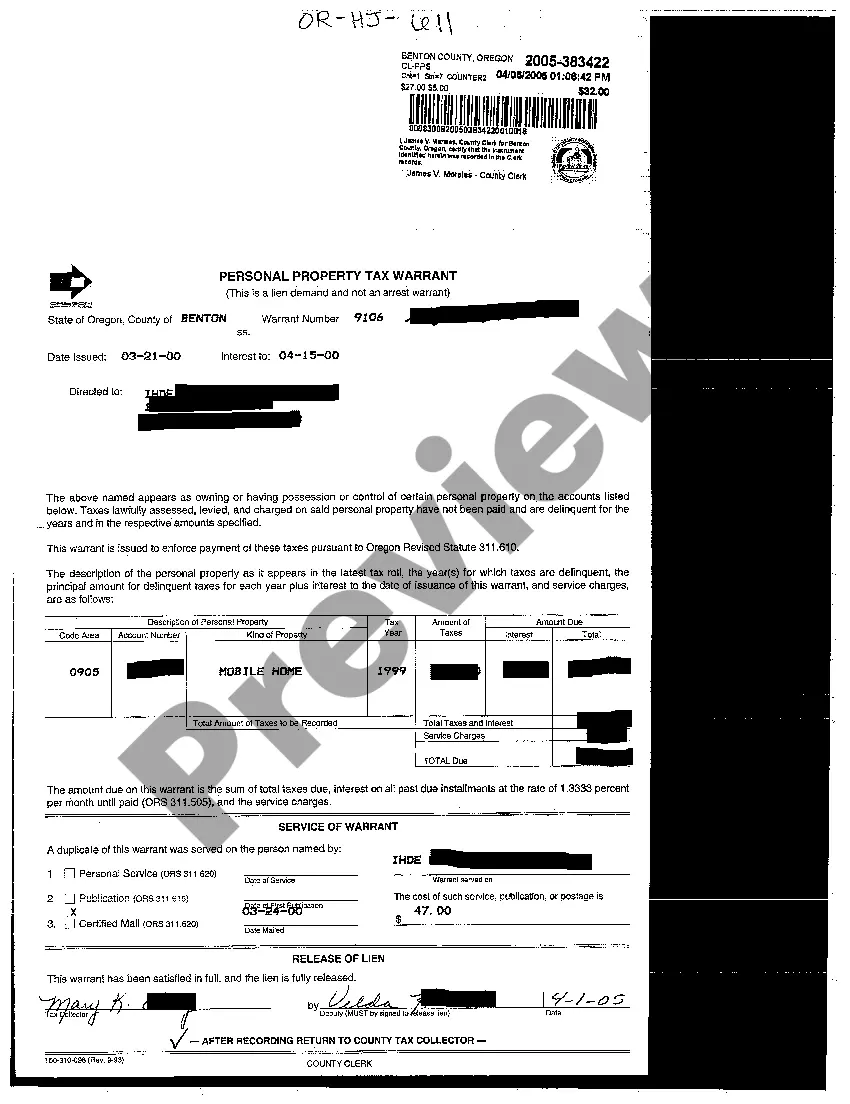

Eugene, Oregon Personal Property Tax Warrant is a legal document issued by the government authorities to collect unpaid personal property taxes from individuals or businesses residing within the jurisdiction of Eugene, Oregon. This warrant serves as a means to enforce compliance with tax regulations and ensure that all taxpayers fulfill their financial obligations. Personal property refers to movable assets such as vehicles, boats, machinery, equipment, livestock, and other tangible items owned by individuals or entities. The personal property tax levied on these assets helps finance local public services, infrastructure development, education, and other essential community needs. When individuals or businesses fail to pay their personal property taxes, the local tax collector's office may issue a personal property tax warrant. This warrant authorizes the tax collector or any designated representative to take necessary actions to collect the outstanding tax debt. There are different types of Eugene Oregon Personal Property Tax Warrants that can be issued based on the seriousness of the delinquency: 1. Notice of Intent to Issue Warrant: Initially, a notice is sent to the taxpayer to inform them about the unpaid personal property taxes. The notice provides a grace period for the taxpayer to address the outstanding balance before a warrant is officially issued. 2. Personal Property Tax Warrant: If the tax debt remains unpaid after the grace period provided in the notice, a personal property tax warrant is issued. This warrant allows the tax collector to utilize various collection methods to recover the amount owed, such as seizing and selling the taxpayer's personal property, bank account levies, wage garnishment, or placing a lien on their property. 3. Arrest Warrant: In extreme cases of non-compliance or intentional tax evasion, a personal property tax warrant can escalate to an arrest warrant. This warrant enables law enforcement authorities to apprehend individuals who refuse to cooperate in paying their personal property taxes and may carry legal consequences such as fines or imprisonment. It is essential for individuals and businesses in Eugene, Oregon to timely and accurately report and pay their personal property taxes to avoid the issuance of a tax warrant. Failure to comply with tax regulations can result in substantial financial consequences and legal actions. It is advisable to seek professional advice or contact the local tax collector's office for any concerns or questions regarding personal property taxes in Eugene, Oregon.

Eugene Oregon Personal Property Tax Warrant

Description

How to fill out Eugene Oregon Personal Property Tax Warrant?

We always want to minimize or avoid legal issues when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney services that, as a rule, are extremely costly. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of a lawyer. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Eugene Oregon Personal Property Tax Warrant or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Eugene Oregon Personal Property Tax Warrant adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Eugene Oregon Personal Property Tax Warrant would work for your case, you can choose the subscription plan and proceed to payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!