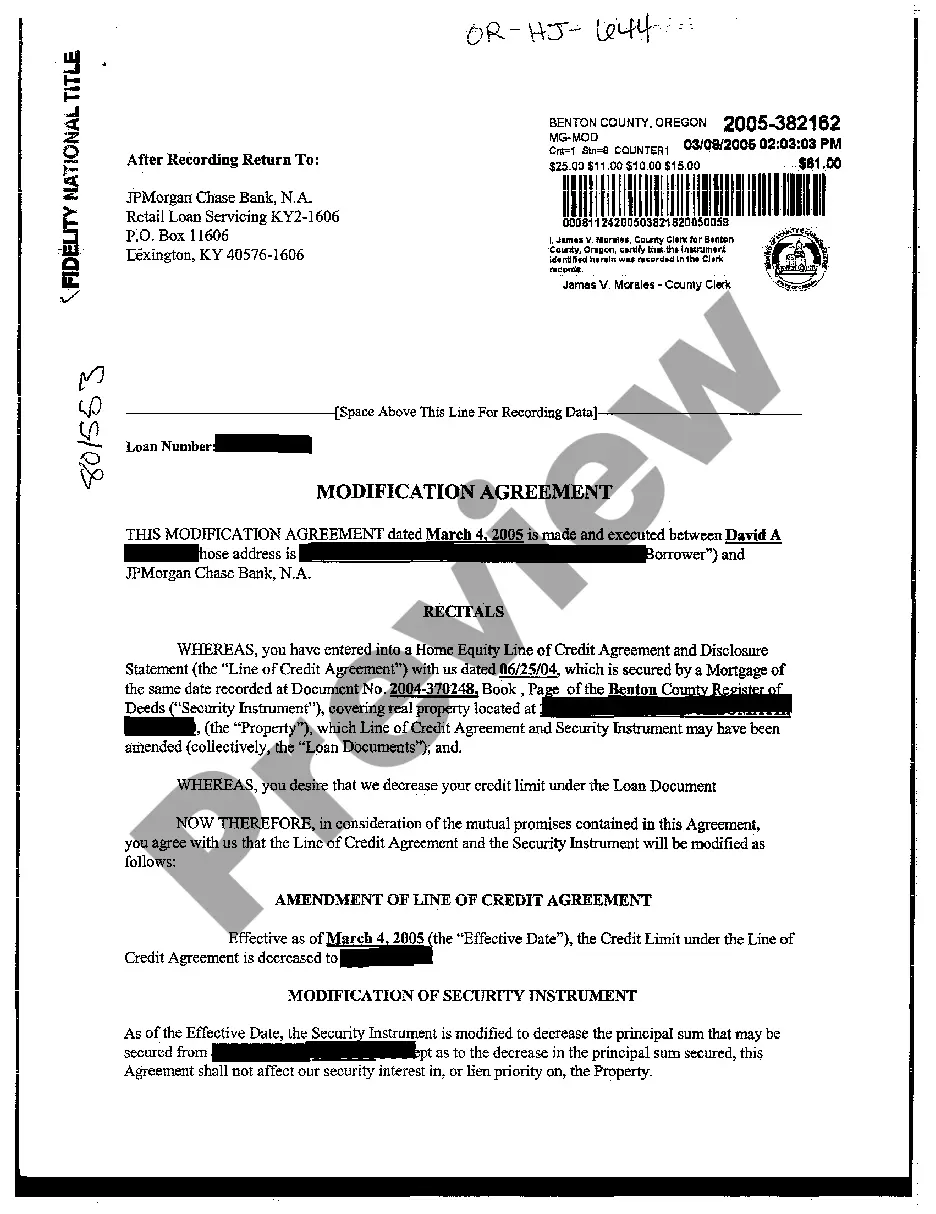

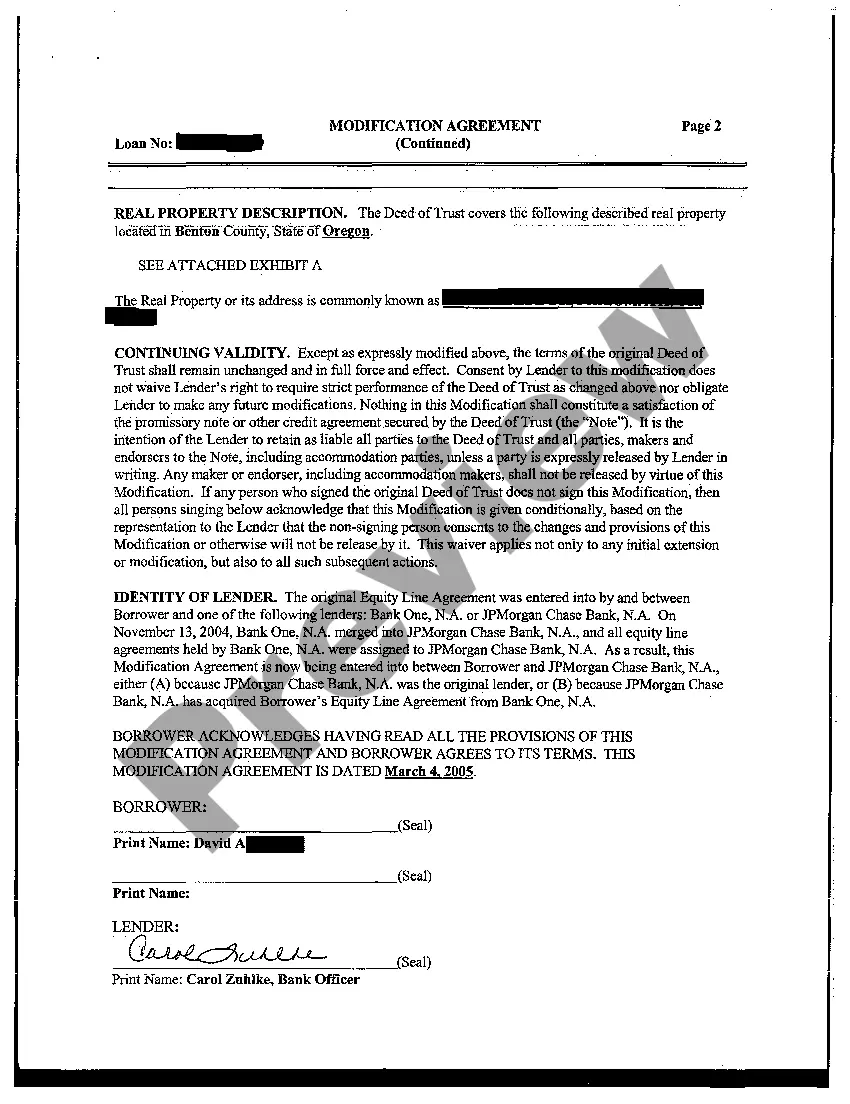

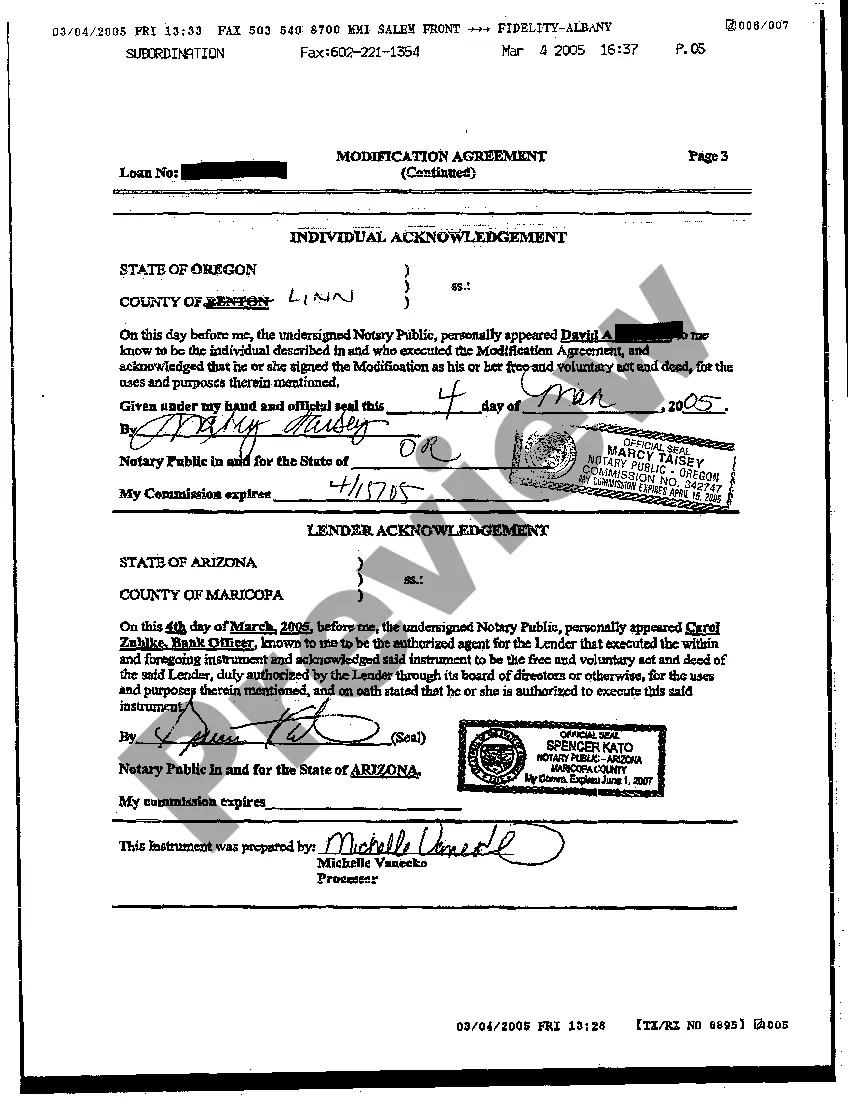

A Hillsboro Oregon Modification Agreement decreasing Line of Credit is a legal document that outlines the terms and conditions of reducing a previously established credit limit. This agreement allows the debtor and creditor to modify the terms of an existing credit facility. The Hillsboro Oregon Modification Agreement decreasing Line of Credit aims to address changing financial circumstances, meeting the needs of both parties involved. The debtor may seek to decrease their credit limit due to factors such as decreased income, changing business conditions, or a desire to minimize debt obligations. On the other hand, the creditor may agree to the modification to maintain a positive relationship with the debtor or to mitigate the risk associated with a higher credit limit. The agreement typically includes the following key details: 1. Parties Involved: Identifies the debtor and creditor involved in the modification agreement. 2. Original Credit Agreement: Refers to the original credit agreement that is being modified. 3. Purpose of Modification: Explains the reason(s) for lowering the credit limit. 4. Revised Credit Limit: Clearly states the new maximum borrowing capacity set by the debtor. 5. Terms and Conditions: Outlines any changes to the repayment terms, interest rates, or fees associated with the credit facility. 