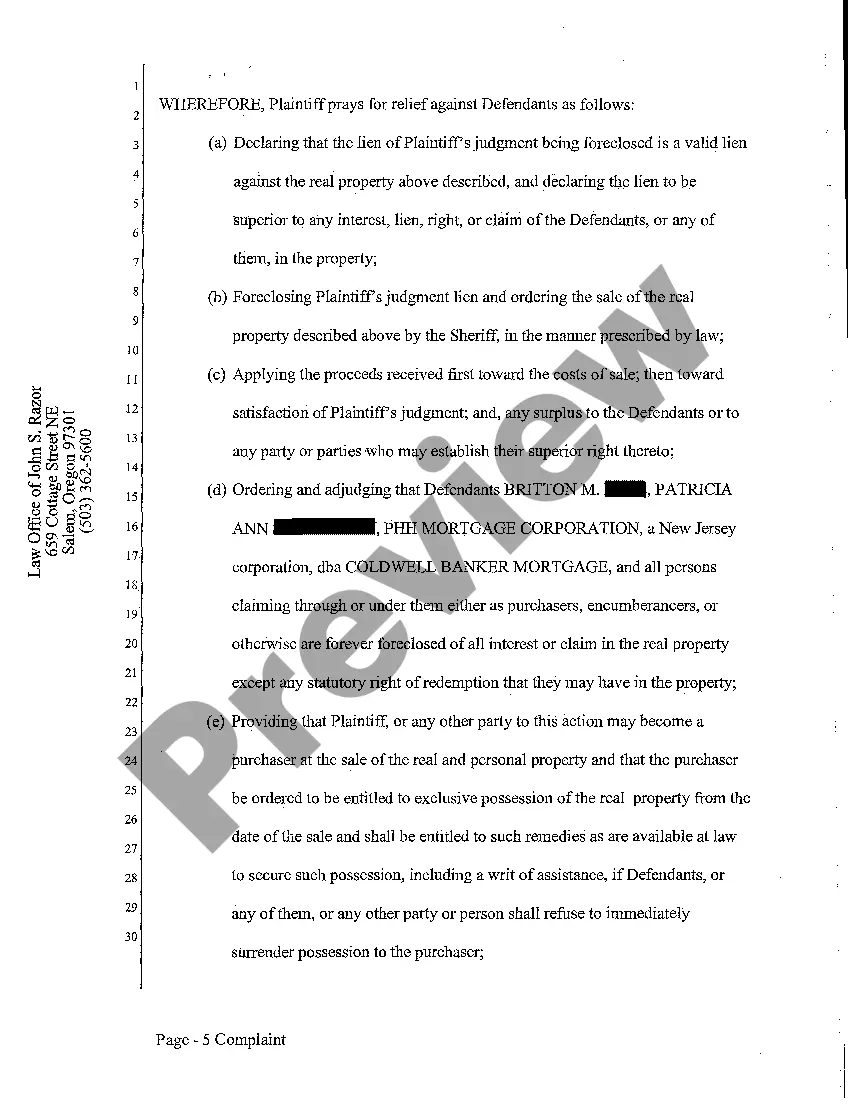

Title: Hillsboro Oregon Complaint — Judicial Foreclosure of Judgment Lien Explained: Types, Process, and Key Considerations Keywords: Hillsboro Oregon, complaint, judicial foreclosure, judgment lien, types, process, key considerations Introduction: In Hillsboro, Oregon, the judicial foreclosure process is initiated through a complaint when a creditor seeks to foreclose on a property to enforce a judgment lien. This process entails legal proceedings overseen by the court system, ensuring a fair and standardized approach. Understanding the various types, steps involved, and essential considerations is crucial for both creditors and property owners. This article provides a detailed description of Hillsboro Oregon Complaint — Judicial Foreclosure of Judgment Lien, its types, process, and key considerations. Types of Hillsboro Oregon Complaint — Judicial Foreclosure of Judgment Lien: 1. Residential Property Foreclosure: This type pertains to the judicial foreclosure initiated against a residential property, typically when the property owner fails to satisfy the judgment within the stipulated timeframe. 2. Commercial Property Foreclosure: Commercial property foreclosure refers to the complaint filed against a commercial property. Similar to residential foreclosure, it is triggered when the judgment debtor defaults on the outstanding judgment amount. Process of Hillsboro Oregon Complaint — Judicial Foreclosure of Judgment Lien: 1. Complaint Filing: The creditor files a complaint in the appropriate court, providing details such as the judgment, the property subject to foreclosure, the parties involved, and any relevant facts supporting the foreclosure request. 2. Service of Process: The creditor must serve the complaint and summons to the judgment debtor, notifying them of the lawsuit and their opportunity to respond. Proper service is essential to ensure due process and fairness. 