Bend, Oregon Rescission of Notice of Default: Understanding the Process In the realm of foreclosure proceedings, the Rescission of Notice of Default is a legal mechanism that provides homeowners in Bend, Oregon, with the opportunity to halt or reverse the foreclosure process. It grants them the ability to reclaim their property rights by rectifying their defaults and bringing their mortgage loans back to good standing. This detailed description aims to shed light on the Bend, Oregon Rescission of Notice of Default process, its significance, and any potential variations. What is the Bend Oregon Rescission of Notice of Default? The Bend, Oregon Rescission of Notice of Default is a legal mechanism that allows homeowners facing foreclosure to request the cancellation of the Notice of Default (NOD) that was previously issued against them. NOD is typically issued when a homeowner fails to make timely mortgage payments, breaching the terms of the loan agreement. The Rescission of Notice of Default is effectively an opportunity for homeowners to make amends and reinstate their mortgage loans. Process and Requirements for Rescission: 1. Timely Action: Homeowners must act swiftly upon receiving the Notice of Default. The specific timeframe for filing a Rescission of Notice of Default request can vary, so it is crucial to consult with legal professionals or refer to specific regulations in Bend, Oregon. 2. Rectifying Defaults: In order to rescind the Notice of Default, homeowners are typically required to fulfill certain criteria, such as paying all overdue amounts, including missed mortgage payments, accrued interest, penalties, and associated fees. The lender may provide a reinstatement amount or negotiate repayment plans. 3. Filing a Rescission Request: Homeowners must prepare and submit a formal Rescission of Notice of Default request to the lender or authorized party responsible for handling the foreclosure proceedings. This request should include relevant details, such as the property address, borrower's information, date of NOD, and the desired action (rescission). Types of Bend, Oregon Rescission of Notice of Default: 1. Traditional Rescission: This is the standard procedure employed to reverse the foreclosure proceedings. It involves fulfilling the necessary requirements, rectifying the defaults, and formally requesting the rescission from the lender. 2. Loan Modification Rescission: In certain cases, homeowners seeking to reinstate their mortgage loans may negotiate a loan modification agreement with the lender. This entails modifying the terms of the loan agreement to make it more manageable for the borrower. 3. Cure and Reinstatement Rescission: Another potential type of rescission involves homeowners curing their defaults by fully paying off all the overdue amounts, reverting the mortgage to good standing, and subsequently requesting the rescission of the Notice of Default. Understanding the Significance: The Bend, Oregon Rescission of Notice of Default process offers homeowners in financial distress an opportunity to rectify their defaults and retain their properties. By halting or reversing the foreclosure proceedings, homeowners can avoid the potentially devastating consequences of losing their homes and work towards returning to financial stability. In conclusion, the Bend, Oregon Rescission of Notice of Default provides a vital lifeline for struggling homeowners, allowing them to reinstate their mortgage loans and regain control over their properties. It is crucial to consult legal professionals or relevant authorities to ensure compliance with specific regulations and enact the appropriate type of rescission based on individual circumstances.

Bend Oregon Rescission of Notice of Default

Category:

State:

Oregon

City:

Bend

Control #:

OR-HJ-607

Format:

