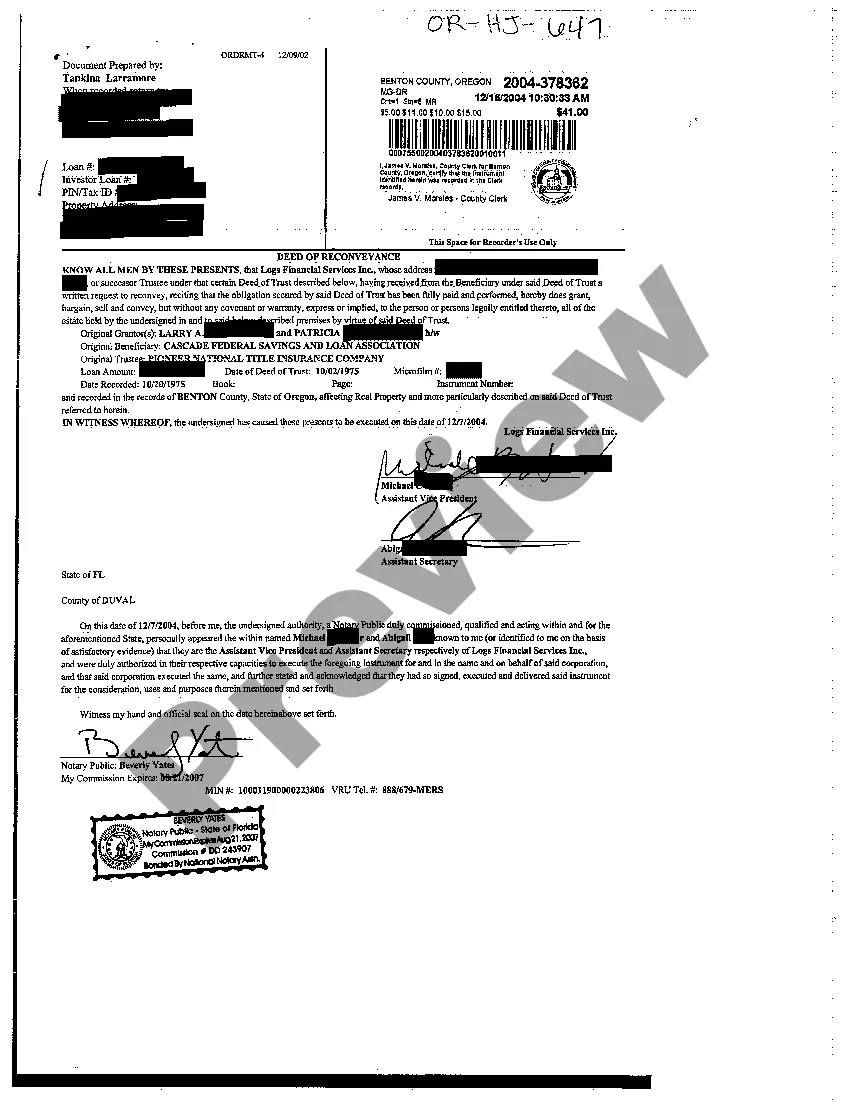

A Portland Oregon Deed of Re conveyance is a legal document that releases a borrower from their mortgage debt and transfers the property title back to the homeowner once the mortgage loan is fully repaid. This document serves as proof that the borrower has fulfilled their financial obligation and has clear ownership of the property. The Portland Oregon Deed of Re conveyance is typically prepared by the lender, also known as the trustee, or a designated third-party agency upon the borrower's final payment. It is an important step in the mortgage process, finalizing the transfer of ownership rights from the lender to the homeowner. Keywords: Portland Oregon Deed of Re conveyance, legal document, releases, borrower, mortgage debt, property title, homeowner, mortgage loan, fully repaid, proof, financial obligation, ownership, lender, trustee, third-party agency, transfer, mortgage process. In Portland, there are primarily two types of Deeds of Re conveyance: 1. Full Re conveyance: This type of deed is issued when the borrower has successfully completed the payment of their entire mortgage loan. Once the full reconveyance document is recorded, the borrower becomes the rightful owner of the property, free from any claims or liens from the lender. 2. Partial Re conveyance: This form of deed is used when the borrower has made a partial payment, reducing the remaining mortgage balance. A partial reconveyance allows the release of a portion of the property, which was initially used as collateral. This type of reconveyance is commonly applied when the homeowner chooses to refinance or take out a second mortgage, leveraging their property's equity. Keywords: Full Re conveyance, Partial Re conveyance, borrower, mortgage loan, payment, property owner, claims, liens, lender, mortgage balance, collateral, refinance, second mortgage, equity. It is crucial to review the terms and conditions stated in the Portland Oregon Deed of Re conveyance carefully. Verification of accurate information is essential to ensure the transfer of property ownership, legal protection, and the removal of any potential clouds on the title. Keywords: Review, terms, conditions, accurate information, transfer, property ownership, legal protection, clouds, title. In summary, a Portland Oregon Deed of Re conveyance is a legal document that finalizes the transfer of property ownership from the lender to the borrower. There are two main types: Full Re conveyance and Partial Re conveyance, each relevant to different stages of mortgage repayment. Careful review and verification of this document are crucial to ensure a smooth transition of property ownership and eliminate any potential legal risks.

