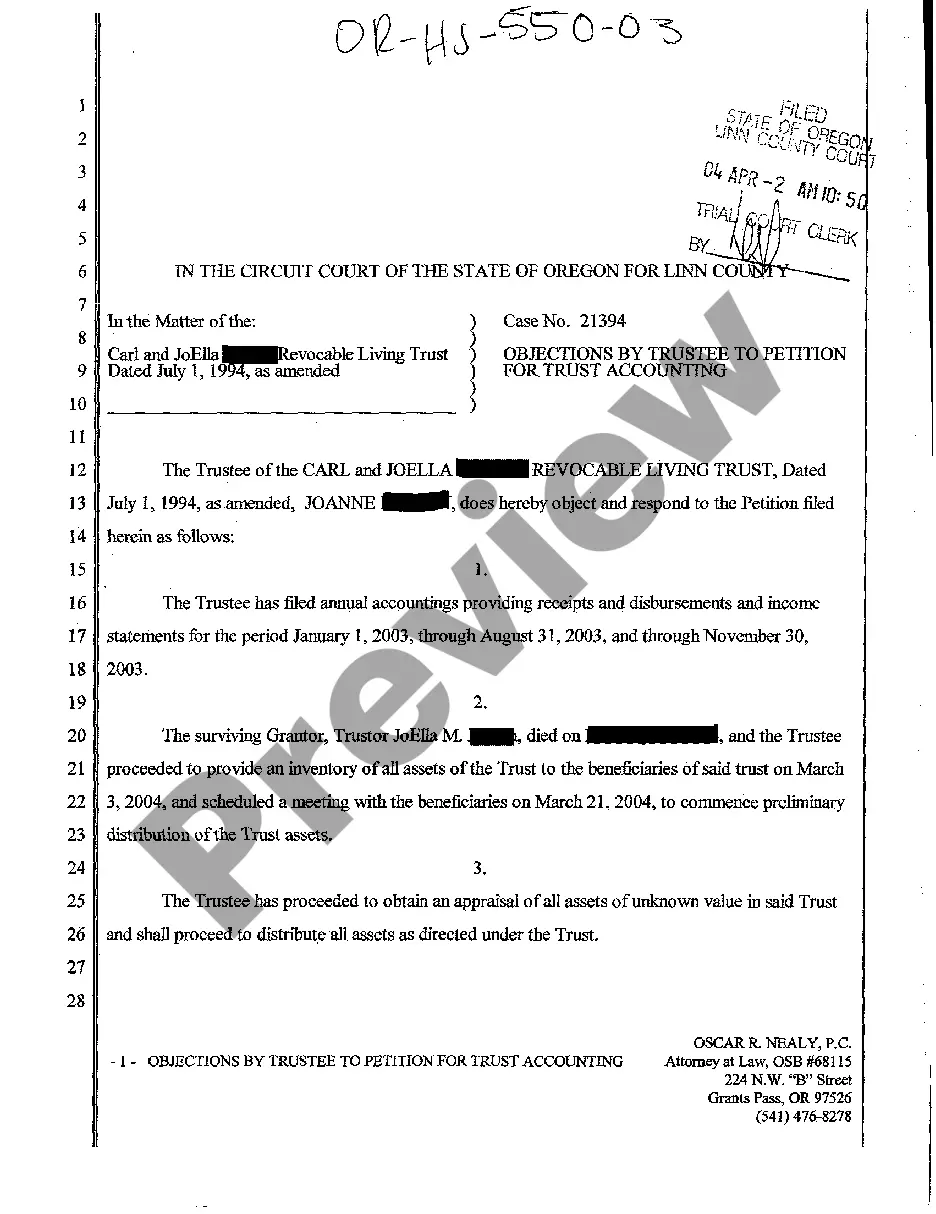

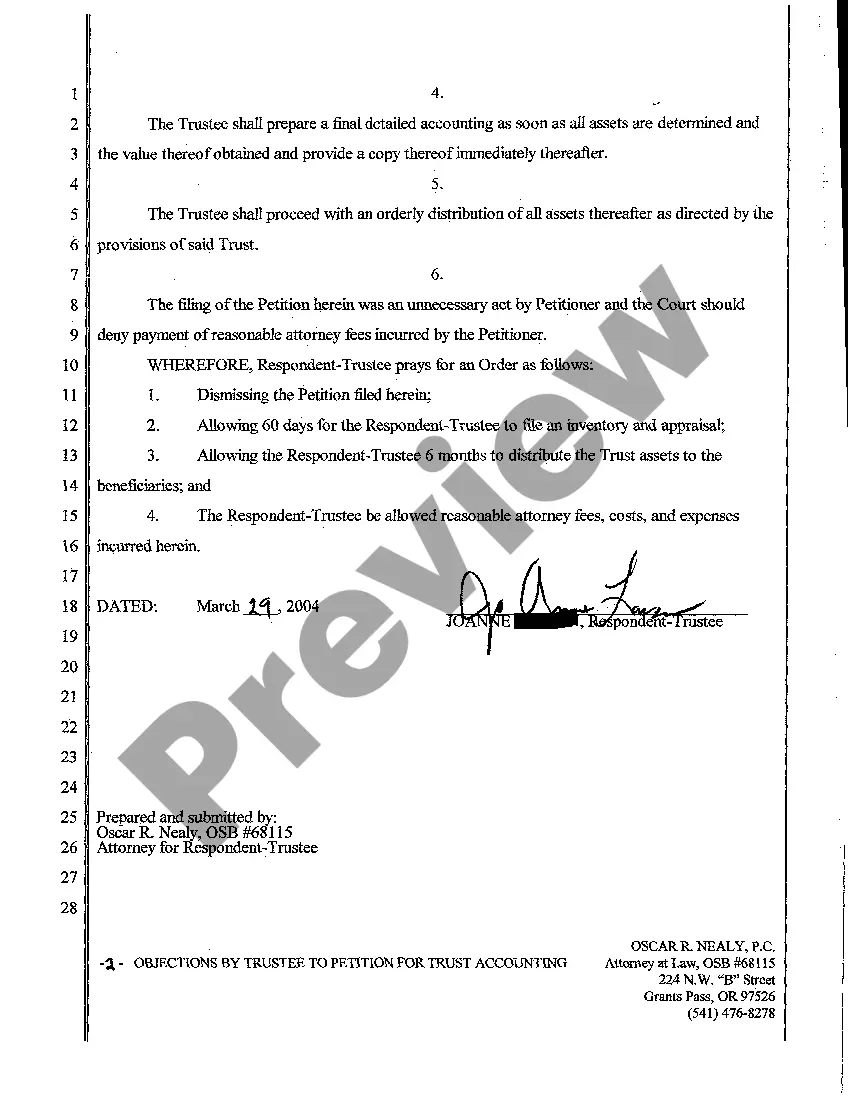

Title: Understanding Bend, Oregon Objections by Trustee to Petition for Trust Accounting Description: Bend, Oregon, known for its stunning landscapes and vibrant community, encompasses a range of legal processes involving trusts. One crucial aspect is when a trustee objects to a petition for trust accounting. This comprehensive article will explore the concept of objections by trustees, discuss their significance, and shed light on various types of objections commonly encountered in Bend, Oregon. Keywords: Bend Oregon, objections by trustee, petition for trust accounting, trust accounting, legal processes, types of objections, significance, trustee's duties Introduction: In Bend, Oregon, trustees are bound by legal obligations to safeguard and properly manage trusts. When a beneficiary petitions for trust accounting, seeking transparency and accountability, trustees have the right to object to this request. This article will delve into the details of objections raised by trustees and shed light on their crucial role in the trust administration process. 1. Understanding the Significance of Objections by Trustees: Trustees play a vital role in managing trusts, and their objections to a petition for trust accounting can carry significant consequences. Exploring the reasons behind these objections helps shed light on the trustee's duty to protect the beneficiaries' interests, ensure adherence to trust terms, and prevent unnecessary disruptions to the trust administration process. 2. Types of Objections Faced by Trustees in Bend, Oregon: 2.1. Insufficient Grounds: Trustees may object to a petition for trust accounting if they believe the grounds provided by the beneficiary are insufficient to warrant an accounting. This objection aims to ensure that the beneficiary's request is based on legitimate reasons and not an attempt to gain unwarranted access to trust information. 2.2. Excessive Costs: Trustees could object if they consider the requested accounting to be excessively costly, leading to an unnecessary burden on the trust. This objection seeks to maintain a balance between the beneficiary's right to information and the trust's financial stability. 