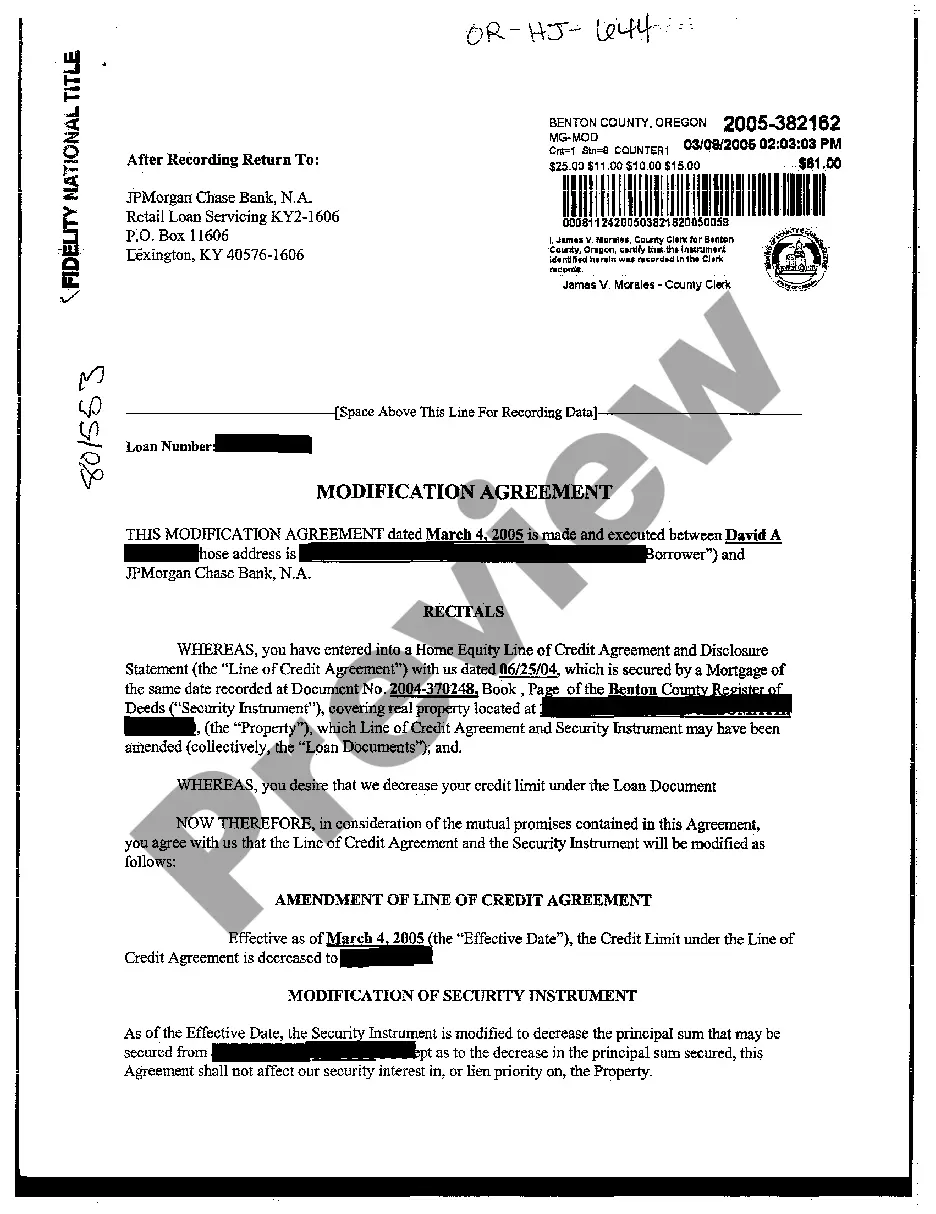

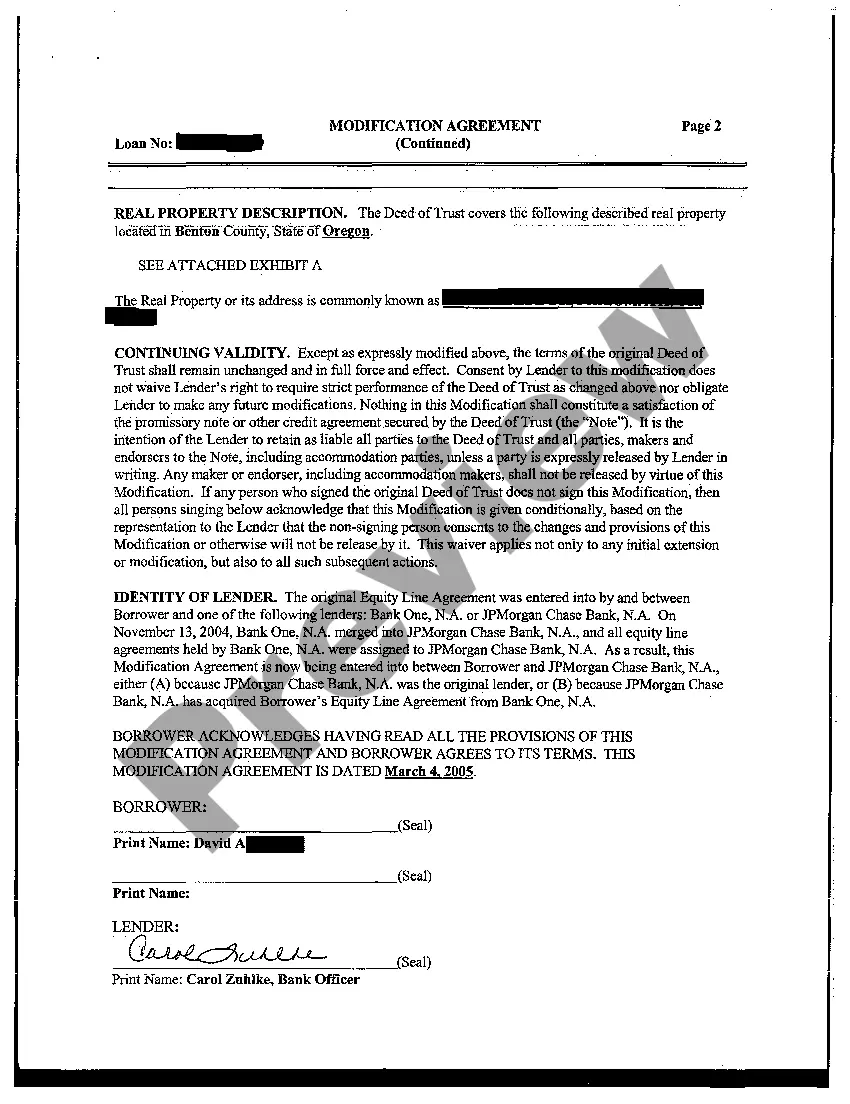

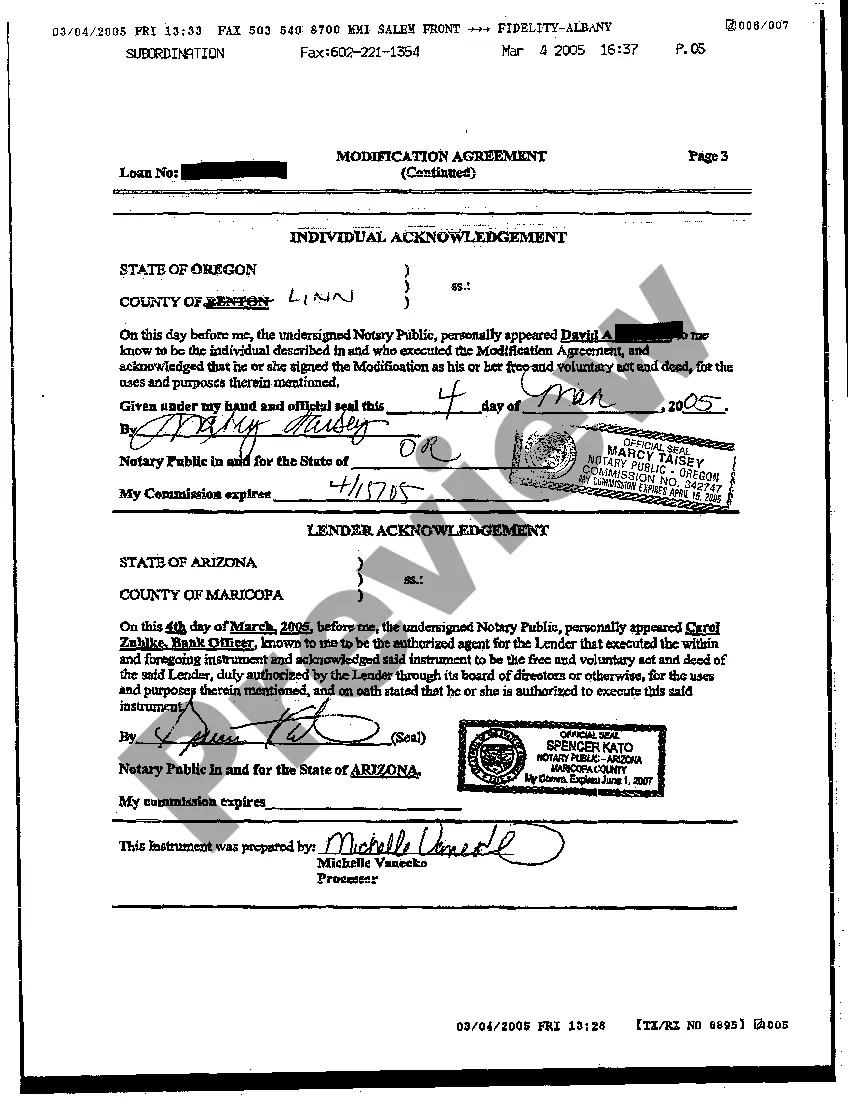

A Eugene Oregon Modification Agreement reducing Line of Credit is a legal document that allows borrowers to alter the terms of their existing line of credit by reducing the credit limit. This modification agreement is typically executed when borrowers are experiencing financial difficulties and need to lower their borrowing capacity. The Eugene Oregon Modification Agreement decreasing Line of Credit is crucial for borrowers who want to proactively manage their debt and avoid potential financial troubles. By reducing their credit limit, borrowers can prevent excessive borrowing, reduce outstanding debt, and improve their overall financial health. There are different types of Eugene Oregon Modification Agreement decreasing Line of Credit, and they may vary based on their specific conditions and objectives. Some common variations include: 1. Temporary Reduction Agreement: This type of modification agreement allows borrowers to temporarily decrease their line of credit for a predefined period. It can be useful if borrowers face short-term financial constraints but expect improvement in the future. This arrangement gives them the flexibility to minimize their borrowing limit temporarily without permanently altering their credit terms. 