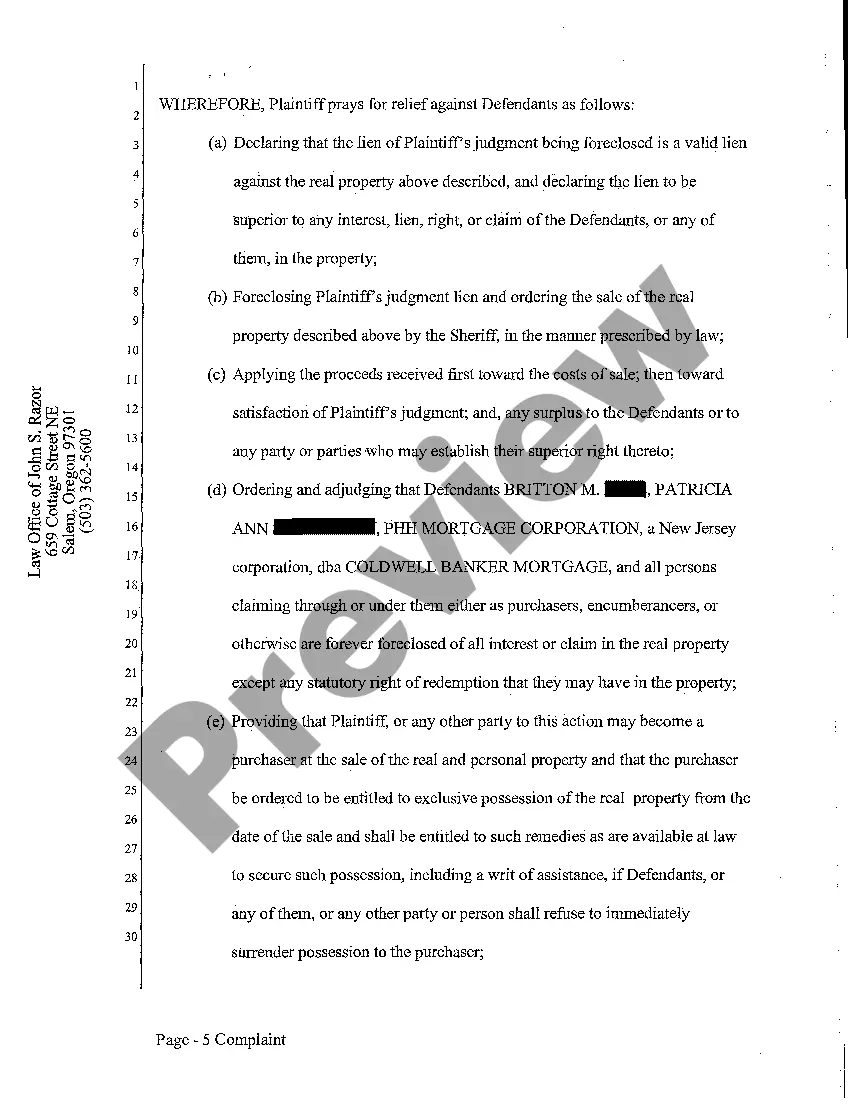

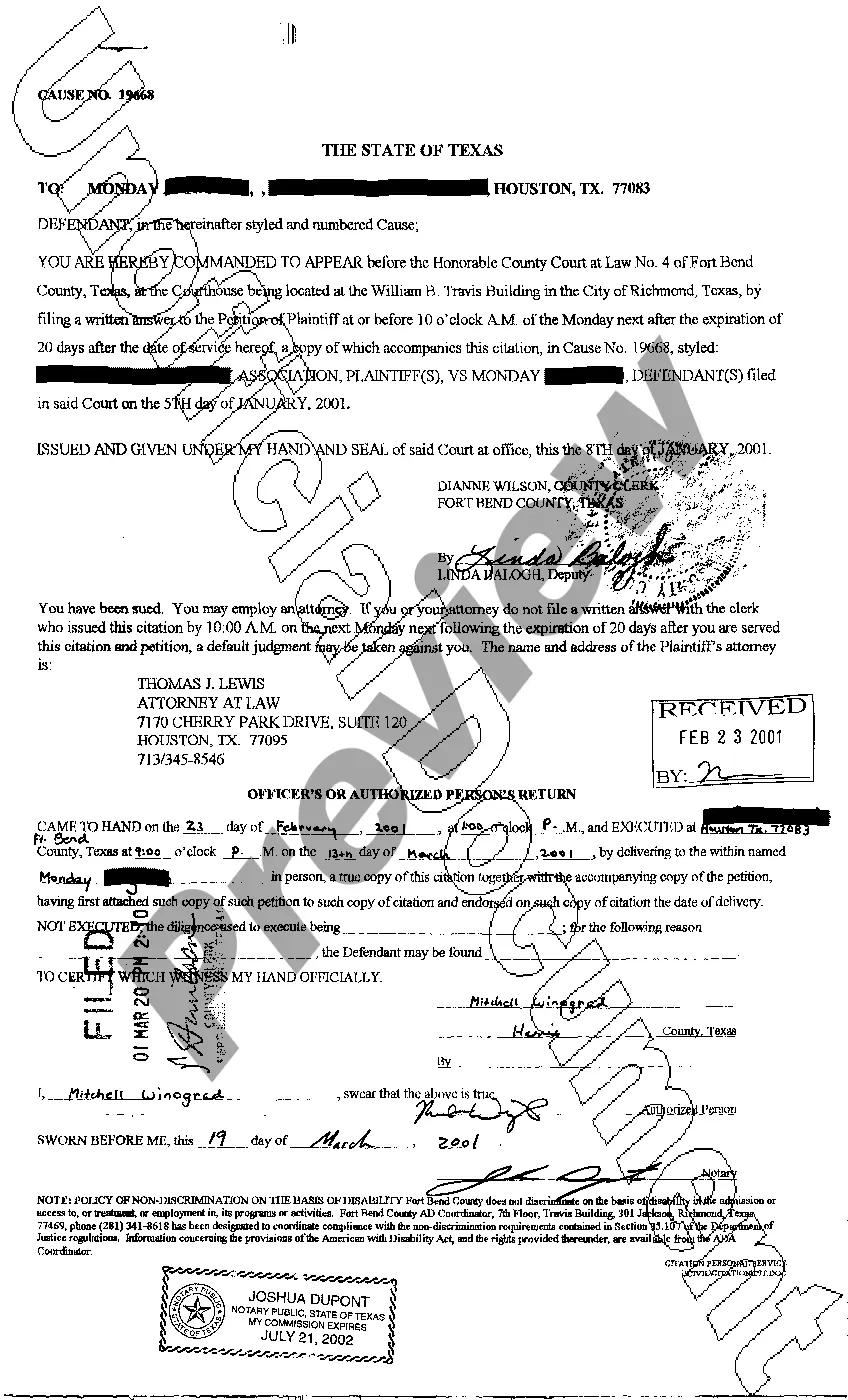

Portland Oregon Complaint — Judicial Foreclosure of Judgment Lien is a legal process used to enforce the payment of a judgment lien on a property located in Portland, Oregon. A judgment lien is a court-ordered claim placed on a debtor's real estate as a result of an unpaid debt. When the debtor fails to satisfy their debt, the creditor can initiate a lawsuit known as a complaint for judicial foreclosure to force the sale of the property in order to collect the owed amount. In Portland, Oregon, there are two types of complaints commonly used for judicial foreclosure of judgment liens: 1. Standard Judicial Foreclosure Complaint: This type of complaint is used when a creditor seeks to foreclose on a property to recover the unpaid judgment lien amount. The complaint outlines the details of the debt, the judgment lien, the property subject to foreclosure, and the legal basis relying on Oregon's laws and regulations. 2. Order to Show Cause (OSC) Complaint: An Order to Show Cause complaint is filed when a creditor wants the court to issue an order requiring the property owner to appear before the court and show cause as to why the property should not be foreclosed upon. This type of complaint is typically used when there is a need for immediate action or if there are exceptional circumstances of the case. In both types of complaints, the creditor must provide evidence of the unpaid judgment lien, such as the court judgment, along with documents related to the property, such as the deed, mortgage, and any recorded liens or encumbrances. It is important for the creditor to accurately and thoroughly describe the property in question to ensure the court can identify it correctly. Keywords: Portland Oregon, complaint, judicial foreclosure, judgment lien, legal process, enforce, property, unpaid debt, lawsuit, creditor, standard judicial foreclosure complaint, order showing cause (OSC) complaint, debt details, foreclosure, Oregon laws and regulations, property owner, court judgment, deed, mortgage, liens, encumbrances.

Portland Oregon Complaint - Judicial Foreclosure of Judgment Lien

State:

Oregon

City:

Portland

Control #:

OR-HJ-528

Format:

PDF

Instant download

This form is available by subscription

Description

Complaint - Judicial Foreclosure of Judgment Lien