6. Effective Date: Specifies the date when the modification comes into effect. Different types of Hillsboro Oregon Modification Agreement decreasing Line of Credit may include: 1. Personal Line of Credit Modification: — Involving individuals seeking a decrease in their credit limit due to personal financial constraints. — Typically used for personal expenses, emergencies, or debt consolidation purposes. 2. Business Line of Credit Modification: — Involving businesses that wish to lower their credit limit, often due to changes in market conditions or a desire to reduce debt. — Generally used for working capital, inventory financing, or short-term cash flow needs. 3. Mortgage Line of Credit Modification: — Involving homeowners who want to decrease their credit limit on a home equity line of credit (HELOT). — Usually used for home renovations, debt consolidation, or other major expenses. Overall, the Hillsboro Oregon Modification Agreement decreasing Line of Credit allows debtors and creditors to come to a mutual agreement on modifying an existing credit facility, providing more flexibility and adaptability to changing financial circumstances.

Hillsboro Oregon Modification Agreement decreasing Line of Credit

Description

How to fill out Hillsboro Oregon Modification Agreement Decreasing Line Of Credit?

If you are looking for a relevant form, it’s impossible to choose a better place than the US Legal Forms website – probably the most comprehensive libraries on the web. Here you can find a large number of form samples for company and individual purposes by types and states, or keywords. With the advanced search feature, getting the most recent Hillsboro Oregon Modification Agreement decreasing Line of Credit is as easy as 1-2-3. Moreover, the relevance of every document is confirmed by a team of skilled lawyers that on a regular basis check the templates on our website and update them according to the newest state and county requirements.

If you already know about our system and have a registered account, all you should do to receive the Hillsboro Oregon Modification Agreement decreasing Line of Credit is to log in to your account and click the Download button.

If you utilize US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have chosen the sample you require. Look at its information and utilize the Preview function (if available) to check its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to get the appropriate record.

- Confirm your selection. Select the Buy now button. After that, select your preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Use your bank card or PayPal account to complete the registration procedure.

- Get the form. Pick the format and download it on your device.

- Make adjustments. Fill out, modify, print, and sign the obtained Hillsboro Oregon Modification Agreement decreasing Line of Credit.

Every single form you save in your account has no expiration date and is yours forever. It is possible to gain access to them via the My Forms menu, so if you want to have an extra copy for modifying or creating a hard copy, feel free to return and export it once more at any time.

Take advantage of the US Legal Forms extensive library to get access to the Hillsboro Oregon Modification Agreement decreasing Line of Credit you were looking for and a large number of other professional and state-specific samples on a single website!