2.3. Lack of Necessity: When the trustee believes that a proper accounting has already been conducted, they can object to the petition on the grounds of lack of necessity. This objection highlights the importance of avoiding redundant accounting to save time, effort, and resources. 2.4. Unreasonable Disruption: Trustees can object to a petition for trust accounting if they anticipate that the process will cause undue disruption to the trust administration. This objection emphasizes the need to balance the beneficiaries' rights with the overall harmony and proper functioning of the trust. 2.5. Privacy and Confidentiality Concerns: In cases where the requested accounting could jeopardize the privacy or confidentiality of certain trust matters, trustees may raise objections to protect sensitive information. This objection is aimed at maintaining the trust's integrity and safeguarding confidential details. Conclusion: Objections by trustees to a petition for trust accounting are an essential part of the legal processes surrounding trusts in Bend, Oregon. Understanding the significance of these objections helps ensure that trustees fulfill their duties diligently, while also considering the rights and interests of the beneficiaries they serve. By exploring various types of objections commonly encountered in Bend, this article aims to provide a comprehensive understanding of this crucial aspect of trust administration.

Bend Oregon Objections by Trustee to Petition for Trust Accounting

Description

How to fill out Bend Oregon Objections By Trustee To Petition For Trust Accounting?

Are you looking for a reliable and affordable legal forms supplier to get the Bend Oregon Objections by Trustee to Petition for Trust Accounting? US Legal Forms is your go-to solution.

Whether you need a basic agreement to set rules for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed in accordance with the requirements of particular state and county.

To download the document, you need to log in account, find the needed form, and click the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Bend Oregon Objections by Trustee to Petition for Trust Accounting conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to find out who and what the document is good for.