PDF

Instant download

This form is available by subscription

Description

Rescission of Notice of Default

Bend, Oregon Rescission of Notice of Default: Understanding the Process In the realm of foreclosure proceedings, the Rescission of Notice of Default is a legal mechanism that provides homeowners in Bend, Oregon, with the opportunity to halt or reverse the foreclosure process. It grants them the ability to reclaim their property rights by rectifying their defaults and bringing their mortgage loans back to good standing. This detailed description aims to shed light on the Bend, Oregon Rescission of Notice of Default process, its significance, and any potential variations. What is the Bend Oregon Rescission of Notice of Default? The Bend, Oregon Rescission of Notice of Default is a legal mechanism that allows homeowners facing foreclosure to request the cancellation of the Notice of Default (NOD) that was previously issued against them. NOD is typically issued when a homeowner fails to make timely mortgage payments, breaching the terms of the loan agreement. The Rescission of Notice of Default is effectively an opportunity for homeowners to make amends and reinstate their mortgage loans. Process and Requirements for Rescission: 1. Timely Action: Homeowners must act swiftly upon receiving the Notice of Default. The specific timeframe for filing a Rescission of Notice of Default request can vary, so it is crucial to consult with legal professionals or refer to specific regulations in Bend, Oregon. 2. Rectifying Defaults: In order to rescind the Notice of Default, homeowners are typically required to fulfill certain criteria, such as paying all overdue amounts, including missed mortgage payments, accrued interest, penalties, and associated fees. The lender may provide a reinstatement amount or negotiate repayment plans. 3. Filing a Rescission Request: Homeowners must prepare and submit a formal Rescission of Notice of Default request to the lender or authorized party responsible for handling the foreclosure proceedings. This request should include relevant details, such as the property address, borrower's information, date of NOD, and the desired action (rescission). Types of Bend, Oregon Rescission of Notice of Default: 1. Traditional Rescission: This is the standard procedure employed to reverse the foreclosure proceedings. It involves fulfilling the necessary requirements, rectifying the defaults, and formally requesting the rescission from the lender. 2. Loan Modification Rescission: In certain cases, homeowners seeking to reinstate their mortgage loans may negotiate a loan modification agreement with the lender. This entails modifying the terms of the loan agreement to make it more manageable for the borrower. 3. Cure and Reinstatement Rescission: Another potential type of rescission involves homeowners curing their defaults by fully paying off all the overdue amounts, reverting the mortgage to good standing, and subsequently requesting the rescission of the Notice of Default. Understanding the Significance: The Bend, Oregon Rescission of Notice of Default process offers homeowners in financial distress an opportunity to rectify their defaults and retain their properties. By halting or reversing the foreclosure proceedings, homeowners can avoid the potentially devastating consequences of losing their homes and work towards returning to financial stability. In conclusion, the Bend, Oregon Rescission of Notice of Default provides a vital lifeline for struggling homeowners, allowing them to reinstate their mortgage loans and regain control over their properties. It is crucial to consult legal professionals or relevant authorities to ensure compliance with specific regulations and enact the appropriate type of rescission based on individual circumstances.

