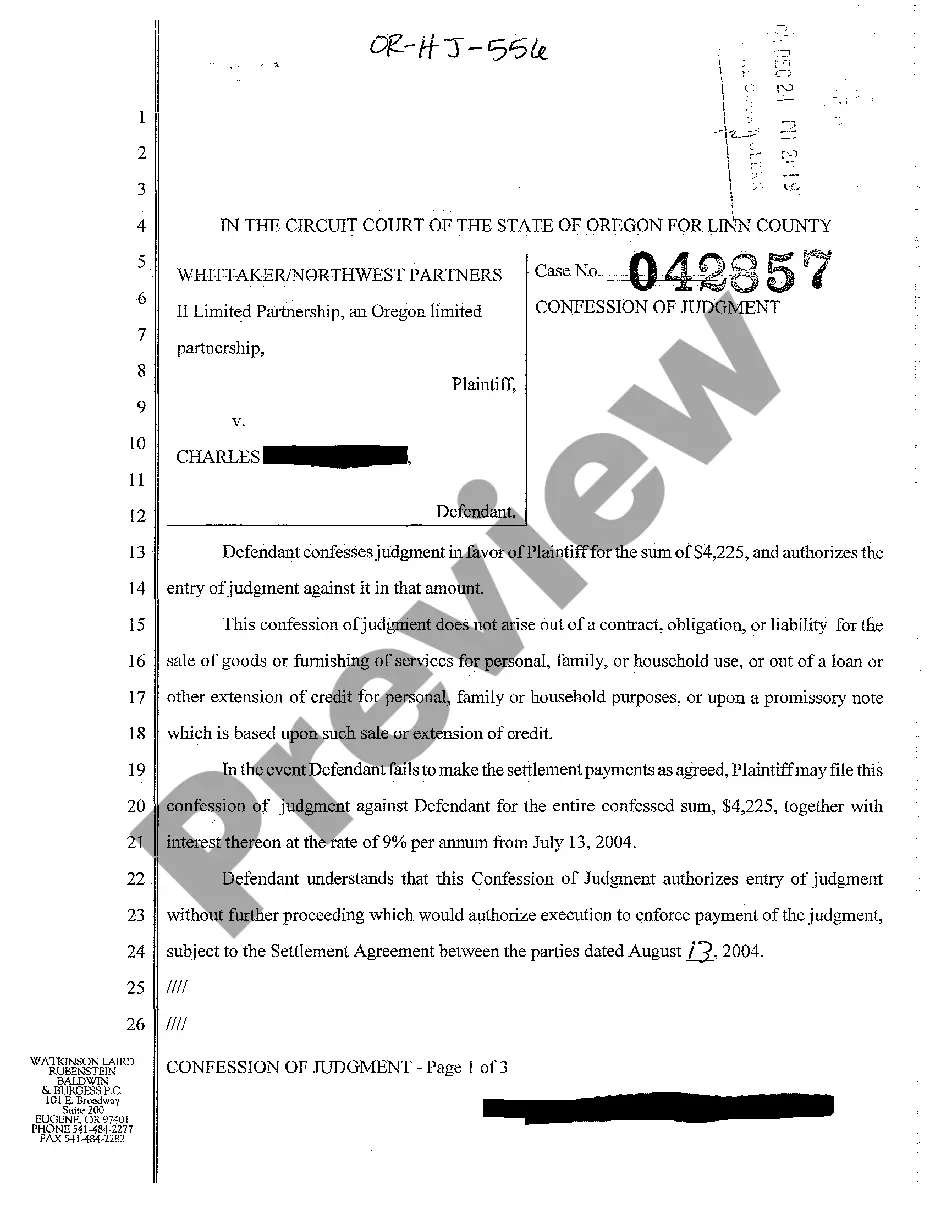

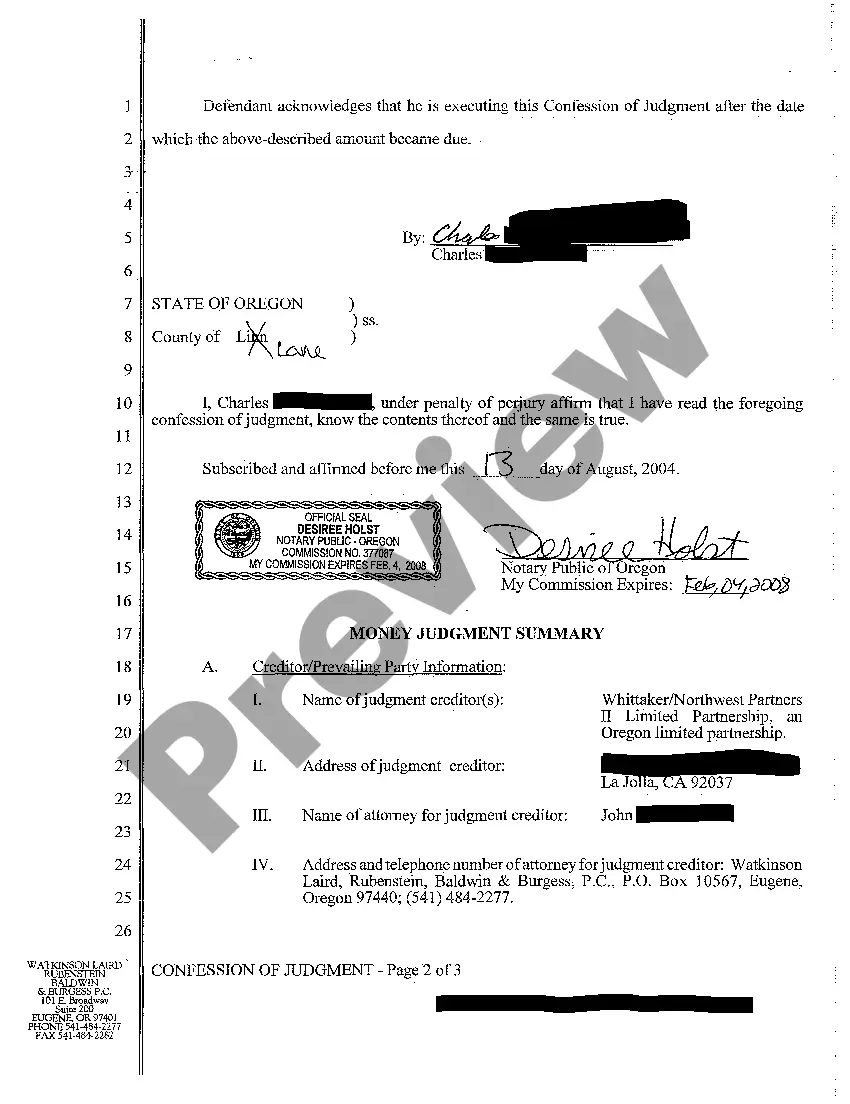

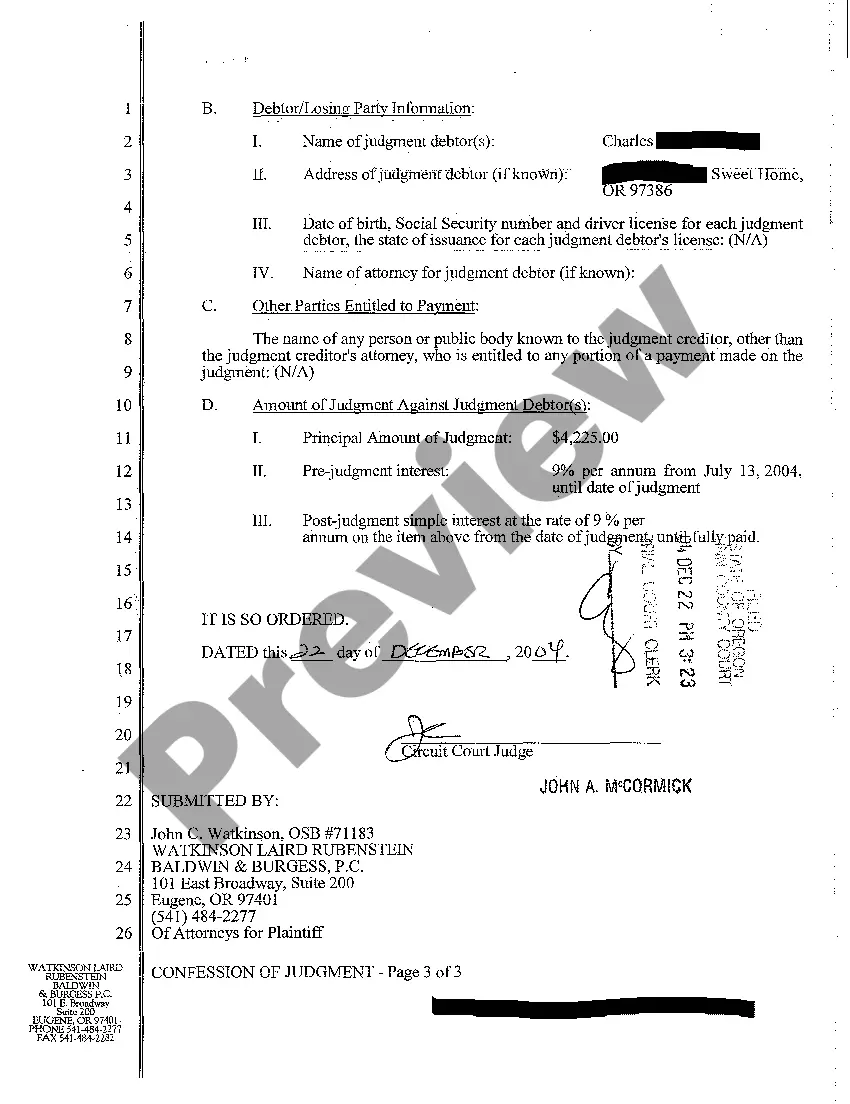

Eugene Oregon Confession of Judgment is a legal term used to describe a legal document that allows a debtor and a creditor to settle a debt dispute without going through a traditional court trial process. It provides creditors with an efficient way to obtain a judgment in their favor, while debtors can avoid lengthy court proceedings and associated costs. In Eugene, Oregon, Confession of Judgment agreements are governed by specific state laws and regulations. These agreements serve as legally binding contracts, where debtors voluntarily agree to waive their rights to dispute a debt, make any legal defenses, or challenge the validity of the agreement in court. By signing the agreement, debtors admit their indebtedness and provide consent to the immediate entry of a judgment against them, empowering creditors to enforce collection actions. There are different types of Eugene Oregon Confession of Judgment that may be used