Portland Oregon Deed of Reconveyance

Description

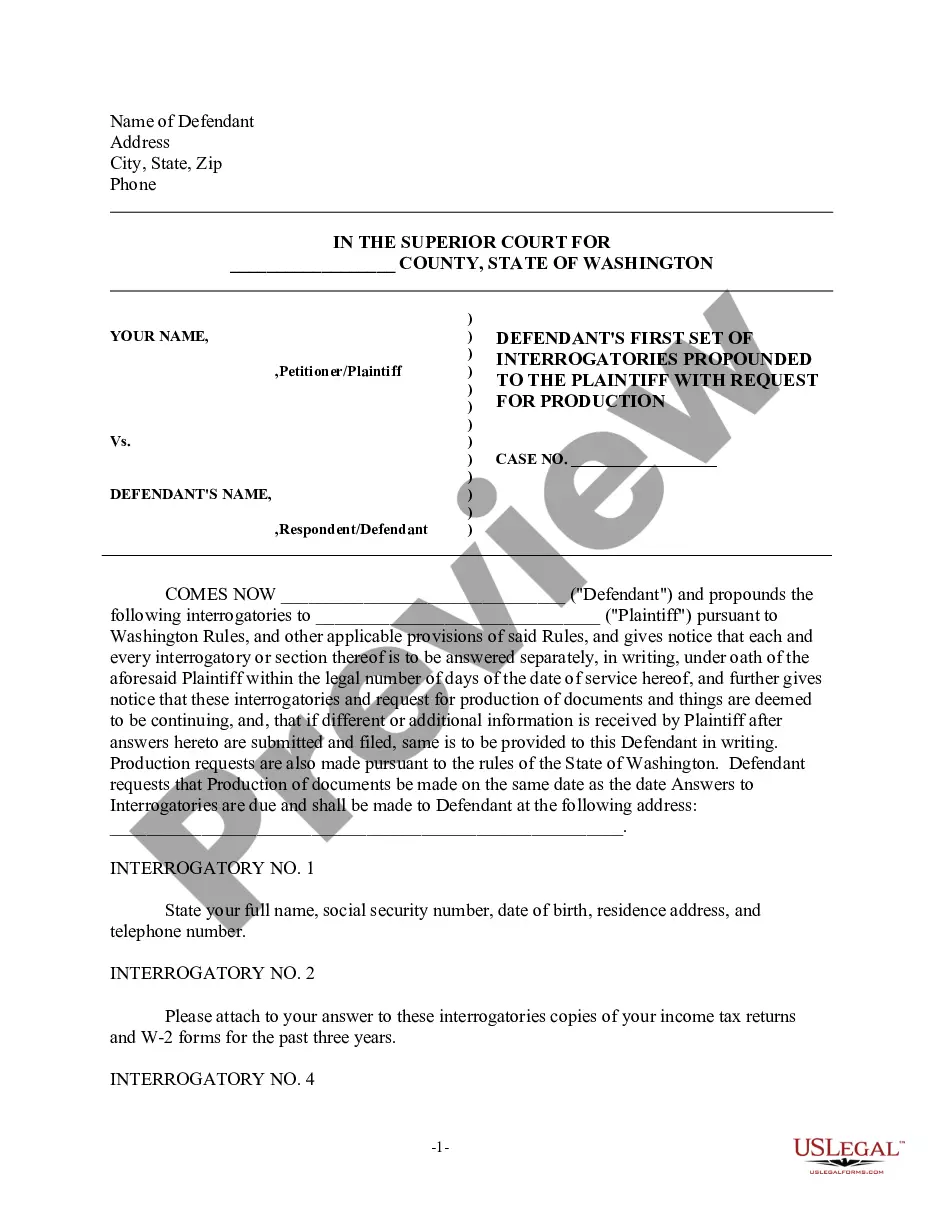

How to fill out Portland Oregon Deed Of Reconveyance?

Are you looking for a reliable and inexpensive legal forms supplier to buy the Portland Oregon Deed of Reconveyance? US Legal Forms is your go-to choice.

No matter if you need a simple arrangement to set rules for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and framed in accordance with the requirements of specific state and area.

To download the form, you need to log in account, locate the required form, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Portland Oregon Deed of Reconveyance conforms to the regulations of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is intended for.

- Start the search over in case the form isn’t good for your legal scenario.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is done, download the Portland Oregon Deed of Reconveyance in any provided format. You can get back to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about spending your valuable time learning about legal paperwork online for good.