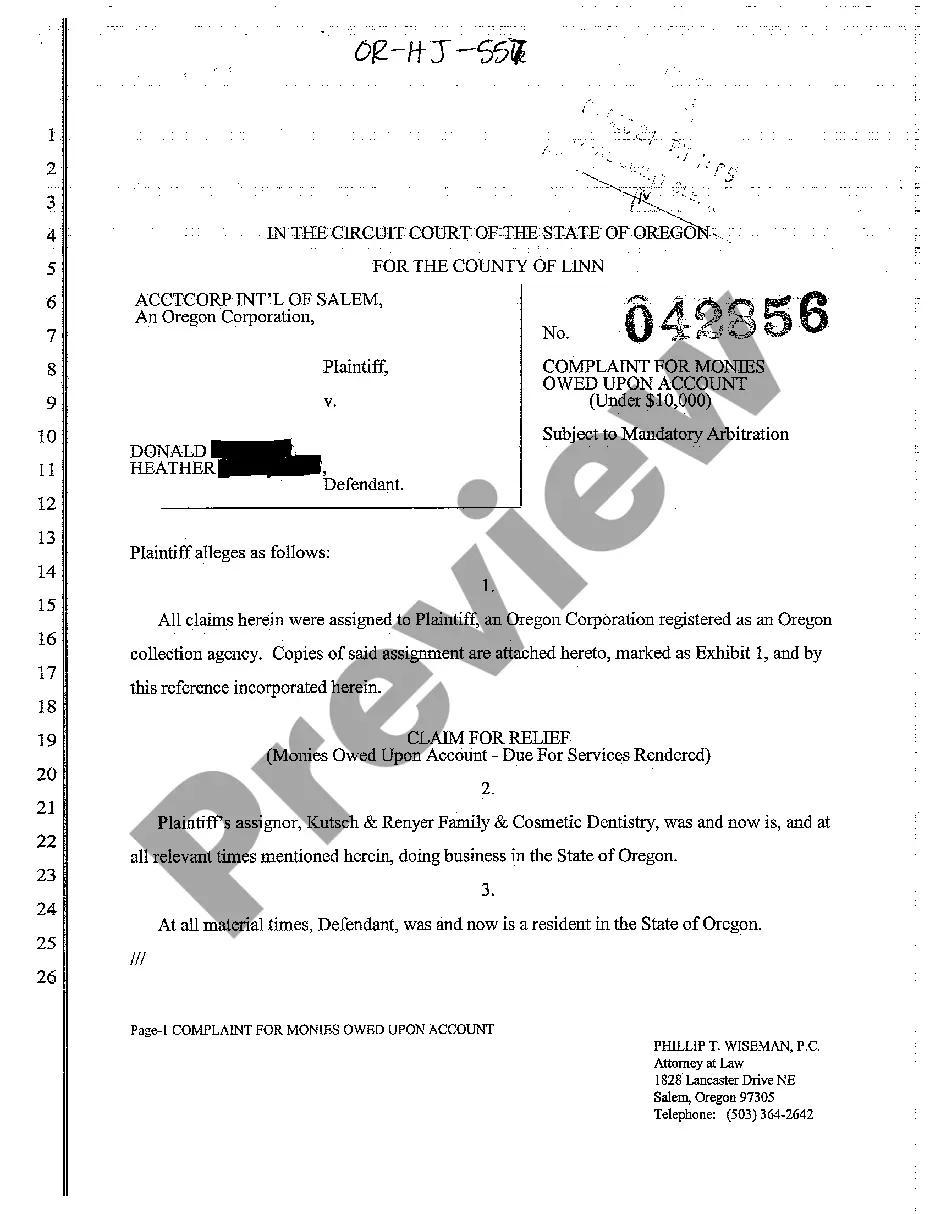

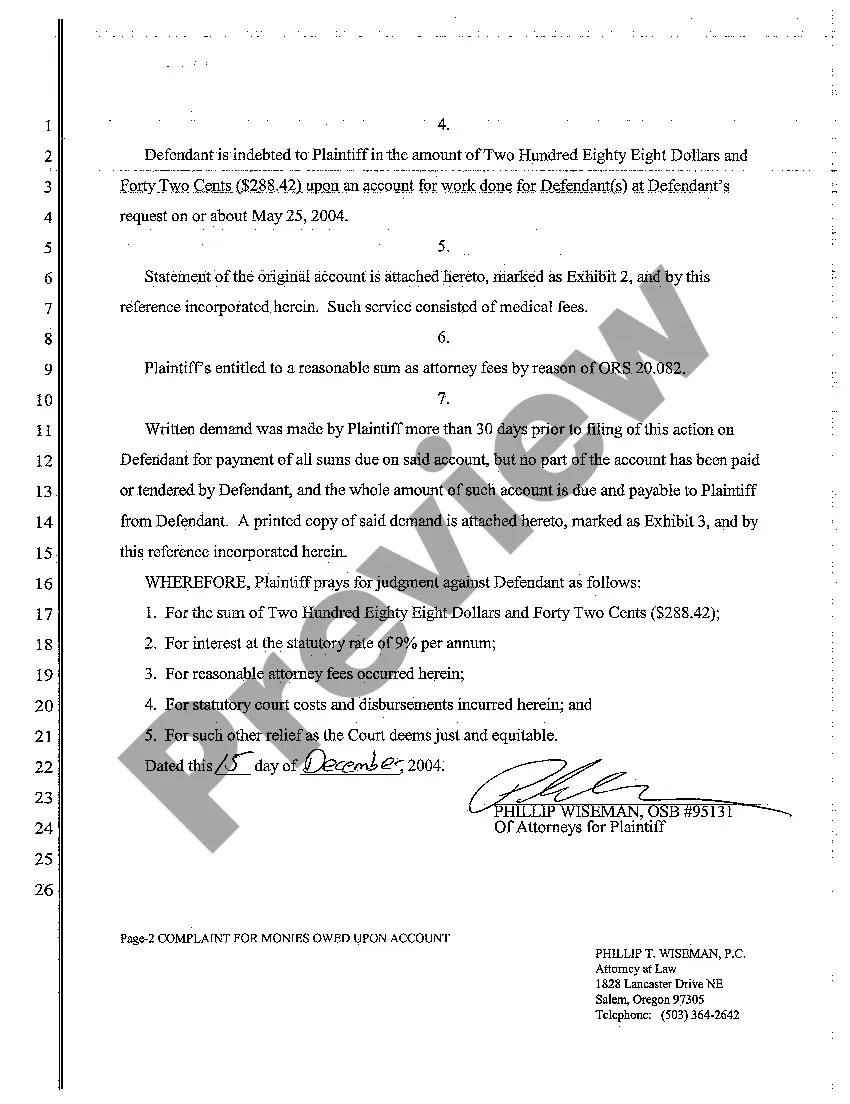

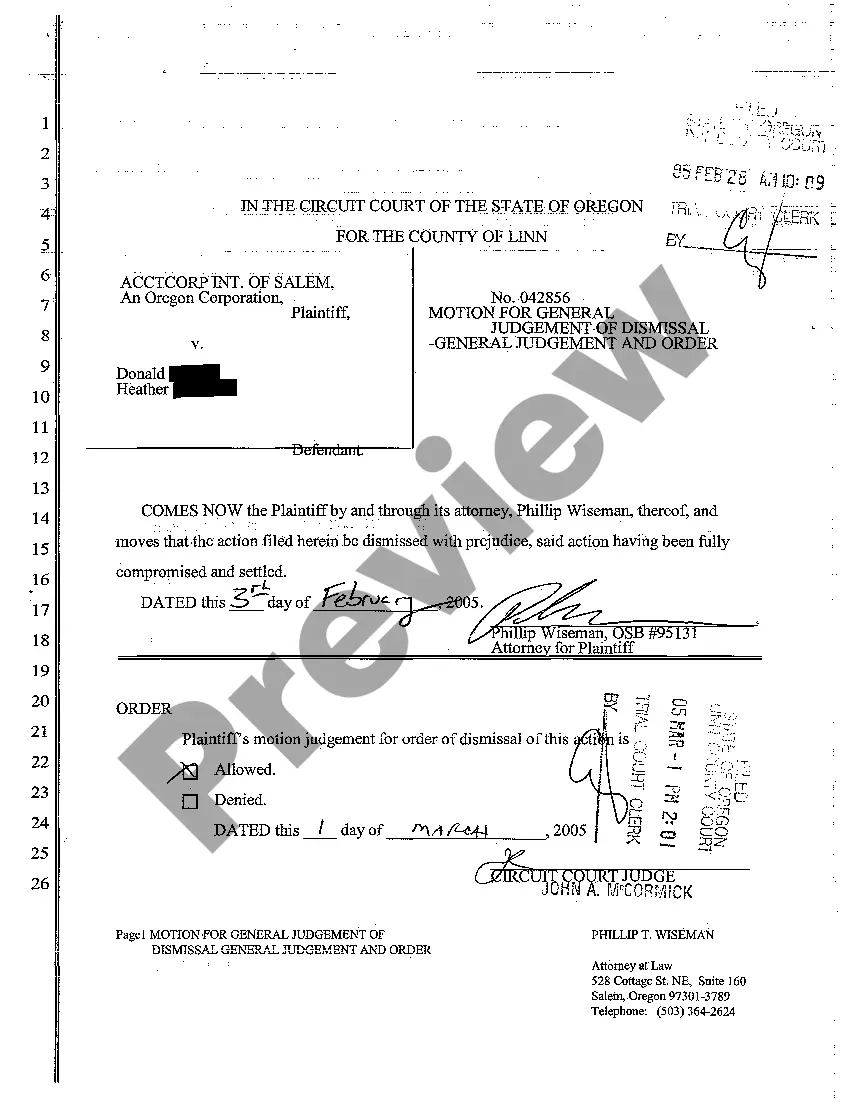

Title: Gresham Oregon Complaint for Monies Owed Upon Account — Detailed Description and Types Introduction: A Gresham Oregon Complaint for Monies Owed Upon Account is a legal action initiated by a creditor or entity seeking resolution for unpaid debts or outstanding balances. This formal complaint is intended to assert their right to collect the owed monies through legal recourse, ensuring the debtor fulfills their financial obligations. Below, we outline the key elements of such a complaint, along with different types that may arise. Keywords: Gresham Oregon Complaint, Monies Owed Upon Account, legal action, unpaid debts, outstanding balances, creditor, debtor, financial obligations. Detailed Description: 1. Parties Involved: In the Gresham Oregon Complaint for Monies Owed Upon Account, the parties involved are typically the creditor or entity owed the monies (plaintiff) and the debtor responsible for fulfilling the owed debt (defendant). The complaint outlines their legal relationship and establishes the basis for the owed monies. 2. Nature of the Complaint: The complaint states that the defendant owes specific monies to the plaintiff. It describes the underlying financial transaction(s), such as a loan, credit account, or purchase agreement, which gave rise to the monetary obligations. It further specifies the terms and conditions of the agreement, including payment deadlines, interest rates, and any relevant penalties for non-payment. 3. Breach of Contract or Non-Payment: The complaint emphasizes that the defendant has failed to honor their financial obligations as outlined in the agreement, constituting a breach of contract. It details any communication or notice sent to the debtor regarding the overdue amounts and their failure to rectify the situation. 