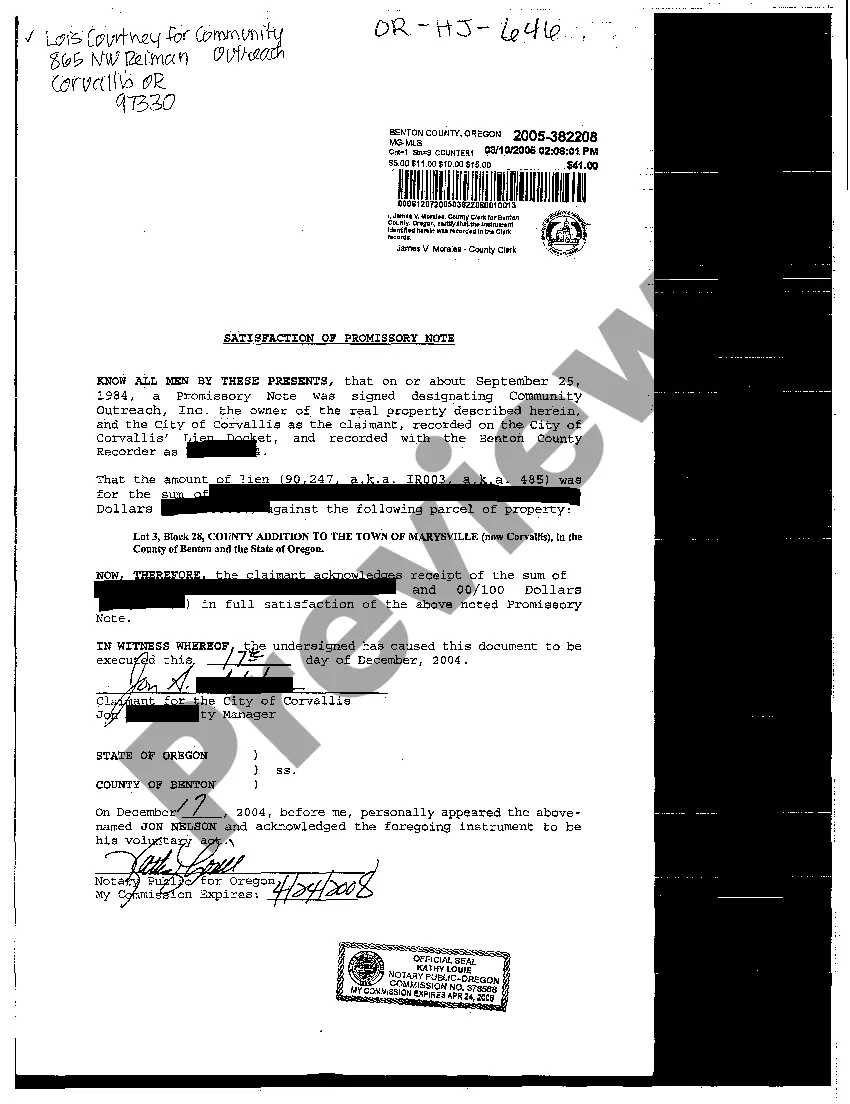

Title: Understanding Eugene Oregon Satisfaction of Promissory Note: Definition, Types, and Key Facts Introduction: The Eugene Oregon Satisfaction of Promissory Note is a legal document that signifies the completion and repayment of a promissory note as agreed upon by the involved parties. This article aims to provide a detailed description of what a Satisfaction of Promissory Note entails, highlight its importance, and discuss the different types that exist within the Eugene, Oregon jurisdiction. Key Content: 1. Definition of Eugene Oregon Satisfaction of Promissory Note: The Eugene Oregon Satisfaction of Promissory Note is a written acknowledgment that the borrower (also referred to as the debtor) has fulfilled their financial obligations under a promissory note by fully repaying the borrowed amount, including any agreed-upon interest or fees. It serves as evidence of the debt's satisfaction and releases the borrower from any further obligations or liabilities. 2. Importance and Significance: The Satisfaction of Promissory Note is crucial for both the debtor and the lender. For the debtor, it demonstrates that they have successfully fulfilled their financial obligation, allowing them to have a clear credit history and potentially seek further loans in the future. For the lender, it provides legal confirmation that the borrower has honored their agreement, closing the transaction and removing any risks associated with non-payment. 3. Types of Eugene Oregon Satisfaction of Promissory Note: While the fundamental purpose of a Satisfaction of Promissory Note remains the same, there may be variations based on the specific circumstances of the loan agreement. The following are different types commonly encountered within Eugene, Oregon: a. Full Satisfaction: This type of Satisfaction of Promissory Note is issued when the debtor has fulfilled their repayment obligations in accordance with the terms laid out in the promissory note, including principal, interest, and any other agreed-upon fees. It completely releases the debtor and acknowledges the loan is closed. b. Partial Satisfaction: In cases where the debtor pays off a portion of the outstanding balance before the scheduled maturity date, a Partial Satisfaction of Promissory Note is issued. This document confirms the amount paid by the debtor, reducing the remaining principal and interest owed. c. Conditional Satisfaction: A Conditional Satisfaction of Promissory Note may be used when certain conditions or requirements are met before discharging the debt. This may include providing collateral, relinquishing property, or fulfilling specific legal obligations for a complete satisfaction. d. Subordination of Debt: This type of satisfaction arises when the borrower agrees to subordinate their debt, allowing another creditor to have a higher priority claim in the event of default. Through this process, the original promissory note is satisfied and amended to reflect the new creditor's position. Conclusion: The Eugene Oregon Satisfaction of Promissory Note is a vital legal instrument that finalizes the repayment of a loan, providing legal proof of debt satisfaction and releasing the borrower from further financial obligations. Understanding the different types of promissory note satisfaction, such as full, partial, conditional, and subordination, is essential to navigate financial transactions effectively and mitigate potential risks.