3. Response and Hearing: The judgment debtor has a designated time frame to respond, typically 30 days from the date of service. If the debtor fails to respond or contest the complaint, a default judgment may be issued in favor of the creditor. If the debtor responds, a court hearing is scheduled to assess the merits of the case. 4. Judgment and Foreclosure Order: If the court finds in favor of the creditor, a judgment is entered against the debtor, providing legal authority to proceed with the foreclosure. The foreclosure order specifies the terms, conditions, and timelines for the sale of the property. 5. Auction and Redemption Period: The property is auctioned, typically through a public sale, to satisfy the judgment debt. Oregon's law provides a redemption period allowing the debtor to repay the debt and reclaim ownership within a specific timeframe. Key Considerations for Hillsboro Oregon Complaint — Judicial Foreclosure of Judgment Lien: 1. Legal Assistance: It is advisable to seek professional legal counsel to ensure compliance with legal requirements, filing accurate complaints, and navigating the complex foreclosure process effectively. 2. Property Evaluation: Before initiating the complaint, creditors should assess the property's value and market conditions to estimate potential recovery and determine if judicial foreclosure is a viable option. 3. Debtor's Financial Status: Understanding the debtor's financial condition is crucial to evaluate their ability to redeem the property or fulfill the judgment lien. Bankruptcy or insolvency circumstances may impact the foreclosure process. 4. Notification and Publication: Complying with the notice and publication requirements ensures transparency, providing interested parties an opportunity to participate and potentially bid on the property at auction. Conclusion: Hillsboro Oregon Complaint — Judicial Foreclosure of Judgment Lien involves a legal process to enforce a judgment lien on a property. With different types specific to residential and commercial properties, it is critical to follow the prescribed steps meticulously and consider relevant factors to maximize the chances of success. Seeking professional guidance and understanding the debtor’s financial situation are key components to navigate this complex process effectively.

