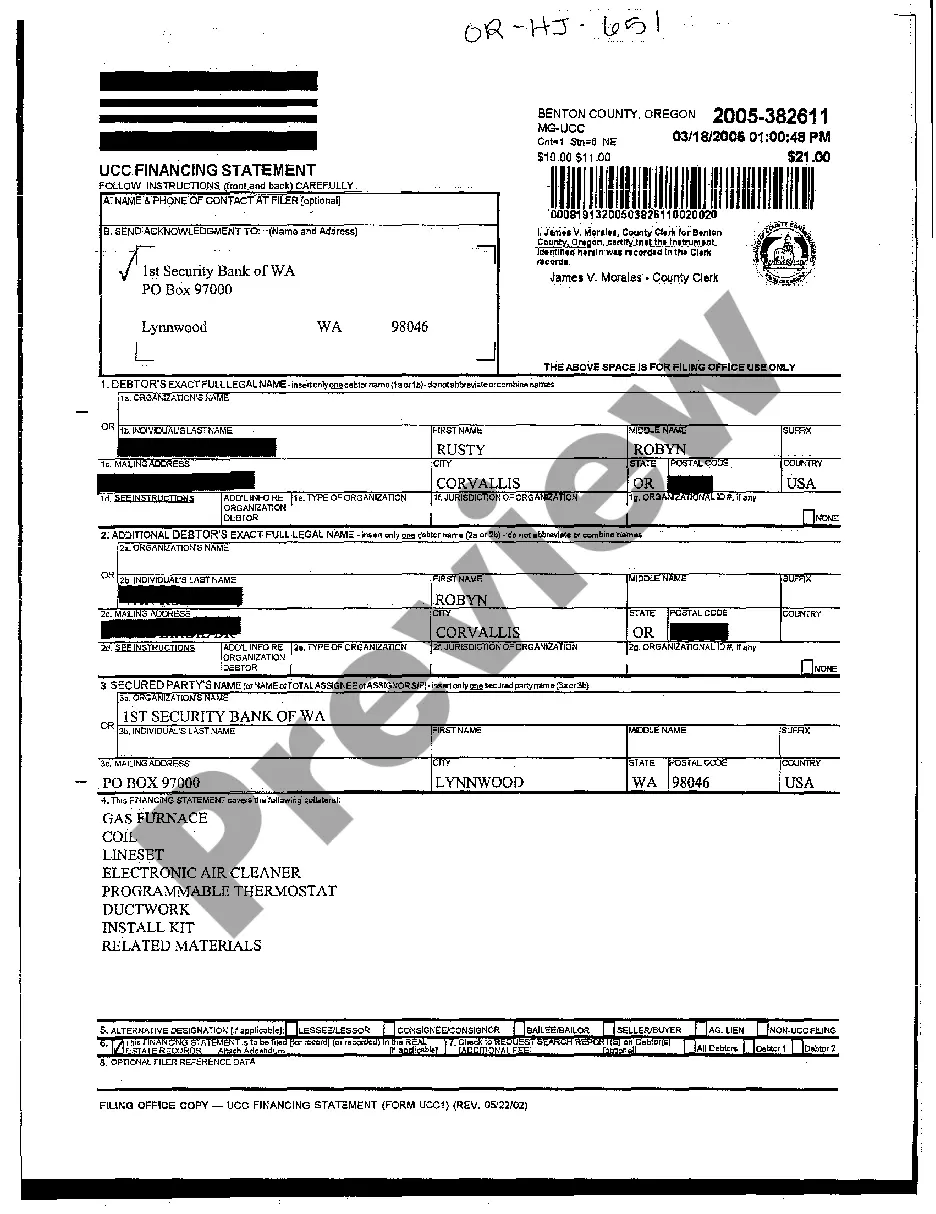

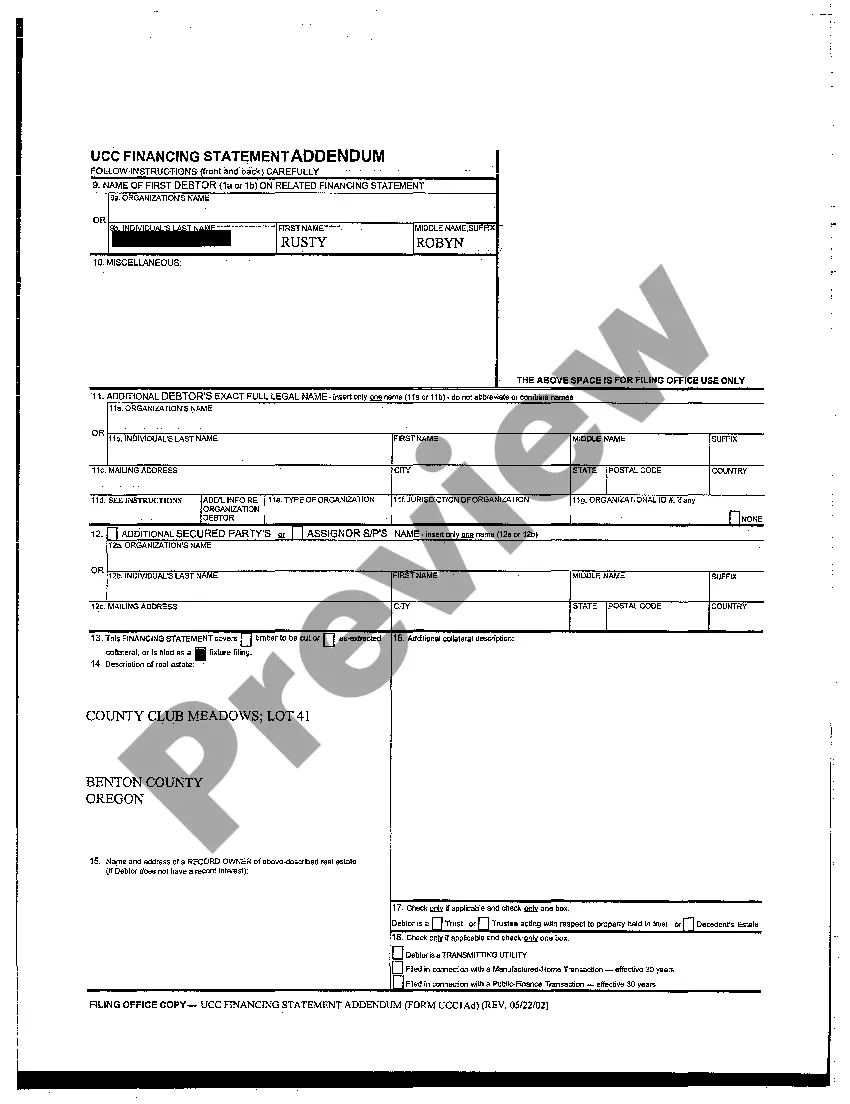

The Gresham Oregon UCC Financing Statement is a legal document that provides a way for creditors to publicly claim their interest in a debtor's personal property to secure a loan or transaction. It is governed by the Uniform Commercial Code (UCC), which sets out rules and guidelines for transactions involving personal property. This financing statement serves as a public notice, alerting other creditors about a specific creditor's claim on the debtor's property. It helps establish a priority order in case of bankruptcy, insolvency, or default. The Gresham Oregon UCC Financing Statement shows up in a search report conducted by potential creditors or other interested parties. The Gresham Oregon UCC Financing Statement contains various essential elements. These include the name and address of both the debtor and the creditor, a description of the collateral being pledged as security, and any appropriate indications of the collateral's type or classification. Additionally, it includes the signature of the debtor authorizing the filing. There are several types of Gresham Oregon UCC Financing Statements that may be filed based on the nature of the transaction or circumstances. These include: 1. Gresham Oregon UCC-1 Financing Statement: This is the most commonly used financing statement and is filed to claim security interest in any type of personal property. 2. Gresham Oregon UCC-3 Financing Statement Amendment: This form is used to modify or alter information previously filed in the financing statement, such as changes in the debtor's name, address, or the collateral being claimed. 3. Gresham Oregon UCC-5 Information Statement: This statement is used to provide additional information or clarify details about a previously filed financing statement. It is crucial to accurately complete and file the appropriate Gresham Oregon UCC Financing Statement to protect the creditor's interest and ensure their claim's validity. It is recommended to consult with legal professionals or utilize online services specialized in UCC filing to ensure compliance with all requirements and avoid any potential errors.

Gresham Oregon UCC Financing Statement

Description

How to fill out Gresham Oregon UCC Financing Statement?

No matter the social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone without any law education to draft such paperwork cfrom the ground up, mostly due to the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform offers a massive collection with over 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you need the Gresham Oregon UCC Financing Statement or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Gresham Oregon UCC Financing Statement in minutes employing our reliable platform. If you are presently a subscriber, you can proceed to log in to your account to get the needed form.

However, in case you are new to our platform, make sure to follow these steps before downloading the Gresham Oregon UCC Financing Statement:

- Ensure the template you have chosen is suitable for your location considering that the rules of one state or county do not work for another state or county.

- Preview the form and go through a brief description (if available) of scenarios the paper can be used for.

- If the one you chosen doesn’t meet your needs, you can start over and search for the needed document.

- Click Buy now and pick the subscription plan that suits you the best.

- utilizing your login information or register for one from scratch.

- Select the payment gateway and proceed to download the Gresham Oregon UCC Financing Statement as soon as the payment is completed.

You’re good to go! Now you can proceed to print the form or complete it online. If you have any issues locating your purchased documents, you can quickly find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.