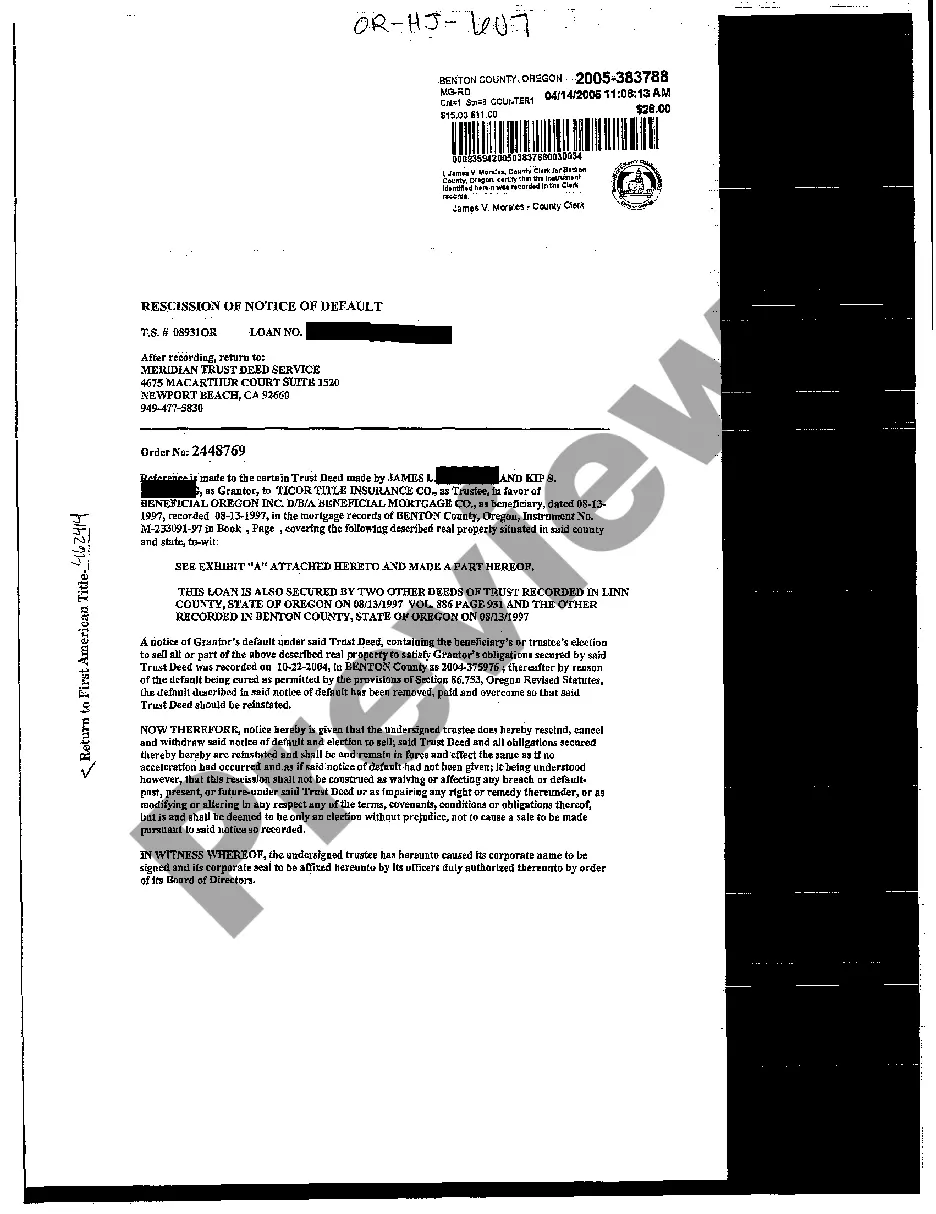

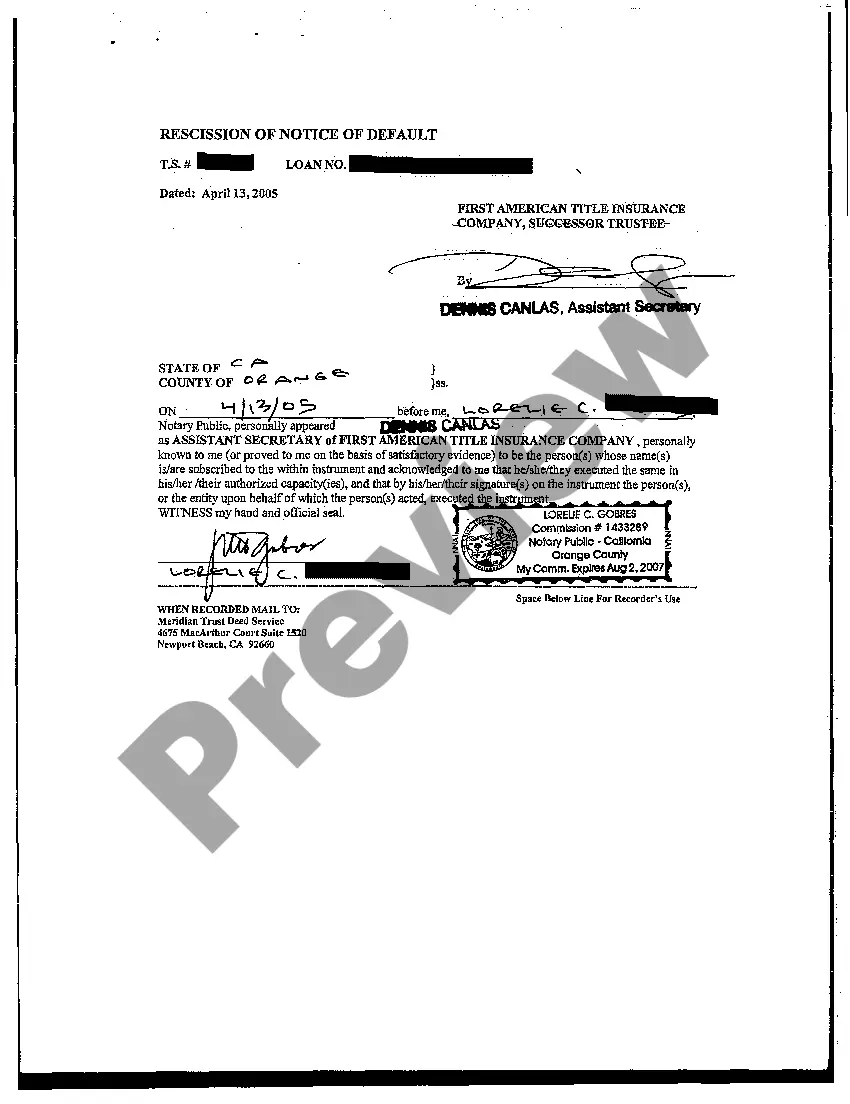

Eugene Oregon Rescission of Notice of Default: Understanding the Process and Types In the realm of real estate and mortgage lending, Eugene, Oregon, experiences situations where homeowners may fall behind on their mortgage payments, leading to a Notice of Default being filed by the lender. However, there is a legal recourse available known as the Rescission of Notice of Default, which allows homeowners to reinstate their loan and prevent foreclosure. This article will provide a detailed description of what the Eugene Oregon Rescission of Notice of Default entails, highlighting key points and relevant keywords along the way. The Rescission of Notice of Default is a legal option that homeowners in Eugene, Oregon, have to stop the foreclosure process initiated by a Notice of Default. It essentially grants them the opportunity to make their mortgage current and retain ownership of their property. This process requires homeowners to act promptly and adhere to specific guidelines set by both state laws and loan agreements. While there may be different types of Rescission of Notice of Default in Eugene, Oregon, it is crucial to focus on two primary approaches: 1. Statutory Rescission of Default: Under Oregon law, homeowners have a statutory right to reinstate their loan by paying off the delinquent amount within a specific time frame. The precise timeline for invoking this type of rescission varies, but it typically ranges from 120 to 180 days after the Notice of Default is filed. By making the required payment, the homeowner effectively eliminates the default and reinstates the loan under its original terms. 2. Mutual Agreement or Loan Modification: In certain cases, homeowners may not have the means to immediately pay the delinquent amount in full. However, if they can reach a reasonable agreement with their lender, they may negotiate a loan modification. This entails adjusting the terms of the loan, such as extending the repayment period or temporarily reducing the interest rate, to make the mortgage more manageable. Accomplishing a loan modification requires clear communication, financial evidence, and presenting a compelling case to the lender. To initiate the Rescission of Notice of Default process, homeowners must act fast by contacting their lender or loan service as soon as they receive the Notice of Default. Open and honest communication with the lender is paramount, as it demonstrates the homeowner's commitment to finding a resolution. In addition, it is vital to consult with legal professionals or housing counselors who specialize in foreclosure prevention to gain expert advice and guidance tailored to the specific situation. Keywords: Eugene Oregon, Rescission of Notice of Default, foreclosure prevention, statutory rescission, loan modification, delinquent amount, mortgage payments, loan reinstatement, homeownership retention.

