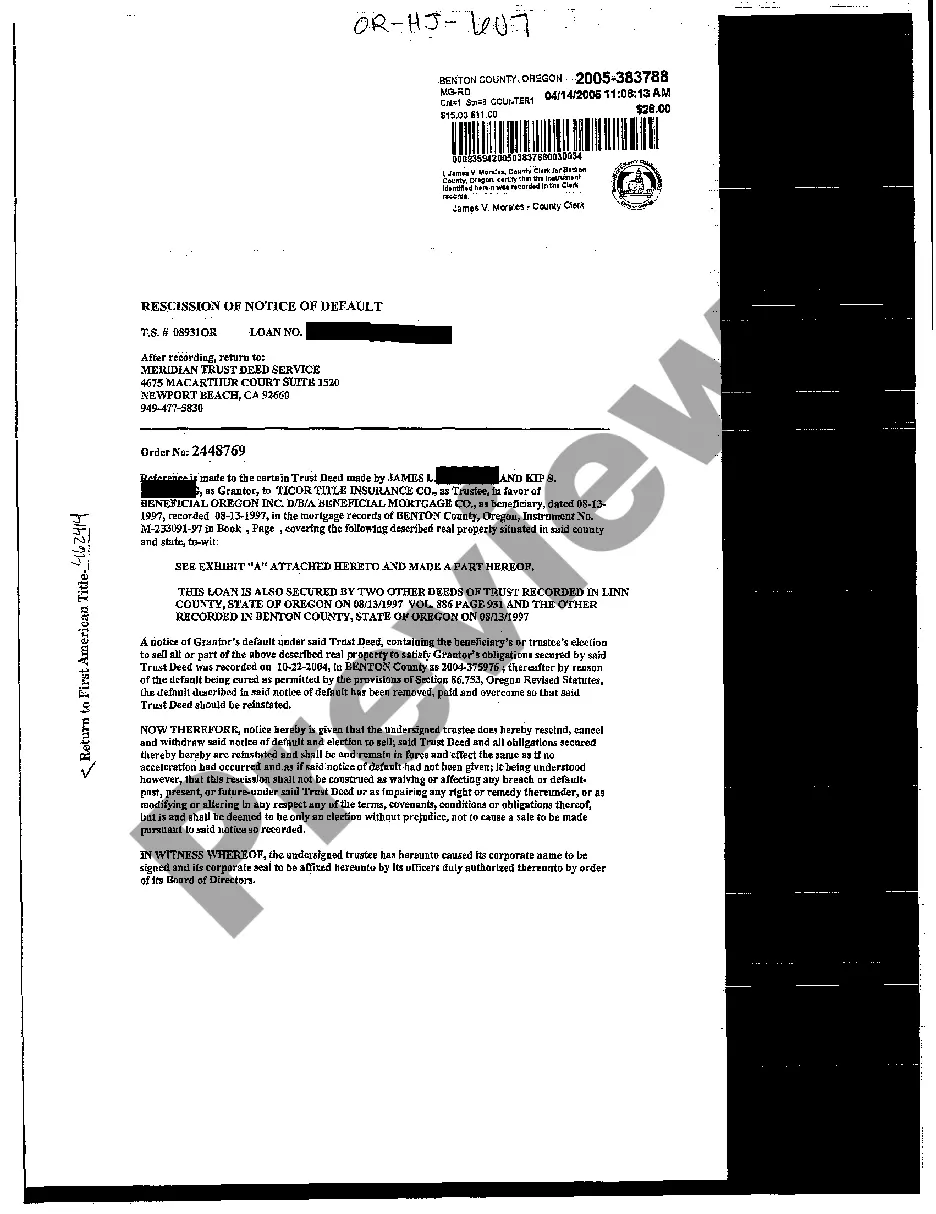

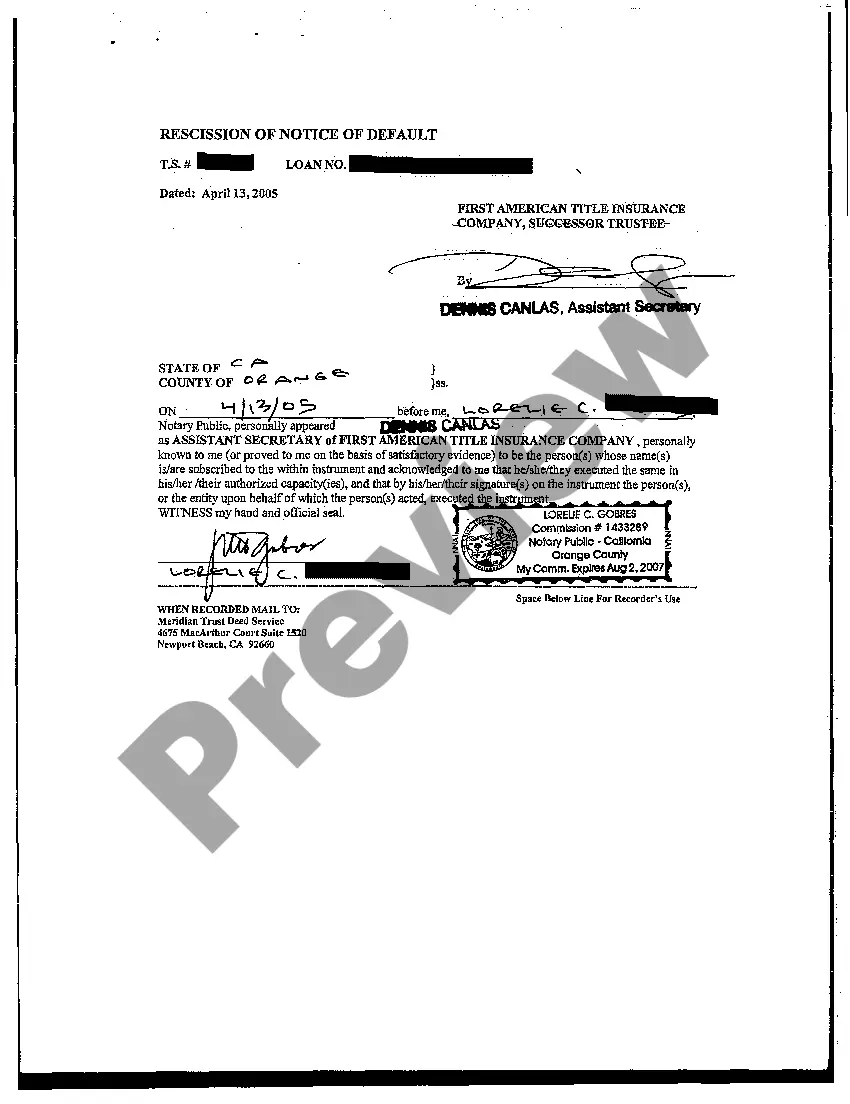

Portland Oregon Rescission of Notice of Default is a legal process that allows homeowners in Portland, Oregon, to cancel or invalidate a previously issued Notice of Default on their property. This action can prevent foreclosure proceedings and give homeowners a chance to resolve their financial issues and retain ownership of their homes. When a homeowner in Portland, Oregon, falls behind on mortgage payments, the lender may initiate the foreclosure process by serving them a Notice of Default (NOD). However, in some cases, homeowners may be able to rectify their default and bring their mortgage payments back up to date. To do so, they can file a Rescission of Notice of Default. A Portland Oregon Rescission of Notice of Default essentially requests the lender to withdraw or rescind the Notice of Default, putting a halt to the foreclosure proceedings. This rescission can only be requested if the homeowner has successfully cured the default by paying off the delinquent amount or engaging in a loan modification or repayment plan with the lender. There are several types of Portland Oregon Rescission of Notice of Default, including: 1. Curative Rescission: Homeowners who have paid off the delinquent amount owed to the lender can file for a curative rescission. This demonstrates to the lender that they have resolved the default and are now current on their mortgage payments. 2. Loan Modification Rescission: If the homeowner is unable to make a lump sum payment to clear the default, they may negotiate a loan modification with the lender. This involves changing the terms of the existing mortgage to make it more affordable. Once the modification is approved and implemented, a loan modification rescission can be filed, effectively rescinding the Notice of Default. 3. Repayment Plan Rescission: In certain cases, lenders may agree to a repayment plan, allowing homeowners to catch up on missed payments gradually. Once the homeowner has successfully followed the repayment plan and brought the mortgage current, they can file a repayment plan rescission, stopping the foreclosure process. Overall, a Portland Oregon Rescission of Notice of Default is a crucial legal step for homeowners facing foreclosure in the Portland area. It offers an opportunity to rectify the default, prevent the loss of their home, and work towards financial stability.

