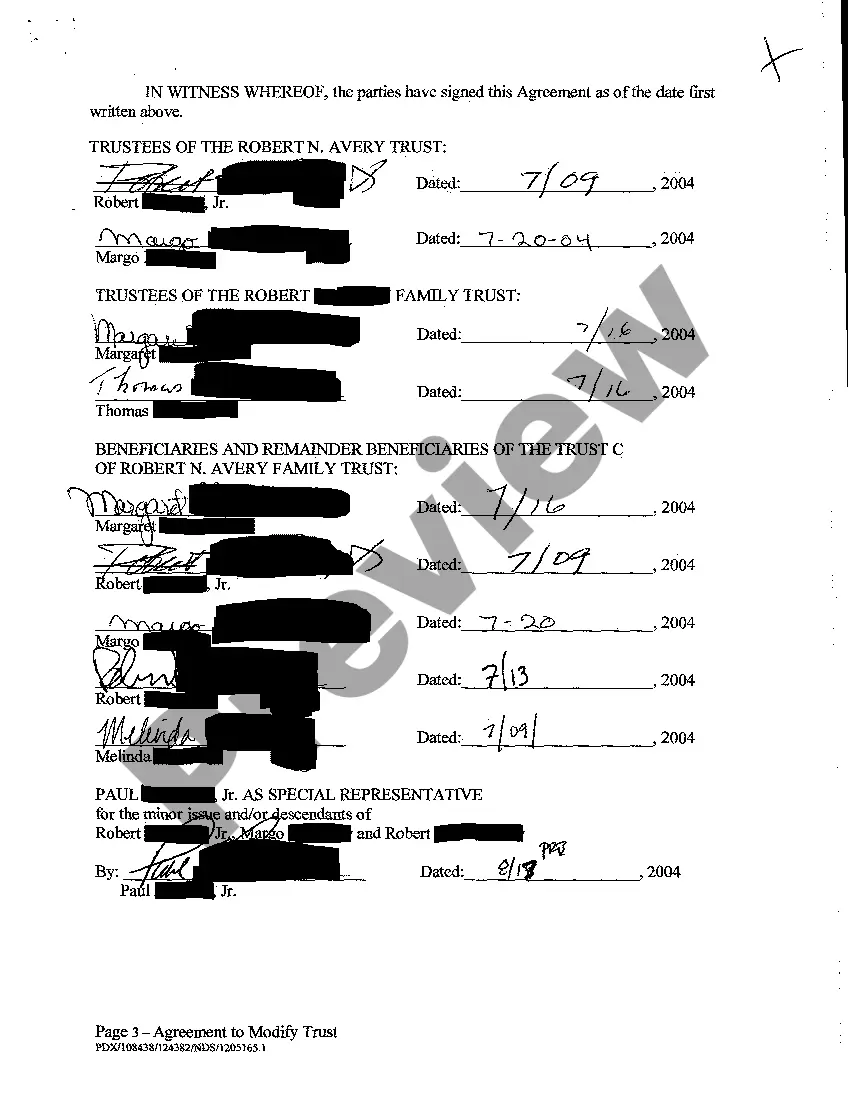

The Hillsboro Oregon filing of the Agreement to Modify Trust is an important legal process that allows individuals or beneficiaries to make changes to an existing trust document. This modification ensures that the trust reflects any necessary updates, amendments, or clarifications to better align with the wishes and goals of the trust granter. When it comes to the Hillsboro Oregon filing of the Agreement to Modify Trust, there may be different types or scenarios where this process becomes necessary. Some of these instances may include: 1. Beneficiary Changes: If there have been changes in the intended beneficiaries of a trust due to life events such as births, deaths, marriages, divorces, or changes in personal circumstances, a modification may be required to reflect these updates accurately. 2. Asset Alterations: Trust modifications may become necessary if there are changes in the assets included in the trust. For example, if the granter wishes to add or remove certain properties, investments, or accounts, the Agreement to Modify Trust becomes crucial to ensure that the trust document remains up to date. 3. Financial Updates: Changes in the financial aspects of the trust, such as adjustments in funding amounts, distributions, or payment schedules, may require the filing of the Agreement to Modify Trust. It ensures that the trust accurately reflects the granter's intentions regarding the financial management of their assets. 