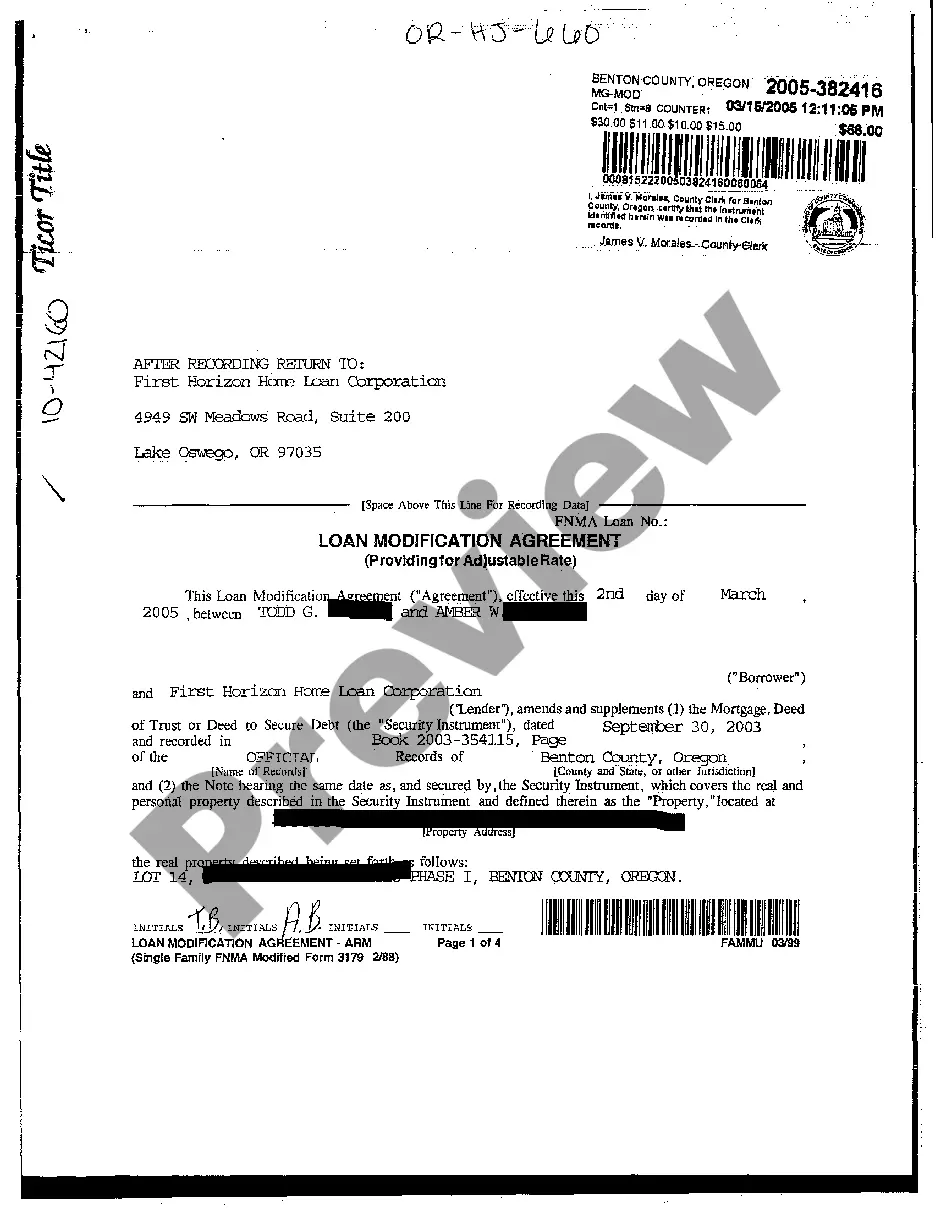

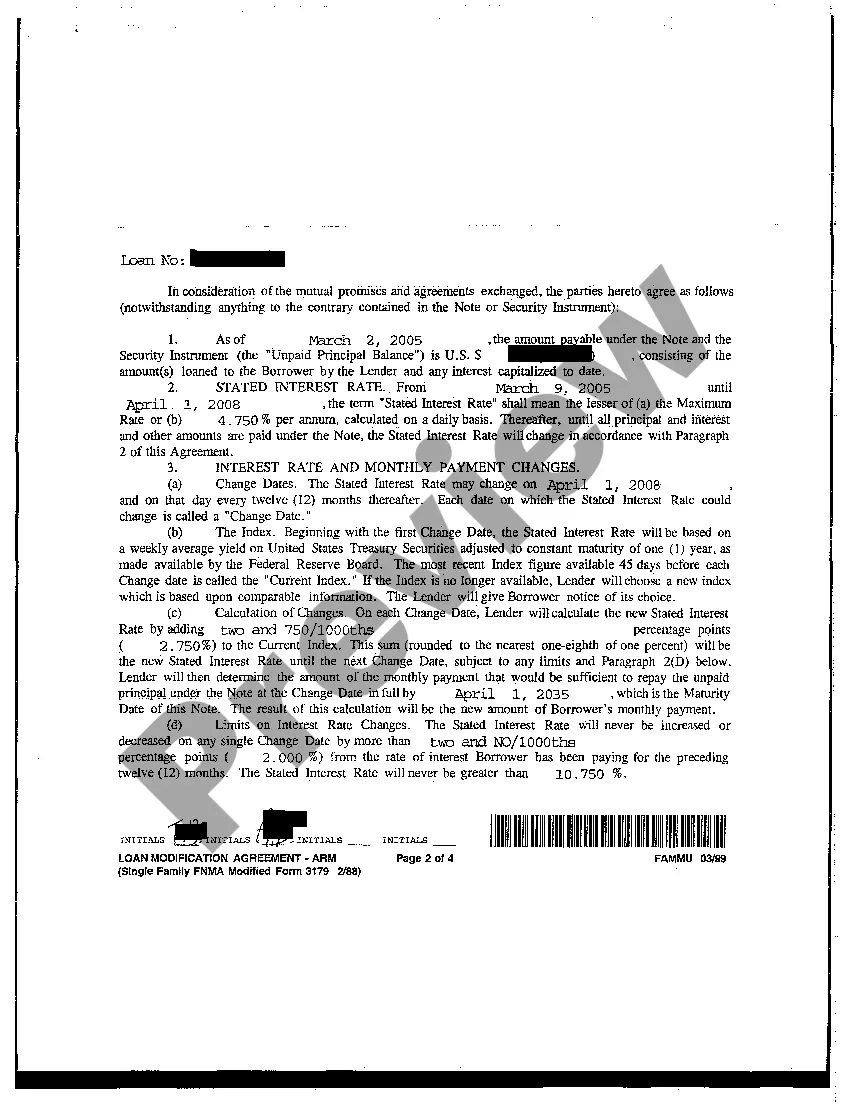

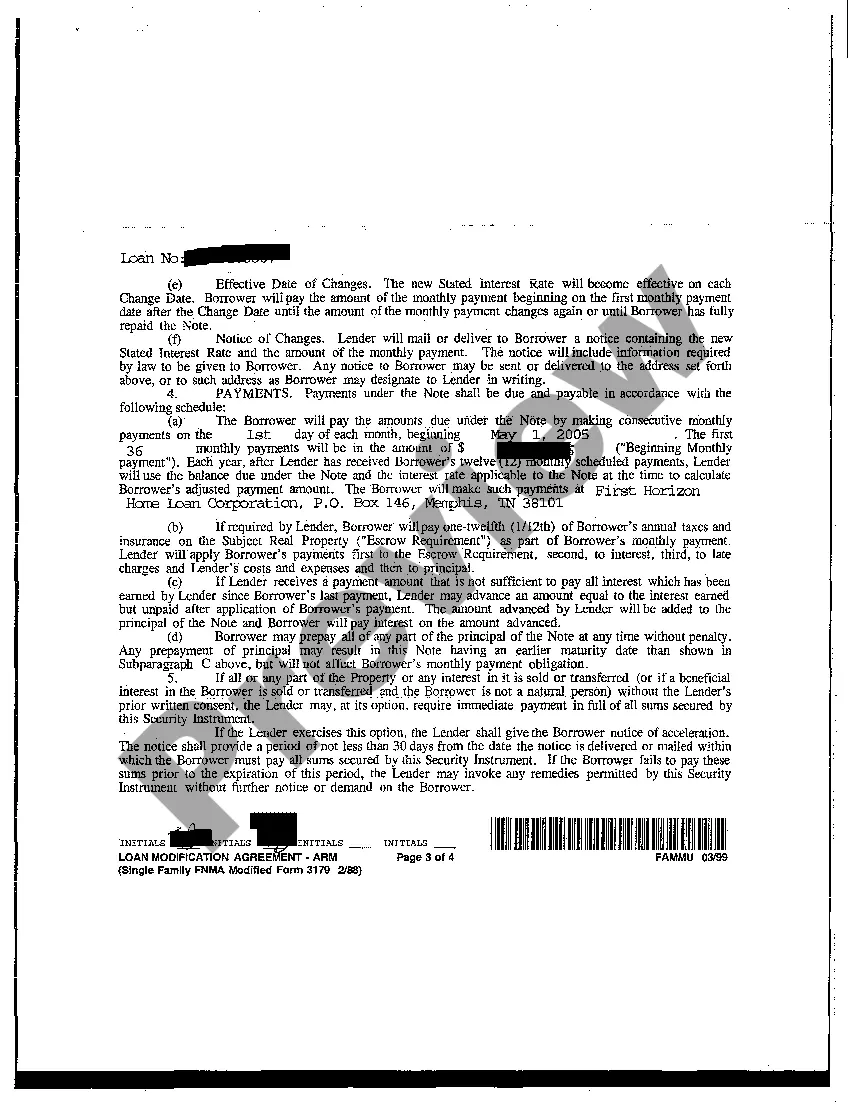

Eugene Oregon Loan Modification Agreements providing for Adjustable Rate are contracts that enable borrowers to adjust their existing mortgage terms, particularly the interest rate, to accommodate changing financial circumstances. This legal arrangement aims to assist homeowners in maintaining affordable monthly payments when interest rates fluctuate. The primary purpose of a Eugene Oregon Loan Modification Agreement is to offer borrowers the flexibility to modify their loans to prevent foreclosure or financial distress. Adjustable Rate Mortgage (ARM) refers to a type of loan where the interest rate fluctuates periodically, typically based on an index. With an ARM loan modification, borrowers can negotiate new terms for their adjustable rate loans, ensuring they remain within their means. Some key aspects covered in a typical Eugene Oregon Loan Modification Agreement for Adjustable Rate include: 1. Interest Rate Adjustment: This provision allows borrowers to modify their loan's interest rate, usually based on changes in market conditions or other specific criteria outlined in the agreement. 2. Index Selection: The agreement specifies the index used to determine the interest rate adjustment. Common indices include the London Interbank Offered Rate (LIBOR), U.S. Prime Rate, or a Treasury index. 