Portland Oregon Complaint — Judicial Foreclosure of Judgment Lien is a legal process used to enforce the payment of a judgment lien on a property located in Portland, Oregon. A judgment lien is a court-ordered claim placed on a debtor's real estate as a result of an unpaid debt. When the debtor fails to satisfy their debt, the creditor can initiate a lawsuit known as a complaint for judicial foreclosure to force the sale of the property in order to collect the owed amount. In Portland, Oregon, there are two types of complaints commonly used for judicial foreclosure of judgment liens: 1. Standard Judicial Foreclosure Complaint: This type of complaint is used when a creditor seeks to foreclose on a property to recover the unpaid judgment lien amount. The complaint outlines the details of the debt, the judgment lien, the property subject to foreclosure, and the legal basis relying on Oregon's laws and regulations. 2. Order to Show Cause (OSC) Complaint: An Order to Show Cause complaint is filed when a creditor wants the court to issue an order requiring the property owner to appear before the court and show cause as to why the property should not be foreclosed upon. This type of complaint is typically used when there is a need for immediate action or if there are exceptional circumstances of the case. In both types of complaints, the creditor must provide evidence of the unpaid judgment lien, such as the court judgment, along with documents related to the property, such as the deed, mortgage, and any recorded liens or encumbrances. It is important for the creditor to accurately and thoroughly describe the property in question to ensure the court can identify it correctly. Keywords: Portland Oregon, complaint, judicial foreclosure, judgment lien, legal process, enforce, property, unpaid debt, lawsuit, creditor, standard judicial foreclosure complaint, order showing cause (OSC) complaint, debt details, foreclosure, Oregon laws and regulations, property owner, court judgment, deed, mortgage, liens, encumbrances.

Free preview

How to fill out Portland Oregon Complaint - Judicial Foreclosure Of Judgment Lien?

If you’ve already used our service before, log in to your account and download the Portland Oregon Complaint - Judicial Foreclosure of Judgment Lien on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Make certain you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Portland Oregon Complaint - Judicial Foreclosure of Judgment Lien. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!