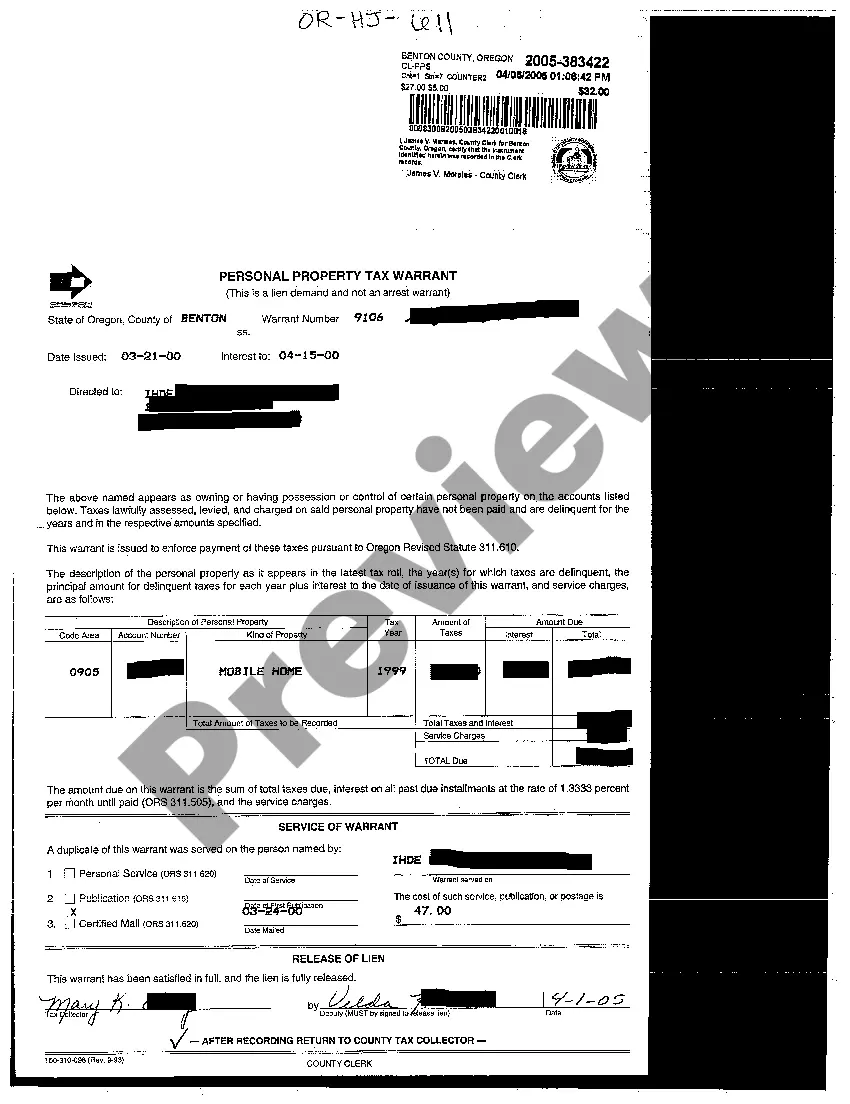

A Bend Oregon Personal Property Tax Warrant is a legal document issued by the government that allows them to collect overdue personal property taxes from individuals residing in Bend, Oregon. Personal property taxes are levied on tangible assets owned by individuals, such as vehicles, boats, equipment, furniture, and certain business assets. When an individual fails to pay their personal property taxes in Bend, the local government may decide to take legal action to recover the unpaid amount. This typically involves obtaining a warrant, which authorizes them to seize and sell the individual's personal property to satisfy the outstanding tax debt. The process of issuing a personal property tax warrant includes multiple steps to ensure fairness and adherence to legal guidelines. There are different types of Bend Oregon Personal Property Tax Warrants that individuals may encounter based on their specific circumstances. These can include: 1. Administrative Warrant: This type of warrant is issued when an individual fails to respond to repeated notifications regarding their overdue personal property taxes. It is typically meant to create a sense of urgency for the taxpayer to address their outstanding debt. 2. Levy Warrant: If a taxpayer neglects to pay their personal property taxes even after receiving an administrative warrant, the government may resort to issuing a levy warrant. This warrant grants the authorities the power to seize the individual's personal property in order to sell it and recover the unpaid taxes. 3. Distraint Warrant: In certain cases, the government may choose to issue a distraint warrant if they believe an individual is deliberately avoiding payment of their personal property taxes. This warrant allows for more aggressive measures to be taken, such as forcibly entering and searching premises to locate and seize eligible personal property. It is important for individuals in Bend, Oregon to be aware of their personal property tax obligations and to promptly address any outstanding payments. Failure to do so may result in the issuance of a Bend Oregon Personal Property Tax Warrant, which could lead to the seizure and sale of personal property to satisfy the overdue tax debt.

Bend Oregon Personal Property Tax Warrant

Description

How to fill out Bend Oregon Personal Property Tax Warrant?

Locating verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Bend Oregon Personal Property Tax Warrant becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Bend Oregon Personal Property Tax Warrant takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few more steps to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve selected the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Bend Oregon Personal Property Tax Warrant. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

Counties in Oregon acquire fee title to tax foreclosed properties and do not sell tax liens or tax lien certificates. The first step in disposing of surplus real property with an assessed value of $15,000 or greater is to offer it at a public sale (auction).

In Oregon, real proper- ty is subject to foreclosure three years after the taxes become delinquent. When are taxes delinquent? Property taxes can be paid in full by November 15 or in three installments: November 15, February 15, and May 15. If the taxes aren't paid in full by May 16 they are delinquent.

Penalty for delinquency : Failure to pay the real property tax during the period of payment without penalty to the quarterly installment thereof shall subject the taxpayer to the payment of interest at the rate of (2%) per month on the unpaid amount or a fraction thereof.

The statute of limitations to collect on a debt in Oregon is generally six years.

Any work valued at $10,000 in one year or $25,000 within five consecutive years can trigger a new assessment and increase your property's taxable value. This can include improvements made in previous years that county assessors missed at the time.

An appraiser has the authority to: Enter private land for appraisal purposes unless the owner or lawful occupant of that property objects to the appraiser's entry.

Entry onto the property without explicit permission will be limited to what is legally known as the curtilage, which is the land and yard immediately surrounding your house. An assessor will not enter your house or dwelling unless they have specific permission.

Licensed vehicles are exempt from ad valorem taxation, with the exception of fixed load/mobile equipment. Oregon law requires all personal property be valued at 100% of its real market value unless exempt by statutes. Intangible personal property is exempt from assessment and taxation.

Oregon has over 100 exemption programs A property tax exemption is a legislatively approved program that relieves qualified individuals or organizations from all or part of their property taxes.