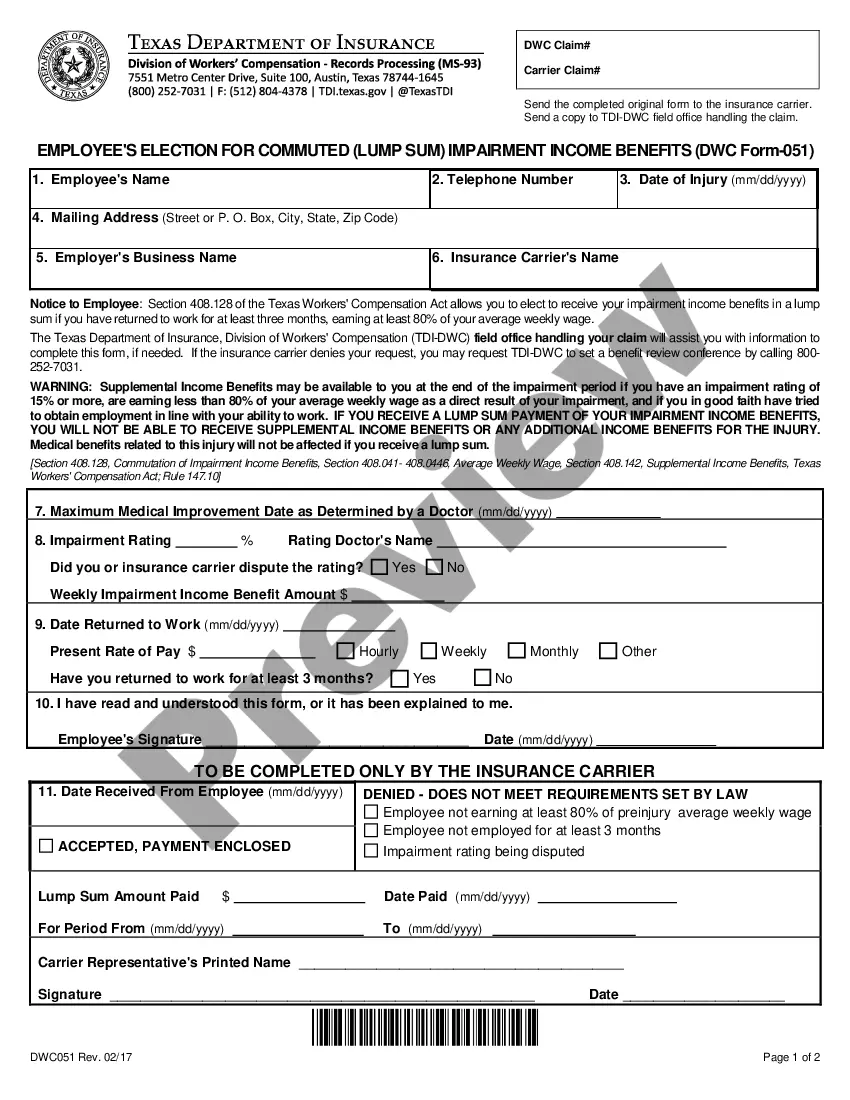

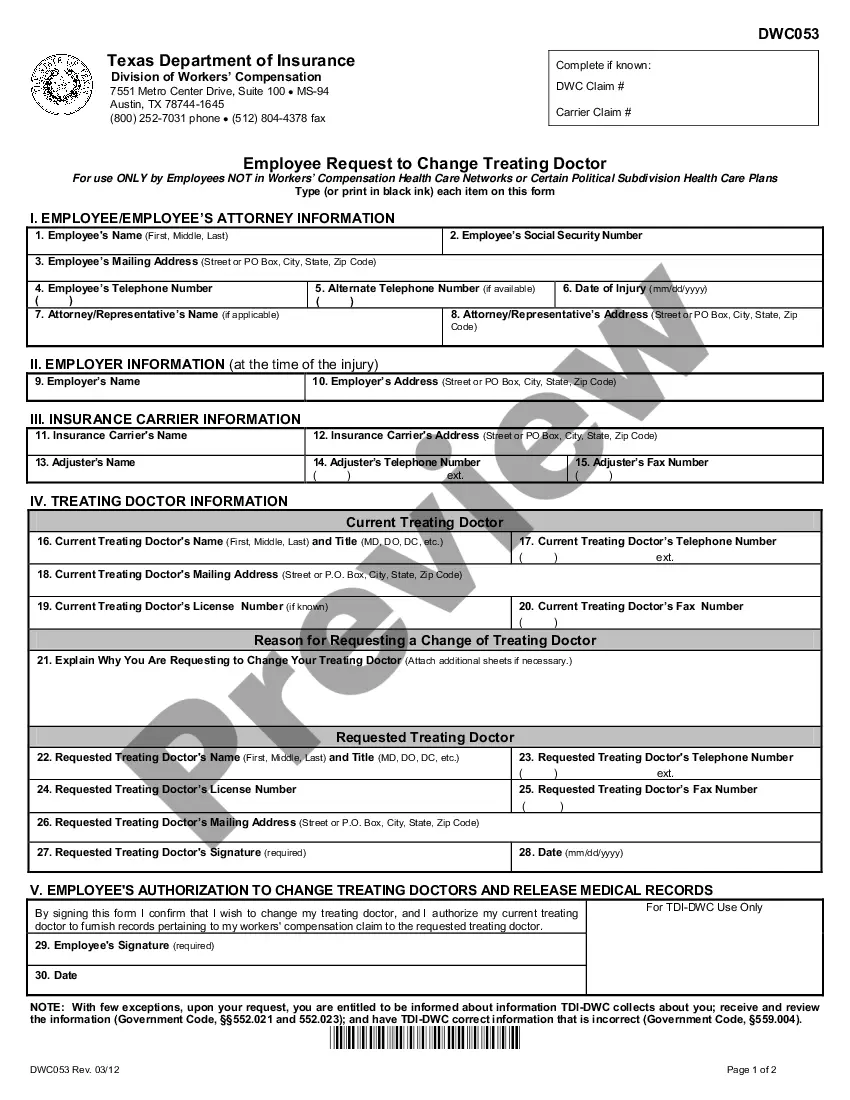

Notice Of Right To Cancel Mortgage

Description

How to fill out Portland Oregon Rescission Of Notice Of Default?

Are you searching for a trustworthy and economical provider of legal forms to purchase the Portland Oregon Rescission of Notice of Default? US Legal Forms is your ideal solution.

Whether you need a straightforward contract to establish rules for living with your partner or a collection of documents to facilitate your separation or divorce through the court system, we have you covered.

Our website offers over 85,000 current legal document templates for personal and business utilization. All templates we provide are not generic and are structured in accordance with the specifications of different states and regions.

To obtain the document, you need to Log In to your account, find the desired template, and click the Download button adjacent to it. Please keep in mind that you can access your previously bought form templates anytime from the My documents tab.

Now you can register for your account. After that, select the subscription plan and proceed to make a payment.

Once the payment is processed, you can download the Portland Oregon Rescission of Notice of Default in any available file format. You can return to the website at any moment and redownload the document without any extra charge.

- Is this your first visit to our platform? No problem.

- You can create an account in just a few minutes, but first, make sure to do the following.

- Verify that the Portland Oregon Rescission of Notice of Default meets the regulations of your state and local area.

- Review the form’s specifics (if available) to understand who and what the document is intended for.

- Restart the search if the template does not fit your legal circumstances.

Form popularity

More info

You will also have to pay sales tax on the purchase. See “What it means to Buy” and “What it means to Hold” of this form. We suggest that you look at the site before you commit to any single one. If the place is good and the price is right then give us a chance, and you will be so happy you will want to put a house next door with a tree in the front yard. “Why is there no mention of interest of mortgage interest at 12%” of the purchase price? As mentioned in the FAQs, it does no matter how much interest the bank charges on a loan, if it fails to pay principal or interest, then you still owe the total cost of the loan. When a mortgage is in default, there is no “waiver” of the default. That is why the government has the power to call the mortgage holder to court and, if necessary, to seize the property and make it “pay”. That is why the interest rate on the loan will not decrease by any amount because the money was never paid.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.