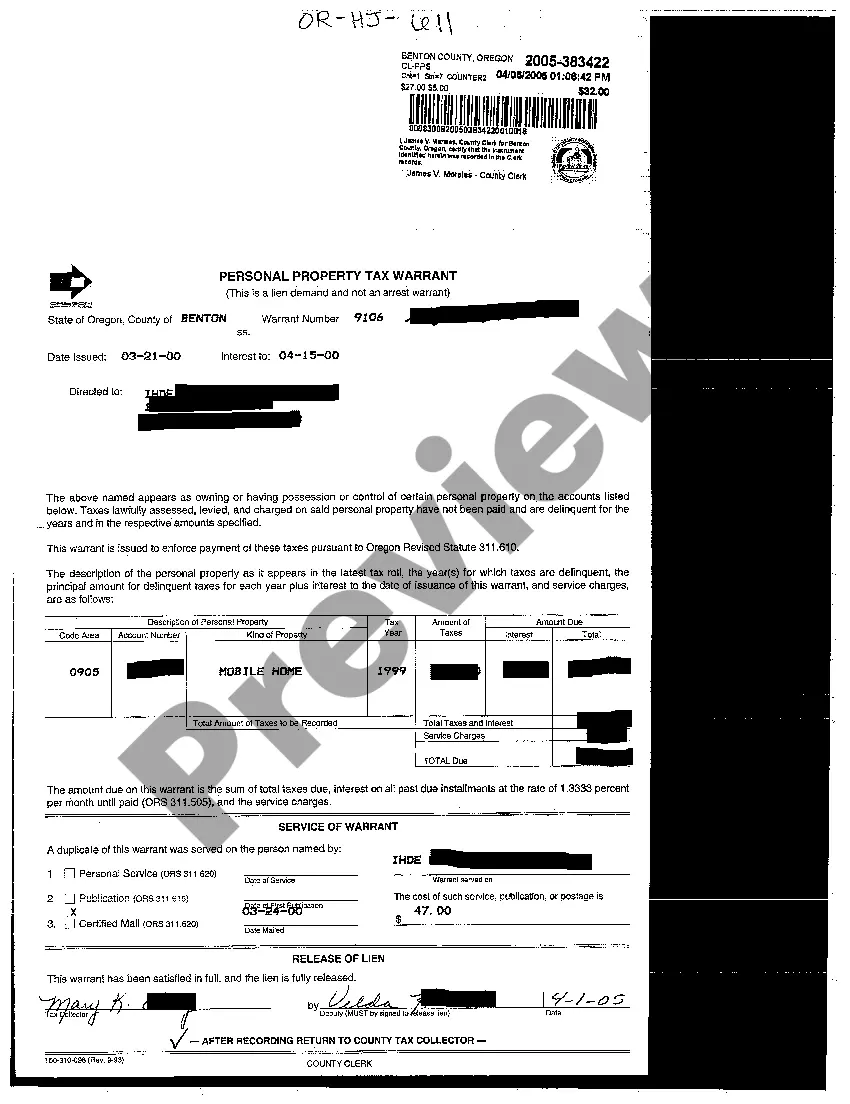

A Hillsboro Oregon Personal Property Tax Warrant refers to a legal document issued by the county government to collect delinquent personal property taxes from individuals or businesses residing in Hillsboro, Oregon. This warrant is usually issued after a taxpayer fails to pay their personal property tax in a timely manner. Personal property taxes are assessed on movable assets such as vehicles, boats, recreational vehicles, machinery, equipment, and inventory owned by individuals or businesses. These taxes are collected annually by the county government to fund various public services, infrastructure, and essential community programs. When a taxpayer fails to pay their personal property taxes, a tax warrant is typically issued. The personal property tax warrant allows the county government to take certain legal actions to enforce the collection of the delinquent taxes. It is important to note that a personal property tax warrant is a serious matter and can lead to significant consequences if not resolved promptly. Different types of Hillsboro Oregon Personal Property Tax Warrants may include: 1. Standard Tax Warrant: This is the most common type of warrant issued when a taxpayer fails to pay their personal property taxes on time. It enables the county government to take legal action to collect the outstanding taxes. 2. Seizure Warrant: In situations where the taxpayer continues to neglect their tax obligations, the county may obtain a seizure warrant. This allows them to seize and sell the delinquent taxpayer's personal property to recover the unpaid taxes. 3. Levy Warrant: A levy warrant is issued when other collection methods have been unsuccessful. It authorizes the county government to garnish the taxpayer's wages, bank accounts, or any other source of income until the delinquent taxes are paid in full. It is crucial for taxpayers to address any personal property tax obligations promptly to avoid the issuance of a tax warrant. Failure to do so can result in additional penalties, interests, and collection fees. To resolve a personal property tax warrant, individuals or businesses should contact the Hillsboro Oregon county tax collector's office to discuss payment options or potential settlement arrangements. In summary, a Hillsboro Oregon Personal Property Tax Warrant is a legal document issued to collect delinquent personal property taxes owed by individuals or businesses residing in Hillsboro, Oregon. Different types of warrants include standard tax warrants, seizure warrants, and levy warrants. It is essential to address these warrants promptly to avoid serious consequences.

Hillsboro Oregon Personal Property Tax Warrant

Description

How to fill out Hillsboro Oregon Personal Property Tax Warrant?

If you are searching for a relevant form, it’s extremely hard to find a more convenient place than the US Legal Forms site – one of the most comprehensive libraries on the web. Here you can find a huge number of form samples for company and individual purposes by types and states, or keywords. With the high-quality search function, finding the most recent Hillsboro Oregon Personal Property Tax Warrant is as elementary as 1-2-3. Moreover, the relevance of each and every file is verified by a group of expert lawyers that regularly review the templates on our platform and revise them according to the most recent state and county laws.

If you already know about our platform and have an account, all you need to receive the Hillsboro Oregon Personal Property Tax Warrant is to log in to your user profile and click the Download option.

If you make use of US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have found the sample you require. Read its explanation and make use of the Preview function (if available) to see its content. If it doesn’t meet your requirements, use the Search field near the top of the screen to discover the needed document.

- Confirm your decision. Click the Buy now option. Next, select your preferred pricing plan and provide credentials to sign up for an account.

- Process the transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Get the form. Pick the format and save it to your system.

- Make modifications. Fill out, revise, print, and sign the received Hillsboro Oregon Personal Property Tax Warrant.

Every single form you save in your user profile does not have an expiration date and is yours permanently. You always have the ability to gain access to them using the My Forms menu, so if you want to have an extra copy for modifying or printing, you may come back and download it again at any time.

Make use of the US Legal Forms professional catalogue to gain access to the Hillsboro Oregon Personal Property Tax Warrant you were looking for and a huge number of other professional and state-specific samples on a single website!