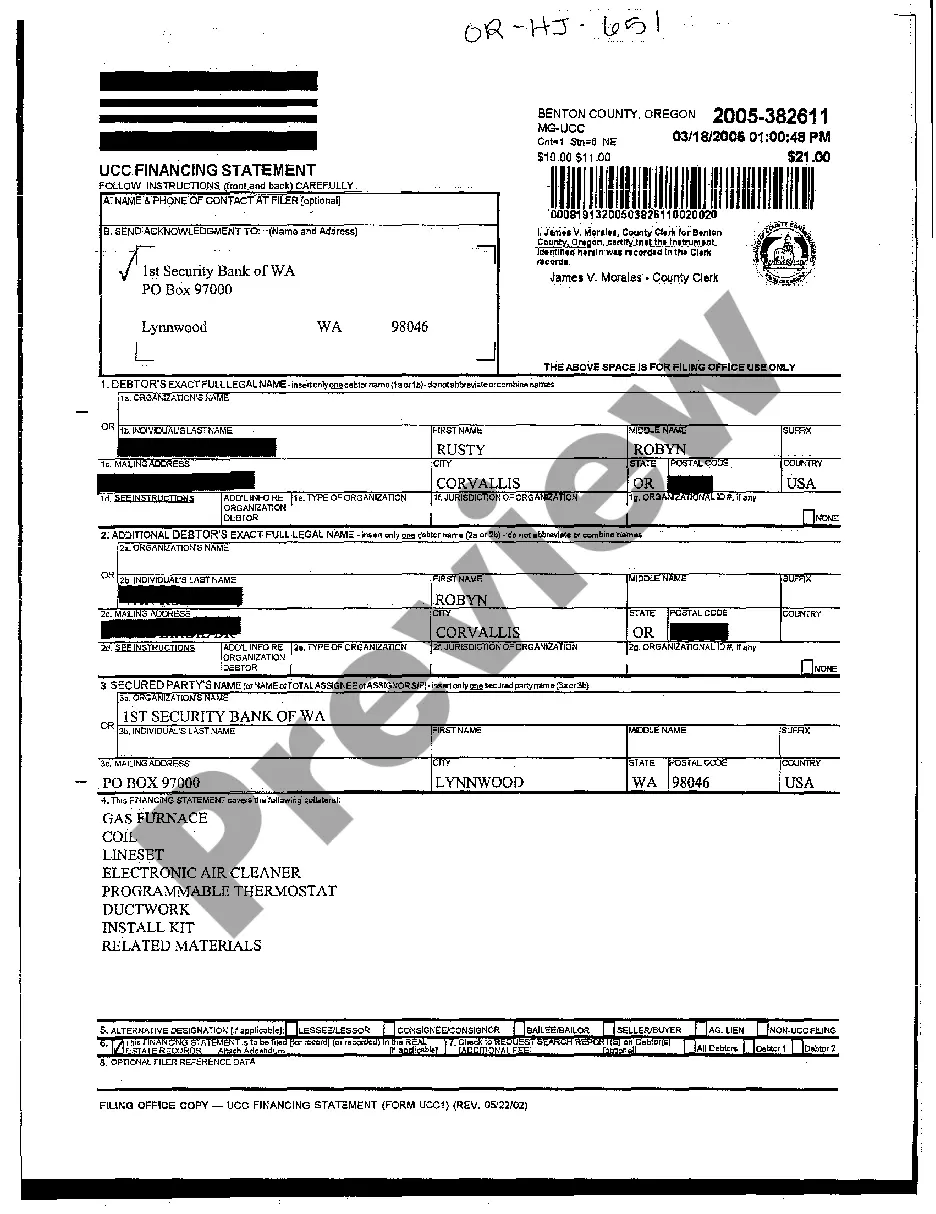

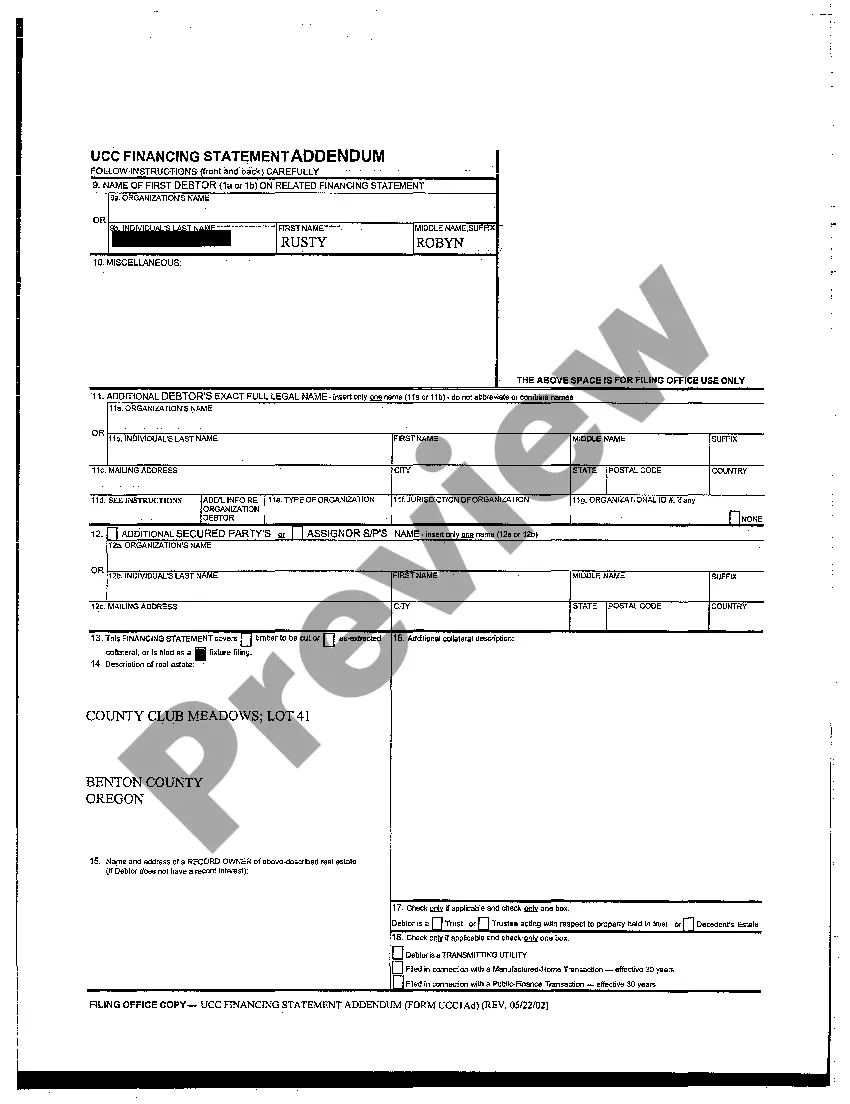

A Bend Oregon UCC Financing Statement is a legal document used to establish a creditor's stake or claim in personal property as collateral for a loan. It is commonly utilized in commercial transactions where tangible or intangible assets are involved. UCC stands for the Uniform Commercial Code, a set of laws governing commercial transactions in the United States. In Bend, Oregon, the UCC Financing Statement is a crucial legal instrument utilized by lenders, banks, and businesses to protect their interests when providing loans or extending credit. By filing this statement with the Oregon Secretary of State, it creates a public record that establishes a creditor's priority over other potential claimants in regard to the collateral. The Bend Oregon UCC Financing Statement typically contains detailed information about the debtor, the creditor, and the collateral involved. Key elements often found within the document include: 1. Debtors and Secured Parties: The UCC Financing Statement outlines the name and address of both the debtor (the party obligated to repay the debt) and the secured party (the lender or creditor). 2. Description of Collateral: A thorough and accurate description of the collateral is provided to clearly identify the assets that secure the debt. This can include physical property like equipment, inventory, or vehicles, as well as intangible assets such as accounts receivable, intellectual property, or commercial fixtures. 3. Financing Statement Types: There are various types of UCC Financing Statements, each serving specific purposes. In Bend, Oregon, some common types include: a) Traditional UCC Financing Statement (Form UCC-1): This is the standard form filed to create a security interest in almost any type of collateral. b) Amendment (Form UCC-3): Used to make changes or modifications to an existing UCC Financing Statement, such as an amendment to the debtor's name, address, or the addition of collateral. c) Termination (Form UCC-3): Filed to release or