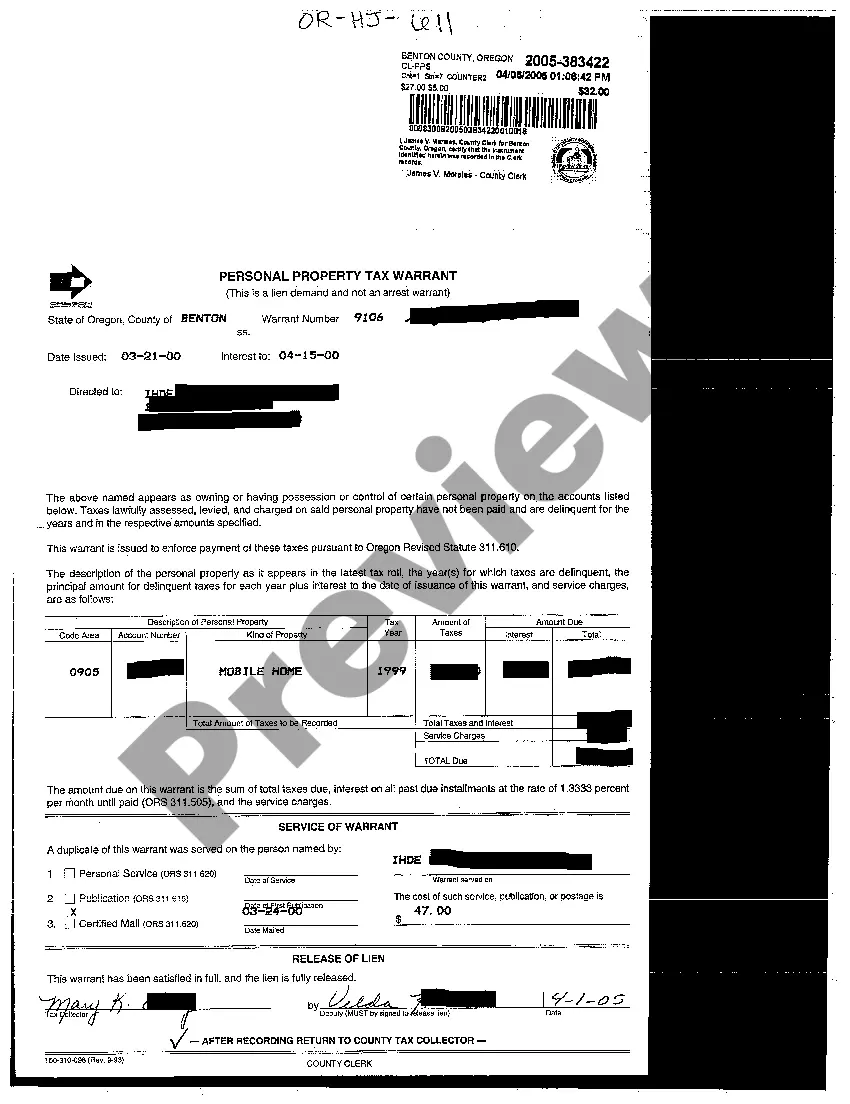

Description: A Portland Oregon Personal Property Tax Warrant is a legal document issued by the Portland City Revenue Bureau (CRB) to collect unpaid personal property taxes from individuals or businesses. This warrant serves as a last resort for the city to recover the owed taxes and is typically issued after multiple attempts to contact the taxpayer and resolve the outstanding debt. Keywords: Portland Oregon, Personal Property Tax Warrant, City Revenue Bureau, unpaid personal property taxes, last resort, outstanding debt. Types of Portland Oregon Personal Property Tax Warrants: 1. Delinquent Personal Property Tax Warrant: This type of warrant is issued when an individual or business fails to pay their personal property taxes by the designated deadline. The CRB will follow a specific process before issuing this warrant, including sending multiple notices and making attempts to collect the outstanding debt. 2. Repeat Offender Personal Property Tax Warrant: If a taxpayer has repeatedly failed to pay their personal property taxes on time or has continued to accumulate outstanding taxes, the CRB may issue a repeat offender warrant. This type of warrant carries heavier penalties and consequences for the taxpayer. 3. Seizure and Sale Warrant: In extreme cases where a taxpayer consistently neglects to pay their personal property taxes, the CRB may obtain a seizure and sale warrant. This allows the CRB to seize the individual's personal property, including assets such as vehicles, real estate, or valuable items, and sell them to recover the owed taxes. 4. Business Closure Personal Property Tax Warrant: If a business ceases operations without fulfilling its personal property tax obligations, the CRB may issue a business closure warrant. This warrant is aimed at recovering unpaid taxes and may include penalties and interest charges. Keywords: Delinquent Personal Property Tax Warrant, Repeat Offender Personal Property Tax Warrant, Seizure and Sale Warrant, Business Closure Personal Property Tax Warrant, unpaid personal property taxes, penalties, interest charges.

Portland Oregon Personal Property Tax Warrant

Category:

State:

Oregon

City:

Portland

Control #:

OR-HJ-611

Format:

PDF

Instant download

This form is available by subscription

Description

Personal Property Tax Warrant

Description: A Portland Oregon Personal Property Tax Warrant is a legal document issued by the Portland City Revenue Bureau (CRB) to collect unpaid personal property taxes from individuals or businesses. This warrant serves as a last resort for the city to recover the owed taxes and is typically issued after multiple attempts to contact the taxpayer and resolve the outstanding debt. Keywords: Portland Oregon, Personal Property Tax Warrant, City Revenue Bureau, unpaid personal property taxes, last resort, outstanding debt. Types of Portland Oregon Personal Property Tax Warrants: 1. Delinquent Personal Property Tax Warrant: This type of warrant is issued when an individual or business fails to pay their personal property taxes by the designated deadline. The CRB will follow a specific process before issuing this warrant, including sending multiple notices and making attempts to collect the outstanding debt. 2. Repeat Offender Personal Property Tax Warrant: If a taxpayer has repeatedly failed to pay their personal property taxes on time or has continued to accumulate outstanding taxes, the CRB may issue a repeat offender warrant. This type of warrant carries heavier penalties and consequences for the taxpayer. 3. Seizure and Sale Warrant: In extreme cases where a taxpayer consistently neglects to pay their personal property taxes, the CRB may obtain a seizure and sale warrant. This allows the CRB to seize the individual's personal property, including assets such as vehicles, real estate, or valuable items, and sell them to recover the owed taxes. 4. Business Closure Personal Property Tax Warrant: If a business ceases operations without fulfilling its personal property tax obligations, the CRB may issue a business closure warrant. This warrant is aimed at recovering unpaid taxes and may include penalties and interest charges. Keywords: Delinquent Personal Property Tax Warrant, Repeat Offender Personal Property Tax Warrant, Seizure and Sale Warrant, Business Closure Personal Property Tax Warrant, unpaid personal property taxes, penalties, interest charges.

How to fill out Portland Oregon Personal Property Tax Warrant?

If you’ve already used our service before, log in to your account and download the Portland Oregon Personal Property Tax Warrant on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Portland Oregon Personal Property Tax Warrant. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!