4. Requested Relief: The creditor seeks relief in the form of a court judgment in their favor. They would typically request the full amount owed, including any accrued interest, late fees, penalties, and attorney fees associated with filing the complaint and pursuing legal action. The creditor may also seek additional remedies, such as wage garnishment or property liens, to satisfy the debt. Types of Gresham Oregon Complaint for Monies Owed Upon Account: 1. Personal Loan Complaint: In cases where an individual borrower fails to repay funds borrowed from an individual or an institution, a personal loan complaint is filed. It outlines the loan details and specific repayment terms, seeking the outstanding balance owed. 2. Credit Card Complaint: This type of complaint is commonly filed when a credit card holder fails to make minimum payments or remains in default on their credit card account. The complaint highlights the credit card agreement terms and the amount owed, requesting full payment. 3. Business Debt Complaint: When a business fails to pay for goods or services provided by another business, the unpaid vendor can file a business debt complaint. This complaint details the unpaid invoices or bills, citing specific agreements or contracts, and seeks full payment. Conclusion: A Gresham Oregon Complaint for Monies Owed Upon Account is a legal avenue for creditors and entities to pursue outstanding debts owed to them. By initiating this formal complaint, the creditor seeks relief and aims to enforce the debtor's financial obligations through a court judgment, ultimately resolving the monetary dispute.

Gresham Oregon Complaint for Monies Owed Upon Account

Description

How to fill out Gresham Oregon Complaint For Monies Owed Upon Account?

