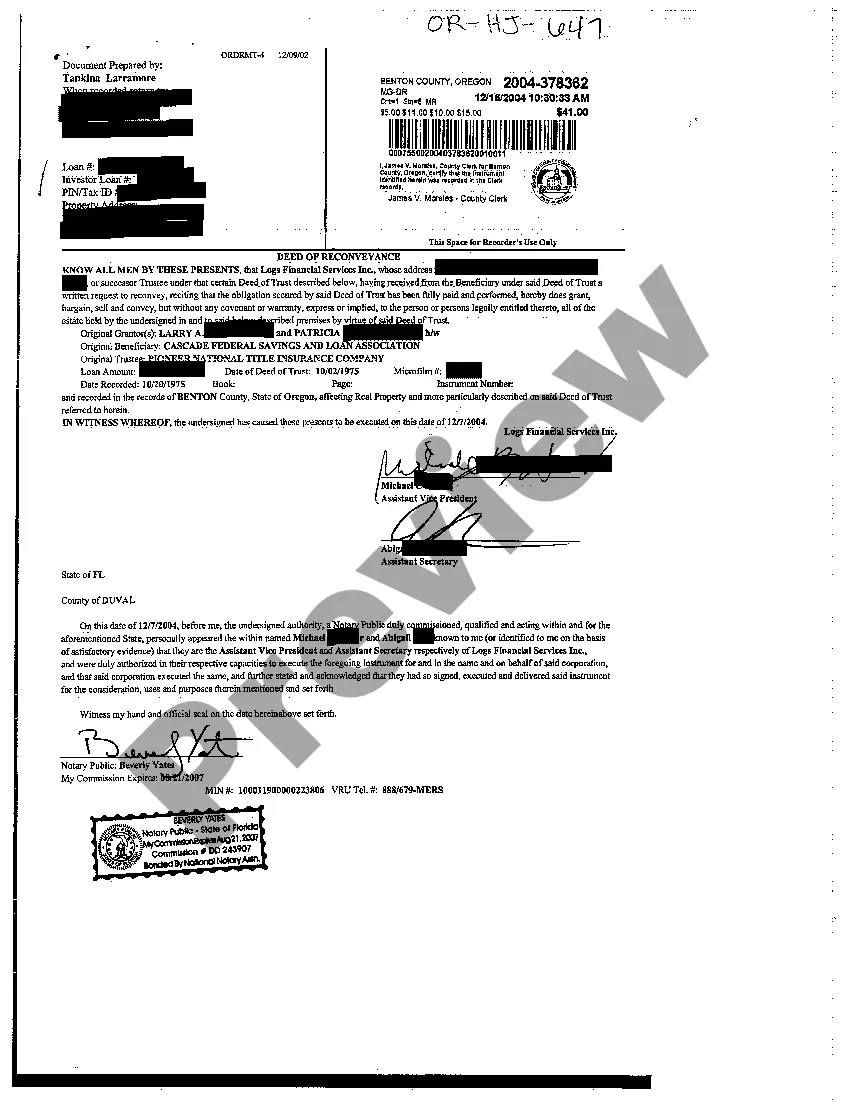

The Bend Oregon Deed of Re conveyance is a legal document used to transfer the title of a property from a lender, typically a mortgage holder, back to the borrower once the mortgage has been fully paid off. This deed serves as proof that the borrower has satisfied their debt obligation to the lender and allows them to regain full ownership of the property. The Bend Oregon Deed of Re conveyance plays a crucial role in the real estate process, as it ensures that the transfer of property ownership is properly recorded and that the borrower's rights are protected. This document is an essential part of the loan payoff process and is typically prepared by the lender or a title company. There are different types of Bend Oregon Deed of Re conveyance that may be used depending on the specific circumstances: 1. Full Re conveyance: This type of reconveyance is used when the borrower has fully paid off their mortgage, and the lender releases all claims and liens on the property. It completely clears the borrower's title from any encumbrances related to the mortgage. 2. Partial Re conveyance: In situations where the borrower has paid off a portion of their mortgage, but not the entire amount, a partial reconveyance may be issued. This document releases the lender's claims and liens on the portion of the property that has been paid off, while the remaining portion remains subject to the mortgage. 3. Certificate of Satisfaction: While not technically a deed of reconveyance, a certificate of satisfaction is a related document that acknowledges the complete payment of a mortgage loan. This document may be used instead of or in addition to a deed of reconveyance to indicate that the borrower has satisfied their debt obligation. When obtaining a property in Bend, Oregon, it is crucial for borrowers to understand the relevance and importance of the Bend Oregon Deed of Re conveyance. Consulting with a real estate attorney or a knowledgeable professional can help ensure that the process is properly executed, protecting the borrower's ownership rights and preventing any future complications related to the property's title.

Bend Oregon Deed of Reconveyance

Description

How to fill out Bend Oregon Deed Of Reconveyance?

Benefit from the US Legal Forms and get immediate access to any form you need. Our useful platform with thousands of templates makes it simple to find and get virtually any document sample you need. It is possible to download, fill, and certify the Bend Oregon Deed of Reconveyance in a few minutes instead of surfing the Net for many hours attempting to find a proper template.

Using our catalog is a superb way to raise the safety of your form submissions. Our experienced legal professionals regularly review all the documents to make certain that the forms are relevant for a particular region and compliant with new acts and polices.

How can you get the Bend Oregon Deed of Reconveyance? If you have a subscription, just log in to the account. The Download option will appear on all the documents you look at. In addition, you can find all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, follow the instruction below:

- Find the form you need. Make sure that it is the template you were hoping to find: verify its headline and description, and take take advantage of the Preview option when it is available. Otherwise, use the Search field to look for the needed one.

- Launch the saving procedure. Select Buy Now and select the pricing plan you like. Then, create an account and process your order utilizing a credit card or PayPal.

- Save the file. Choose the format to obtain the Bend Oregon Deed of Reconveyance and modify and fill, or sign it for your needs.

US Legal Forms is one of the most significant and reliable template libraries on the internet. Our company is always happy to help you in any legal procedure, even if it is just downloading the Bend Oregon Deed of Reconveyance.

Feel free to make the most of our service and make your document experience as efficient as possible!