Hillsboro Oregon Complaint - Judicial Foreclosure of Judgment Lien

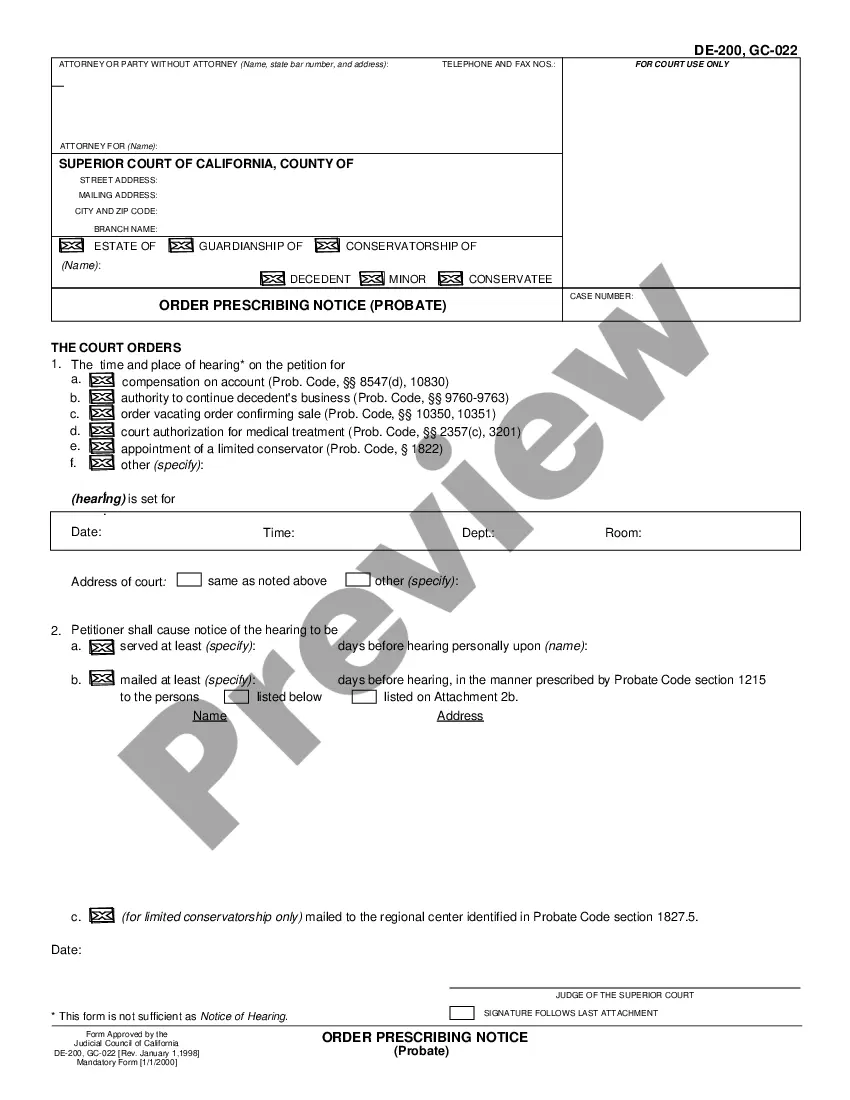

Description

How to fill out Hillsboro Oregon Complaint - Judicial Foreclosure Of Judgment Lien?

If you’ve already used our service before, log in to your account and download the Hillsboro Oregon Complaint - Judicial Foreclosure of Judgment Lien on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

