Bend Oregon UCC Financing Statement Amendment

Description

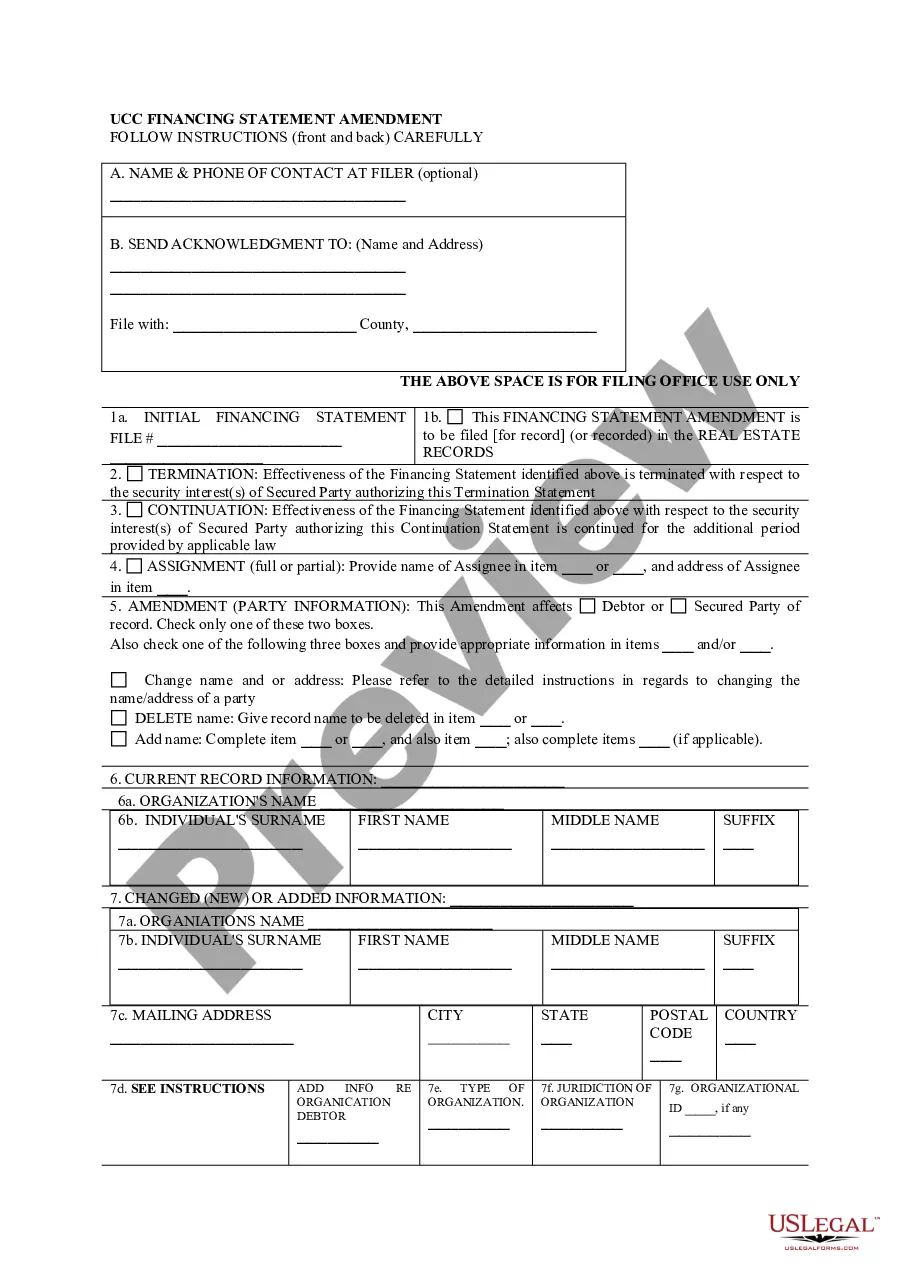

How to fill out Oregon UCC Financing Statement Amendment?

