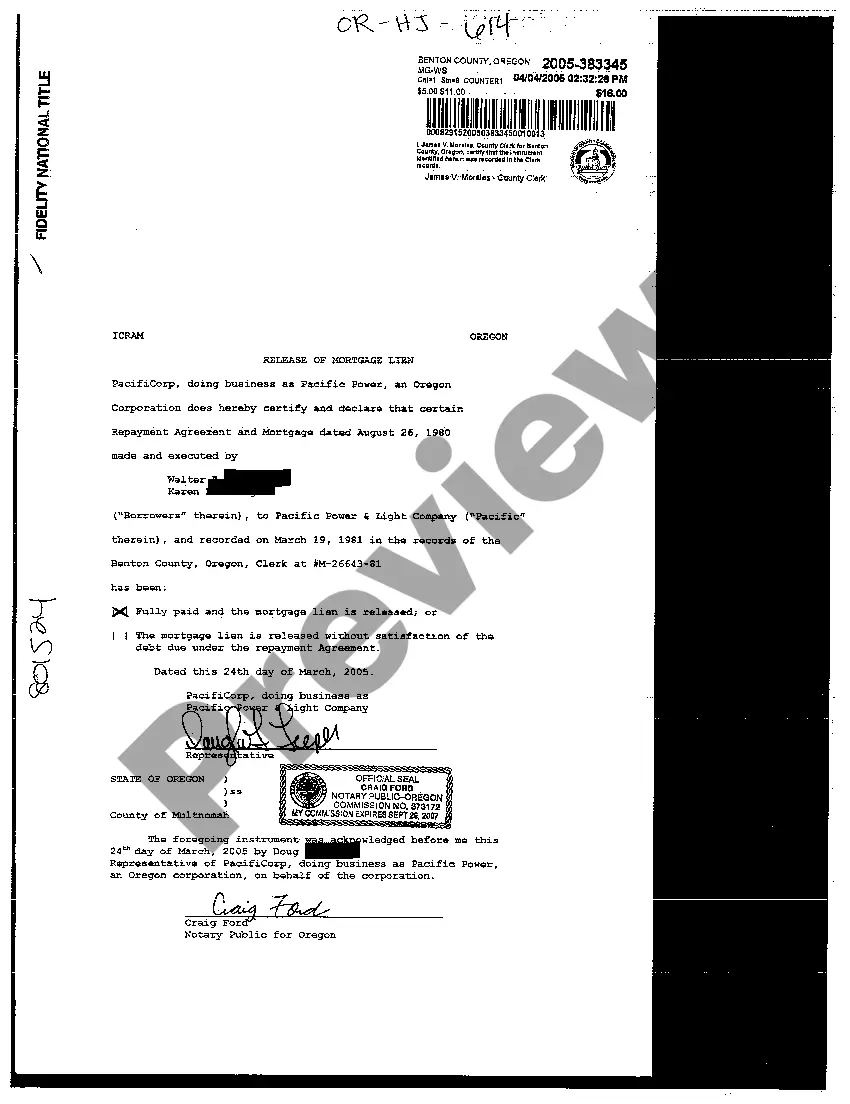

A release of mortgage lien is a legal document that clears the title of a property from the encumbrance of a mortgage lien. In Bend, Oregon, the release of mortgage lien is a crucial step in transferring ownership of a property or refinancing a mortgage. This process signifies that the mortgage debt has been fully paid off, and the lender releases their claim on the property. The Bend Oregon Release of Mortgage Lien is typically initiated by the borrower or the borrower's representative once the mortgage has been satisfied. It involves filing the necessary paperwork with the appropriate county recorder's office to officially release the lien from the property's title. There are different types of Bend Oregon release of mortgage lien, including: 1. Full Release: This is the most common type and occurs when the mortgage debt is completely paid off. The lender provides a full release of the lien, clearing the property title of any encumbrances related to the mortgage. 2. Partial Release: In some cases, a borrower may request a partial release of mortgage lien. This occurs when a portion of the property covered by the mortgage is sold or transferred, and the lender releases the lien on that specific portion while keeping the remaining property as collateral. 3. Subordination Agreement: This type of release involves the lender agreeing to subordinate their lien position to another lien holder. This is common in cases of refinancing where the borrower wants to secure a new loan but still keeps the existing mortgage. This agreement determines the priority of liens in case of foreclosure. The Bend Oregon Release of Mortgage Lien is a critical step in the real estate transaction process. It ensures that the property is free and clear of any mortgage debt, allowing for a smooth transfer of ownership or refinancing opportunity. It is essential for both borrowers and lenders to understand the importance and requirements of the release of mortgage lien to protect their respective interests. When dealing with a Bend Oregon Release of Mortgage Lien, it is advisable to consult with a qualified real estate attorney or title company specializing in property transactions. Having professional guidance can ensure that the process is executed accurately and in compliance with local laws and regulations.

Bend Oregon Release of Mortgage Lien

Description

How to fill out Bend Oregon Release Of Mortgage Lien?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial matters. To accomplish this, we apply for legal solutions that, usually, are extremely expensive. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of a lawyer. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Bend Oregon Release of Mortgage Lien or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is just as easy if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Bend Oregon Release of Mortgage Lien complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Bend Oregon Release of Mortgage Lien is proper for you, you can choose the subscription option and proceed to payment.

- Then you can download the form in any suitable format.

For more than 24 years of our existence, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!