Title: Exploring the Bend Oregon Satisfaction of Promissory Note: Types and Detailed Description Introduction: In Bend, Oregon, the Satisfaction of Promissory Note acts as a legal document used to officially confirm the repayment of a loan or debt. This article aims to provide a comprehensive understanding of this document, its purpose, and the different variations that exist within Bend, Oregon. Key Phrases/Keywords: Bend Oregon, Satisfaction of Promissory Note, legal document, loan repayment, debt, types. 1. Basic Overview: The Bend Oregon Satisfaction of Promissory Note is a legally binding agreement that signifies the completion of a loan or debt repayment. It serves as evidence that the borrower has successfully fulfilled their financial obligations towards the lender. 2. Purpose and Importance: This document holds vital significance for both parties involved. For the borrower, it acts as proof of debt satisfaction, allowing for peace of mind and ensuring future creditworthiness. Simultaneously, for the lender, the Satisfaction of Promissory Note adds a layer of legality and legitimacy to the repayment process. 3. Different Types of Bend Oregon Satisfaction of Promissory Note: a) Full Satisfaction: This type of promissory note confirms that the borrower has completely repaid the loan in its entirety, leaving no outstanding balance. b) Partial Satisfaction: In certain cases, a borrower may not be able to repay the loan in full at once. In such instances, a Partial Satisfaction of Promissory Note is used to acknowledge the repayment of a portion of the loan while documenting the remaining outstanding balance. c) Conditional Satisfaction: This type of promissory note applies when certain conditions need to be met before the debt is considered fully satisfied. These conditions can vary depending on specific terms agreed upon by both parties. d) Multilateral Satisfaction: This variation applies when there are multiple parties involved in the loan agreement, such as co-borrowers or co-signers. The Multilateral Satisfaction of Promissory Note ensures that all parties acknowledge and confirm the debt repayment. 4. Contents of a Bend Oregon Satisfaction of Promissory Note: a) Borrower and Lender Information: Includes the names, addresses, and contact details of both parties. b) Loan Details: Specifies the loan amount, interest rate, repayment terms, and any associated fees or penalties. c) Date and Signatures: Reflects the date of the agreement's execution and requires both the borrower's and lender's signatures to ensure its authenticity. d) Release of Claims: States that by signing, the borrower acknowledges and releases the lender from any future claims, liabilities, or lawsuits related to the loan. Conclusion: The Bend Oregon Satisfaction of Promissory Note serves as a crucial legal instrument in ensuring the proper documentation and completion of loan repayments. Its various types cater to specific scenarios, providing flexibility to borrowers and lenders alike. By understanding the different variations and contents of this document, both parties can navigate the repayment process confidently while fostering trust and accountability.

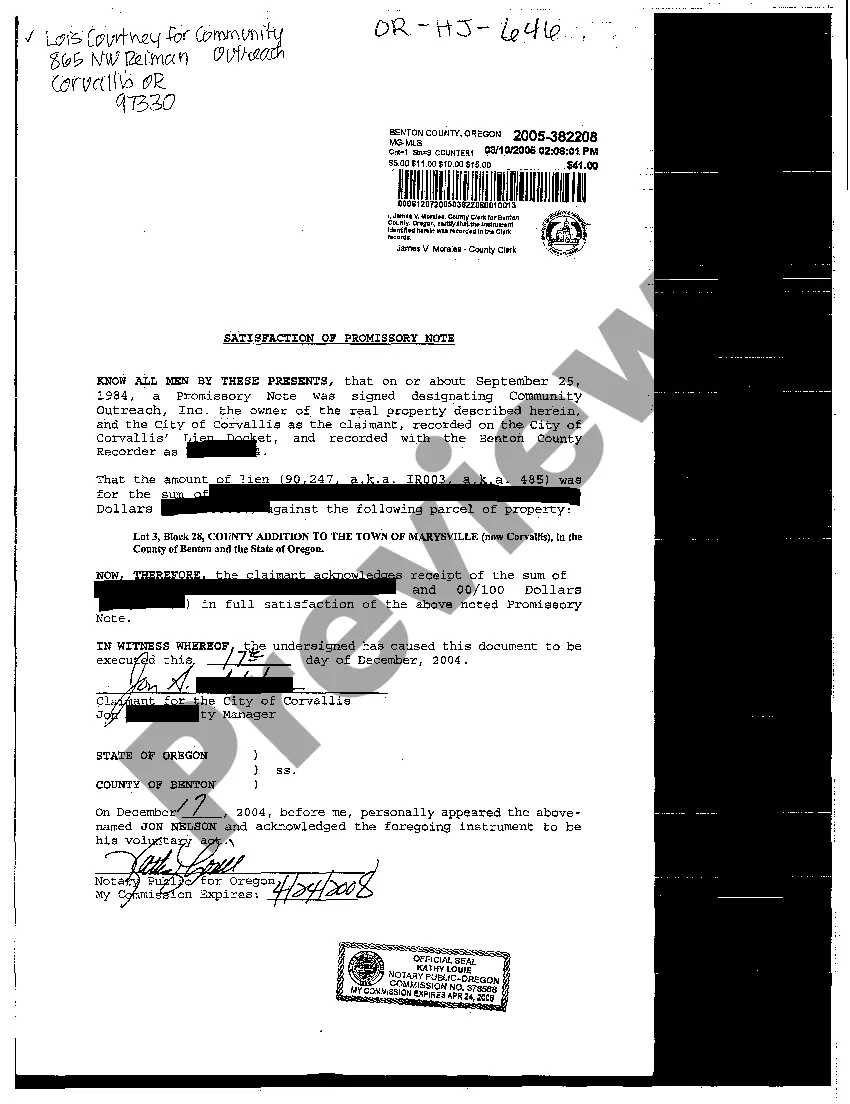

Bend Oregon Satisfaction of Promissory Note

Description

How to fill out Bend Oregon Satisfaction Of Promissory Note?

Make use of the US Legal Forms and have immediate access to any form you want. Our beneficial platform with a large number of document templates allows you to find and obtain virtually any document sample you need. You are able to save, complete, and certify the Bend Oregon Satisfaction of Promissory Note in just a few minutes instead of surfing the Net for hours trying to find the right template.

Using our catalog is an excellent way to raise the safety of your document submissions. Our professional legal professionals regularly check all the documents to make certain that the forms are relevant for a particular state and compliant with new acts and polices.

How can you obtain the Bend Oregon Satisfaction of Promissory Note? If you already have a profile, just log in to the account. The Download button will appear on all the samples you look at. Additionally, you can find all the earlier saved records in the My Forms menu.

If you don’t have an account yet, follow the tips listed below:

- Find the form you need. Ensure that it is the form you were hoping to find: check its name and description, and use the Preview function when it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the downloading procedure. Click Buy Now and choose the pricing plan you like. Then, sign up for an account and process your order with a credit card or PayPal.

- Export the file. Indicate the format to obtain the Bend Oregon Satisfaction of Promissory Note and modify and complete, or sign it according to your requirements.

US Legal Forms is probably the most considerable and reliable document libraries on the web. We are always ready to assist you in any legal process, even if it is just downloading the Bend Oregon Satisfaction of Promissory Note.

Feel free to make the most of our service and make your document experience as efficient as possible!