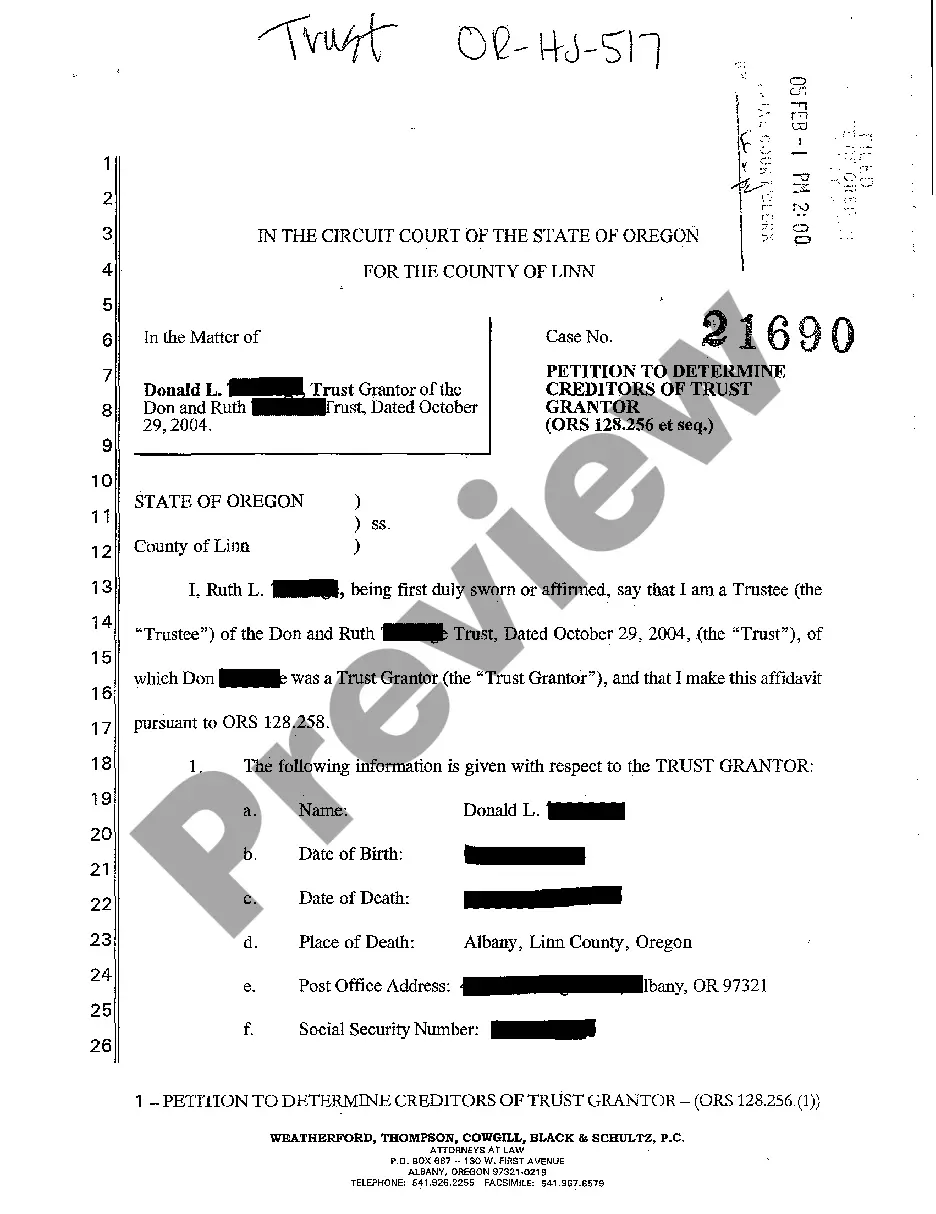

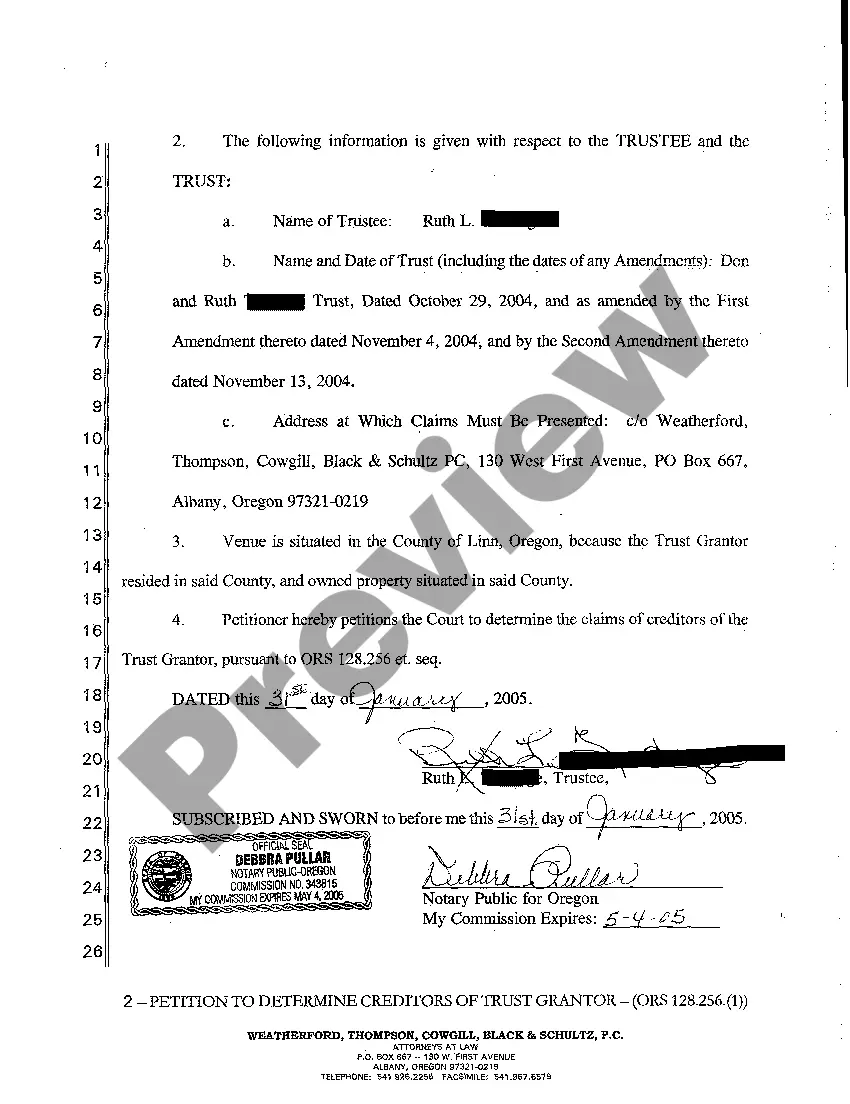

Title: Understanding the Eugene Oregon Petition to Determine Creditors of Trust Granter Introduction: The Eugene Oregon Petition to Determine Creditors of Trust Granter refers to a legal process through which individuals or entities involved in a trust attempt to identify and validate all claims made by creditors against the assets held by the granter of the trust. This detailed description aims to shed light on the petition, its purpose, and potential variations. Keywords: Eugene Oregon, petition, determine creditors, trust granter, legal process, assets, claims, validation, variations. 1. Purpose of the Eugene Oregon Petition to Determine Creditors of Trust Granter: The primary objective of the Eugene Oregon Petition to Determine Creditors of Trust Granter is to provide a formal platform for the assessment and determination of legitimate claims made by creditors against the assets held by the trust granter. This legal process ensures fairness and transparency in resolving debt obligations. 2. Key Steps Involved in the Process: a. Filing the Petition: The interested party (often the trustee or a representative) must file the petition with the relevant court. b. Notice to Creditors: Once the petition is filed, public notice is usually required to inform potential creditors of their opportunity to submit their claims within a specified period. c. Claim Submission: Interested creditors must provide detailed documentation of their claims, including supporting evidence, within the designated timeframe. d. Claim Determination: A thorough examination of all submitted claims takes place, involving verification of the validity of each claim and assessment of its priority against available trust assets. e. Dispute Resolution: In instances where disputes arise concerning claim validity or priority, resolution processes may be employed, such as hearings or negotiations. f. Creditor Payment: Finally, available trust assets are distributed proportionately among validated creditors, satisfying the determined claims in accordance with relevant laws and regulations. 3. Potential Variations: a. Individual Trust Granter vs. Corporate Trust Granter: The Eugene Oregon Petition to Determine Creditors of Trust Granter can be initiated in cases where the trust was established by either an individual person or a corporation or other legal entity acting as the granter. The process generally remains the same but might have specific rules or considerations depending on the type of granter. b. Inter Vivos Trust vs. Testamentary Trust: Inter vivos trusts are established during the granter's lifetime, while testamentary trusts are created according to the granter's instructions stipulated in their will. Although the petition generally serves to determine creditors' claims for both types, minor variations may exist in terms of filing deadlines or notification requirements. c. Revocable