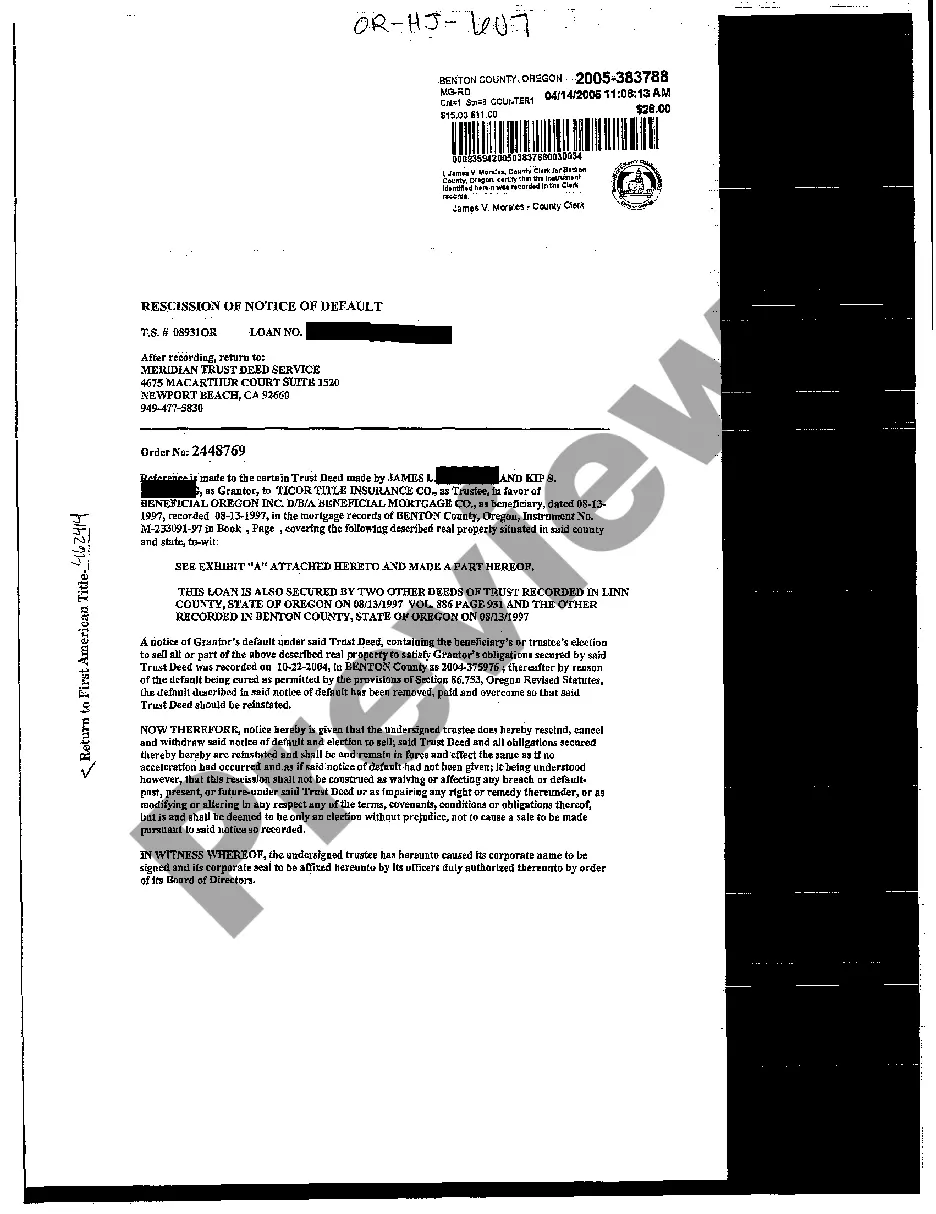

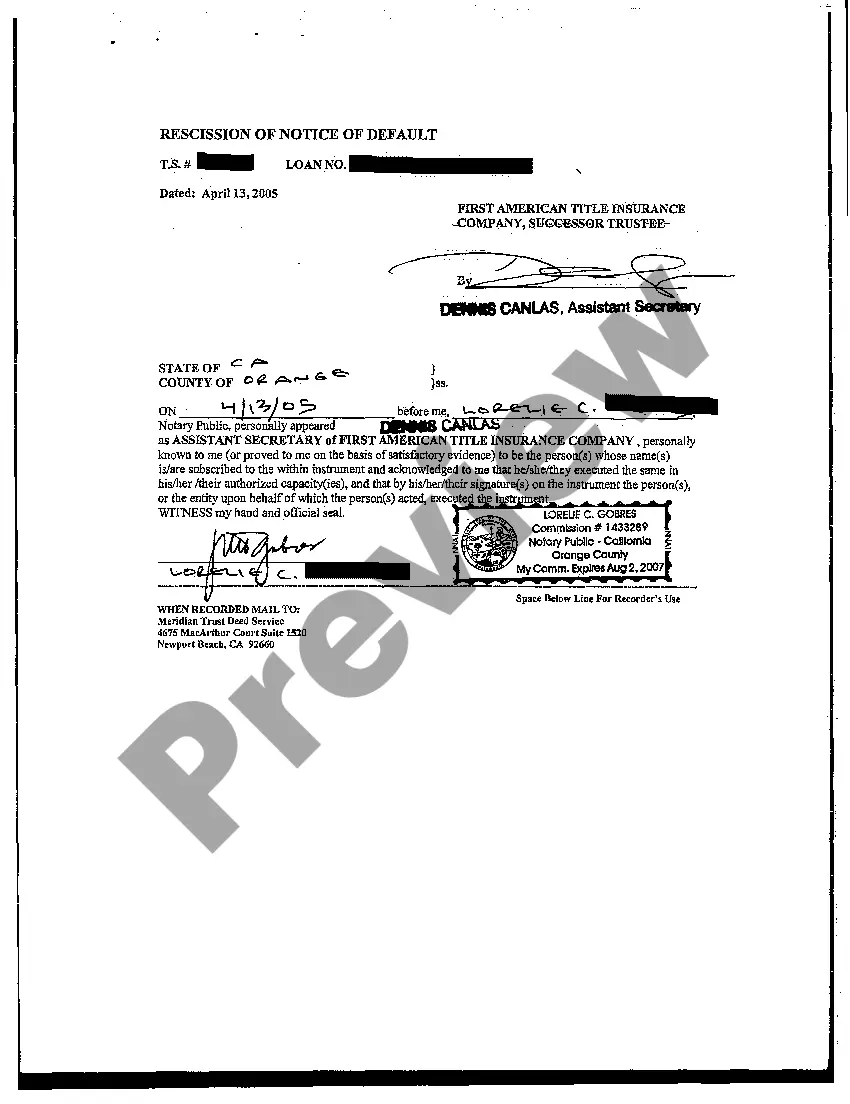

Free preview

How to fill out Bend Oregon Rescission Of Notice Of Default?

If you’ve already utilized our service before, log in to your account and save the Bend Oregon Rescission of Notice of Default on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Bend Oregon Rescission of Notice of Default. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!