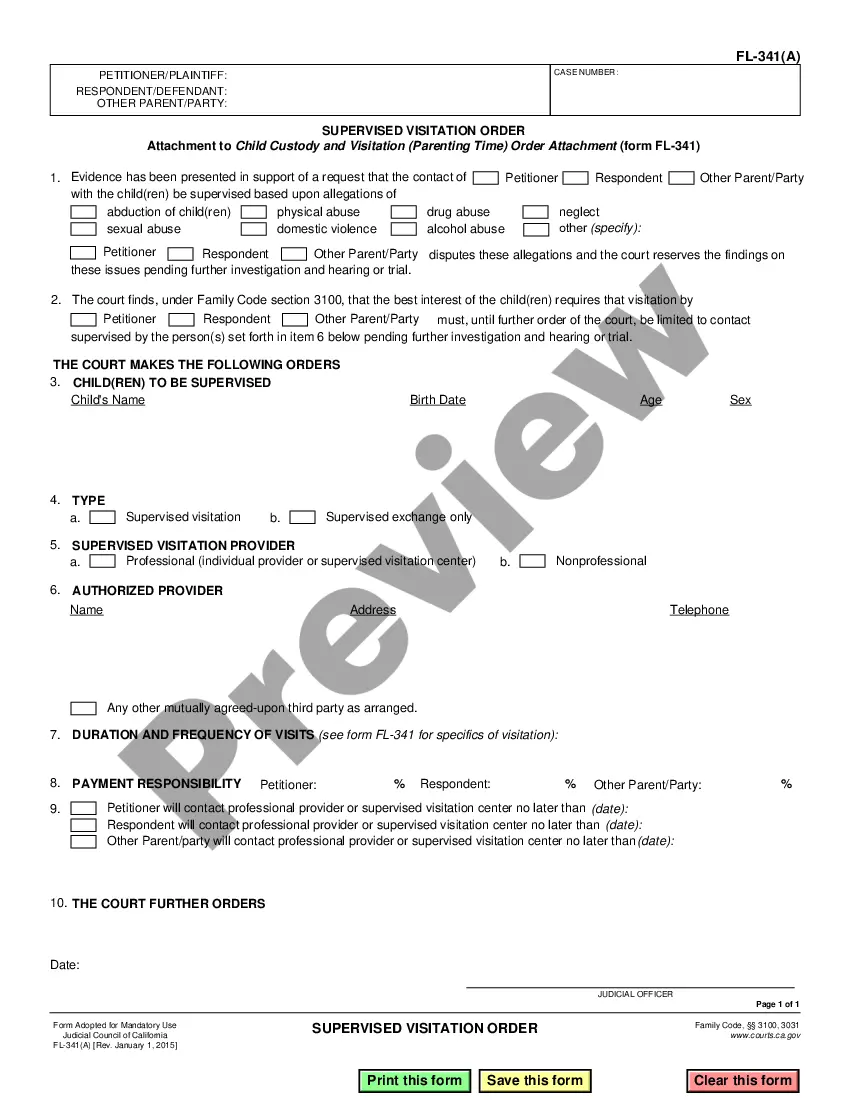

A05 Respondent's Answer to Petition to Review Accounting and Surcharge Trustee

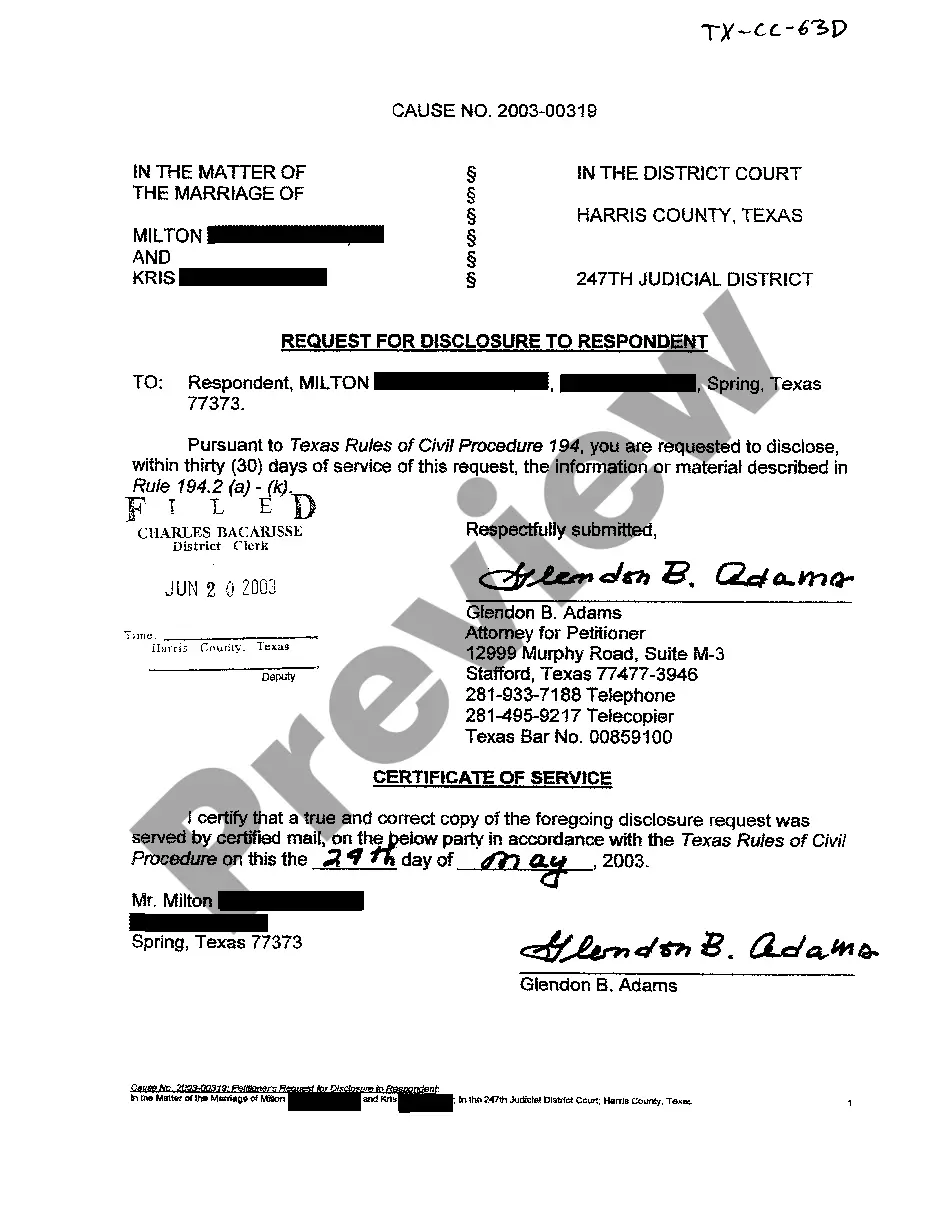

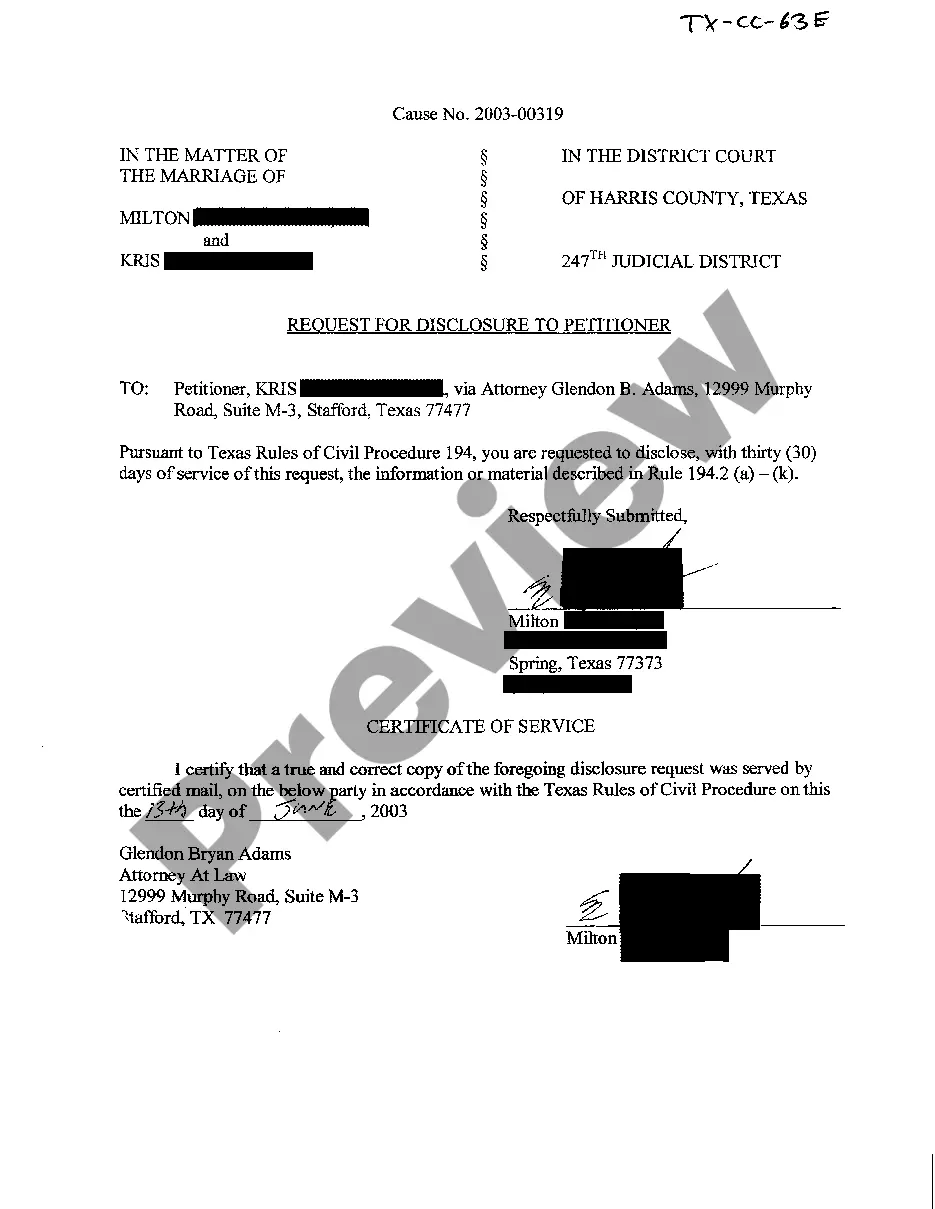

Free preview

How to fill out Portland Oregon Respondent's Answer To Petition To Review Accounting And Surcharge Trustee?

If you have previously employed our service, sign in to your account and download the Portland Oregon Respondent's Answer to Petition to Review Accounting and Surcharge Trustee to your device by clicking the Download button. Ensure your subscription is current. If it is not, renew it according to your payment plan.

If this is your initial encounter with our service, follow these straightforward steps to acquire your document.

You have continuous access to all the documents you have purchased: you can find them in your profile under the My documents section whenever you need to refer back to them. Utilize the US Legal Forms service to quickly find and save any template for your personal or professional purposes!

- Ensure you've located an appropriate document. Review the description and utilize the Preview option, if available, to verify if it fulfills your requirements. If it does not meet your expectations, use the Search tab above to find the correct one.

- Purchase the document. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Portland Oregon Respondent's Answer to Petition to Review Accounting and Surcharge Trustee. Choose the file format for your document and save it to your device.

- Complete your document. Print it or use professional online editors to fill it out and sign it digitally.

Form popularity

Interesting Questions

More info

The person who creates a trust is called the settlor or the grantor. 3. Costs assessed to trust or estate.The fiduciary may charge the cost of any. Applications to pay in installments or to prompt more requests for fee waivers.