Trust vs. Irrevocable Trust: The petition can also vary depending on whether the trust is revocable or irrevocable. Revocable trusts allow the granter to make modifications during their lifetime, whereas irrevocable trusts are unchangeable. This distinction might impact certain aspects of the petition, such as claim priority or the validity of claims against specific trust assets. Conclusion: The Eugene Oregon Petition to Determine Creditors of Trust Granter serves as a crucial legal process to fairly assess and validate creditors' claims against trust assets. By adhering to specific procedures and timelines, this process ensures that creditor disputes are addressed and resolved with respect to applicable laws and regulations. Understanding the nuances and potential variations within this petition can help all parties involved navigate the process smoothly.

Eugene Oregon Petition to Determine Creditors of Trust Grantor

Description

How to fill out Eugene Oregon Petition To Determine Creditors Of Trust Grantor?

Make use of the US Legal Forms and get instant access to any form you need. Our useful platform with a huge number of documents simplifies the way to find and get almost any document sample you will need. You are able to save, fill, and sign the Eugene Oregon Petition to Determine Creditors of Trust Grantor in a few minutes instead of browsing the web for several hours searching for a proper template.

Using our collection is an excellent way to improve the safety of your document filing. Our professional lawyers on a regular basis check all the records to make sure that the templates are appropriate for a particular region and compliant with new acts and polices.

How can you obtain the Eugene Oregon Petition to Determine Creditors of Trust Grantor? If you already have a subscription, just log in to the account. The Download button will appear on all the samples you view. In addition, you can find all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instruction listed below:

- Find the template you require. Ensure that it is the template you were looking for: examine its title and description, and make use of the Preview feature when it is available. Otherwise, make use of the Search field to find the needed one.

- Launch the downloading process. Select Buy Now and choose the pricing plan you prefer. Then, create an account and process your order with a credit card or PayPal.

- Export the file. Select the format to obtain the Eugene Oregon Petition to Determine Creditors of Trust Grantor and change and fill, or sign it according to your requirements.

US Legal Forms is among the most considerable and trustworthy document libraries on the web. We are always ready to assist you in virtually any legal case, even if it is just downloading the Eugene Oregon Petition to Determine Creditors of Trust Grantor.

Feel free to take advantage of our form catalog and make your document experience as convenient as possible!