terminate a UCC Financing Statement when the debt is fully repaid or the collateral is no longer pledged as security. It is crucial for creditors to file the Bend Oregon UCC Financing Statement accurately and in a timely manner to ensure their priority rights in the collateral. Thorough documentation, including detailed descriptions and correct information, plays a vital role in avoiding disputes and protecting the creditor's interests. In conclusion, a Bend Oregon UCC Financing Statement is a meticulous and legally binding document used to establish a creditor's claim on specific collateral provided as security for a loan. It helps maintain the transparency of commercial transactions, protects the rights of creditors, and ensures proper disclosure of encumbrances on personal property.

Bend Oregon UCC Financing Statement

State:

Oregon

City:

Bend

Control #:

OR-HJ-651

Format:

PDF

Instant download

This form is available by subscription

Description

UCC Financing Statement

A Bend Oregon UCC Financing Statement is a legal document used to establish a creditor's stake or claim in personal property as collateral for a loan. It is commonly utilized in commercial transactions where tangible or intangible assets are involved. UCC stands for the Uniform Commercial Code, a set of laws governing commercial transactions in the United States. In Bend, Oregon, the UCC Financing Statement is a crucial legal instrument utilized by lenders, banks, and businesses to protect their interests when providing loans or extending credit. By filing this statement with the Oregon Secretary of State, it creates a public record that establishes a creditor's priority over other potential claimants in regard to the collateral. The Bend Oregon UCC Financing Statement typically contains detailed information about the debtor, the creditor, and the collateral involved. Key elements often found within the document include: 1. Debtors and Secured Parties: The UCC Financing Statement outlines the name and address of both the debtor (the party obligated to repay the debt) and the secured party (the lender or creditor). 