depending on the nature and complexity of the debt. Some common types include: 1. Commercial Confession of Judgment: This type of agreement is often used in commercial transactions, such as business loans, merchant cash advances, or equipment financing. It allows lenders to swiftly obtain a judgment and enforce collection actions in case of default. 2. Landlord-Tenant Confession of Judgment: This form is commonly used in rental agreements, allowing landlords to recover unpaid rent or damages without resorting to lengthy eviction proceedings. Tenants agree to the entry of a judgment as part of the lease agreement which enables landlords to quickly regain possession of the property if the tenant fails to pay rent. 3. Personal Confession of Judgment: This type is typically used in personal loan agreements, where individuals borrow money from friends, family, or private lenders. By signing this agreement, borrowers consent to the creditor's ability to obtain a judgment if they fail to repay the loan as agreed. It is important to note that Confession of Judgment agreements can have serious implications for debtors as they limit their ability to defend themselves in court. Therefore, it is crucial that all parties thoroughly understand and carefully consider the terms and consequences of such agreements before signing them.

Eugene Oregon Confession of Judgment

Description

How to fill out Eugene Oregon Confession Of Judgment?

We always want to minimize or avoid legal issues when dealing with nuanced legal or financial matters. To do so, we apply for attorney solutions that, as a rule, are very costly. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of an attorney. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Eugene Oregon Confession of Judgment or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is equally easy if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Eugene Oregon Confession of Judgment complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Eugene Oregon Confession of Judgment is proper for you, you can choose the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!