2. Permanent Reduction Agreement: Unlike temporary reduction agreements, this type of modification agreement involves a permanent decrease in the line of credit. Borrowers who are trying to adopt a more conservative financial approach or want to reduce their overall debt burden may opt for a permanent reduction agreement. By permanently cutting down their credit limit, borrowers can restrict their borrowing capacity and avoid potential over-indebtedness. 3. Strategic Reduction Agreement: This modification agreement is mainly implemented by financial institutions to mitigate risks associated with a borrower's financial situation. If a borrower's creditworthiness deteriorates, the lender might require a strategic reduction agreement to minimize their exposure. This type of modification aims to protect both parties by reducing the line of credit to a more manageable level. In conclusion, a Eugene Oregon Modification Agreement decreasing Line of Credit is a vital legal instrument that enables borrowers to modify their existing line of credit by reducing the credit limit. This agreement is beneficial for managing debt and fostering financial stability. Whether borrowers need a temporary or permanent reduction, or if lenders implement strategic reductions for risk management purposes, this modification agreement ensures that both parties are protected and can maintain a sustainable financial position.

Eugene Oregon Modification Agreement decreasing Line of Credit

Description

How to fill out Eugene Oregon Modification Agreement Decreasing Line Of Credit?

We always want to minimize or prevent legal issues when dealing with nuanced legal or financial matters. To do so, we sign up for attorney solutions that, usually, are very costly. Nevertheless, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of a lawyer. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Eugene Oregon Modification Agreement decreasing Line of Credit or any other document easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it in the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Eugene Oregon Modification Agreement decreasing Line of Credit adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Eugene Oregon Modification Agreement decreasing Line of Credit is proper for you, you can pick the subscription plan and proceed to payment.

- Then you can download the document in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!