- Start the search over if the form isn’t good for your specific scenario.

Now you can register your account. Then pick the subscription plan and proceed to payment. As soon as the payment is completed, download the Bend Oregon Objections by Trustee to Petition for Trust Accounting in any provided format. You can get back to the website when you need and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time learning about legal papers online for good.

Form popularity

FAQ

And although a beneficiary generally has very little control over the trust's management, they are entitled to receive what the trust allocates to them. In general, a trustee has extensive powers when it comes to overseeing the trust.

Trustees are responsible for holding and managing all the assets and property inside the Trust as well as distributing assets as needed to the beneficiaries named.

However, to succeed in any proceedings against a trustee, the aggrieved beneficiary will need to show that the trustees acted in breach of their powers and duties under the trust. Let us now look in more detail at how a trustee's decision can be challenged in the court.

Beneficiaries can provide fully informed consent to some breaches - notably including the duty of undivided loyalty. However, beneficiaries and co-trustees may not wish to consent and would rather take action against a trustee that has breached a duty.

A trustee has responsibility for managing the trust assets and owes fiduciary duties to the beneficiaries. A trustee is personally liable for any breach of his or her fiduciary duty.

Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust. But just as we mentioned earlier, the trustee must follow the rules of the legal document and can only take out income or principal when it's in the best interest of the trust.

Generally, a beneficiary designation will override the trust provisions. There are situations, however, in which the beneficiary designation will fail and the proceeds of the account will pass under the terms of the trust.

Yes, a trustee can refuse to pay a beneficiary if the trust allows them to do so. Whether a trustee can refuse to pay a beneficiary depends on how the trust document is written. Trustees are legally obligated to comply with the terms of the trust when distributing assets.