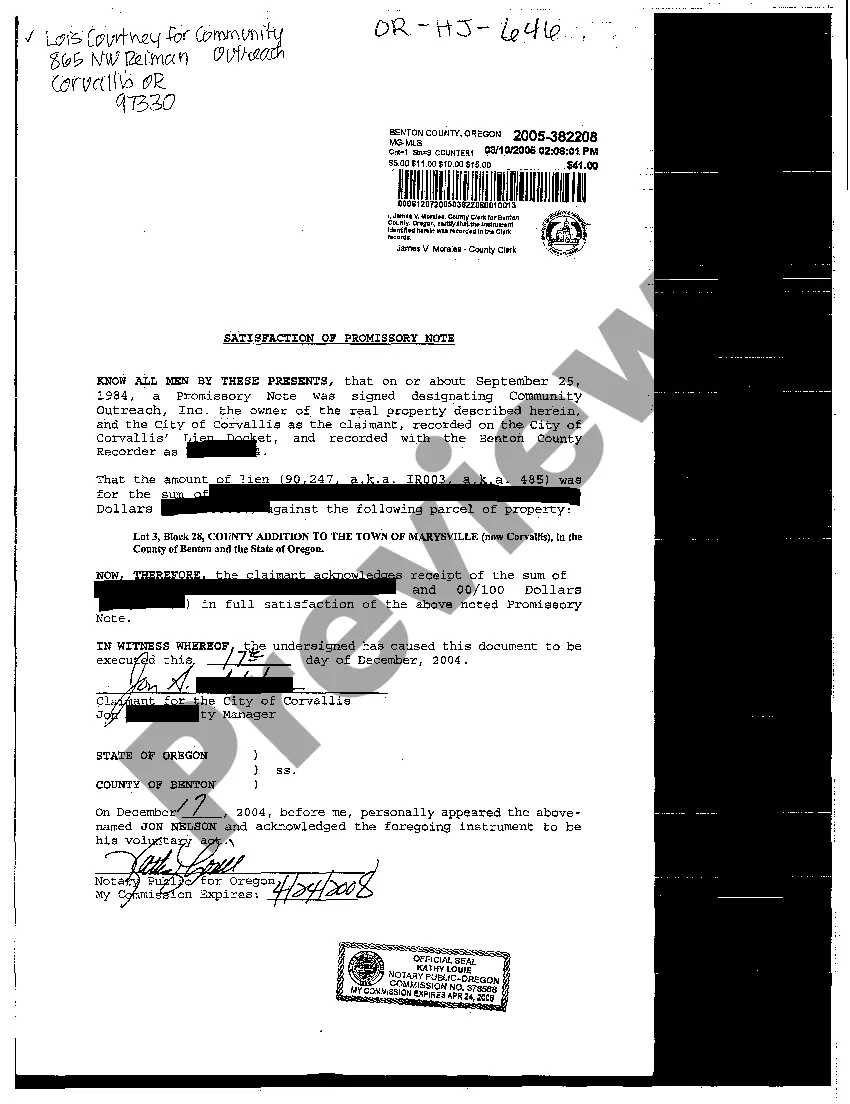

Portland Oregon Satisfaction of Promissory Note

Description

How to fill out Oregon Satisfaction Of Promissory Note?

Irrespective of one’s social or occupational standing, fulfilling law-related paperwork is a regrettable requirement in today’s society.

Frequently, it’s nearly impossible for someone without any legal experience to draft such documents from the ground up, primarily due to the intricate language and legal nuances they encompass.

This is where US Legal Forms proves to be beneficial.

Confirm that the template you selected is appropriate for your area since the regulations in one state or region may not apply to another.

Examine the form and read a brief overview (if available) of the situations the document can address.

- Our service offers a vast assortment of over 85,000 ready-to-use state-specific templates suitable for nearly any legal circumstance.

- US Legal Forms also acts as a valuable tool for associates or legal advisors aiming to conserve time with our DIY documents.

- No matter if you require the Portland Oregon Satisfaction of Promissory Note or any other document suitable for your state or region, US Legal Forms makes everything accessible.

- Here’s how you can obtain the Portland Oregon Satisfaction of Promissory Note within minutes using our reliable service.

- If you are already a member, you can proceed to Log In to your account to retrieve the appropriate form.

- However, if you are new to our platform, please ensure to follow these steps before downloading the Portland Oregon Satisfaction of Promissory Note.

Form popularity

FAQ

Only the borrower signs the promissory note, whereas both the lender and the borrower sign a loan agreement. The signed document means that the borrower agrees to pay back the loan.

Typically, promissory notes are used in connection with short term financing, and business loans. They are usually unsecured. For the note to be legally valid, the note must be signed by the borrower and must include language that clearly shows the borrower promises to pay a defined amount.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Place a signature beside the ?paid in full? notation. The lender must sign and date the front of the promissory note beside the ?paid in full? notation. The date the lender includes on the promissory note should be the date on which the borrower made the final payment on the loan.

Except for the foregoing, Borrower may pay all or a portion of the amount owed earlier than it is due. Early payments will not, unless agreed to by Lender in writing, relieve Borrower of Borrower's obligation to continue to make payments under the payment schedule.

A promissory note default can affect a borrower's credit rating if the promissory note holder has the ability to report the deficiency to the various credit reporting agencies.

Once a note has been paid off, it's time to wrap up any loose ends and release the parties from their duties. A clean break will provide peace of mind, discharge all obligations, and lead to an amicable conclusion. A release is the definitive end of the parties' commitments under a note.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note.Accept full payment of the loan.Mark ?paid in full? on the promissory note.Place a signature beside the ?paid in full? notation.Mail the original promissory note to the borrower.

Do promissory notes hold up in court? They do if the terms of borrowing and repayment are properly stated and signed by the borrower. Promissory notes are used as financial tools to document the terms of borrowing and lending money.