2. Description of Collateral: A thorough and accurate description of the collateral is provided to clearly identify the assets that secure the debt. This can include physical property like equipment, inventory, or vehicles, as well as intangible assets such as accounts receivable, intellectual property, or commercial fixtures. 3. Financing Statement Types: There are various types of UCC Financing Statements, each serving specific purposes. In Bend, Oregon, some common types include: a) Traditional UCC Financing Statement (Form UCC-1): This is the standard form filed to create a security interest in almost any type of collateral. b) Amendment (Form UCC-3): Used to make changes or modifications to an existing UCC Financing Statement, such as an amendment to the debtor's name, address, or the addition of collateral. c) Termination (Form UCC-3): Filed to release or terminate a UCC Financing Statement when the debt is fully repaid or the collateral is no longer pledged as security. It is crucial for creditors to file the Bend Oregon UCC Financing Statement accurately and in a timely manner to ensure their priority rights in the collateral. Thorough documentation, including detailed descriptions and correct information, plays a vital role in avoiding disputes and protecting the creditor's interests. In conclusion, a Bend Oregon UCC Financing Statement is a meticulous and legally binding document used to establish a creditor's claim on specific collateral provided as security for a loan. It helps maintain the transparency of commercial transactions, protects the rights of creditors, and ensures proper disclosure of encumbrances on personal property.

Free preview

How to fill out Bend Oregon UCC Financing Statement?

If you’ve already used our service before, log in to your account and save the Bend Oregon UCC Financing Statement on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Ensure you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Bend Oregon UCC Financing Statement. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!