Take advantage of the US Legal Forms and gain instant access to any form template you require.

Our advantageous website with a vast collection of documents enables you to discover and obtain practically any document sample you might need.

You can download, complete, and sign the Bend Oregon UCC Financing Statement Amendment within minutes instead of spending several hours online searching for an appropriate template.

Utilizing our assortment is an excellent method to enhance the security of your record submissions.

The Download button will be active on all the samples you view. Additionally, you can retrieve all the previously saved documents in the My documents section.

If you haven’t created an account yet, follow the steps below.

- Our knowledgeable attorneys frequently verify all the documents to ensure that the forms are applicable to a specific area and comply with current laws and regulations.

- How do you obtain the Bend Oregon UCC Financing Statement Amendment.

- If you already have a subscription, simply Log In to your account.

Form popularity

FAQ

To file a UCC financing statement in New York, you typically submit your documents to the New York Department of State's Division of Corporations. It is crucial to complete this step accurately, as filing can include amendments, like the Bend Oregon UCC Financing Statement Amendment for those looking to update existing records. Using platforms like USLegalForms can streamline the filing process and ensure you meet all requirements efficiently. This can save you time and help you avoid potential legal issues down the road.

UCC stands for Uniform Commercial Code, which provides a standardized way to handle commercial transactions. In Oregon, UCC filings, including the Bend Oregon UCC Financing Statement Amendment, are essential for protecting secured interests in personal property. Filing a UCC statement ensures that your claim is recognized legally and helps establish priority over other creditors. Understanding UCC in Oregon can benefit businesses by creating a clear framework for securing financing.

You file a UCC financing statement amendment with your state's Secretary of State office. In Bend, Oregon, this is the appropriate authority for all UCC filings, including amendments. When working through the Bend Oregon UCC Financing Statement Amendment process, it’s also recommended to check for any specific filing instructions on their official website. This ensures that you follow local regulations and submit the correct documentation for your amendments.

If a financing statement is deemed seriously misleading, it may fail to perfect the security interest in the collateral, resulting in potential loss of rights for the secured party. For those dealing with a Bend Oregon UCC Financing Statement Amendment, any inaccuracies could affect your legal standing and your ability to recover collateral. It is crucial to ensure that all details are correct and reflect the true nature of the transaction. Regularly reviewing and updating your filings can prevent such issues.

To terminate an SBA lien through a UCC-3 financing statement amendment, first, locate the original UCC filing number related to the lien. Fill out the UCC-3 form, specifically noting the termination of the lien, and submit it to your Secretary of State office. The Bend Oregon UCC Financing Statement Amendment process simplifies the termination of liens by ensuring all necessary changes are officially recorded. After filing, always confirm that the amendment has been processed to avoid any future complications.

To file a UCC financing statement amendment, you need to submit a UCC-3 form, which indicates the changes being made to the original filing. Make sure to include the original filing details along with the updates when completing the form. By focusing on the Bend Oregon UCC Financing Statement Amendment, you can ensure that your records are accurate and reflect current information. It’s best to file this amendment with your local Secretary of State's office to maintain proper legal standing.

A UCC financing statement typically includes the names of the debtor and the secured party, a description of the collateral, and the filing information. When seeking clarity on a Bend Oregon UCC Financing Statement Amendment, you may notice that it follows a specific format as dictated by state regulations. It is designed to be simple, providing essential details that secure a creditor’s interest in a debtor’s assets. You can find a sample format on various legal resource websites.

