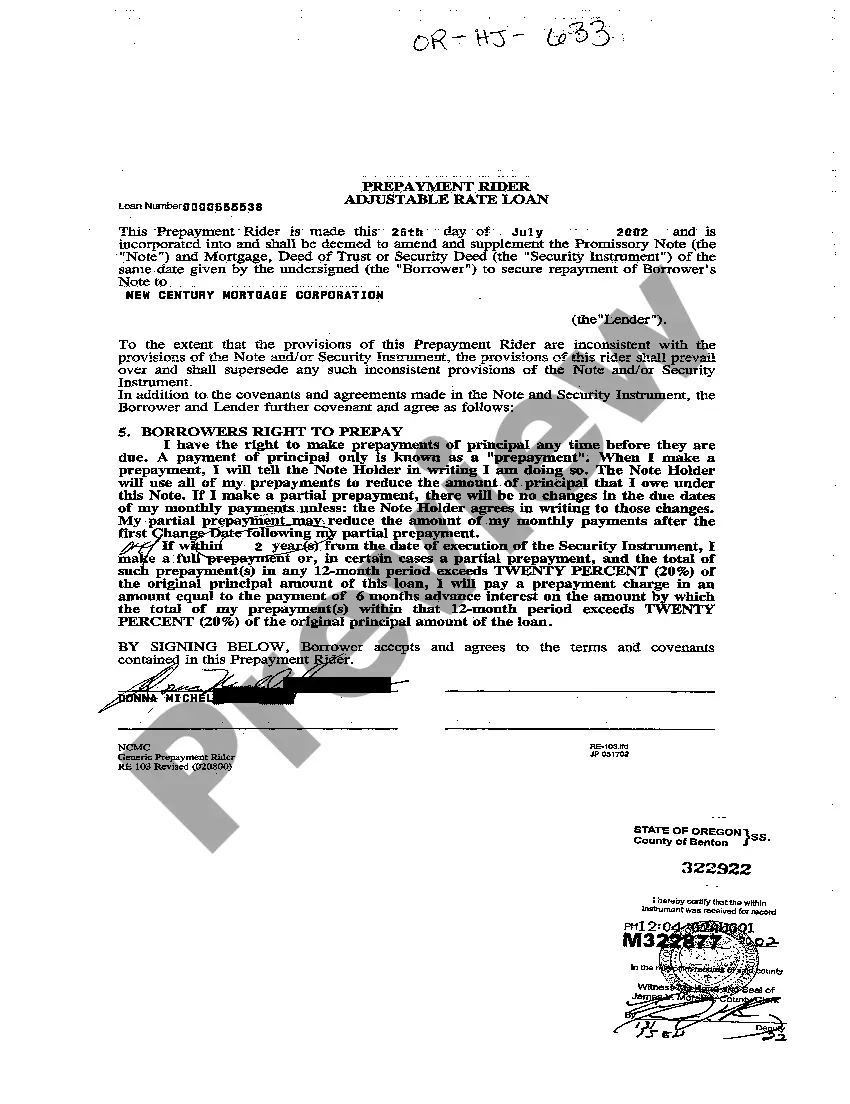

Portland Oregon Prepayment Rider Adjustable Rate Loan is a mortgage option available in the city of Portland, Oregon, that offers flexibility in loan payments and interest rates. This type of loan is designed to cater to individuals who seek an adjustable rate mortgage (ARM) and wish to take advantage of prepayment options to pay off their loan faster. This description will provide a comprehensive overview of this loan type, highlighting its features, benefits, and potential variations available in Portland, Oregon. The Portland Oregon Prepayment Rider Adjustable Rate Loan offers borrowers the opportunity to secure a mortgage with an adjustable interest rate. With this loan, the interest rate can fluctuate periodically, usually based on an index such as the London Interbank Offered Rate (LIBOR) or the Constant Maturity Treasury (CMT) rate. The adjustable rate allows borrowers to take advantage of potentially lower interest rates initially, which can help reduce monthly payments, especially during the introductory fixed-rate period. One of the distinguishing features of the Portland Oregon Prepayment Rider Adjustable Rate Loan is its prepayment option. Prepayment enables borrowers to pay off their loan faster by making additional principal payments, either periodically or in a lump sum, without incurring prepayment penalties. This feature is particularly beneficial for individuals who anticipate increases in income or expect to receive a windfall, such as a bonus or inheritance, as they can reduce the outstanding balance on their loan and potentially shorten the loan term. Moreover, borrowers who choose the Portland Oregon Prepayment Rider Adjustable Rate Loan can personalize the terms to suit their financial goals and preferences. They can select between various adjustable rate terms, such as 3/1, 5/1, or 7/1, denoting the fixed-rate period before the loan turns into an adjustable rate mortgage. For instance, in a 5/1 ARM, the introductory fixed rate would last for five years, after which the rate adjusts annually based on the index and predetermined margin. Applying for a Portland Oregon Prepayment Rider Adjustable Rate Loan follows a similar process to other mortgage applications. Borrowers need to provide the necessary documentation, including proof of income, employment history, credit history, and the required down payment. It is advisable to consult a mortgage broker or lender experienced with this loan type, ensuring a smooth and transparent application process. In summary, the Portland Oregon Prepayment Rider Adjustable Rate Loan is an appealing mortgage choice for borrowers in the Portland, Oregon area who desire an adjustable interest rate with the added option to make prepayments. This type of loan allows individuals to have more control over their mortgage payments and potentially save both money and time in the long run. By exploring the different adjustable rate terms and personalizing the loan to fit their circumstances, borrowers can find a suitable loan structure that aligns with their financial objectives.

Portland Oregon Prepayment Rider Adjustable Rate Loan

Description

How to fill out Portland Oregon Prepayment Rider Adjustable Rate Loan?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person with no legal background to draft this sort of papers from scratch, mostly because of the convoluted jargon and legal subtleties they come with. This is where US Legal Forms can save the day. Our platform provides a massive catalog with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you require the Portland Oregon Prepayment Rider Adjustable Rate Loan or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Portland Oregon Prepayment Rider Adjustable Rate Loan quickly employing our trusted platform. In case you are presently a subscriber, you can go on and log in to your account to get the needed form.

However, in case you are unfamiliar with our platform, make sure to follow these steps prior to downloading the Portland Oregon Prepayment Rider Adjustable Rate Loan:

- Ensure the form you have chosen is good for your area since the regulations of one state or county do not work for another state or county.

- Review the form and go through a quick outline (if provided) of cases the document can be used for.

- In case the form you chosen doesn’t meet your needs, you can start again and look for the necessary form.

- Click Buy now and pick the subscription plan you prefer the best.

- utilizing your credentials or create one from scratch.

- Choose the payment method and proceed to download the Portland Oregon Prepayment Rider Adjustable Rate Loan as soon as the payment is through.

You’re all set! Now you can go on and print the form or complete it online. Should you have any problems locating your purchased forms, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try now and see for yourself.