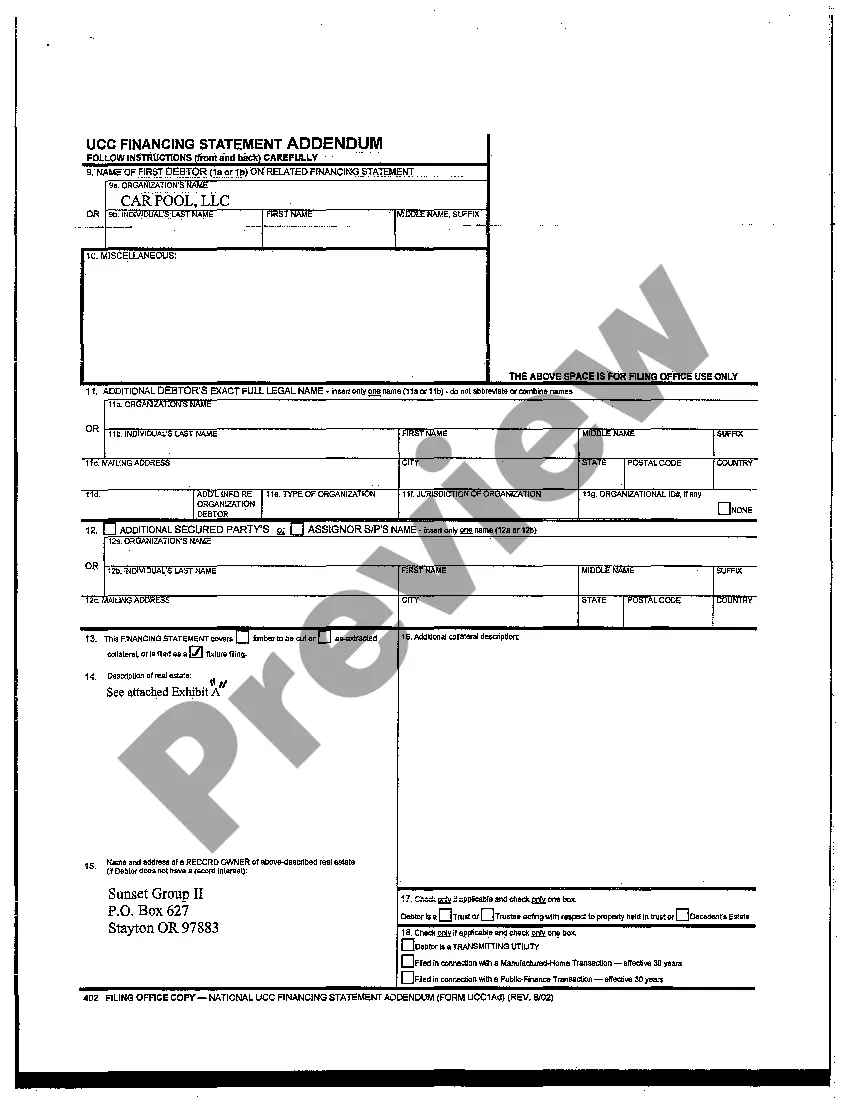

Title: Gresham, Oregon UCC Financing Statement: A Comprehensive Overview Introduction: The Gresham, Oregon UCC (Uniform Commercial Code) Financing Statement is an essential legal tool that serves as a public record documenting a secured party's interest in the personal property of a debtor. Understanding the intricacies of this statement is crucial for creditors engaging in financial transactions in Gresham, Oregon. In this article, we will provide a detailed description of the Gresham, Oregon UCC Financing Statement, its purpose, requirements, filing process, and potential variations. Key Keywords: Gresham, Oregon, UCC Financing Statement, secured party, debtor, personal property, legal tool, public record, financial transactions. 1. Purpose and Importance: The Gresham, Oregon UCC Financing Statement plays a crucial role in securing a creditor's interest in the personal property of a debtor. By filing this statement, the creditor protects their rights against competing claims and establishes priority in case of the debtor's default or bankruptcy. 2. Content and Requirements: The Gresham, Oregon UCC Financing Statement typically includes the following vital information: — Debtor's Legal Name and Address: Accurate identification of the debtor is crucial to ensure proper filing and the protection of the creditor's interest. — Secured Party's Legal Name and Address: The statement must include the secured party's information, signifying their claim on the debtor's personal property. — Description of Collateral: Clear and detailed information about the collateral being used as security must be provided. This may include assets such as inventory, equipment, accounts receivable, or even intangible assets. — Uniform Commercial Code (UCC) Information: The statement must indicate that it is being filed pursuant to Oregon's UCC laws and provide the appropriate UCC section numbers. 3. Filing Process: To file a Gresham, Oregon UCC Financing Statement, the creditor must typically submit the completed form to the Oregon Secretary of State or an authorized filing office. The filed statement becomes a public record, accessible to interested parties, thereby providing notice of the secured party's interest in the debtor's personal property. 4. Variations of Gresham, Oregon UCC Financing Statement: While there are no specific variations of the Gresham, Oregon UCC Financing Statement, it is important to note that there may be different types of UCC Financing Statements based on the nature of the transaction or collateral involved, such as: — UCC-1 Financing Statement: The most common type, used for traditional transactions where the debtor grants a security interest in specific collateral to secure an obligation. — UCC-1AD Financing Statement Addendum: Used to provide additional information or amendments to the initial UCC-1 Financing Statement. — UCC-3 Financing Statement Amendment: Used to modify or terminate an existing UCC-1 Financing Statement, reflecting changes to the debtor's personal property or the secured party's position. Conclusion: The Gresham, Oregon UCC Financing Statement is a vital instrument for creditors seeking to protect their interests in personal property transactions. By understanding the purpose, requirements, filing process, and potential variations, creditors can ensure compliance with the UCC laws and secure their priority interest in Gresham, Oregon.

Gresham Oregon UCC Financing Statement

Description

How to fill out Gresham Oregon UCC Financing Statement?

Are you looking for a reliable and affordable legal forms provider to get the Gresham Oregon UCC Financing Statement? US Legal Forms is your go-to solution.

Whether you require a simple arrangement to set rules for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed based on the requirements of separate state and area.

To download the form, you need to log in account, locate the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Gresham Oregon UCC Financing Statement conforms to the laws of your state and local area.

- Go through the form’s details (if available) to find out who and what the form is good for.

- Start the search over in case the template isn’t suitable for your legal scenario.

Now you can register your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Gresham Oregon UCC Financing Statement in any available file format. You can return to the website at any time and redownload the form without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time researching legal paperwork online once and for all.