4. Successor Trustees or Fiduciaries: In case the original trustee or fiduciary is no longer capable or willing to fulfill their responsibilities, a trust modification is necessary to name a new trustee or fiduciary, ensuring the smooth continuation of trust management. When initiating the Hillsboro Oregon filing of the Agreement to Modify Trust, it is crucial to have proper legal guidance from an experienced attorney specializing in trusts and estate planning. They will assist in preparing the necessary paperwork, ensuring compliance with the relevant laws and regulations, and guiding individuals through the process from beginning to end. To summarize, the Hillsboro Oregon filing of the Agreement to Modify Trust is a legal procedure designed to make necessary changes to an existing trust document. Different types of modifications may include beneficiary changes, asset alterations, financial updates, and appointment of successor trustees or fiduciaries. Seeking professional legal assistance during this process helps ensure that the trust is accurately modified according to the granter's intentions.

Hillsboro Oregon Filing of the Agreement to Modify Trust

Description

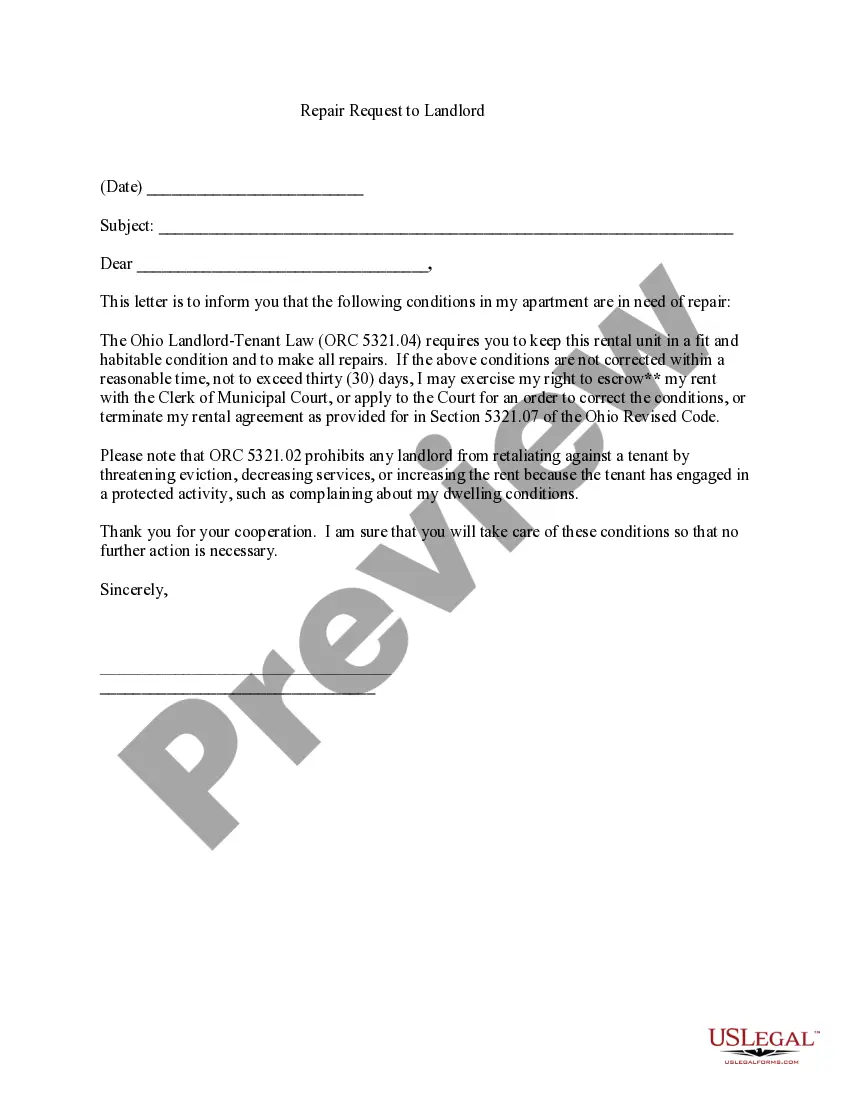

How to fill out Hillsboro Oregon Filing Of The Agreement To Modify Trust?