Eugene Oregon Satisfaction of Promissory Note

Description

How to fill out Oregon Satisfaction Of Promissory Note?

Regardless of social or occupational standing, completing legal forms is a regrettable requirement in the modern world.

Frequently, it is nearly impossible for an individual without any legal training to create such documents from the ground up, primarily due to the complicated terminology and legal nuances they entail.

This is where US Legal Forms can be a lifesaver.

Confirm that the form you’ve selected is appropriate for your jurisdiction because the regulations of one state do not apply to another.

Review the document and read a brief description (if available) regarding the situations the document can be applicable for.

- Our service provides a vast array of over 85,000 state-specific templates that cater to nearly any legal situation.

- US Legal Forms also acts as a valuable resource for associates or legal representatives looking to conserve time using our DIY forms.

- Whether you need the Eugene Oregon Satisfaction of Promissory Note or another form valid in your region, US Legal Forms has everything you need at your fingertips.

- Here’s how to swiftly acquire the Eugene Oregon Satisfaction of Promissory Note employing our reliable service.

- If you're already a subscriber, you can proceed to Log In to your account to access the needed form.

- However, if you are not acquainted with our collection, make sure to follow these instructions before obtaining the Eugene Oregon Satisfaction of Promissory Note.

Form popularity

FAQ

drafted promissory note generally holds up well in court, especially if it meets the Eugene Oregon satisfaction of promissory note requirements. Courts typically enforce these notes, as they serve as clear evidence of a debt. Having proper documentation, like signatures and terms, significantly strengthens your case.

In the context of Eugene Oregon satisfaction of promissory note, notarization is not strictly required for an assignment of a promissory note to be valid. However, having it notarized can enhance its credibility and provide additional legal protection if disputes arise. It's always wise to have a legal professional review the documents to ensure compliance with state laws.

The statute of limitations on a written contract in Oregon is also six years. This applies to all written agreements, including promissory notes. Understanding this timeline is vital for both lenders and borrowers to ensure compliance with legal obligations and for obtaining a Satisfaction of Promissory Note when necessary.

The statute of limitations for collecting a debt in Oregon is generally six years as well. This includes various forms of debt, not just promissory notes. To protect your rights, consider documenting the repayment process using services like uslegalforms that can help with proper agreements.

In Oregon, the statute of limitations for enforcing a promissory note is typically six years. This means that a lender must initiate legal action within this period to collect the debt. It is wise to maintain clear records and seek a Satisfaction of Promissory Note once the debt is settled, ensuring peace of mind.

In Oregon, a promissory note does not legally require notarization to be enforceable. However, having a notary sign the document can add an extra layer of credibility and protection. This is especially beneficial when it comes to the Eugene Oregon Satisfaction of Promissory Note, as it helps prevent disputes over its validity.

Filling out a promissory demand note involves supplying essential information such as the borrower's name, the amount borrowed, and the interest rate, if applicable. You also need to include a clear repayment schedule and specify the due date for payment on demand. Utilizing tools like US Legal Forms can help you create this document accurately, ensuring you meet the requirements for Eugene Oregon Satisfaction of Promissory Note.

To legally enforce a promissory note, the lender may need to take legal action if the borrower fails to repay. This process often involves filing a lawsuit to obtain a judgment against the borrower. It’s crucial to have proper documentation, including the original note and any records of payments. Utilizing uslegalforms can help you create enforceable promissory notes that meet Eugene Oregon satisfaction of promissory note standards.

The satisfaction of a promissory note occurs when the borrower has fully repaid the amount owed to the lender. This process typically involves the lender providing a written statement or certificate confirming the payment. By obtaining this satisfaction, both parties can finalize their agreement and avoid future claims. Use uslegalforms to generate a satisfaction document that aligns with Eugene Oregon satisfaction of promissory note requirements.

Yes, a promissory note can hold up in court if it meets certain criteria. These requirements include clarity in terms, signatures from both parties, and proper documentation. If disputes arise, the note serves as evidence of the agreement between lenders and borrowers. To safeguard your interests, consider consulting uslegalforms to create a legally binding promissory note that aligns with Eugene Oregon satisfaction of promissory note standards.