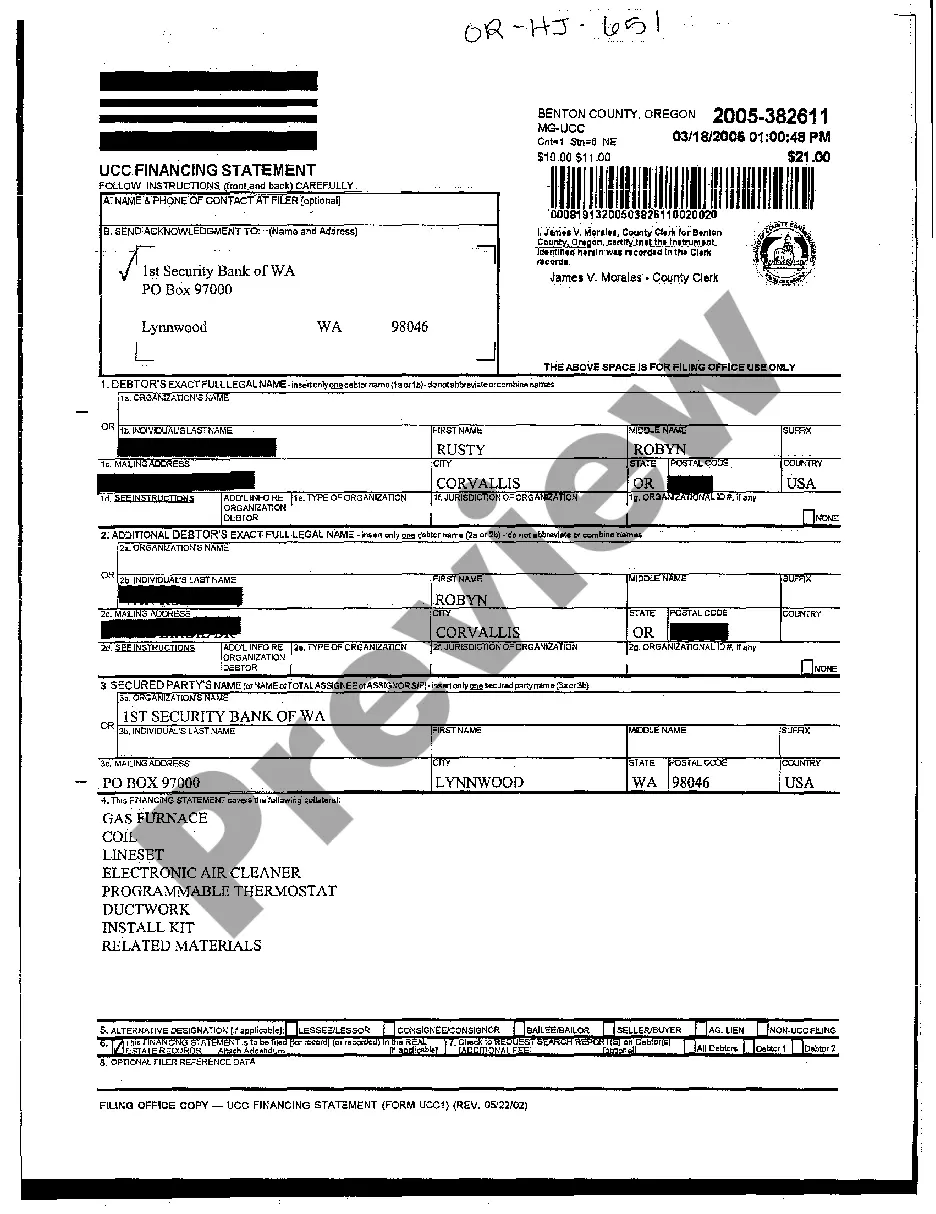

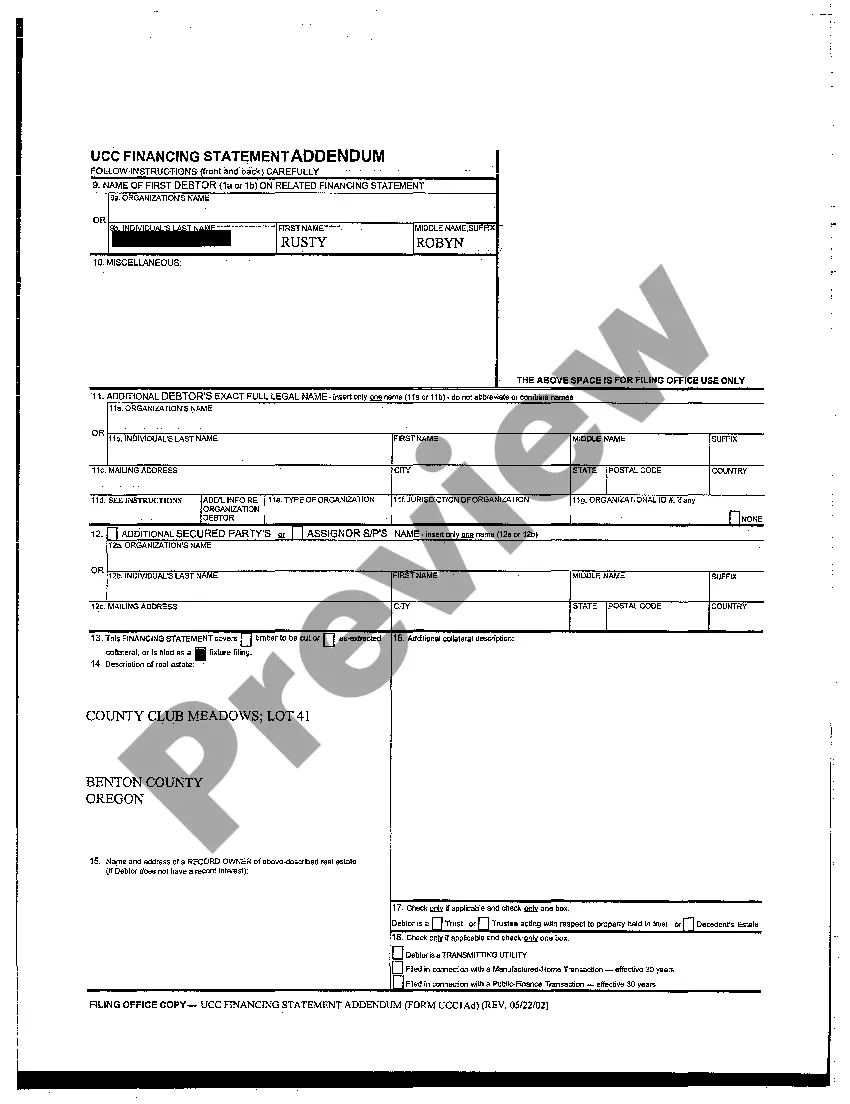

Eugene Oregon UCC Financing Statement is a legal document that provides public notice of a lender's security interest in personal property. UCC stands for Uniform Commercial Code, which is a set of laws governing commercial transactions in the United States. In Eugene, Oregon, UCC Financing Statements are filed with the Oregon Secretary of State's office to establish priority and protect the rights of the secured party in case of default or bankruptcy. These statements serve as a record of the lender's claim or lien against the debtor's assets, such as equipment, inventory, and receivables. There are two main types of UCC Financing Statements that can be filed in Eugene, Oregon: 1. UCC-1 Financing Statement: This is the most common type of financing statement filed by lenders. It includes essential information such as the debtor's name and address, the secured party's name and address, description of collateral, and other relevant details. The UCC-1 statement is effective for five years from the date of filing, and it is crucial for lenders to renew or terminate it within this timeframe to maintain their security interest. 2. UCC-3 Financing Statement Amendment: This type of financing statement is used to modify, terminate, or continue an existing UCC-1 statement. Amendments may be filed to reflect changes in the debtor's name or address, provide additional collateral, or release certain assets from the security interest. It is essential to file UCC-3 amendments promptly and accurately to maintain the accuracy and effectiveness of the initial UCC-1 statement. In Eugene, Oregon, UCC Financing Statements are an essential mechanism used by lenders to protect their interests and gain priority over other creditors. They play a crucial role in commercial transactions, ensuring transparency and facilitating the flow of credit while safeguarding the rights of all parties involved. Therefore, if you are a lender operating in Eugene, Oregon, it is vital to understand the requirements and procedures associated with UCC Financing Statements. Keeping accurate and up-to-date records, timely filing your UCC-1 statements, and promptly amending or terminating them when necessary will help ensure your security interests are properly protected and enforced. Consult legal professionals or the Oregon Secretary of State's office for detailed guidance on filing UCC Financing Statements in Eugene, Oregon.