3. Adjustment Frequency: The agreement outlines the frequency at which the interest rate will be adjusted, such as annually, semi-annually, or quarterly. 4. Adjustment Caps: To protect borrowers from significant rate fluctuations, the agreement may include caps limiting the amount the interest rate can increase in a given adjustment period. For example, a cap may restrict the increase to 2% per year. 5. Adjustment Notice: The agreement may require lenders to provide borrowers with advance notice of any rate adjustments, allowing them to prepare for potential changes in their monthly payments. 6. Payment Calculation: The agreement stipulates how the adjusted interest rate impacts the borrower's monthly mortgage payments, ensuring transparency and clarity. 7. Loan Term Extension: Depending on the circumstances, the agreement may allow for extending the loan term to facilitate more manageable monthly payments after interest rate adjustments. It's essential to note that there might be different variations of Eugene Oregon Loan Modification Agreements for Adjustable Rate loans, tailored to specific individual needs or legal requirements. These variations could include agreements with different adjustment frequencies, more stringent caps on rate increases, or variations in the index selection process. In conclusion, Eugene Oregon Loan Modification Agreements providing for Adjustable Rate offer homeowners the opportunity to negotiate new terms, including adjusting the interest rate, to ensure affordable monthly mortgage payments in response to fluctuating interest rates. These loan modifications aim to support borrowers in avoiding foreclosure and achieving long-term financial stability.

Eugene Oregon Loan Modification Agreement providing for Adjustable Rate

Description

How to fill out Eugene Oregon Loan Modification Agreement Providing For Adjustable Rate?

We always want to reduce or prevent legal issues when dealing with nuanced legal or financial affairs. To do so, we apply for legal services that, as a rule, are very expensive. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to a lawyer. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Eugene Oregon Loan Modification Agreement providing for Adjustable Rate or any other document quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is equally effortless if you’re new to the platform! You can register your account within minutes.

- Make sure to check if the Eugene Oregon Loan Modification Agreement providing for Adjustable Rate adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Eugene Oregon Loan Modification Agreement providing for Adjustable Rate would work for your case, you can pick the subscription option and make a payment.

- Then you can download the document in any available file format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!