Eugene Oregon Rescission of Notice of Default

Description

How to fill out Eugene Oregon Rescission Of Notice Of Default?

If you are looking for a valid form, it’s difficult to choose a more convenient service than the US Legal Forms website – one of the most considerable libraries on the web. With this library, you can get a large number of document samples for organization and individual purposes by categories and regions, or keywords. Using our advanced search feature, finding the most up-to-date Eugene Oregon Rescission of Notice of Default is as easy as 1-2-3. Additionally, the relevance of each record is verified by a team of skilled lawyers that on a regular basis review the templates on our platform and revise them based on the newest state and county demands.

If you already know about our system and have an account, all you need to receive the Eugene Oregon Rescission of Notice of Default is to log in to your user profile and click the Download button.

If you use US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have opened the sample you need. Read its explanation and make use of the Preview option to check its content. If it doesn’t suit your needs, use the Search field near the top of the screen to find the appropriate record.

- Affirm your choice. Click the Buy now button. Following that, pick the preferred pricing plan and provide credentials to register an account.

- Process the purchase. Use your bank card or PayPal account to complete the registration procedure.

- Receive the template. Choose the format and download it on your device.

- Make changes. Fill out, modify, print, and sign the received Eugene Oregon Rescission of Notice of Default.

Each and every template you save in your user profile does not have an expiry date and is yours permanently. You always have the ability to gain access to them using the My Forms menu, so if you want to get an extra duplicate for modifying or printing, feel free to return and download it once again at any moment.

Make use of the US Legal Forms extensive collection to get access to the Eugene Oregon Rescission of Notice of Default you were seeking and a large number of other professional and state-specific samples in a single place!