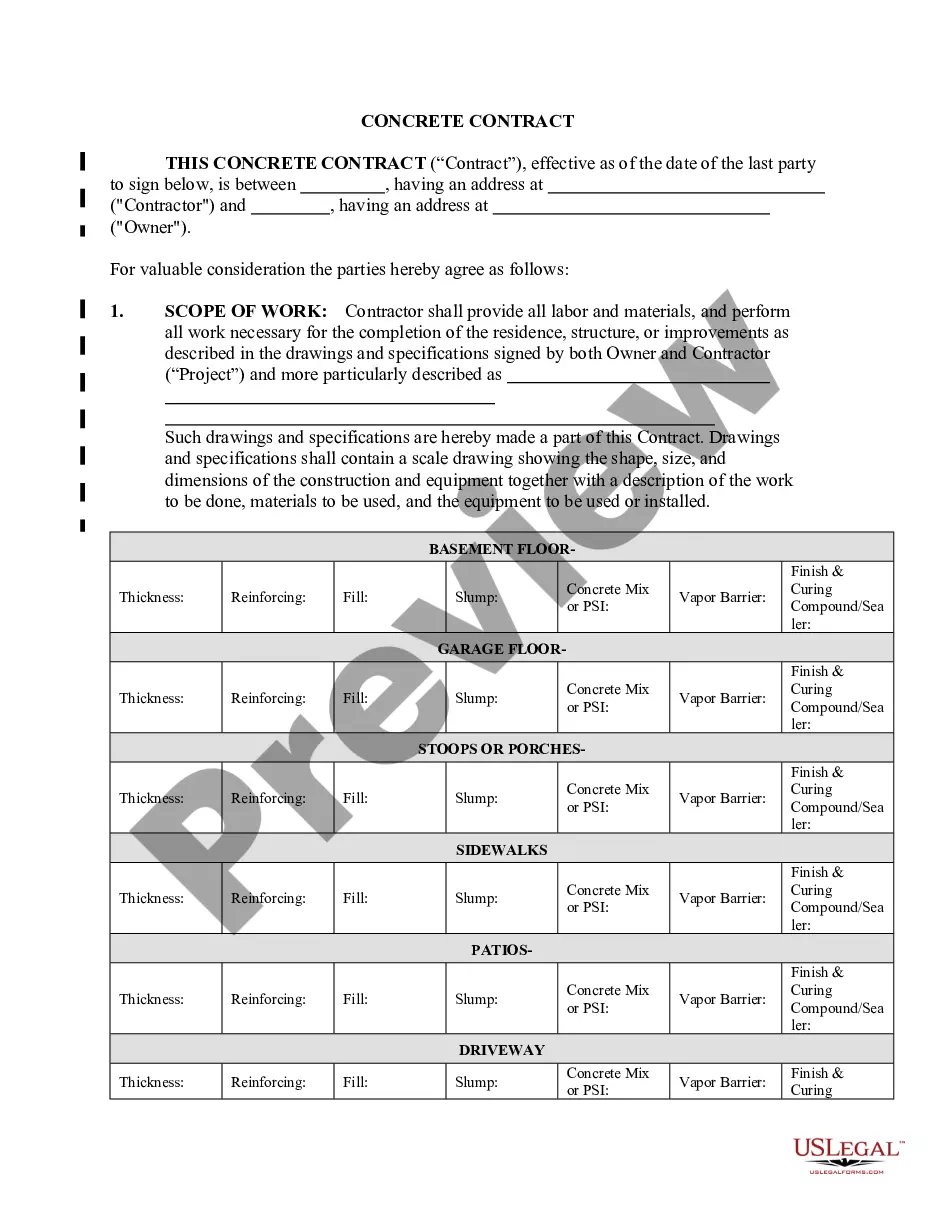

- Ensure you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Hillsboro Oregon Complaint - Judicial Foreclosure of Judgment Lien. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!

Form popularity

FAQ

Judicial Foreclosure is the first type of Real Estate Mortgage Foreclosure in a form of lawsuit. It's legal process is done by filing a complaint in the Regional Trial Court of the location of the mortgaged property.

It is up to you to find out where the defendant has assets (property) that can be seized to pay your judgment. If you have received a judgment and the defendant refuses to pay it, you may be able to have his or her wages or bank account garnished. The court does not provide garnishment forms.

Banks and other lenders typically use a trust deed. A trust deed can be foreclosed by a lawsuit in the circuit court of the county where the property is located. This type of foreclosure is referred to as a judicial foreclosure and is now common for residential loans in Oregon.

Oregon borrowers can expect that the foreclosure process will take approximately six months to complete if everything goes smoothly during the foreclosure. Court delays, borrower objects or a borrower's filing for bankruptcy can delay the process.

How long does a judgment lien last in Oregon? A judgment lien in Oregon will remain attached to the debtor's property (even if the property changes hands) for ten years.

The judgment remedies for a judgment that are extended under the provisions of this section expire 10 years after the certificate of extension is filed. Judgment remedies for a judgment may be extended only once under the provisions of this section.

Way too long to ignore. For non-governmental judgments, they last for 10 (yep, ten) years. And, so long as the creditor files a renewal prior to the expiration of that ten-year term, it is renewed for another 10 years.

A judgment remains on your credit record for 5 years or until it is paid in full or a rescission is granted by the courts. Although not always the case, in general a consumer is listed as defaulting before a credit provider applies for a judgment.

Judicial Foreclosure Process It's legal process is done by filing a complaint in the Regional Trial Court of the location of the mortgaged property. For example, if the property is in Metro Manila, the foreclosure filing should be done in Metro Manila as well.

In general, a judicial foreclosure can take two to three years to complete in California. A judicial foreclosure is subject to a four-year statute of limitations and is subject to a post-sale redemption right unless the deficiency claim is waived.