Take advantage of the US Legal Forms and obtain immediate access to any form template you need. Our helpful website with thousands of templates allows you to find and get almost any document sample you require. You can save, complete, and certify the Gresham Oregon Complaint for Monies Owed Upon Account in a matter of minutes instead of browsing the web for hours seeking a proper template.

Using our library is a wonderful way to increase the safety of your record submissions. Our professional attorneys regularly review all the records to make certain that the templates are appropriate for a particular state and compliant with new laws and regulations.

How can you get the Gresham Oregon Complaint for Monies Owed Upon Account? If you have a subscription, just log in to the account. The Download button will be enabled on all the documents you look at. In addition, you can get all the earlier saved documents in the My Forms menu.

If you don’t have an account yet, follow the instructions listed below:

- Open the page with the template you require. Make certain that it is the template you were looking for: verify its title and description, and make use of the Preview function when it is available. Otherwise, make use of the Search field to look for the needed one.

- Launch the downloading procedure. Select Buy Now and select the pricing plan you prefer. Then, create an account and process your order with a credit card or PayPal.

- Save the file. Choose the format to obtain the Gresham Oregon Complaint for Monies Owed Upon Account and modify and complete, or sign it for your needs.

US Legal Forms is one of the most significant and reliable template libraries on the web. We are always ready to assist you in virtually any legal procedure, even if it is just downloading the Gresham Oregon Complaint for Monies Owed Upon Account.

Feel free to benefit from our platform and make your document experience as convenient as possible!