Eugene Oregon UCC Financing Statement

Description

How to fill out Eugene Oregon UCC Financing Statement?

If you are searching for a relevant form, it’s difficult to choose a better platform than the US Legal Forms site – one of the most comprehensive libraries on the internet. With this library, you can find a huge number of form samples for company and personal purposes by types and states, or key phrases. With our advanced search function, discovering the latest Eugene Oregon UCC Financing Statement is as elementary as 1-2-3. Additionally, the relevance of every file is proved by a group of skilled attorneys that regularly review the templates on our platform and revise them according to the latest state and county demands.

If you already know about our system and have an account, all you should do to receive the Eugene Oregon UCC Financing Statement is to log in to your account and click the Download button.

If you utilize US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have opened the sample you require. Check its explanation and use the Preview feature (if available) to see its content. If it doesn’t meet your needs, use the Search option near the top of the screen to get the appropriate record.

- Confirm your choice. Select the Buy now button. After that, pick your preferred pricing plan and provide credentials to sign up for an account.

- Make the transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Obtain the template. Indicate the format and save it to your system.

- Make changes. Fill out, revise, print, and sign the acquired Eugene Oregon UCC Financing Statement.

Every template you save in your account does not have an expiry date and is yours permanently. It is possible to access them using the My Forms menu, so if you want to get an extra duplicate for modifying or printing, you may return and download it again anytime.

Make use of the US Legal Forms extensive library to gain access to the Eugene Oregon UCC Financing Statement you were looking for and a huge number of other professional and state-specific templates on a single website!