Take advantage of the US Legal Forms and have instant access to any form template you want. Our helpful website with a huge number of documents makes it easy to find and obtain virtually any document sample you need. It is possible to export, fill, and sign the Hillsboro Oregon Filing of the Agreement to Modify Trust in a couple of minutes instead of browsing the web for hours trying to find an appropriate template.

Utilizing our library is a great way to raise the safety of your record filing. Our experienced attorneys regularly review all the records to make sure that the forms are appropriate for a particular region and compliant with new acts and regulations.

How can you get the Hillsboro Oregon Filing of the Agreement to Modify Trust? If you have a profile, just log in to the account. The Download button will appear on all the samples you view. Additionally, you can get all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, follow the instruction listed below:

- Find the form you require. Make certain that it is the form you were hoping to find: examine its name and description, and take take advantage of the Preview feature if it is available. Otherwise, use the Search field to find the needed one.

- Start the downloading process. Select Buy Now and select the pricing plan you like. Then, create an account and process your order utilizing a credit card or PayPal.

- Export the file. Choose the format to obtain the Hillsboro Oregon Filing of the Agreement to Modify Trust and edit and fill, or sign it for your needs.

US Legal Forms is one of the most extensive and reliable form libraries on the web. We are always ready to assist you in virtually any legal procedure, even if it is just downloading the Hillsboro Oregon Filing of the Agreement to Modify Trust.

Feel free to take advantage of our form catalog and make your document experience as efficient as possible!

Form popularity

FAQ

Irrevocable Trusts in Massachusetts Grantors cannot dissolve or change an irrevocable trust after creating the trust. However, creators of irrevocable trusts still retain some control over their assets.

Yes. The trust document can allow for changes. Sometimes a trust document designates an independent person - a trust protector - as someone who can make certain changes to the trust.

In Arizona, the power to decant may be exercised without court approval. It is also unlikely that a beneficiary would be able to successfully oppose the exercise of the trustee's discretion if the trustee exercises a decanting power consistently with state law.

Most importantly, ORS 130.200 (1) provides that an irrevocable trust may be modified or terminated with approval of the court upon consent of the settlor and all beneficiaries who are not remote interest beneficiaries, even if the modification or termination is inconsistent with a material purpose of the trust.

Generally, no. Most living or revocable trusts become irrevocable upon the death of the trust's maker or makers. This means that the trust cannot be altered in any way once the successor trustee takes over management of it.

Similar to wine decanting, trust decanting is a method by which a trustee may remove or modify trust provisions from an irrevocable trust by pouring ? or distributing ? the trust assets from an old trust into a new trust.

If you have a good reason to amend an irrevocable trust you can usually go to court and ask the judge to approve the changes. What's more, there are laws that specifically authorize an irrevocable trust to be amended or terminated under certain circumstances.

There is an ability to apply to the court to amend a trust deed where the Court is satisfied that an alteration is expedient, to authorise the trustees to do or abstain from doing any act or thing which if done or omitted by them without the authorisation of the Court or the consent of the beneficiaries would be a

A trustee has the responsibility of handling, managing, and distributing assets within the trust even while the grantor is alive. A revocable trust can be changed or canceled only when the grantor is alive but becomes irrevocable after their death.

As discussed above, irrevocable trusts are not completely irrevocable; they can be modified or dissolved, but the settlor may not do so unilaterally. The most common mechanisms for modifying or dissolving an irrevocable trust are modification by consent and judicial modification.