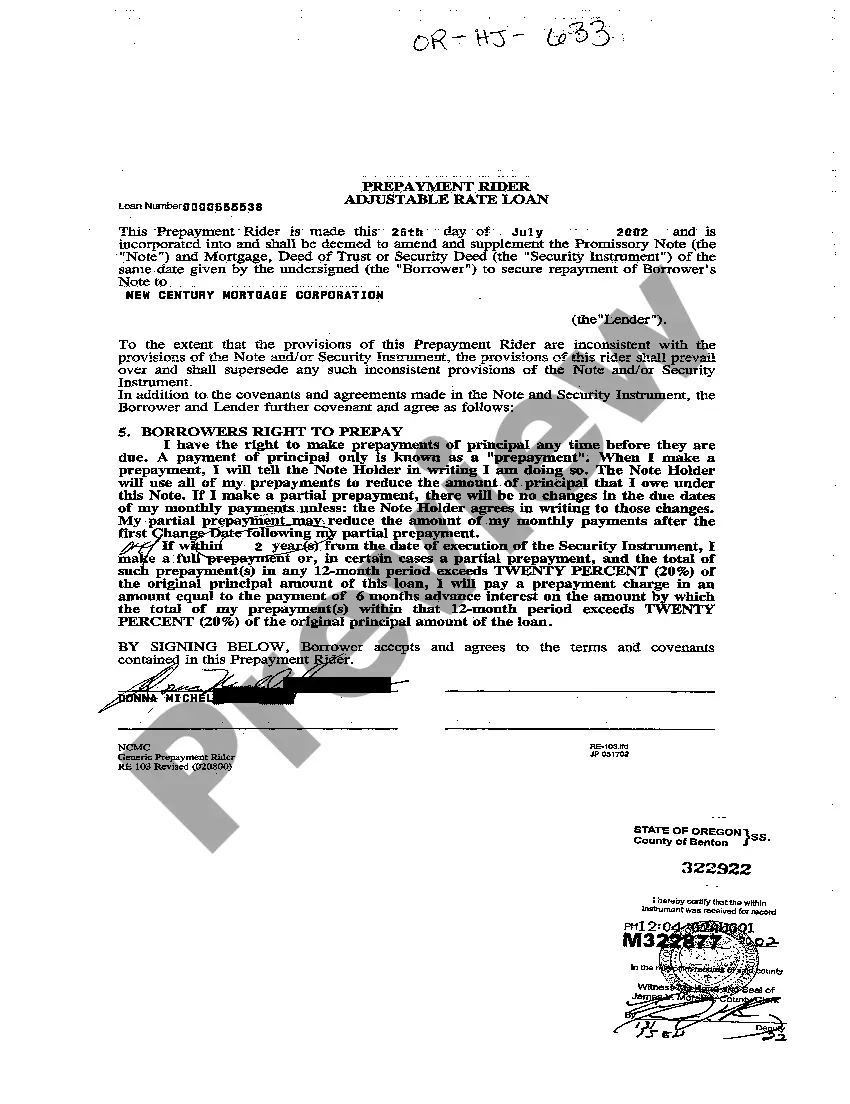

Eugene Oregon Prepayment Rider Adjustable Rate Loan is a specific type of mortgage loan available for homebuyers in the Eugene, Oregon area. This loan product allows borrowers to take advantage of adjustable interest rates while also providing the option of making prepayments without incurring any penalty fees. Eugene is a vibrant city located in the scenic Willamette Valley of Oregon, renowned for its natural beauty, diverse recreational opportunities, and strong sense of community. With the Eugene Oregon Prepayment Rider Adjustable Rate Loan, prospective homeowners can benefit from flexible repayment options while enjoying the unique lifestyle and amenities this city offers. This loan type is particularly advantageous for individuals who anticipate changes in their income, or who plan to sell, refinance, or move in the near future. With the adjustable rate feature, borrowers can take advantage of initially lower interest rates, which can result in lower monthly mortgage payments compared to traditional fixed-rate loans. The key feature of the Eugene Oregon Prepayment Rider Adjustable Rate Loan is the prepayment rider. This provision allows borrowers to make extra payments towards the principal balance of the loan without any penalties. Prepayments help borrowers reduce their outstanding loan balance faster, potentially shortening the overall loan term and saving on interest payments in the long run. It's worth noting that while the basic structure of the Eugene Oregon Prepayment Rider Adjustable Rate Loan remains the same, there may be different variations and options available from different lenders or financial institutions. Some common types of adjustable rate loans include: 1. 3/1 ARM (3-year Adjustable Rate Mortgage): This type of loan has a fixed interest rate for the first three years, after which the rate adjusts annually based on market conditions. 2. 5/1 ARM (5-year Adjustable Rate Mortgage): Similar to the 3/1 ARM, this loan offers a fixed interest rate for the first five years before transitioning to annual rate adjustments. 3. 7/1 ARM (7-year Adjustable Rate Mortgage): With this loan, the initial fixed interest rate extends for seven years before converting to annual rate adjustments. 4. 10/1 ARM (10-year Adjustable Rate Mortgage): This loan provides a fixed interest rate for ten years, after which the rate adjusts annually. To explore the specific options available for the Eugene Oregon Prepayment Rider Adjustable Rate Loan, it is essential to connect with local mortgage lenders or financial institutions operating in the area. These professionals can provide comprehensive information, personalized advice, and assist in selecting the most suitable loan option based on individual circumstances and financial goals.

Eugene Oregon Prepayment Rider Adjustable Rate Loan

Description

How to fill out Eugene Oregon Prepayment Rider Adjustable Rate Loan?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for someone without any legal background to draft such papers cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our platform offers a massive catalog with over 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you want the Eugene Oregon Prepayment Rider Adjustable Rate Loan or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Eugene Oregon Prepayment Rider Adjustable Rate Loan in minutes employing our trustworthy platform. If you are presently an existing customer, you can go on and log in to your account to download the appropriate form.

Nevertheless, if you are unfamiliar with our platform, make sure to follow these steps before downloading the Eugene Oregon Prepayment Rider Adjustable Rate Loan:

- Ensure the form you have chosen is specific to your area considering that the regulations of one state or area do not work for another state or area.

- Review the form and go through a short description (if provided) of cases the document can be used for.

- If the form you picked doesn’t meet your requirements, you can start again and search for the suitable form.

- Click Buy now and choose the subscription plan that suits you the best.

- utilizing your login information or create one from scratch.

- Select the payment gateway and proceed to download the Eugene Oregon Prepayment Rider Adjustable Rate Loan as soon as the payment is completed.

You’re good to go! Now you can go on and print the form or fill it out online. If you have any problems locating your purchased documents, you can easily find them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.