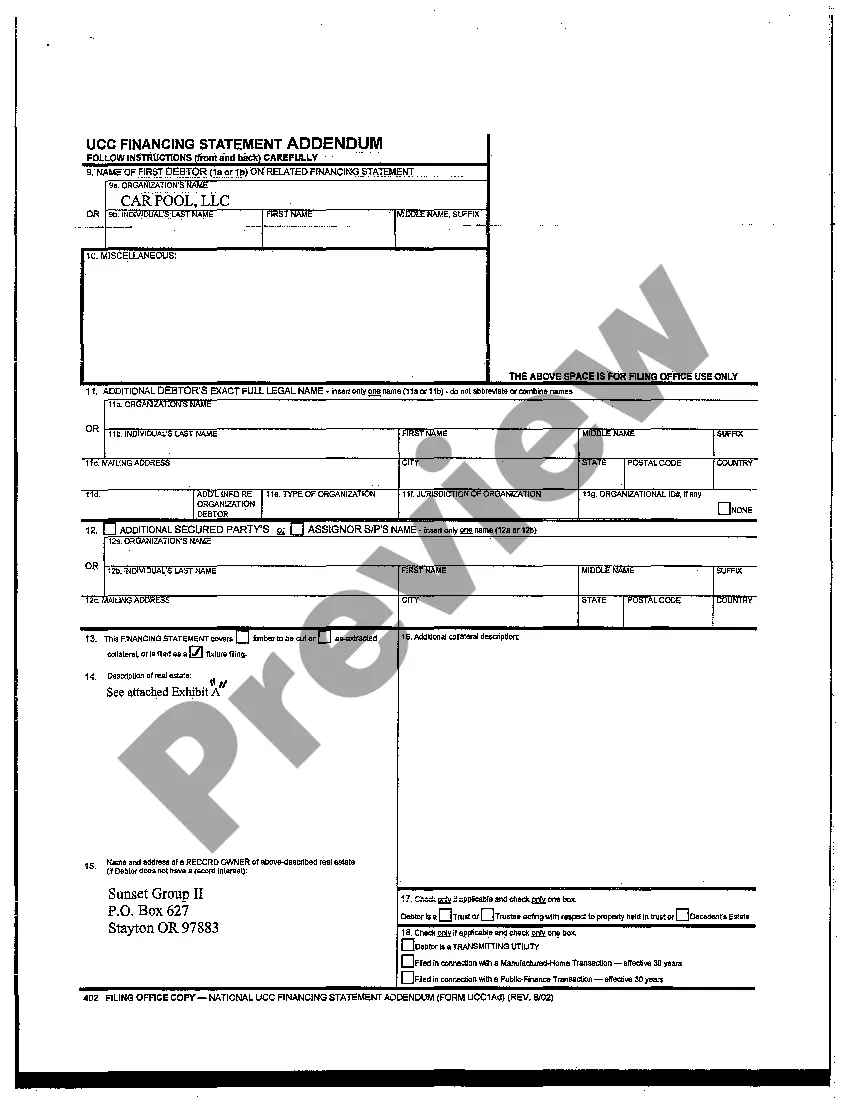

A Bend Oregon UCC Financing Statement is a legal document used to secure a creditor's interest in personal property as collateral for a loan. This statement is an essential part of the Uniform Commercial Code (UCC) regulations, which govern commercial transactions in Bend, Oregon. The purpose of a UCC Financing Statement is to provide notice to other parties, including potential lenders or buyers, that a particular creditor has a security interest in the debtor's assets. By filing this statement with the Oregon Secretary of State's office, the creditor establishes their priority over other parties in case of default or bankruptcy. The Bend Oregon UCC Financing Statement includes crucial information, such as: 1. Debtor's Information: This section includes the debtor's legal name, mailing address, and organization type (such as an individual, partnership, corporation, or limited liability company). 2. Secured Party's Information: This section identifies the secured party or creditor, including their name, mailing address, and contact details. 3. Collateral Description: The UCC Financing Statement requires a detailed description of the collateral being used as security for the loan. This typically includes a general description and can also include specific details like serial numbers, make, model, or any other identifying information. 4. Additional Provisions: This section allows the creditor to provide any additional information or instructions regarding the security interest. It is important to note that there are different types of UCC Financing Statements that may be applicable in Bend, Oregon based on the nature of the transaction. These types include: 1. Blanket UCC Financing Statements: This type of statement provides a broad security interest in all the debtor's assets, present, and future. It serves as a comprehensive lien on all the debtor's personal property. 2. Single-Transaction UCC Financing Statements: This type of statement applies to a specific transaction or loan. It covers only the collateral related to that particular transaction and is typically used for one-time loans. 3. Fixture Filings: When a debtor's personal property becomes a fixture or is attached to real estate, a fixture filing may be necessary. This ensures the creditor's interest remains valid even if the property is affixed to the land. In conclusion, a Bend Oregon UCC Financing Statement is a legal document that creates a security interest in personal property to secure a loan. By filing this statement with the Oregon Secretary of State's office, a creditor provides notice to other parties and establishes their priority in case of default. Different types of UCC Financing Statements, such as blanket, single-transaction, and fixture filings, may be used depending on the nature of the transaction.

Bend Oregon UCC Financing Statement

Description

How to fill out Bend Oregon UCC Financing Statement?

If you are searching for a relevant form, it’s extremely hard to find a better platform than the US Legal Forms site – one of the most comprehensive libraries on the internet. With this library, you can get thousands of document samples for company and individual purposes by categories and states, or key phrases. Using our high-quality search option, discovering the most up-to-date Bend Oregon UCC Financing Statement is as easy as 1-2-3. Moreover, the relevance of each document is verified by a team of skilled attorneys that regularly review the templates on our platform and revise them based on the newest state and county demands.

If you already know about our platform and have a registered account, all you should do to get the Bend Oregon UCC Financing Statement is to log in to your account and click the Download option.

If you use US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have opened the form you need. Look at its description and make use of the Preview function (if available) to see its content. If it doesn’t suit your needs, utilize the Search option near the top of the screen to discover the appropriate record.

- Confirm your decision. Choose the Buy now option. Following that, choose the preferred subscription plan and provide credentials to register an account.

- Process the purchase. Use your bank card or PayPal account to complete the registration procedure.

- Obtain the form. Choose the format and download it to your system.

- Make modifications. Fill out, modify, print, and sign the obtained Bend Oregon UCC Financing Statement.

Each and every form you save in your account has no expiration date and is yours permanently. You can easily gain access to them using the My Forms menu, so if you want to get an additional version for editing or printing, you can come back and download it once again at any time.

Take advantage of the US Legal Forms professional collection to gain access to the Bend Oregon UCC Financing Statement you were seeking and thousands of other professional and state-specific samples in one place!