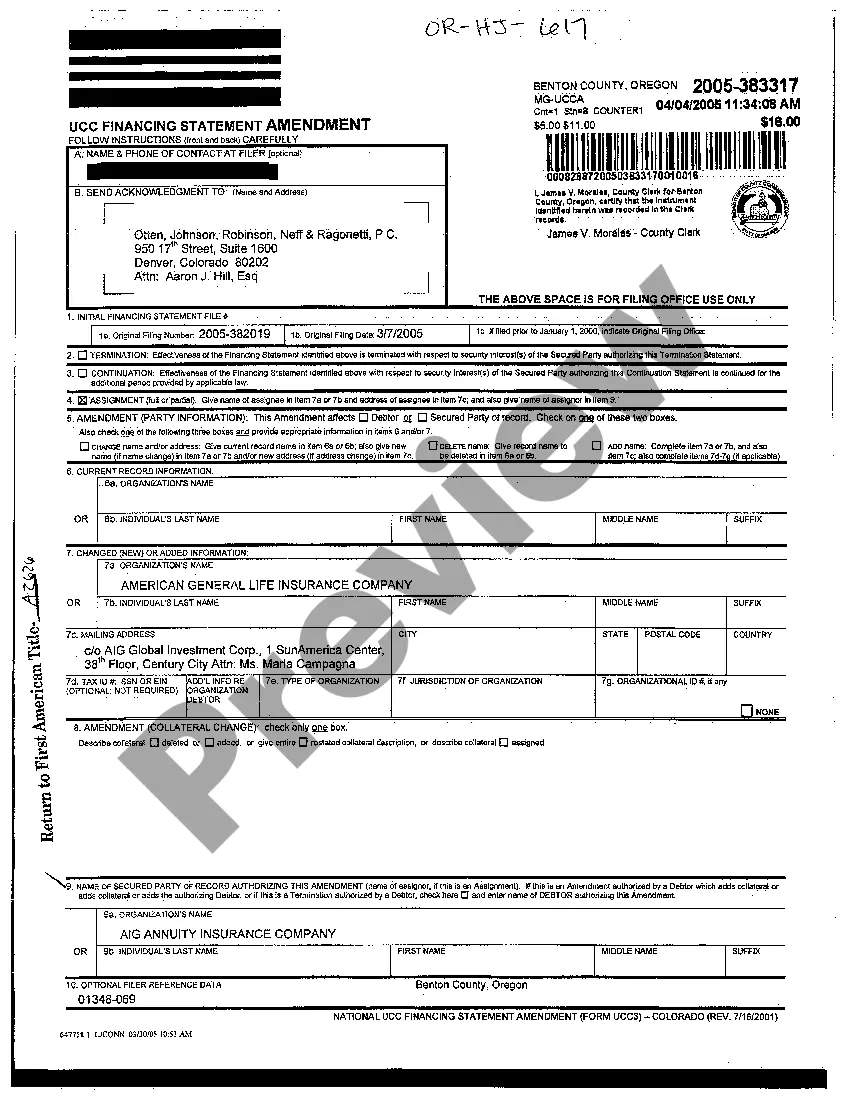

Yes, a UCC financing statement can be assigned to another party. This process involves formally transferring the rights and obligations outlined in the statement. When considering a Bend Oregon UCC Financing Statement Amendment, it's essential to follow state regulations to ensure the assignment is valid. For an efficient solution, you may want to explore platforms like USLegalForms, which provide resources and templates to assist you in making the necessary amendments.

A UCC financing statement amendment is a document used to make changes to an existing UCC financing statement. This can involve updating information about the debtor, the secured party, or the collateral involved. In Bend, Oregon, these amendments help ensure that all parties have accurate and up-to-date information regarding secured transactions. If you need assistance with filing a UCC financing statement amendment, US Legal Forms offers a straightforward solution to guide you through the process.

You received a UCC financing statement because it serves as a public record of a secured transaction. This document informs other business entities that a creditor has a legal interest in your collateral. In Bend, Oregon, UCC financing statements also provide protection for creditors and maintain transparency in financial dealings. If you're not sure how to navigate this process, US Legal Forms can help clarify your rights and obligations regarding your Bend Oregon UCC Financing Statement Amendment.